Palantir Technologies Stock: Buy, Sell, Or Hold?

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir Technologies operates primarily through two core platforms: Gotham and Foundry. Gotham caters to government agencies, offering advanced data analytics and integration capabilities for national security and intelligence applications. Foundry, on the other hand, targets commercial clients across various sectors, providing a similar platform for operational efficiency and data-driven decision-making.

Palantir's revenue streams are diverse, though heavily weighted towards government contracts initially. This diversification is a key factor in assessing Palantir Technologies stock. Here's a breakdown:

- Government contracts: A significant portion of Palantir's revenue comes from long-term contracts with government agencies worldwide. This provides stability but also presents risks associated with government budgeting cycles and geopolitical factors.

- Commercial adoption: Palantir is actively expanding its commercial client base, targeting sectors such as finance, healthcare, and energy. Success in this area is crucial for long-term growth and reducing reliance on government contracts.

- Data analytics services: Palantir provides consulting services alongside its software platforms, offering customized solutions and support to its clients. This contributes to higher margins and stronger client relationships.

- Software licensing: A recurring revenue stream generated from the licensing of its Gotham and Foundry platforms. This is a key indicator of the sustainability of the Palantir business model.

- Consulting revenue: Revenue generated from implementation, training, and ongoing support provided to clients.

Analyzing Palantir's current financial performance requires careful examination of its revenue growth, profitability (or lack thereof in earlier years), and operating margins. While revenue has shown substantial growth, profitability has been a key focus for investors, with recent reports indicating a shift toward greater profitability. Access to up-to-date financial statements and analysis from reputable sources is essential for a thorough assessment.

Competitive Landscape and Market Position

Palantir faces competition from several established players and emerging startups in the big data and analytics space. Key competitors include Databricks, Snowflake, and other cloud-based data warehousing and analytics providers. However, Palantir possesses several key competitive advantages:

- Proprietary technology: Palantir's platforms boast unique data integration and analytical capabilities that differentiate them from competitors.

- Strong government relationships: Its established presence within government agencies provides a significant barrier to entry for competitors.

- Data integration capabilities: Palantir excels at integrating disparate data sources, a critical capability for many organizations.

While analyzing Palantir's market share is challenging due to the nature of its clientele and competitive landscape, its potential for future growth is significant. This is particularly true as the adoption of big data analytics continues to increase across both public and private sectors. The company's ability to innovate and adapt to changing market trends, particularly in areas like AI and machine learning, will be a key determinant of its future success.

Risk Assessment and Potential Challenges

Investing in Palantir Technologies stock carries inherent risks. A crucial aspect of any Palantir Technologies stock analysis is acknowledging these risks:

- Government contract reliance: Dependence on government contracts exposes Palantir to budgetary fluctuations and geopolitical uncertainties.

- Competition intensity: The competitive landscape is dynamic, with established players and innovative startups constantly vying for market share.

- Economic sensitivity: Palantir's business can be sensitive to economic downturns, as companies may reduce spending on data analytics services during times of uncertainty.

- Cybersecurity vulnerabilities: As a provider of critical data analytics services, Palantir is a potential target for cyberattacks, which could damage its reputation and financial performance.

- Debt and leverage: Analyzing the company's financial health and debt levels is vital, as high debt levels can increase financial risk.

- Regulatory hurdles and compliance issues: Navigating complex regulatory environments, particularly in government contracts, poses challenges.

Valuation and Stock Price Analysis

Analyzing Palantir's stock price history, current valuation metrics (such as P/E ratio, Price-to-Sales ratio, and others), and comparing it to its competitors are all essential parts of the decision-making process. Considering analyst ratings and price targets provides further insight. However, it's crucial to remember that valuation metrics alone don't tell the whole story; future earnings potential significantly impacts stock price. A detailed understanding of Palantir's financial projections is necessary for a comprehensive valuation.

Future Outlook and Investment Implications

Projecting Palantir's future growth requires considering factors such as increased adoption of its products and services, potential for strategic acquisitions or partnerships, and the long-term sustainability of its business model. Based on the factors discussed above, a reasoned buy, sell, or hold recommendation can be made. While Palantir shows significant potential, especially in the expanding commercial sector, the dependence on government contracts and the competitive landscape require cautious assessment.

Conclusion

In conclusion, assessing Palantir Technologies stock requires a careful weighing of its strengths – its unique technology, strong government relationships, and growth potential in the commercial sector – against its weaknesses – dependence on government contracts, intense competition, and inherent risks associated with the data analytics industry. This analysis highlights the need for thorough due diligence before investing in Palantir Technologies stock.

Recommendation: Based on the current analysis, a [Buy/Sell/Hold – insert your reasoned recommendation here] recommendation for Palantir Technologies stock is warranted. [Justify your recommendation based on your analysis, referencing key findings from the preceding sections].

Call to Action: Further research is crucial before making any investment decisions. Consider your own risk tolerance and investment goals. Share your thoughts and analysis of Palantir Technologies stock in the comments below!

Featured Posts

-

A Fast Flying Farce Takes Flight At St Albert Dinner Theatre

May 10, 2025

A Fast Flying Farce Takes Flight At St Albert Dinner Theatre

May 10, 2025 -

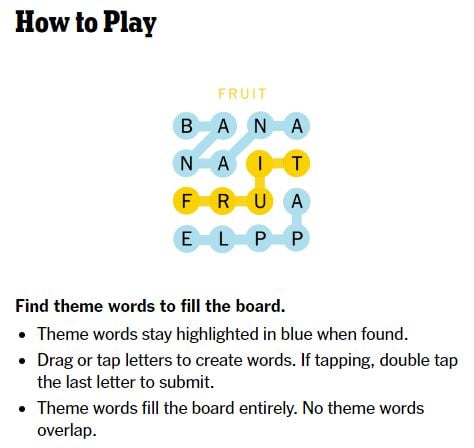

Nyt Strands Game 405 Solutions And Clues For April 12th

May 10, 2025

Nyt Strands Game 405 Solutions And Clues For April 12th

May 10, 2025 -

Troubled Nhs Trust And Nottingham Attacks Full Cooperation Promised

May 10, 2025

Troubled Nhs Trust And Nottingham Attacks Full Cooperation Promised

May 10, 2025 -

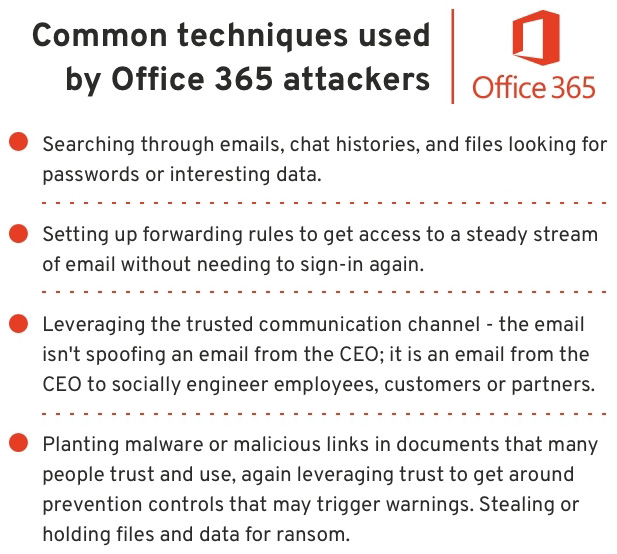

Cybercriminal Accumulates Millions Through Executive Office365 Intrusions

May 10, 2025

Cybercriminal Accumulates Millions Through Executive Office365 Intrusions

May 10, 2025 -

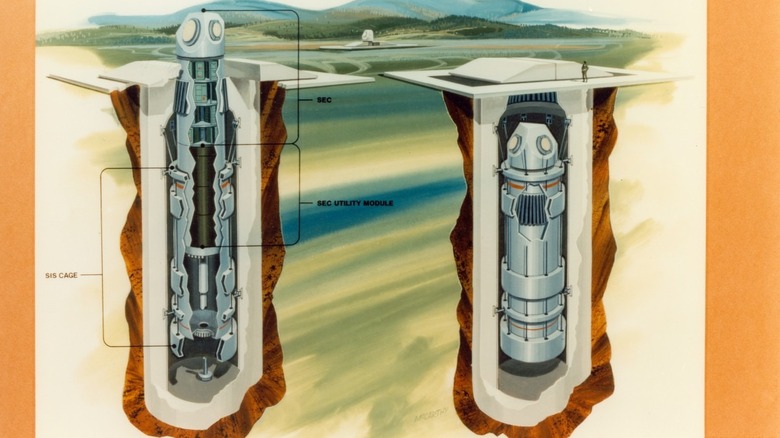

Pentagon Weighs Greenland Transfer To Northern Command Concerns Rise Over Trumps Legacy

May 10, 2025

Pentagon Weighs Greenland Transfer To Northern Command Concerns Rise Over Trumps Legacy

May 10, 2025