Palantir Stock Before May 5th: Is It A Buy? Wall Street's Verdict

Table of Contents

Keywords: Palantir stock, Palantir investment, Palantir price prediction, Palantir buy or sell, Wall Street Palantir, Palantir earnings, May 5th Palantir, data analytics stocks

Palantir Technologies (PLTR) stock has experienced considerable volatility, leaving investors questioning its future trajectory. With a significant date – May 5th – approaching (likely encompassing an earnings report or other key event), the question on many investors' minds is: is Palantir stock a buy before this date? This article examines Wall Street's perspective, analyzes recent performance, and assesses the inherent risks to help you make a well-informed investment decision.

Wall Street's Sentiment Towards Palantir Stock

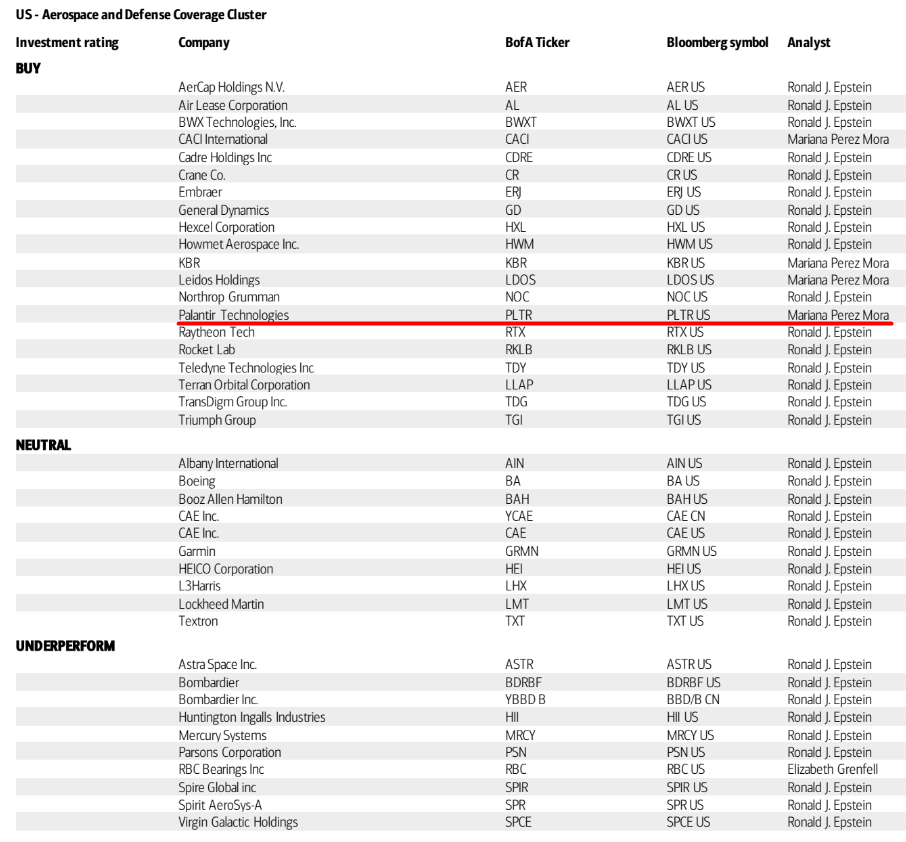

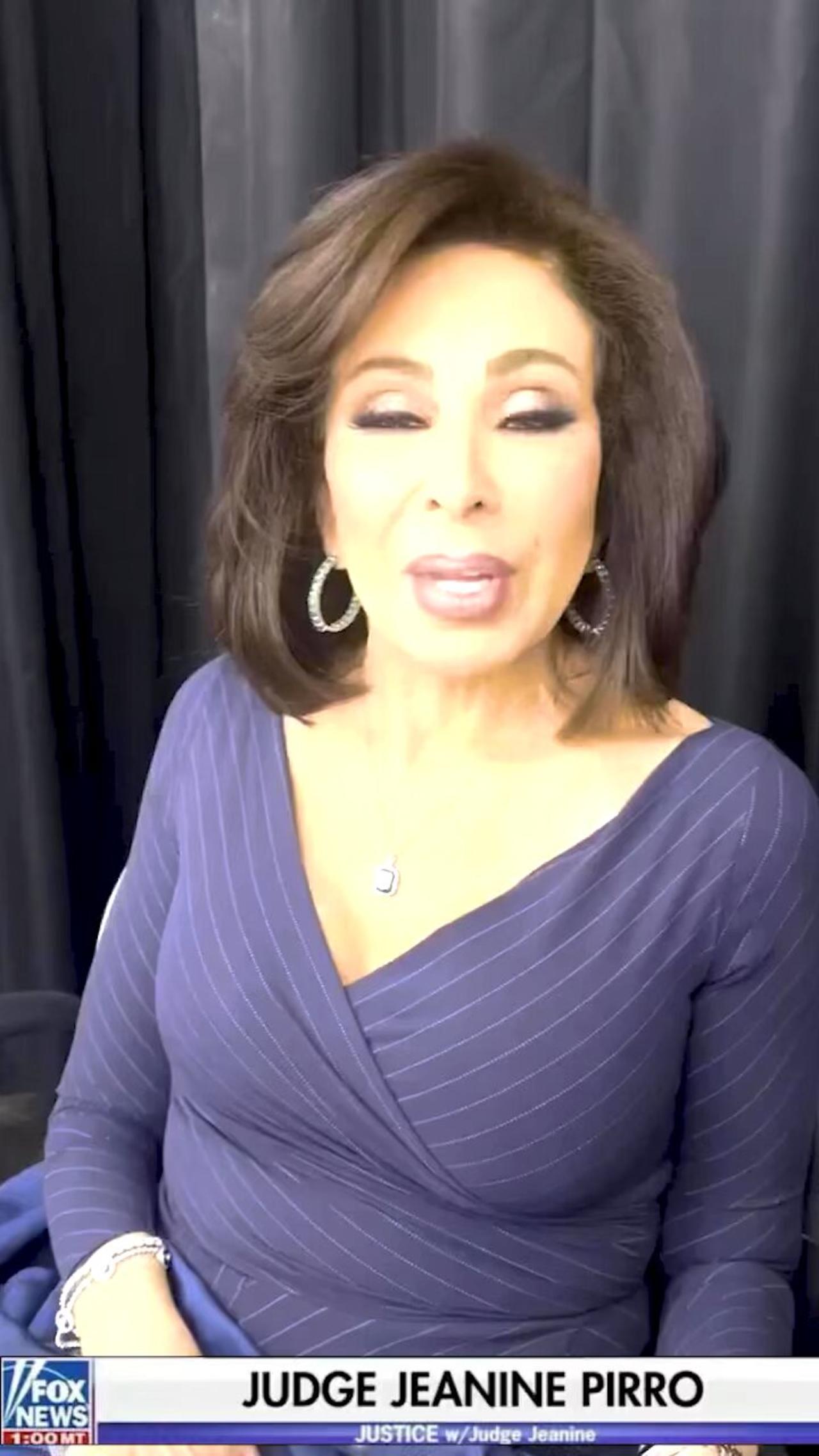

Analyst Ratings and Price Targets

The consensus among analysts regarding Palantir stock is currently mixed. While some analysts maintain a bullish outlook, others express more cautious sentiment. It's crucial to analyze individual ratings and price targets to gain a holistic perspective.

-

Key Analyst Firms and Recommendations: As of [Insert Date - get current data], [Analyst Firm A] holds a "Buy" rating with a price target of $[Price]. [Analyst Firm B], however, maintains a "Hold" rating, projecting a price of $[Price]. [Analyst Firm C] has issued a "Sell" rating with a price target of $[Price]. The average price target across all analysts currently stands at $[Price]. These figures are subject to change.

-

Recent Shifts in Sentiment: Note any significant changes in analyst sentiment in recent weeks or months. Highlight if major firms have upgraded or downgraded their ratings and the reasons behind these changes. For example, mention if a significant contract win or disappointing earnings report influenced these changes.

Factors Influencing Analyst Opinions

Several factors contribute to the divergence in analyst opinions on Palantir stock. These include:

- Government Contract Wins: Palantir's significant reliance on government contracts influences analyst sentiment. Large contract wins generally boost the stock price, while delays or losses can negatively impact it.

- Commercial Sector Growth: The success of Palantir's expansion into the commercial sector is another critical factor. Strong growth in this area signifies diversification and reduced dependence on government contracts, increasing investor confidence.

- Profitability and Financial Performance: Palantir's path to profitability remains a key focus for analysts. Improvements in operating margins and revenue growth are generally viewed positively. Conversely, continued losses can raise concerns.

- Competition: The competitive landscape within the data analytics and AI sectors is intense. Analysts assess Palantir’s competitive advantages, including its proprietary technology and established relationships with key clients, when forming their opinions.

Analyzing Palantir's Recent Performance and Future Outlook

Recent Financial Results and Key Metrics

Analyzing Palantir's recent financial reports provides valuable insights into the company's performance and future potential. Key performance indicators (KPIs) to consider include:

-

Revenue Growth: Examine the percentage increase or decrease in revenue compared to the previous quarter and year. Highlight any trends indicating acceleration or deceleration in growth.

-

Operating Margins: Assess the company's profitability by examining its operating margins. Improvements in margins signal increased efficiency and cost management.

-

Customer Acquisition: Track the number of new customers acquired in recent periods. A rising customer base suggests healthy growth and market demand.

-

Key Figures: Include specific numbers from Palantir's recent earnings reports to support the analysis. For example, "In Q[Quarter] [Year], Palantir reported revenue of $[Revenue], representing a [Percentage]% increase year-over-year."

Growth Potential and Market Opportunities

Palantir operates within the rapidly expanding data analytics and artificial intelligence (AI) markets, presenting significant growth opportunities.

- New Market Expansion: Discuss Palantir's plans to expand into new sectors, such as healthcare, finance, or manufacturing. Mention any specific initiatives or partnerships aimed at penetrating these markets.

- Strategic Partnerships and Acquisitions: Analyze the impact of strategic alliances and acquisitions on Palantir's future growth prospects. Assess whether these collaborations enhance its technological capabilities or market reach.

- Competitive Advantages: Highlight Palantir's unique strengths, such as its advanced data analytics platform, strong government relationships, and expertise in AI and machine learning, enabling it to maintain a competitive edge.

Assessing the Risks Involved in Investing in Palantir Stock

Valuation and Stock Price Volatility

Palantir's valuation and stock price volatility are crucial factors to consider:

- Valuation Metrics: Analyze Palantir's valuation compared to industry peers using metrics such as the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio. Compare these metrics to determine if the stock is overvalued or undervalued.

- Stock Price Volatility: Discuss the historical volatility of Palantir's stock price and identify factors that may contribute to its price fluctuations, such as market sentiment, news events, and earnings reports.

Potential Downside Risks and Challenges

Several potential risks could negatively impact Palantir's stock price:

- Increased Competition: Highlight the intensifying competition within the data analytics sector and assess Palantir's ability to maintain its market share.

- Slowing Revenue Growth: A deceleration in revenue growth could raise investor concerns, particularly if it’s coupled with persistent losses.

- Dependence on Government Contracts: Palantir's considerable reliance on government contracts exposes it to potential risks associated with changing government priorities or budget cuts.

- Regulatory Hurdles and Cybersecurity Concerns: The nature of Palantir's business involves handling sensitive data, making it susceptible to regulatory scrutiny and cybersecurity threats. Any breaches or regulatory actions could negatively affect the stock price.

- Economic Downturn: A broader economic slowdown could impact demand for Palantir's services, particularly in the commercial sector.

Conclusion

Wall Street's sentiment towards Palantir stock before May 5th is mixed, reflecting both the company's growth potential and the inherent risks involved in investing in it. While Palantir operates in a rapidly expanding market with strong potential for growth, its path to profitability, dependence on government contracts, and vulnerability to competitive pressures present significant considerations. Analyzing recent financial performance, future growth prospects, and potential risks provides a more complete picture.

While Wall Street offers mixed signals on Palantir stock before May 5th, careful consideration of the risks and potential rewards is crucial. Conduct further due diligence, including reviewing Palantir's latest filings and financial reports, before making any investment decisions regarding Palantir stock. Remember, this is not financial advice, and all investment decisions should be made with a thorough understanding of your own risk tolerance.

Featured Posts

-

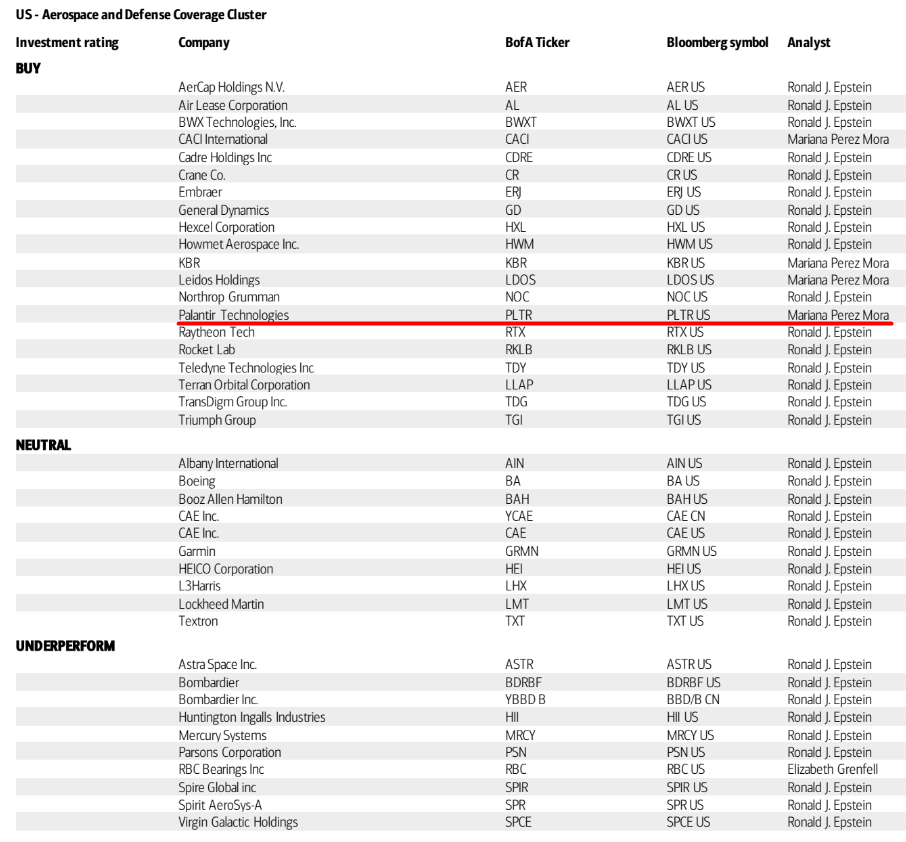

Kaitlin Olson And The Return Of High Potential Episodes On Abc

May 09, 2025

Kaitlin Olson And The Return Of High Potential Episodes On Abc

May 09, 2025 -

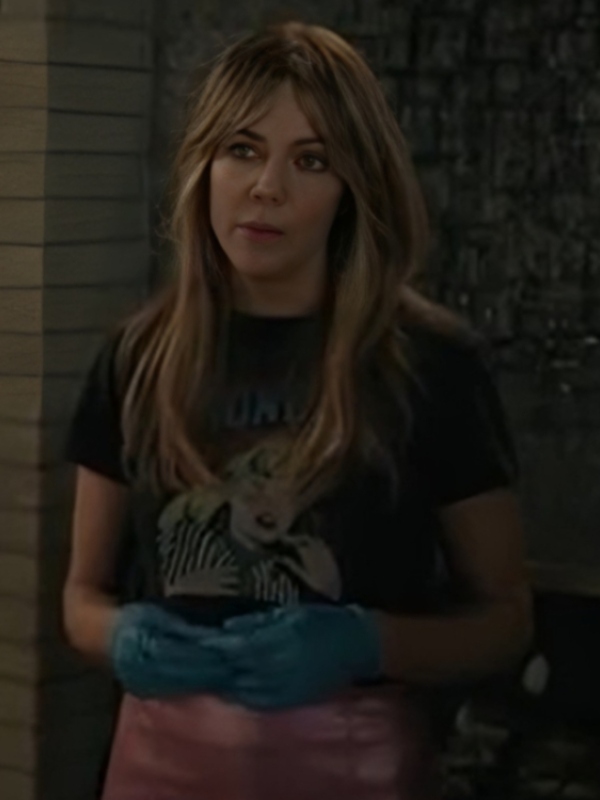

The Jeanine Pirro Appointment A Look At The Alleged Drunk Episode And Its Fallout

May 09, 2025

The Jeanine Pirro Appointment A Look At The Alleged Drunk Episode And Its Fallout

May 09, 2025 -

Vehicule Projete Contre Un Mur A Dijon Rue Michel Servet Le Conducteur Se Constitue Prisonnier

May 09, 2025

Vehicule Projete Contre Un Mur A Dijon Rue Michel Servet Le Conducteur Se Constitue Prisonnier

May 09, 2025 -

Nl Federal Election Know Your Candidates Before You Vote

May 09, 2025

Nl Federal Election Know Your Candidates Before You Vote

May 09, 2025 -

Babysitting Costs Vs Daycare A Mans Unexpected And Expensive Childcare Journey

May 09, 2025

Babysitting Costs Vs Daycare A Mans Unexpected And Expensive Childcare Journey

May 09, 2025