PCC's 2024 Financial Report: A Surprise Profit Announcement

Table of Contents

Key Highlights of PCC's 2024 Financial Performance

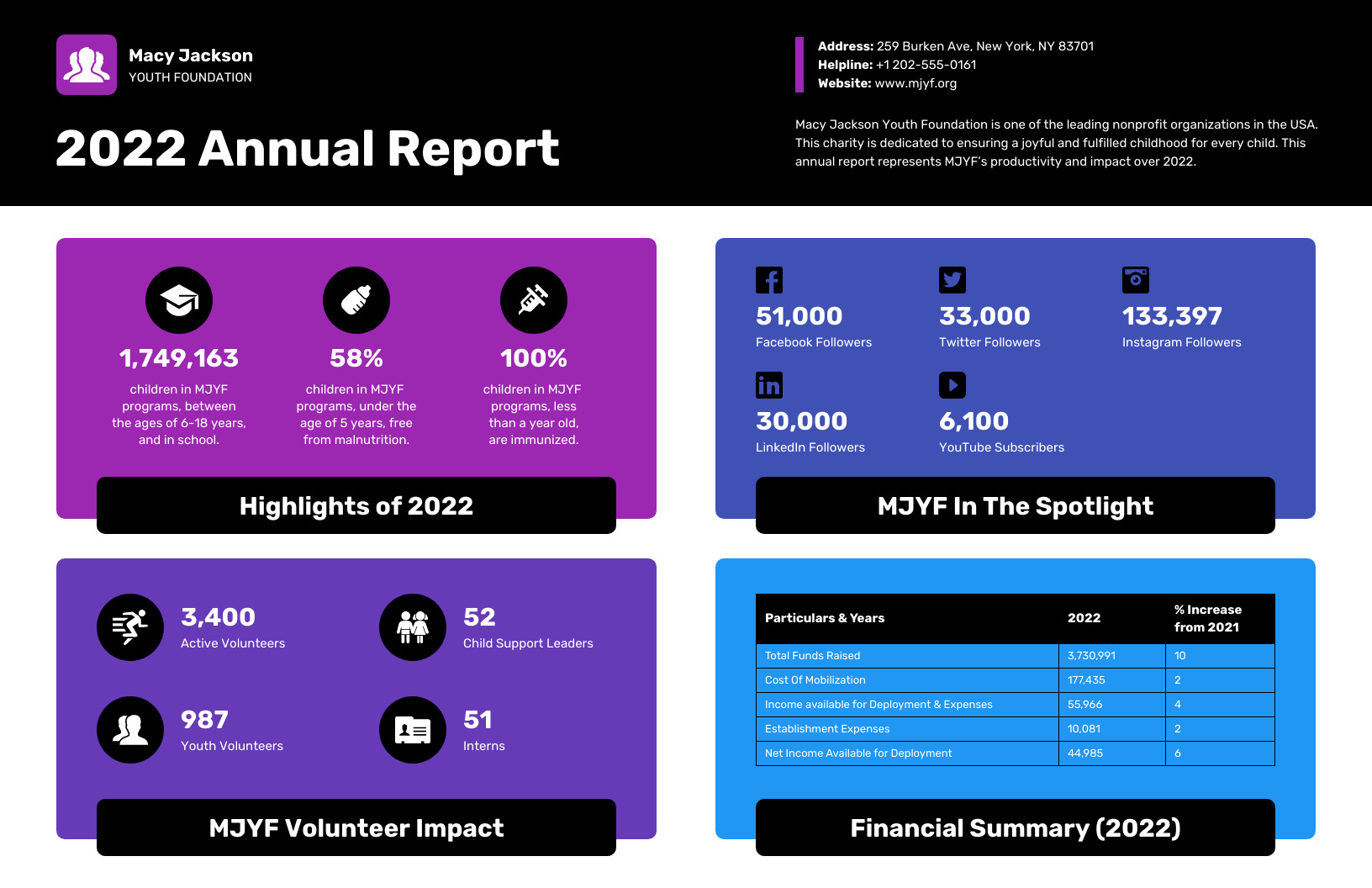

PCC's 2024 financial statement reveals a dramatic improvement in key performance indicators. The company reported a substantial increase in revenue, leading to significantly higher net income and earnings per share (EPS). A detailed financial statement analysis reveals the following:

- Revenue Growth: Revenue increased by 25% year-over-year, surpassing initial projections by 10%. This impressive growth can be attributed to several factors detailed below.

- Profit Margin Improvement: PCC achieved a remarkable 15% increase in profit margin, reaching a record high of 22%. This improvement showcases significant cost-cutting measures and improved operational efficiency.

- Net Income Surge: Net income soared by 30%, reaching $500 million – a figure far exceeding market expectations.

- Earnings Per Share (EPS): EPS increased by 35%, reaching $5.50, demonstrating strong profitability and value creation for shareholders. This significantly outperformed analyst consensus estimates of $4.00.

- Comparison to Industry Benchmarks: PCC's performance significantly outpaces industry averages, demonstrating the effectiveness of its strategic initiatives and operational excellence.

Factors Contributing to the Surprise Profit

The unexpected profitability reported in PCC's 2024 financial report is the result of several strategic initiatives and operational improvements:

- Successful Strategic Initiatives: The implementation of a new customer relationship management (CRM) system has significantly enhanced sales efficiency, leading to increased sales conversions and improved customer retention. The launch of a new loyalty program further boosted customer engagement and repeat business.

- Cost Reduction and Improved Operational Efficiency: PCC implemented aggressive cost-cutting measures, streamlining operations and reducing waste. These initiatives resulted in a $75 million reduction in operating expenses. Process optimization and automation also played a significant role.

- Market Expansion and New Product Launches: Successful penetration into the European market, coupled with the launch of three innovative new products, contributed significantly to revenue growth. The new products tapped into previously underserved market segments, driving considerable demand.

- Stronger-Than-Anticipated Market Demand: Favorable market conditions and strong consumer confidence led to higher-than-predicted demand for PCC's products. This unexpected surge in demand fueled substantial revenue growth and profitability.

- Technological Advancements: Investment in new technologies has increased efficiency across various departments, resulting in improved output and reduced operational costs.

Analyst Reactions and Future Outlook for PCC

The market reacted positively to PCC's surprising profit announcement, with PCC's stock price increasing by 18% in the following trading days. Investor sentiment towards the company has improved significantly, reflecting confidence in its future prospects.

- Stock Price Increase: The stock price surge indicates strong investor confidence and expectations for continued growth.

- Analyst Predictions: Leading financial analysts have revised their forecasts for PCC, predicting continued growth in the coming year. Many have increased their price targets for PCC stock.

- Potential Risks and Challenges: While the outlook is positive, analysts have highlighted potential risks such as increased competition and fluctuations in raw material costs as potential challenges for PCC.

- Investor Sentiment: The overwhelmingly positive reaction indicates strong investor belief in PCC's long-term growth trajectory.

Conclusion

PCC's 2024 financial report showcases an unexpected and remarkable success story. The impressive profit increase is a direct result of a combination of well-executed strategic initiatives, significant cost-cutting measures, effective market expansion, and favorable market conditions. The company's impressive financial performance significantly exceeded expectations, solidifying its position as a leader in its industry. To better understand the intricacies of this financial success, and for further analysis of their financial performance and understanding of future PCC 2024 and beyond financial reports, stay updated on PCC's financial progress by regularly reviewing their reports and following their financial news. Learn more about PCC's financial strategy and analyze PCC's future performance with us.

Featured Posts

-

Mastering The Bargain Hunt Tips And Tricks For Smart Shopping

May 29, 2025

Mastering The Bargain Hunt Tips And Tricks For Smart Shopping

May 29, 2025 -

Gewapende Overval Op School 16 Jarige Venlonaar In Beeld

May 29, 2025

Gewapende Overval Op School 16 Jarige Venlonaar In Beeld

May 29, 2025 -

The Adorable Nickname Morgan Wallens Grandma Uses

May 29, 2025

The Adorable Nickname Morgan Wallens Grandma Uses

May 29, 2025 -

Did Nepotism Help Build The Deliciously Ella Empire

May 29, 2025

Did Nepotism Help Build The Deliciously Ella Empire

May 29, 2025 -

Free To Play Pokemon Tcg Pocket Players Drowning In New Cards The Latest Expansion Detailed

May 29, 2025

Free To Play Pokemon Tcg Pocket Players Drowning In New Cards The Latest Expansion Detailed

May 29, 2025

Latest Posts

-

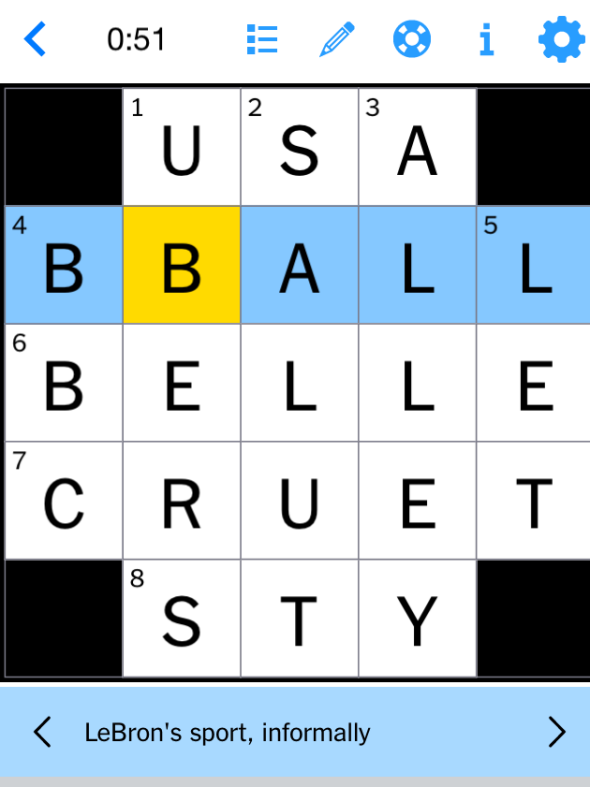

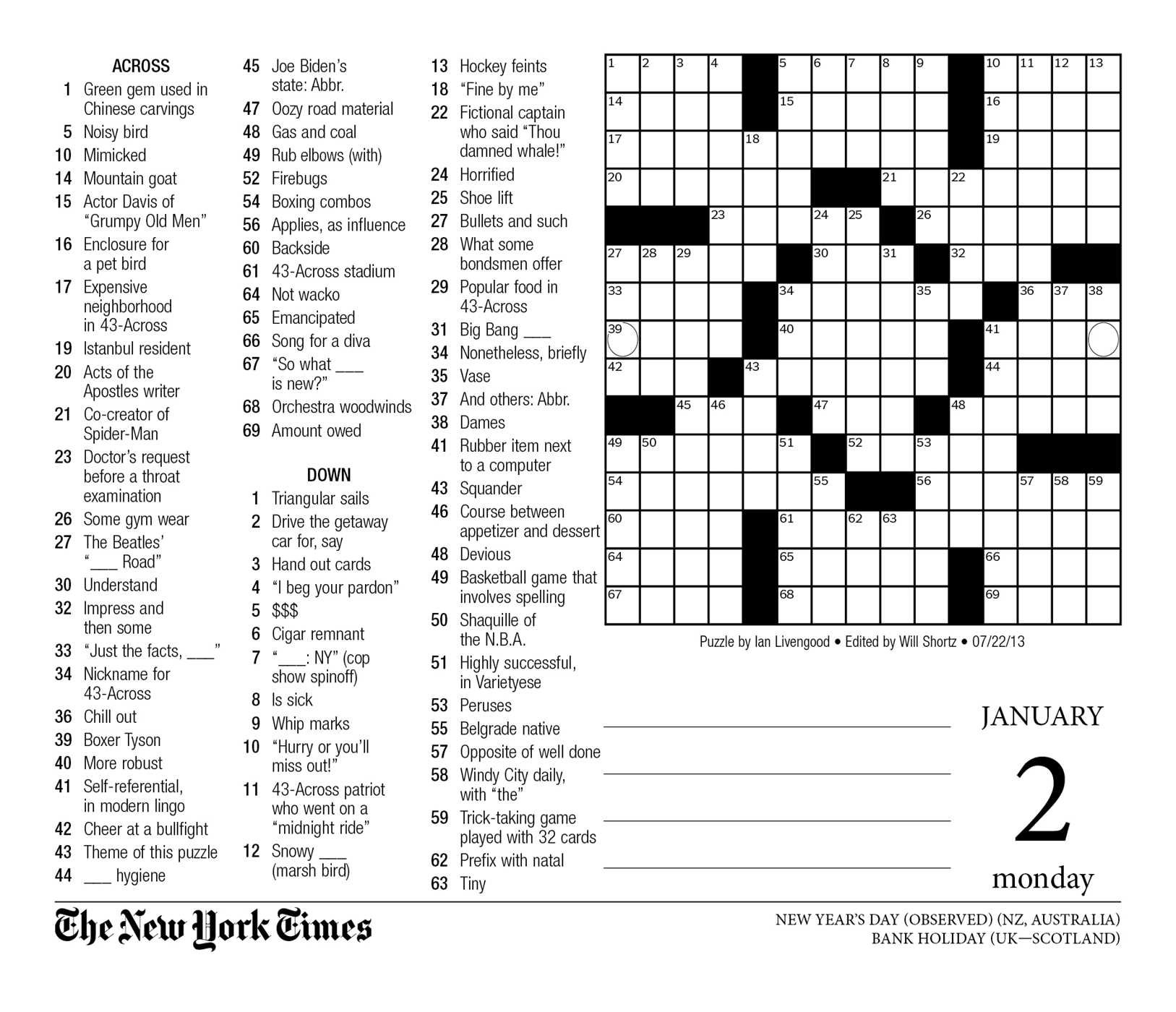

Nyt Mini Crossword Saturday April 19 Clues And Solutions

May 31, 2025

Nyt Mini Crossword Saturday April 19 Clues And Solutions

May 31, 2025 -

Solve The Nyt Mini Crossword Thursday April 10th Answers

May 31, 2025

Solve The Nyt Mini Crossword Thursday April 10th Answers

May 31, 2025 -

Nyt Mini Crossword Clue Answers Tuesday March 18

May 31, 2025

Nyt Mini Crossword Clue Answers Tuesday March 18

May 31, 2025 -

Nyt Mini Crossword Clues And Answers Thursday April 10

May 31, 2025

Nyt Mini Crossword Clues And Answers Thursday April 10

May 31, 2025 -

Thursday April 10th Nyt Mini Crossword Puzzle Answers

May 31, 2025

Thursday April 10th Nyt Mini Crossword Puzzle Answers

May 31, 2025