Palantir Stock: Analyzing The Potential For A 40% Rise By 2025

Table of Contents

Palantir's Growth Trajectory and Market Position

Palantir's success hinges on its ability to secure and retain lucrative contracts, both within the government and commercial sectors. Its growth trajectory is intrinsically linked to its ability to navigate these diverse markets.

Palantir Government Contracts and Revenue Streams

Palantir has historically relied heavily on government contracts, particularly with US agencies. However, the company is actively diversifying into the commercial sector. This dual approach presents both opportunities and challenges.

- Recent Contract Wins: Palantir has secured significant contracts in recent years, demonstrating continued demand for its data analytics platform. The specifics and financial implications of these contracts need further scrutiny to understand their contribution to the projected 40% growth.

- Size and Stability of Government Contracts: Government contracts often involve long-term agreements, providing a degree of revenue stability. However, the renewal of these contracts and potential budgetary changes represent inherent risks.

- Growth Potential of the Commercial Market: Palantir's commercial revenue growth is crucial for achieving a 40% stock price increase. Success in this sector will depend on its ability to compete effectively against established players and demonstrate a strong return on investment for commercial clients. The current growth rate in this sector needs to be examined against the targeted 40% increase for a realistic assessment. Keywords: Palantir government contracts, Palantir commercial contracts, Palantir revenue growth.

Technological Innovation and Competitive Advantage

Palantir's proprietary data analytics platforms, Gotham and Foundry, are central to its competitive advantage. These platforms offer unique capabilities for data integration, analysis, and visualization.

- Key Technological Advancements: Continuous innovation is critical for maintaining a competitive edge. Tracking Palantir's patent filings and software updates reveals its investment in R&D and its efforts to stay ahead of the curve.

- Comparison with Competitors: While Palantir faces competition from tech giants like AWS, Google Cloud, and Microsoft Azure, its specialized focus on data integration and analytics for complex problems differentiates it. Direct comparison of capabilities and market share is needed to understand Palantir's competitive positioning. Keywords: Palantir Foundry, Palantir Gotham, data analytics platform, big data analytics, competitive landscape.

Financial Performance and Valuation

A realistic assessment of a potential 40% surge in Palantir stock requires a thorough analysis of the company's financial health and valuation.

Profitability and Revenue Projections

Palantir's journey towards profitability is a key factor influencing its stock price.

- Key Financial Metrics: Analyzing revenue growth, operating margins, and debt levels provides insight into the company's financial performance and its potential for future earnings. Historical data should be analyzed and compared to industry benchmarks.

- Path to Profitability: Examining Palantir's strategy for achieving sustainable profitability is vital. This includes evaluating cost-cutting measures, revenue diversification, and operational efficiency improvements. Keywords: Palantir financials, Palantir revenue, Palantir profitability, Palantir stock valuation, PLTR stock price.

Assessing Current Valuation and Potential Upside

Determining whether the current stock price accurately reflects Palantir's potential requires a robust valuation analysis.

- Valuation Metrics: Using metrics like Price-to-Sales (P/S) and Price-to-Earnings (P/E) ratios, and comparing them to industry peers, allows for a comparative assessment of Palantir's valuation.

- Potential Catalysts: Identifying potential catalysts for a 40% stock price increase is crucial. This could include exceeding revenue projections, securing major new contracts, or successful product launches. Keywords: Palantir stock price prediction, Palantir valuation, PLTR stock forecast, Palantir investment.

Risks and Challenges

While the potential for growth is significant, several risks and challenges could hinder Palantir's trajectory.

Geopolitical Risks and Regulatory Hurdles

Palantir's operations are subject to various geopolitical and regulatory risks.

- Geopolitical Events: International relations and political instability can directly impact Palantir's government contracts and overall business environment.

- Data Privacy Regulations: Compliance with data privacy regulations like GDPR and CCPA is paramount and any breaches could negatively affect Palantir's reputation and financial performance. Keywords: Palantir risks, Palantir data privacy, geopolitical risk, regulatory compliance.

Competition and Market Saturation

The data analytics market is highly competitive, with established players and emerging startups vying for market share.

- Competitive Threats: Analyzing the competitive strategies of established tech giants and the emergence of new competitors is essential to evaluate Palantir's ability to retain its market position.

- Market Saturation: Assessing the potential for market saturation in the data analytics sector and Palantir's strategies to address this are crucial. Keywords: Palantir competition, data analytics market, market saturation, competitive advantage.

Conclusion

A 40% rise in Palantir stock by 2025 is an ambitious projection. While Palantir exhibits significant growth potential driven by its technological innovation and expansion into the commercial market, significant risks related to geopolitical factors, competition, and regulatory compliance remain. The company's path to profitability and the sustainability of its revenue streams will be critical determinants of its future valuation. Therefore, thorough due diligence, including a deep dive into Palantir's financials and competitive landscape, is essential before making any investment decisions. While the potential for substantial returns exists, it's crucial to approach investing in Palantir stock (PLTR) with caution and a realistic understanding of the inherent risks involved. Conduct thorough due diligence and consider consulting a financial advisor before investing in Palantir stock. Further research into Palantir's financials and market position is crucial for informed investing in Palantir stock.

Featured Posts

-

Analyzing Abcs March 2025 Schedule High Potential Repeat Episodes

May 10, 2025

Analyzing Abcs March 2025 Schedule High Potential Repeat Episodes

May 10, 2025 -

Investigating Us Funding For Transgender Animal Studies

May 10, 2025

Investigating Us Funding For Transgender Animal Studies

May 10, 2025 -

How Middle Management Drives Business Results And Employee Satisfaction

May 10, 2025

How Middle Management Drives Business Results And Employee Satisfaction

May 10, 2025 -

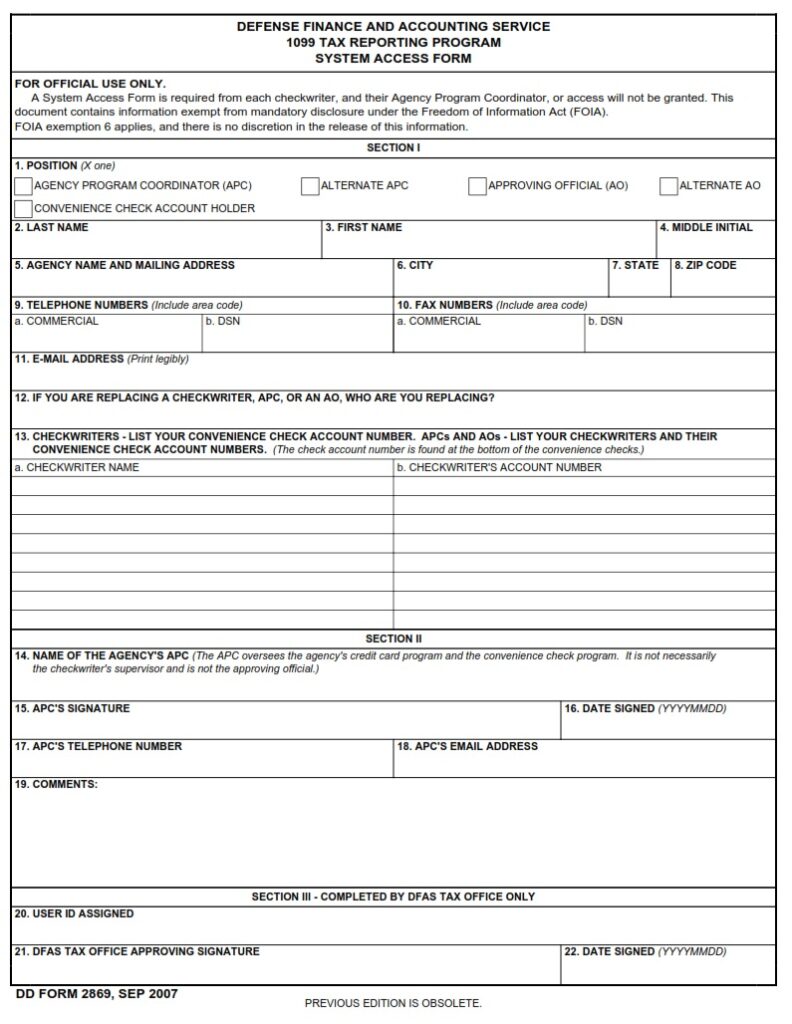

Deutsche Banks Strategic Investment In Defense Finance A New Team Takes The Lead

May 10, 2025

Deutsche Banks Strategic Investment In Defense Finance A New Team Takes The Lead

May 10, 2025 -

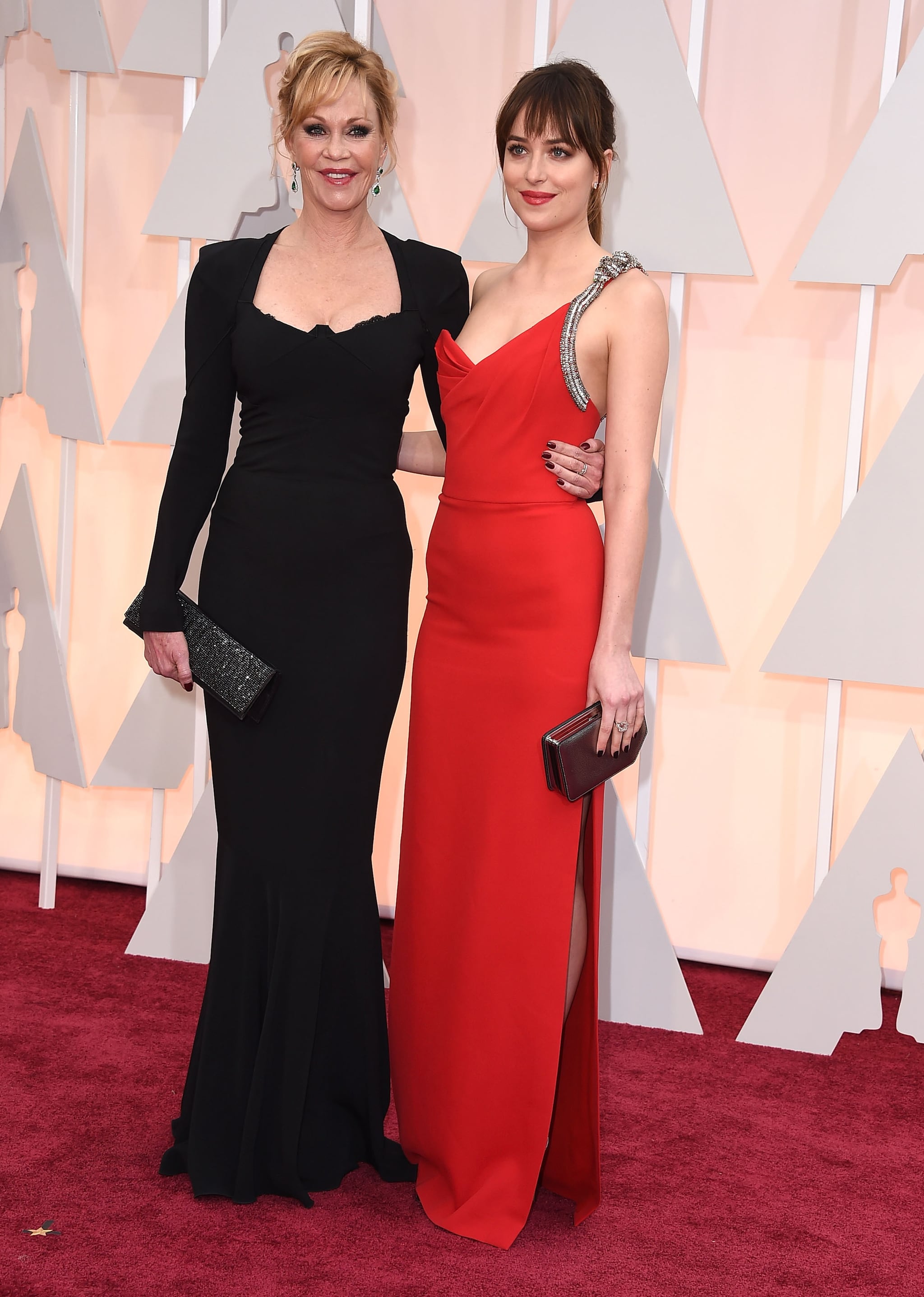

Melanie Griffith And Siblings Join Dakota Johnson At Materialist Event

May 10, 2025

Melanie Griffith And Siblings Join Dakota Johnson At Materialist Event

May 10, 2025