Palantir Technologies Stock: 40% Growth Potential By 2025 - Is It Worth The Risk?

Table of Contents

Palantir's Business Model and Competitive Advantage

Data Analytics Powerhouse

Palantir's core offerings, Gotham and Foundry, are sophisticated data integration and analytics platforms. Gotham, primarily used by government agencies, focuses on national security and intelligence applications. Foundry, aimed at the commercial sector, assists organizations in streamlining operations and extracting valuable insights from diverse data sources. These platforms cater to various sectors, including government, finance, healthcare, and energy, positioning Palantir at the forefront of the big data analytics revolution.

Government Contracts and Future Growth

Government contracts have been a cornerstone of Palantir's revenue. These contracts, often multi-year and high-value, provide a significant and relatively stable revenue stream. For example, [Insert example of a large government contract and its value]. However, relying heavily on government contracts presents inherent risks.

- Successful Government Deployments: Palantir's success with [mention specific government agencies and their use cases] demonstrates the platform's effectiveness in complex environments.

- Risks of Government Contract Reliance: Changes in government priorities, budget cuts, or shifts in political landscape could impact future contracts, creating revenue uncertainty for Palantir.

Commercial Market Penetration

Palantir's commercial market penetration is crucial for long-term growth. While initially focusing on government clients, the company is increasingly attracting commercial clients across various industries.

- Key Commercial Clients and Success Stories: [Mention examples of successful commercial deployments and the positive impact on their businesses]. This demonstrates Palantir's ability to deliver value beyond the government sector.

- Challenges in the Competitive Commercial Market: The commercial market is highly competitive, with established players like [mention competitors, e.g., AWS, Microsoft, Google] offering competing solutions. Palantir faces challenges in proving its value proposition and acquiring new customers.

Technological Innovation and Differentiation

Palantir's commitment to research and development (R&D) fuels its technological innovation. Its proprietary technology, particularly its advanced data integration and visualization capabilities, provides a significant competitive advantage.

- Technological Advancements: Recent advancements in [mention specific technologies, e.g., AI, machine learning] are enhancing Palantir's offerings, making them more powerful and user-friendly.

- Comparison with Competitors: While competitors offer similar data analytics solutions, Palantir distinguishes itself through its [mention specific differentiating factors, e.g., ease of use, data integration capabilities, security features].

Financial Performance and Valuation

Revenue Growth and Profitability

Palantir's financial performance has shown significant revenue growth in recent years. [Insert relevant charts and graphs illustrating revenue growth, profitability margins, and cash flow].

- Key Financial Metrics (Past Few Years): [Include data points such as revenue, EPS, debt-to-equity ratio for the past few years. Source the data].

- Future Financial Projections: While projections indicate continued growth, their reliability depends on several factors, including successful commercial market penetration and securing further government contracts.

Stock Valuation and Price Target

Palantir's current stock valuation can be assessed using metrics such as P/E ratio and Price-to-Sales ratio. [Compare these ratios to industry peers]. Analyst price targets vary, reflecting different growth scenarios and risk assessments.

- Analyst Price Targets: [Mention different analyst price targets and their rationale, citing sources].

- Impact of Market Sentiment: Investor sentiment and overall market conditions significantly influence Palantir's stock price.

Risks and Challenges

Competition and Market Saturation

The data analytics market is fiercely competitive. Established players and new entrants pose significant challenges to Palantir's growth.

- Major Competitors and Strengths: [List major competitors and their strengths, highlighting potential threats to Palantir].

- Risk of Market Saturation: The risk of market saturation, where the market becomes saturated with similar offerings, could hinder Palantir's future growth.

Dependence on Key Clients

Palantir's dependence on a relatively small number of large clients, especially government agencies, poses a significant risk.

- Impact of Losing a Major Client: Losing a major client could have a substantial negative impact on Palantir's revenue and profitability.

- Mitigation Strategies: Palantir is actively diversifying its client base and expanding its commercial offerings to mitigate this risk.

Geopolitical Risks

Geopolitical factors can significantly influence Palantir's business, especially its government contracts.

- Potential Geopolitical Risks: [Identify potential geopolitical risks and their potential impact on Palantir's operations].

- Mitigation Strategies: Careful risk assessment and diversification of its client base can help mitigate geopolitical risks.

Conclusion: Is Investing in Palantir Technologies Stock Right for You?

Palantir Technologies presents a compelling investment opportunity with significant growth potential driven by its innovative data analytics platforms and strong government contracts. However, the company faces challenges, including intense competition, reliance on key clients, and geopolitical risks. The projected 40% growth by 2025 is ambitious and hinges on successful execution of its strategic plans. While the potential rewards are considerable, investors must carefully weigh these against the inherent risks. Before investing in Palantir Technologies stock, conduct thorough due diligence, reviewing its financial reports and industry analyses to arrive at an informed investment decision. Is investing in Palantir Technologies stock right for you? Only further research can provide the answer.

Featured Posts

-

Bitcoin Madenciliginin Suerdueruelebilirligi Ve Sonlanma Senaryolari

May 09, 2025

Bitcoin Madenciliginin Suerdueruelebilirligi Ve Sonlanma Senaryolari

May 09, 2025 -

China Seeks New Canola Sources Amidst Canada Trade Tensions

May 09, 2025

China Seeks New Canola Sources Amidst Canada Trade Tensions

May 09, 2025 -

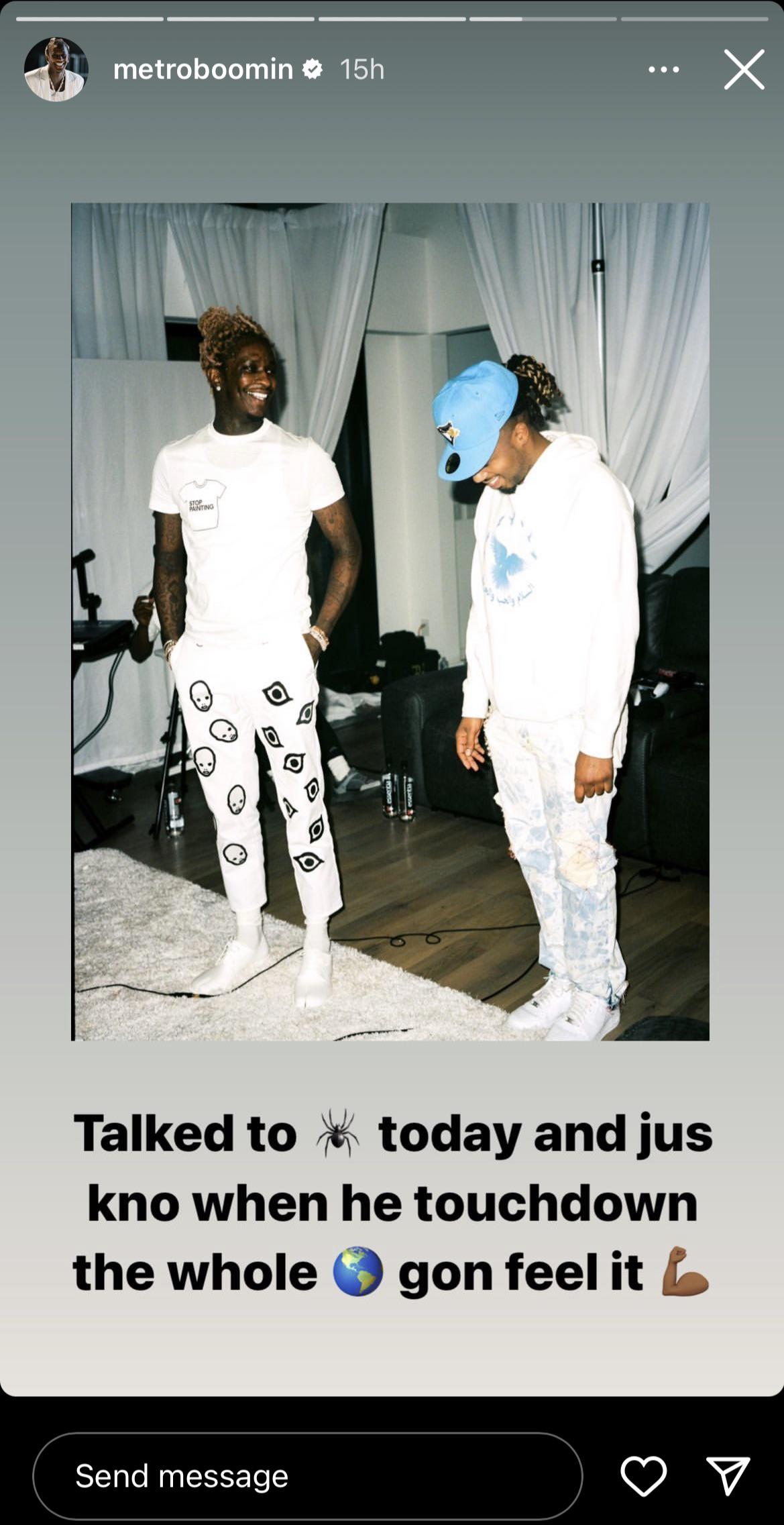

Uy Scuti Release Date Teased By Young Thug

May 09, 2025

Uy Scuti Release Date Teased By Young Thug

May 09, 2025 -

600 Sensex Nifty

May 09, 2025

600 Sensex Nifty

May 09, 2025 -

Proposed Uk Visa Restrictions Which Nationalities Could Be Affected

May 09, 2025

Proposed Uk Visa Restrictions Which Nationalities Could Be Affected

May 09, 2025