Palantir Stock Investment: Before May 5th Considerations

Table of Contents

Palantir's Recent Financial Performance & Growth Projections

Analyzing Palantir's recent financial performance is paramount before any Palantir stock investment. We need to look beyond headline numbers and delve into the specifics. Reviewing quarterly and annual reports, focusing on revenue growth, profitability, and key performance indicators (KPIs), provides a solid foundation.

- Review the recent earnings call transcripts: These transcripts offer invaluable insights into management's outlook and strategic direction, crucial for any informed Palantir stock investment decision. Pay close attention to their commentary on growth strategies and challenges.

- Examine the company's customer acquisition and retention rates: A strong customer base is vital for long-term growth. Analyzing these metrics reveals the health and sustainability of Palantir's business model. High retention indicates customer satisfaction and loyalty, positive indicators for a Palantir stock investment.

- Assess the impact of government contracts and commercial sales on overall revenue: Palantir operates in both government and commercial sectors. Understanding the revenue contribution from each sector reveals potential risks and opportunities. Over-reliance on government contracts could be a risk factor for a Palantir stock investment.

- Consider the company's guidance for future growth and profitability: Management's projections for future performance are important indicators. Compare these projections to historical performance and industry trends to gauge their realism. Realistic projections increase confidence in a Palantir stock investment.

The long-term growth potential of Palantir hinges on its ability to expand in both its core business areas: government and commercial. Success in the commercial sector could significantly diversify revenue streams and reduce reliance on government contracts, improving the risk profile of a Palantir stock investment.

Understanding Palantir's Business Model and Competitive Landscape

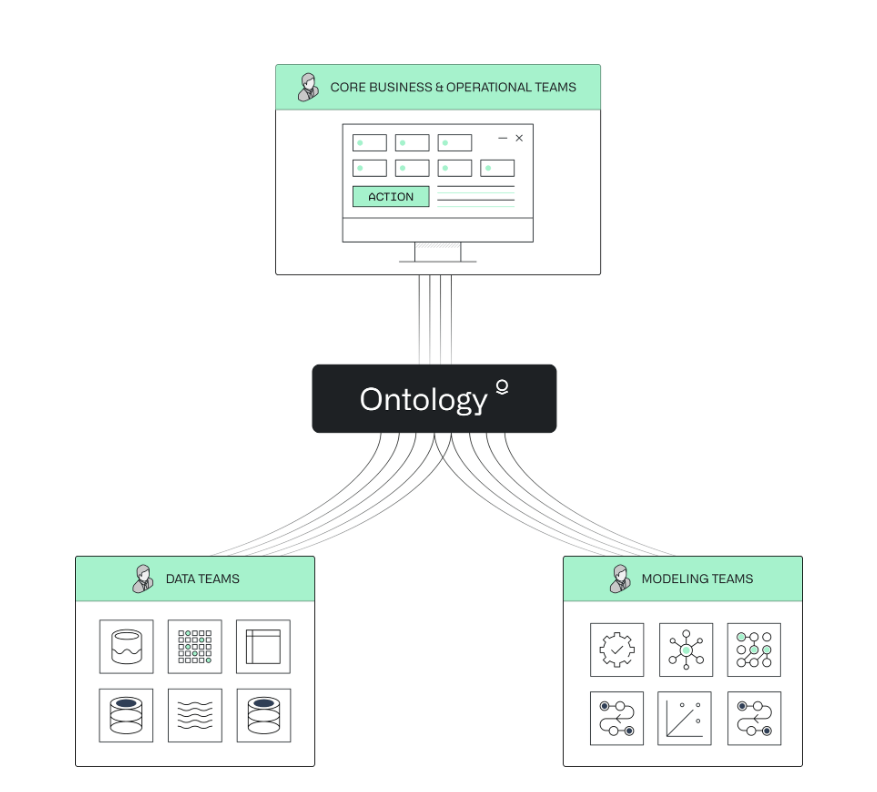

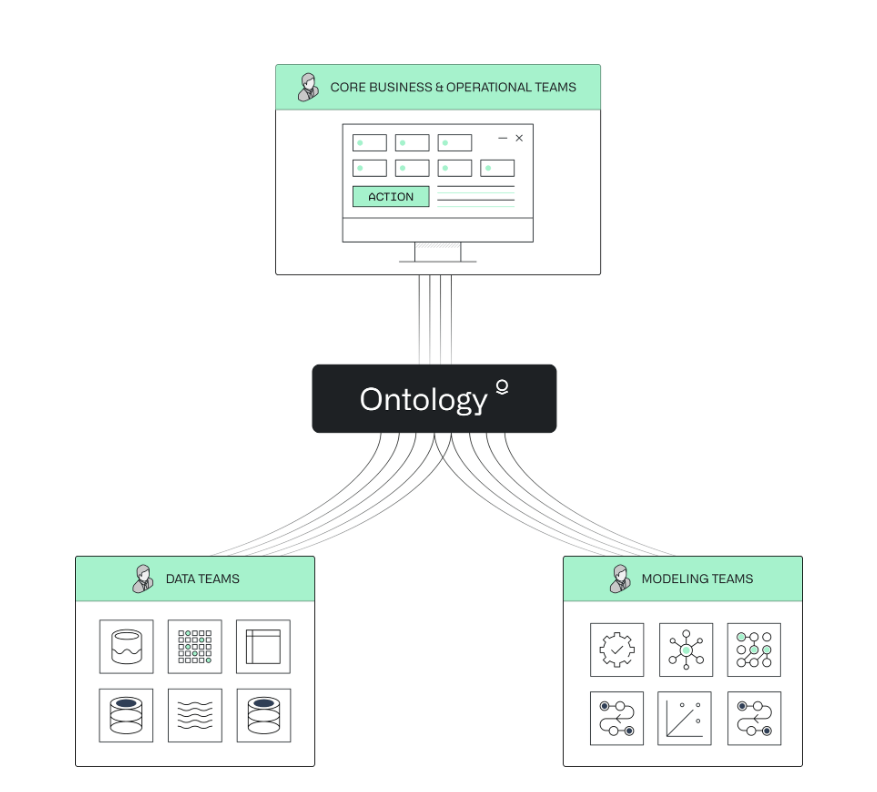

Palantir's business model revolves around providing data analytics and software platforms to both government agencies and commercial clients. Their platforms help organizations integrate and analyze massive datasets to improve decision-making. Understanding this model is crucial before committing to a Palantir stock investment.

- Identify Palantir's key competitors and their market share: The data analytics market is competitive. Identifying key players like AWS, Microsoft, and Google, and understanding their market share, helps assess Palantir's position and potential for future growth. This is vital information for a successful Palantir stock investment.

- Assess Palantir's competitive advantages: Palantir's strong government relationships, unique data sets, and advanced technology provide significant competitive advantages. However, these advantages need to be carefully weighed against the strengths of its competitors.

- Analyze the potential for disruption from emerging technologies and competitors: The tech landscape is ever-changing. Considering potential threats from emerging technologies and new competitors is essential for assessing the long-term viability of a Palantir stock investment.

The long-term sustainability of Palantir's business model depends on its ability to adapt to changing market conditions, innovate, and maintain its competitive edge. This adaptability is a key factor to consider for any Palantir stock investment.

Assessing the Risks Associated with a Palantir Stock Investment

Investing in Palantir, like any stock, carries inherent risks. A thorough understanding of these risks is paramount before committing to a Palantir stock investment.

-

Market volatility: The overall stock market's performance significantly impacts Palantir's stock price. Broad market downturns can negatively affect even the strongest companies.

-

Dependence on government contracts: A substantial portion of Palantir's revenue comes from government contracts. Changes in government policy or budget cuts could severely impact the company's performance.

-

Competition: The competitive landscape is intense, with established players and new entrants constantly vying for market share.

-

Geopolitical risks: Geopolitical instability can affect Palantir's government contracts, particularly internationally.

-

High valuation: Palantir's stock price might be high relative to its current earnings, making it vulnerable to corrections.

-

Negative news or regulatory changes: Negative news or regulatory changes can significantly impact Palantir's stock price, potentially leading to substantial losses for investors.

-

Interest rate sensitivity: Changes in interest rates can affect Palantir's stock price, as investors may shift their investments to higher-yielding assets.

Diversification is crucial to mitigate these risks. Don't put all your eggs in one basket. Spread your investments across different asset classes to reduce your overall portfolio risk.

May 5th and its Potential Implications for Palantir Stock

May 5th might be a significant date for Palantir, potentially bringing market reactions. While we cannot predict the future, considering potential scenarios is crucial before a Palantir stock investment.

- Anticipated news releases or earnings reports: Any upcoming news releases or earnings reports around May 5th could significantly impact investor sentiment and the stock price.

- Shifts in investor sentiment: Investor sentiment can be volatile. Any negative news or unforeseen events could lead to a sell-off, impacting the stock price negatively.

- Monitoring market news: Closely monitor market news and analyst reports leading up to and following May 5th to gauge investor sentiment and potential market reactions.

Consider employing risk management strategies like setting stop-loss orders to limit potential losses. Remember, diversification remains key to managing risk around this date or any Palantir stock investment.

Conclusion

Investing in Palantir stock before May 5th requires a thorough understanding of its financial performance, growth prospects, competitive landscape, and inherent risks. By carefully analyzing its financial statements, understanding its business model, and assessing the potential implications of upcoming events, you can make a more informed decision regarding a Palantir stock investment. Remember to conduct your own thorough research and consider consulting a financial advisor before making any investment decisions. Don't hesitate to explore further resources and news concerning Palantir stock investment to solidify your understanding.

Featured Posts

-

The Trump Factor How Threats Reshaped Greenlands Relationship With Denmark

May 09, 2025

The Trump Factor How Threats Reshaped Greenlands Relationship With Denmark

May 09, 2025 -

Inter Milans Shock Win Against Bayern Munich In Champions League

May 09, 2025

Inter Milans Shock Win Against Bayern Munich In Champions League

May 09, 2025 -

Stock Market Freefall Understanding The Fallout From Operation Sindoor

May 09, 2025

Stock Market Freefall Understanding The Fallout From Operation Sindoor

May 09, 2025 -

Dijon Et La Cite De La Gastronomie Le Cas Epicure

May 09, 2025

Dijon Et La Cite De La Gastronomie Le Cas Epicure

May 09, 2025 -

Enhanced Accessibility For Wheelchair Users On The Elizabeth Line A Call To Action

May 09, 2025

Enhanced Accessibility For Wheelchair Users On The Elizabeth Line A Call To Action

May 09, 2025