Planning For A Low-Inflation Economy: A Podcast Discussion

Table of Contents

A low-inflation economy presents unique challenges and opportunities. While seemingly positive, persistently low inflation can stifle economic growth and significantly impact investment strategies and business planning. This article summarizes a recent podcast discussion exploring the complexities of planning for a low-inflation economy, offering insights for investors, businesses, and individuals alike. Understanding the nuances of a low-inflation environment is crucial for long-term financial success.

Understanding the Low-Inflation Environment

Defining Low Inflation and its Causes

What constitutes a low-inflation environment? Generally, economists consider inflation rates below 2% annually as low inflation. This contrasts sharply with periods of high inflation, which can erode purchasing power rapidly. Several factors contribute to a low-inflation environment:

- Technological Advancements: Automation and increased productivity often lead to lower production costs, resulting in lower prices for goods and services. This contributes to a subdued inflation rate.

- Globalization: Increased global competition keeps prices down, as businesses constantly strive to offer competitive pricing to maintain market share. The ease of sourcing cheaper materials and labor internationally also plays a role.

- Demographic Shifts: Aging populations in many developed nations can lead to decreased consumer demand and slower wage growth, further suppressing inflationary pressure.

The difference between deflation and low inflation is critical. Deflation, a sustained decrease in the general price level, is generally considered more harmful than low inflation, as it can lead to a vicious cycle of delayed purchases and economic contraction. Low inflation, on the other hand, while posing challenges, doesn't necessarily signal economic downturn.

- Impact on Consumer Spending: Low inflation can lead to increased consumer purchasing power, as the prices of goods and services remain relatively stable. However, prolonged low inflation may also lead to decreased consumer confidence, resulting in lower spending levels. Central banks actively monitor these trends.

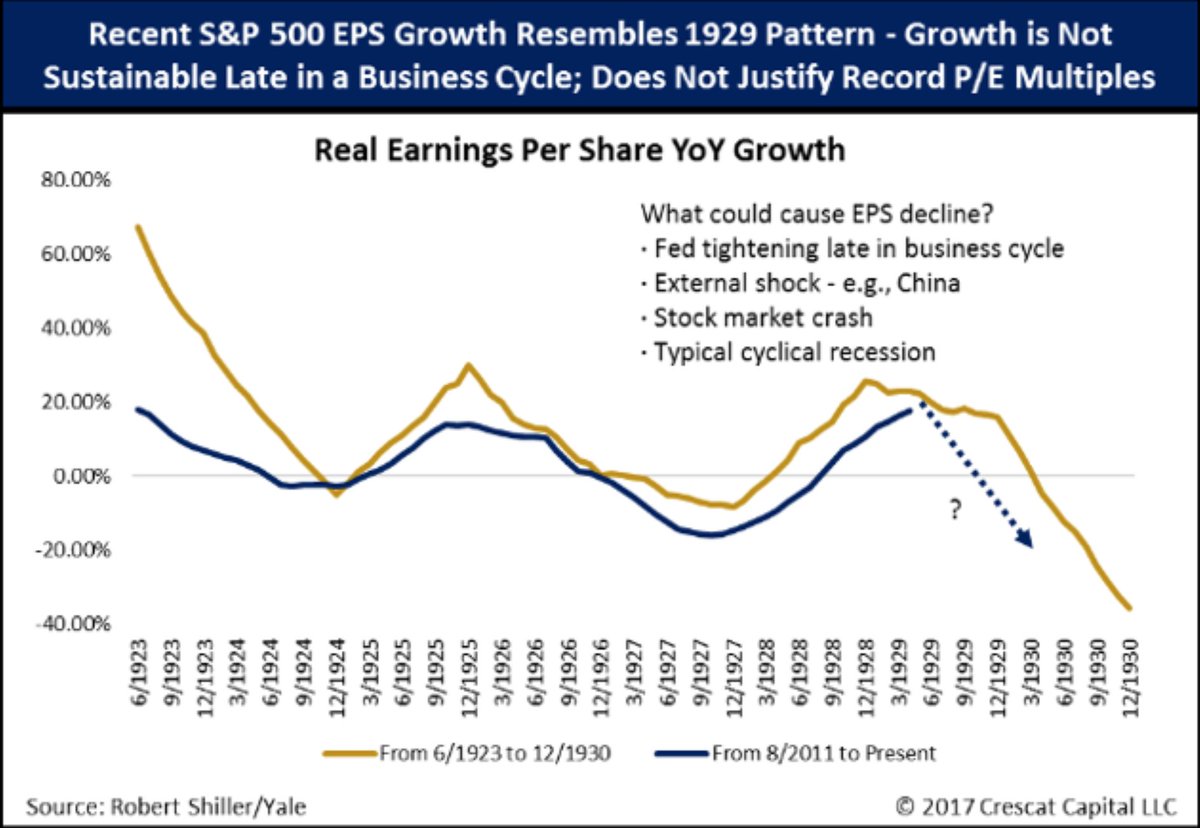

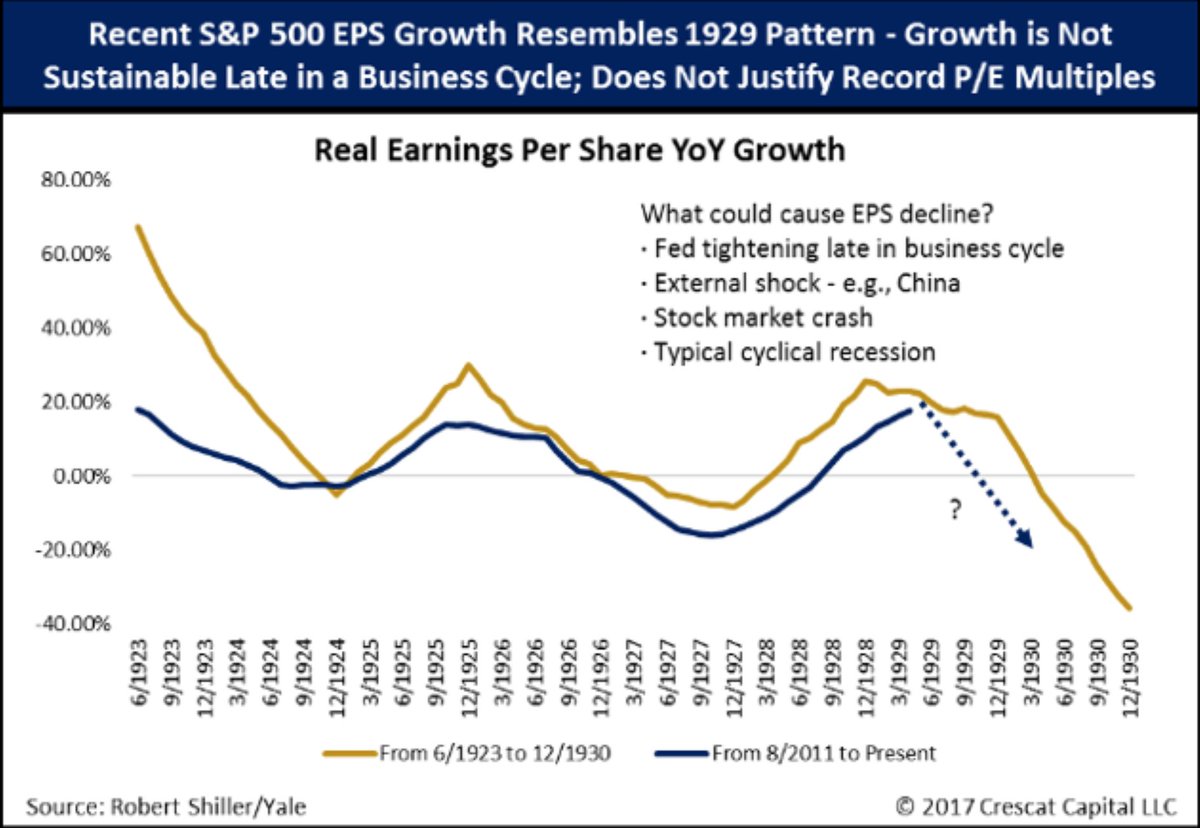

The Impact of Low Inflation on Investments

Low inflation significantly alters the investment landscape. Traditional investment strategies need careful recalibration:

- Bonds: In a low-inflation environment, bond yields tend to be low, reducing the attractiveness of fixed-income investments.

- Stocks: While stocks can still provide returns, achieving substantial growth requires careful stock selection and potentially higher risk tolerance.

- Real Estate: Real estate may offer some inflation hedge, but its performance can be affected by broader economic conditions and interest rate fluctuations.

The challenges are substantial: generating sufficient returns in a low-inflation environment requires a sophisticated approach.

- Alternative Investments: Consideration of alternative investments like commodities, private equity, or infrastructure projects might be necessary to boost returns. Diversification across various asset classes is key to mitigating risk.

Strategies for Navigating a Low-Inflation Economy

Adjusting Investment Strategies

Investors need to adapt their portfolios to thrive in a low-inflation climate:

- Value Investing: Focus on undervalued companies with strong fundamentals, as these may offer better returns compared to growth stocks in a low-growth environment.

- Dividend Investing: Companies that consistently pay dividends can provide a steady stream of income, which is particularly valuable during periods of low inflation.

- Inflation-Protected Securities (TIPS): These securities offer protection against inflation, ensuring that the returns keep pace with rising prices, although their appeal is lessened in a low-inflation climate.

- Long-Term Investment Horizon: Maintaining a long-term investment perspective is crucial in a low-inflation environment, allowing investors to ride out short-term market fluctuations and capitalize on long-term growth opportunities.

Business Planning in a Low-Inflation Environment

Businesses must adapt their strategies for continued success:

- Productivity and Efficiency: Focus on improving operational efficiency and productivity to reduce costs and maintain profitability. Automation and technology can be key drivers here.

- Pricing Strategies: Careful pricing strategies are crucial, balancing the need for competitiveness with the need to maintain profitability in a low-margin environment.

- Cost Management: Rigorous cost control and expense management are vital for maintaining profitability and sustainability. Every aspect of the business needs scrutiny.

- Innovation and Technology: Investment in research and development, and the adoption of new technologies, can lead to cost savings, improved productivity and the creation of new revenue streams.

Personal Financial Planning for Low Inflation

Personal financial planning in a low-inflation environment also requires adjustments:

- Saving and Budgeting: Maintaining disciplined saving and budgeting habits is crucial to build financial security.

- Debt Management: Prioritize debt reduction, as low inflation doesn't necessarily translate into lower interest rates.

- Diversifying Income Streams: Exploring additional income sources to ensure financial stability is advisable.

Conclusion

Planning for a low-inflation economy requires a proactive and adaptable approach. The key takeaways from this summary of our recent podcast are the importance of diversification, careful investment strategy selection, robust business planning, and disciplined personal financial management. Understanding the impact of low inflation on various asset classes and businesses is crucial for making informed decisions.

Learn more about effectively planning for a low-inflation economy by listening to the full podcast [link to podcast]. Understanding and adapting to a low-inflation environment is crucial for long-term financial success. Don't wait – start planning your low-inflation strategy today!

Featured Posts

-

Ujabb Egyeztetesek Trump Kepviseloje Es Putyin

May 27, 2025

Ujabb Egyeztetesek Trump Kepviseloje Es Putyin

May 27, 2025 -

10 Marzo 2024 Almanacco Giornaliero Eventi Storici E Curiosita

May 27, 2025

10 Marzo 2024 Almanacco Giornaliero Eventi Storici E Curiosita

May 27, 2025 -

Ligue 1 Algerienne Le Laso Chlef S Impose Face A L Usma

May 27, 2025

Ligue 1 Algerienne Le Laso Chlef S Impose Face A L Usma

May 27, 2025 -

J And K Cricket Team Suffers Defeat Against Goa

May 27, 2025

J And K Cricket Team Suffers Defeat Against Goa

May 27, 2025 -

Can We Make Housing Affordable Without Crashing Prices Gregor Robertson Says Yes

May 27, 2025

Can We Make Housing Affordable Without Crashing Prices Gregor Robertson Says Yes

May 27, 2025

Latest Posts

-

Leeds United Transfer News 31 Cap England Players Future Revealed

May 28, 2025

Leeds United Transfer News 31 Cap England Players Future Revealed

May 28, 2025 -

Mc Kennas Back Cajustes Progress Trio Still Out Ipswich Town Injury Update

May 28, 2025

Mc Kennas Back Cajustes Progress Trio Still Out Ipswich Town Injury Update

May 28, 2025 -

Confirmed Leeds United Close To Signing England International Latest Transfer News

May 28, 2025

Confirmed Leeds United Close To Signing England International Latest Transfer News

May 28, 2025 -

Leeds United Transfer News England Stars Verbal Agreement And Player Stance

May 28, 2025

Leeds United Transfer News England Stars Verbal Agreement And Player Stance

May 28, 2025 -

Manchester City Transfer News Serie A Star Targeted

May 28, 2025

Manchester City Transfer News Serie A Star Targeted

May 28, 2025