Paytm Payments Bank Hit With ₹5.45 Crore Fine For Money Laundering Failures: FIU-IND Action

Table of Contents

Details of the FIU-IND Action Against Paytm Payments Bank

The FIU-IND's action against Paytm Payments Bank stems from several key shortcomings in their Know Your Customer (KYC) procedures and overall anti-money laundering (AML) compliance framework. The investigation revealed significant weaknesses in several areas:

-

Inadequate KYC Checks: The FIU-IND report allegedly highlighted insufficient verification of customer identities, potentially allowing for the use of the platform by individuals involved in illicit activities. This failure to properly implement KYC protocols is a serious regulatory breach.

-

Failure to Report Suspicious Transactions: Crucially, Paytm Payments Bank reportedly failed to adequately identify and report suspicious transactions, a critical component of AML compliance. This omission undermines the effectiveness of the entire AML system.

-

Weaknesses in AML Systems and Processes: The investigation pointed towards systemic weaknesses in Paytm Payments Bank's AML systems and processes, indicating a lack of comprehensive internal controls and potentially inadequate training for staff responsible for AML compliance.

-

Lack of Proper Internal Controls: The FIU-IND likely found that internal controls designed to prevent and detect money laundering were insufficient, highlighting a lack of oversight and accountability within the bank's operations. This suggests a failure to proactively identify and mitigate risks.

These failures represent significant regulatory breaches and underscore the need for a more rigorous approach to AML compliance within the fintech industry. Further details of the specific instances cited in the FIU-IND report are awaited, but the scale of the fine speaks volumes about the severity of the identified lapses.

The Significance of the ₹5.45 Crore Fine

The ₹5.45 crore fine imposed on Paytm Payments Bank is not merely a financial penalty; it's a strong statement from the FIU-IND regarding the seriousness of AML non-compliance. This significant "financial penalty" carries several weighty implications:

-

Impact on Paytm Payments Bank's Financials: While the exact impact on Paytm Payments Bank's bottom line will depend on their financial reporting, a fine of this magnitude is undoubtedly substantial, affecting their profitability and potentially influencing their investment strategies.

-

Message to Other Financial Institutions: The fine serves as a stark warning to other financial institutions, particularly within the rapidly expanding fintech sector, about the crucial need for robust AML compliance. The regulatory repercussions can be severe.

-

Reputational Risk: The reputational damage to Paytm Payments Bank is significant. Customer trust is paramount in the financial sector, and this incident could erode confidence in the bank’s ability to safeguard customer data and prevent illegal activities. The associated "reputational risk" is considerable.

Paytm Payments Bank's Response and Future Actions

Paytm Payments Bank has yet to release a comprehensive public statement directly addressing the specifics of the FIU-IND findings. However, it's anticipated that they will implement "corrective measures" and strengthen their AML procedures. This may include:

-

Investment in upgraded technology: Implementing more advanced systems for transaction monitoring and suspicious activity detection.

-

Enhanced employee training: Providing comprehensive training for staff on AML procedures and best practices.

-

Strengthened internal controls: Improving internal audit functions and strengthening oversight to better identify and mitigate risks.

The future implications for Paytm Payments Bank include increased regulatory oversight and potentially further investigations. The bank's response and proactive steps to improve their "compliance improvements" will be crucial in restoring customer confidence.

Implications for the Fintech Industry and Customers

The Paytm Payments Bank case has far-reaching implications for the entire fintech industry and its customers:

-

Increased Fintech Regulation: This incident is likely to prompt increased regulatory scrutiny across the fintech sector. Expect stricter AML compliance standards and more frequent audits.

-

Customer Data Protection: The importance of robust data protection measures and user verification is highlighted. Customers need to be assured that their financial information is safe and that the institutions they use are complying with all relevant regulations.

-

Industry Best Practices: Fintech companies will need to prioritize the adoption of industry best practices in AML compliance, proactively investing in technology and training to prevent future incidents. Following "AML compliance standards" becomes even more critical.

Customers should be mindful of the potential risks associated with using financial technology services and choose providers with a proven track record of robust security measures and compliance with AML regulations.

Conclusion: Understanding the Paytm Payments Bank Money Laundering Fine and its Ramifications

The ₹5.45 crore fine levied against Paytm Payments Bank for money laundering failures serves as a significant wake-up call for the entire fintech industry. The FIU-IND investigation highlights the critical need for stringent AML compliance, encompassing robust KYC procedures, effective transaction monitoring, and strong internal controls. Non-compliance carries severe consequences, including substantial financial penalties, significant reputational damage, and a devastating loss of customer trust. Understanding Paytm Payments Bank’s AML compliance issues and the subsequent actions taken should serve as a learning experience for all financial institutions. To protect yourself and your financial information, it is crucial to research and choose fintech apps and banks that prioritize robust security measures and demonstrate a commitment to "avoiding money laundering risks with fintech apps." Learn more about AML compliance and responsible financial practices today.

Featured Posts

-

Mays Ge Force Now Game Additions Doom Blades Of Fire And Other Titles

May 15, 2025

Mays Ge Force Now Game Additions Doom Blades Of Fire And Other Titles

May 15, 2025 -

Dreigende Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025

Dreigende Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025 -

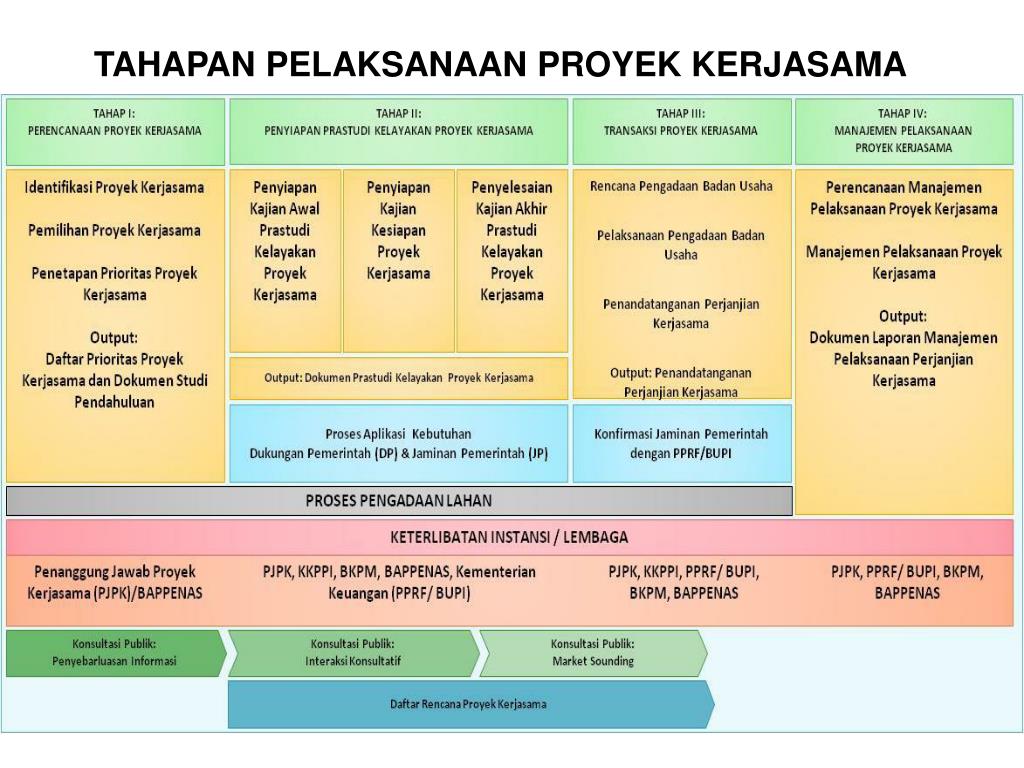

Investasi Giant Sea Wall Kerja Sama Pemerintah Dan Swasta Untuk Infrastruktur Pesisir

May 15, 2025

Investasi Giant Sea Wall Kerja Sama Pemerintah Dan Swasta Untuk Infrastruktur Pesisir

May 15, 2025 -

Ovechkins Historic Goal 893 Closing In On Gretzky

May 15, 2025

Ovechkins Historic Goal 893 Closing In On Gretzky

May 15, 2025 -

Earthquakes Fall To Rapids Analysis Of Steffens Performance

May 15, 2025

Earthquakes Fall To Rapids Analysis Of Steffens Performance

May 15, 2025