Palantir Stock Plunges 30%: Should You Buy The Dip?

Table of Contents

Analyzing the Reasons Behind the Palantir Stock Drop

Several factors contributed to the recent decline in Palantir stock. Understanding these reasons is crucial before considering any investment strategy related to PLTR stock.

Disappointing Earnings Report

Palantir's latest earnings report revealed several key weaknesses that spooked investors. The report fell short of expectations, leading to a significant sell-off in Palantir stock.

- Missed revenue projections: The company failed to meet its projected revenue targets for the quarter, raising concerns about future growth.

- Decreased growth in key segments: Growth in certain key sectors, which are vital for Palantir's overall revenue, slowed down, signaling potential market saturation or competitive pressure.

- Increased operating expenses: Higher-than-expected operating expenses further squeezed profit margins, adding to investor concerns about Palantir's profitability.

Broader Market Sentiment and Tech Sector Downturn

The recent Palantir stock drop doesn't exist in a vacuum. The broader market is experiencing volatility, significantly impacting the tech sector. This broader downturn has exacerbated the negative sentiment around Palantir.

- Overall market volatility: Geopolitical uncertainties and macroeconomic factors have created a volatile market environment, impacting even strong companies.

- Interest rate hikes: Increased interest rates have made borrowing more expensive, impacting the growth prospects of many technology companies, including Palantir.

- Investor concerns about future growth: Investors are increasingly cautious about the future growth potential of tech companies, leading to a general sell-off in the sector, impacting the Palantir share price.

Competition and Market Saturation

Palantir faces increasing competition in the data analytics and software markets. This competitive pressure may be contributing to the recent challenges faced by the company.

- Increased competition from established players: Large, established technology companies are expanding their offerings into areas where Palantir operates, intensifying competition.

- Emergence of new technologies: The rapid evolution of technology means that new competitors and disruptive technologies are constantly emerging, posing a threat to Palantir's market share.

- Challenges in scaling operations: Expanding operations and maintaining profitability can be challenging, particularly in a competitive market.

Evaluating the Potential for Palantir Stock Recovery

While the recent decline is concerning, it's important to consider the potential for Palantir stock to recover. Analyzing the long-term prospects and current valuation is key.

Long-Term Growth Prospects

Despite the recent setbacks, Palantir maintains long-term growth potential, particularly in the government and commercial sectors.

- Government contracts and partnerships: Palantir holds significant government contracts, providing a stable revenue stream.

- Expansion into new markets: The company continues to expand into new markets and explore new applications for its technology.

- Innovative technologies and product development: Palantir is continually innovating and developing new technologies, which could drive future growth.

Undervalued Asset or Risky Investment?

The current valuation of Palantir stock is a critical consideration. Is it truly undervalued, presenting a buying opportunity, or is it still a risky investment?

- Comparison to industry peers: Comparing Palantir's valuation metrics (like P/E ratio) to those of its competitors can provide insights into its relative attractiveness.

- Potential for future earnings growth: Analyzing future earnings projections is vital to determine the potential for stock price appreciation.

- Risks associated with the investment: Investing in Palantir stock carries significant risks, including further price declines and the potential for the company to fail to meet its growth targets.

Technical Analysis of PLTR Stock Chart

A brief look at technical indicators might offer some insight into potential short-term trends. (Disclaimer: This is not financial advice).

- Support and resistance levels on the PLTR stock chart can indicate potential price floors or ceilings.

- Moving averages can suggest the overall trend of the stock price.

- Other technical indicators may provide additional clues (but should not be relied upon solely for investment decisions).

Strategies for Investing in Palantir Stock (Disclaimer: This is not financial advice)

If you're considering investing in Palantir stock, employing sound investment strategies is crucial.

Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the stock price. This strategy helps mitigate the risk of investing a lump sum at a market high.

Diversification

Never put all your eggs in one basket. Diversifying your portfolio across different asset classes reduces overall risk.

Risk Tolerance Assessment

Before investing in any stock, particularly a volatile one like Palantir, it’s vital to assess your own risk tolerance. Are you comfortable with the potential for significant losses?

Conclusion: Should You Buy the Dip in Palantir Stock?

The recent 30% plunge in Palantir stock presents a complex situation. While the long-term growth prospects of the company are promising, the recent disappointing earnings report and broader market conditions present significant risks. The current valuation of Palantir stock is a key factor to consider. There's inherent uncertainty around the future price of Palantir stock.

Before making any decisions about buying Palantir stock, conduct thorough due diligence, consider your own risk tolerance, and consult with a qualified financial advisor. While the dip might seem tempting, it's crucial to make informed decisions based on your financial goals and comfort level. Learn more about Palantir stock investing today!

Featured Posts

-

The Us Attorney General And Fox News A Daily Occurrence Demanding Scrutiny

May 09, 2025

The Us Attorney General And Fox News A Daily Occurrence Demanding Scrutiny

May 09, 2025 -

Rejected By Wolves Now A European Footballing Heartbeat

May 09, 2025

Rejected By Wolves Now A European Footballing Heartbeat

May 09, 2025 -

Sno Og Is I Fjellet Viktig Informasjon For Forere I Sor Norge

May 09, 2025

Sno Og Is I Fjellet Viktig Informasjon For Forere I Sor Norge

May 09, 2025 -

Hurun Report 2025 Elon Musk Holds Top Spot Despite 100 Billion Loss

May 09, 2025

Hurun Report 2025 Elon Musk Holds Top Spot Despite 100 Billion Loss

May 09, 2025 -

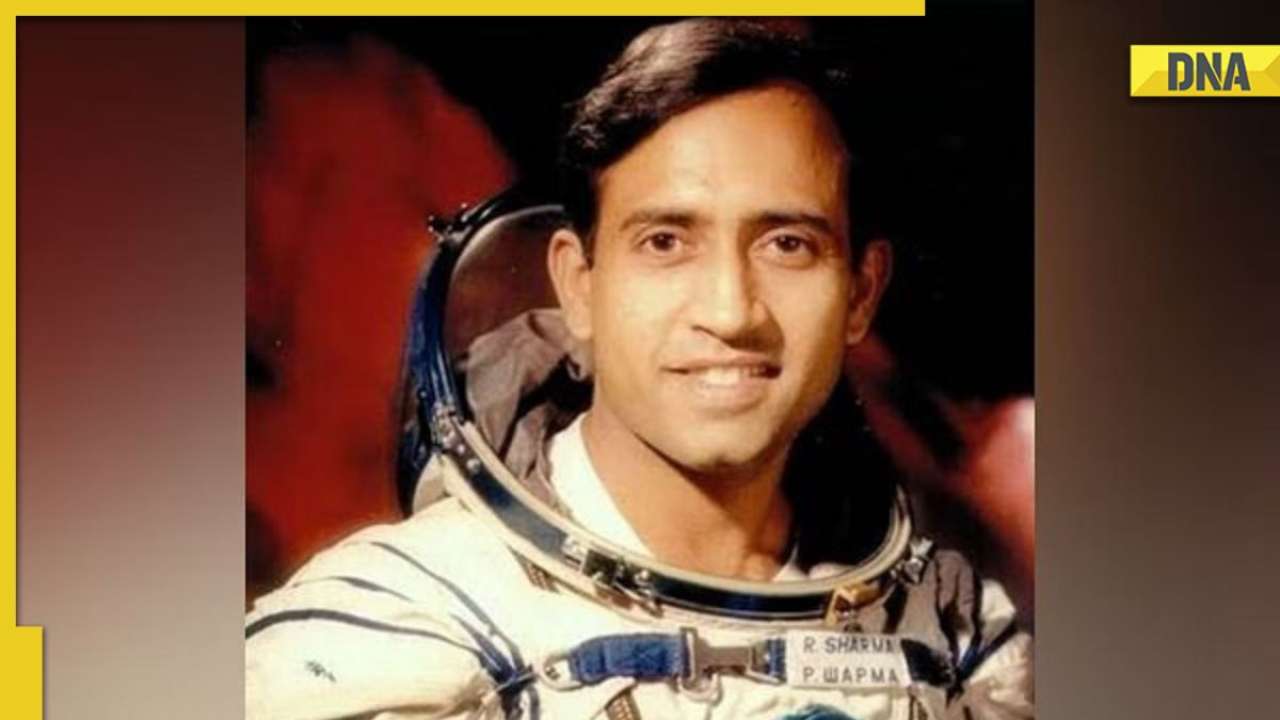

The Life And Legacy Of Rakesh Sharma Where Is Indias First Astronaut Today

May 09, 2025

The Life And Legacy Of Rakesh Sharma Where Is Indias First Astronaut Today

May 09, 2025