Palantir's Stock: A History Of Volatility And Its Current Valuation

Table of Contents

A Historical Overview of Palantir's Stock Performance

Palantir's initial public offering (IPO) in September 2020 was highly anticipated, yet the initial market reception was somewhat muted. The company, known for its secretive work with government agencies and its powerful data analysis platform, went public at a price of $10 per share. However, the stock price didn't immediately soar, experiencing initial fluctuations that reflected both excitement and uncertainty about its future prospects.

The subsequent years saw significant price swings. Several factors contributed to this volatility. Positive earnings reports and announcements of large government contracts often fueled upward price movements, while periods of slower growth or setbacks in securing new deals led to declines. Geopolitical events also played a significant role, with increased global tensions sometimes benefiting Palantir's business, and periods of relative stability potentially dampening investor enthusiasm.

- IPO Price and Date: $10 per share, September 2020

- Highest Stock Price: [Insert highest price and date – requires up-to-date market data]

- Lowest Stock Price: [Insert lowest price and date – requires up-to-date market data]

- Key Dates of Significant Price Movements: [Insert key dates and corresponding price changes – requires up-to-date market data; examples: Q4 2020 earnings, specific contract wins or losses, major geopolitical events]

- Impact of Major News Events on Stock Price: [Insert examples of how news impacted price – e.g., a large contract win leading to a price surge, negative press impacting investor confidence.]

Factors Contributing to Palantir's Stock Volatility

Palantir's stock volatility stems from several interconnected factors inherent in its business model and the broader macroeconomic environment.

One key risk is Palantir's significant reliance on government contracts. While these contracts often represent substantial revenue streams, they can be subject to unpredictable budgeting cycles, political changes, and competitive bidding processes. This dependence makes Palantir's revenue stream less predictable than companies with more diversified customer bases.

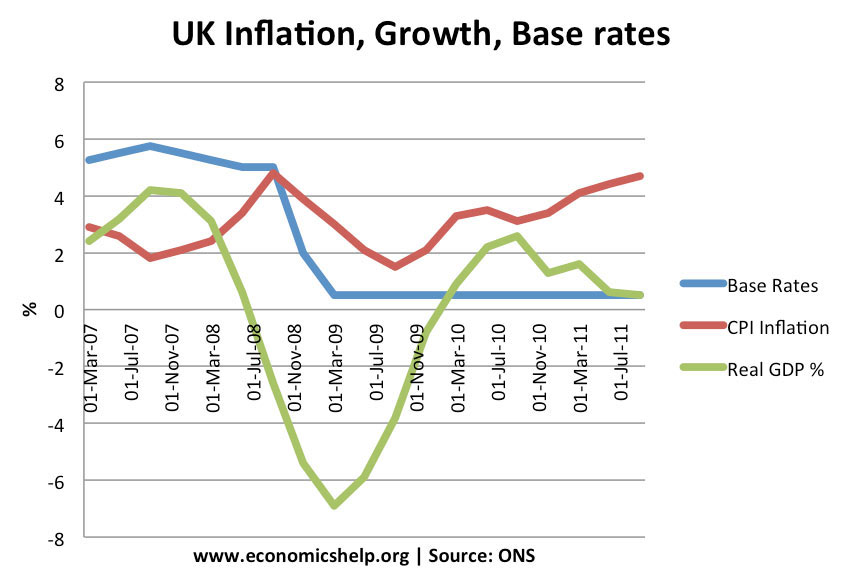

Furthermore, Palantir operates in a competitive landscape, facing pressure from established tech giants and emerging data analytics firms. The constant need to innovate and adapt to changing market demands contributes to the uncertainty surrounding the company's future performance. Investor sentiment plays a crucial role. Positive media coverage and analyst upgrades often lead to price increases, while negative news or disappointing earnings reports can trigger sharp declines. Macroeconomic factors, such as interest rate hikes and inflation, further complicate the situation, influencing investor risk appetite and overall market valuations.

- Government Contract Reliance: A significant percentage of revenue comes from government sources, creating inherent volatility.

- Competitive Landscape: Intense competition from established and emerging players in the data analytics space.

- Market Perception of Palantir's Technology: Investor confidence fluctuates based on perceptions of the company's technological advantage and future market penetration.

- Economic Factors Impacting Stock Performance: Interest rates, inflation, and overall economic growth significantly influence Palantir's stock price.

Analyzing Palantir's Current Valuation

As of [Insert Date], Palantir's market capitalization is [Insert Current Market Cap]. Its price-to-earnings (P/E) ratio is [Insert Current P/E Ratio], which can be compared to industry averages to gauge its relative valuation. Analyzing Palantir's financial health reveals [Insert key financial metrics – revenue growth rate, profit margins, debt levels]. The company's recent financial performance and future growth potential, based on its current projects and market trends, should be considered when evaluating its current valuation.

- Current Market Cap: [Insert Current Market Cap – requires up-to-date market data]

- P/E Ratio Compared to Industry Averages: [Compare Palantir's P/E ratio to competitors – requires up-to-date market data]

- Key Financial Metrics (Revenue, Profit Margins, Debt): [Insert relevant data – requires up-to-date financial statements]

- Growth Projections and Potential Catalysts: [Discuss potential growth drivers like expansion into new markets or technological advancements]

Investing in Palantir Stock: Risks and Rewards

Investing in Palantir stock presents a classic high-risk, high-reward scenario. The potential for significant long-term growth is undeniable, given Palantir's innovative technology and expanding market opportunities. However, the inherent volatility and dependence on large contracts necessitate a cautious approach. Investors should carefully consider their risk tolerance and investment timeframe before allocating capital to Palantir. Diversification is crucial to mitigate the risk associated with this volatile stock.

- High-Risk, High-Reward Investment Potential: Significant potential for gains, but also considerable risk of losses.

- Long-Term vs. Short-Term Investment Strategies: Palantir is better suited for long-term investors with a higher risk tolerance.

- Diversification and Risk Management Strategies: Diversifying your portfolio is crucial to mitigate risk associated with Palantir’s volatility.

Conclusion: Making Informed Decisions About Palantir's Stock

Palantir's stock has demonstrated considerable volatility throughout its history, driven by factors such as its reliance on government contracts, competitive pressures, and broader macroeconomic conditions. While the company holds significant potential for long-term growth, investing in Palantir's stock necessitates a thorough understanding of its inherent risks. Before making any investment decisions regarding Palantir stock investment, conduct thorough research, analyze its current valuation against its competitors, and assess its alignment with your personal risk tolerance and investment goals. Consider seeking advice from a qualified financial advisor to further refine your Palantir stock analysis and develop a comprehensive investment strategy. Remember, informed decisions about Palantir stock valuation are paramount to successful investing.

Featured Posts

-

Filming Begins This Summer Jenna Ortega And Glen Powell In A New Fantasy Film

May 07, 2025

Filming Begins This Summer Jenna Ortega And Glen Powell In A New Fantasy Film

May 07, 2025 -

The Glossy Mirage Fact Vs Fiction

May 07, 2025

The Glossy Mirage Fact Vs Fiction

May 07, 2025 -

Conclave The Process Of Electing The Pope

May 07, 2025

Conclave The Process Of Electing The Pope

May 07, 2025 -

The Truth Behind Jenna Ortega Leaving Scream Post Barrera Departure

May 07, 2025

The Truth Behind Jenna Ortega Leaving Scream Post Barrera Departure

May 07, 2025 -

Warriors Defeat Kings Kuminga Returns Curry And Kerr Achieve Milestones

May 07, 2025

Warriors Defeat Kings Kuminga Returns Curry And Kerr Achieve Milestones

May 07, 2025

Latest Posts

-

Chinas Monetary Policy Shift Lower Rates Increased Bank Lending

May 08, 2025

Chinas Monetary Policy Shift Lower Rates Increased Bank Lending

May 08, 2025 -

Smokey Robinson Accused Of Sexual Assault Four Employees Come Forward

May 08, 2025

Smokey Robinson Accused Of Sexual Assault Four Employees Come Forward

May 08, 2025 -

The Vaticans Financial Crisis A Legacy Pope Francis Couldnt Resolve

May 08, 2025

The Vaticans Financial Crisis A Legacy Pope Francis Couldnt Resolve

May 08, 2025 -

Papal Conclave 2023 Preparing For The Election Of A New Pope

May 08, 2025

Papal Conclave 2023 Preparing For The Election Of A New Pope

May 08, 2025 -

U S Intensifies Greenland Surveillance Exclusive Intelligence Report

May 08, 2025

U S Intensifies Greenland Surveillance Exclusive Intelligence Report

May 08, 2025