Palantir Stock: Analyzing Q1 Earnings – Government Vs. Commercial Growth

Table of Contents

Government Segment Performance

Palantir's government segment, historically a significant revenue driver, continues to be a key focus for the company. Analyzing the performance of Palantir government contracts reveals insights into the stability and future potential of Palantir stock.

Revenue Growth and Contract Wins

Palantir's government revenue growth in Q1 2024 [Insert actual growth percentage from Q1 report here] compared to the same period last year. While [Insert comparison to previous quarter growth], this signifies [Positive or negative interpretation based on the data]. Significant contract wins in [mention specific agencies or projects if disclosed in the report] contributed substantially to this growth. These contracts, focusing on [mention specific areas like national security, defense, or intelligence], demonstrate the ongoing demand for Palantir's data analytics platform within the government sector.

Profitability and Margin Analysis

Profitability within the government segment remains strong, with margins of [Insert margin percentage from Q1 report here]. This is [Higher/Lower] than the previous quarter, potentially attributed to [mention factors like contract renegotiations, increased operational efficiency, or changes in pricing strategies]. The length of government contracts, typically spanning several years, provides a degree of predictability and revenue stability, mitigating some of the risks associated with shorter-term commercial contracts.

- Breakdown of revenue by government agency: [Insert breakdown if available in the report. Otherwise, state “A detailed breakdown by agency was not provided in the Q1 report.”]

- Potential risks associated with government contracts: Budgetary constraints, shifting political priorities, and the competitive landscape all present potential risks to future government revenue streams.

- Analysis of long-term government contract pipeline: Palantir's pipeline of potential future contracts [Insert information from the report on the pipeline]. This indicates [Positive or negative interpretation of the pipeline].

Commercial Segment Performance

Palantir's commercial growth is a crucial indicator of its long-term sustainability and potential for broader market penetration. The performance of this segment offers valuable insight into the potential of Palantir stock as a long-term investment.

Revenue Growth and Customer Acquisition

Commercial revenue experienced a [Insert growth percentage from Q1 report here] increase in Q1 2024 compared to the same period last year. This demonstrates [Positive or negative interpretation of the growth]. Key customer acquisition wins in the [mention specific industries or sectors] sector underscore Palantir's ability to expand its reach beyond its traditional government clientele. Successful implementation in [mention specific examples of successful projects] showcases the value proposition of Palantir's platform in the commercial sphere.

Profitability and Customer Retention

While profitability in the commercial segment may lag behind the government segment initially [compare margins from the report], it holds significant long-term potential. High customer retention rates [Insert retention rate if available] indicate a strong value proposition and the potential for upselling and cross-selling opportunities. This recurring revenue stream is crucial for sustainable, long-term growth.

- Successful commercial partnerships and implementations: [Provide specific examples from the report if available].

- Customer concentration risk: [Analyze potential risks related to reliance on a small number of large clients].

- Scalability of Palantir's commercial platform: The scalability of Palantir's platform [Analyze the platform's ability to handle increased customer volume and data processing demands].

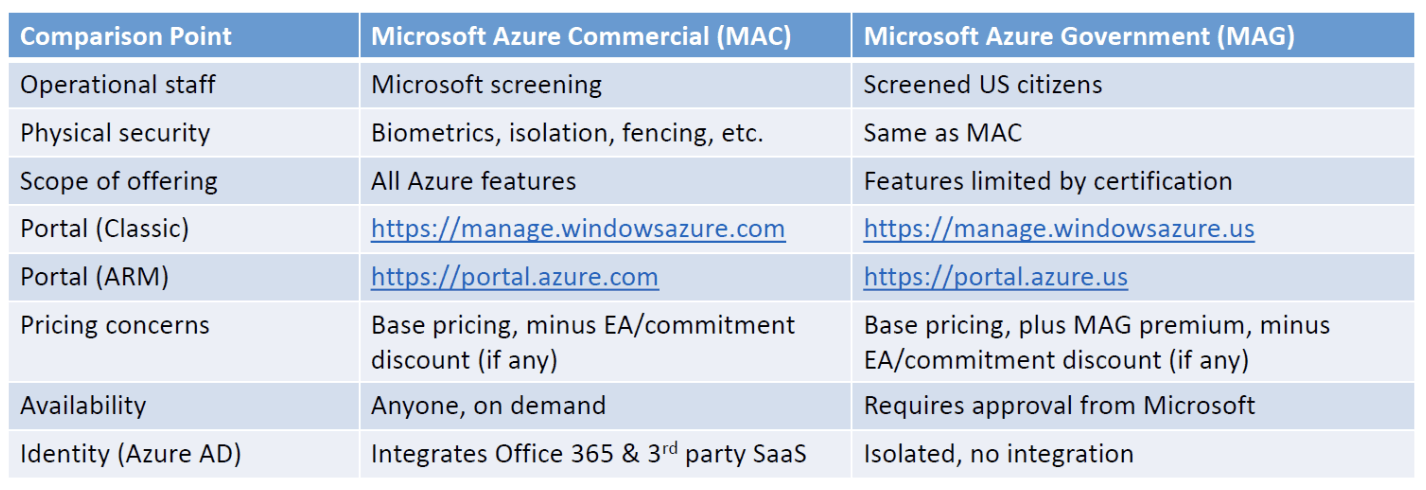

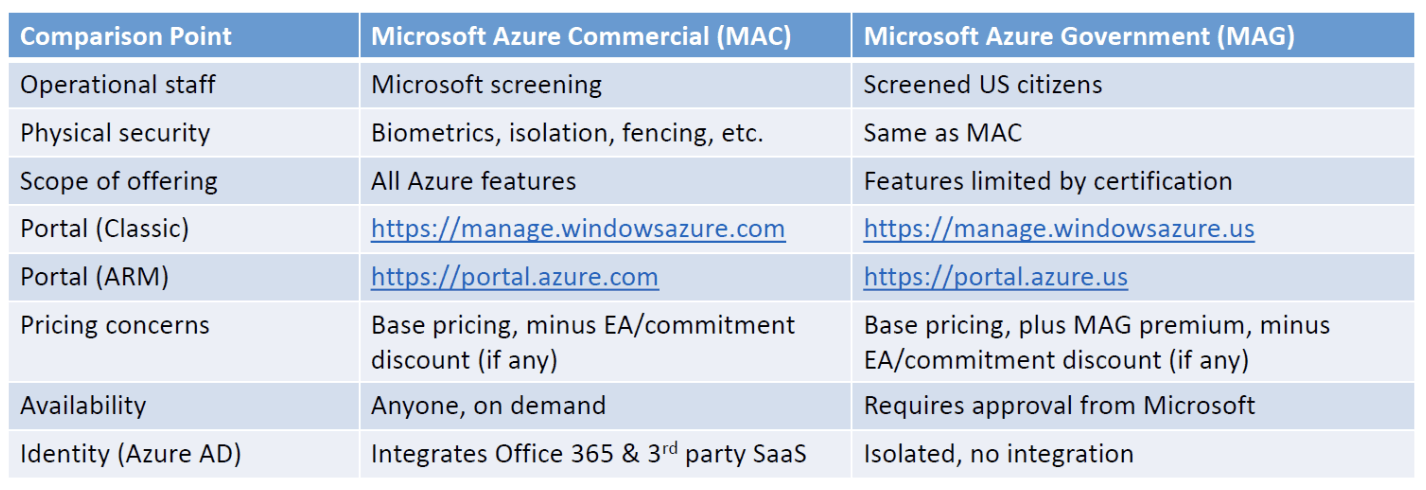

Comparison of Government and Commercial Segments

A direct comparison of Palantir's government and commercial segments is critical to understanding the company's overall performance and future direction. This analysis highlights the strengths and weaknesses of each segment and their contributions to Palantir stock's valuation.

Revenue Growth Comparison

[Insert chart or graph comparing revenue growth for both segments. If not possible, describe the comparative growth numerically]. The comparison reveals that [State which segment had higher growth and offer a potential explanation].

Profitability Comparison

A comparison of profitability margins [Insert chart or graph comparing margins, if possible; otherwise, describe the difference numerically] indicates that [State which segment is more profitable and offer reasons]. This disparity may be attributed to [mention factors like pricing strategies, contract lengths, or operational costs].

- Summary table comparing key metrics: [Create a table comparing key metrics such as revenue growth, profitability, and customer acquisition for both segments].

- Long-term strategic implications: The performance differences between the segments highlight [mention strategic implications for future investments and resource allocation].

- Potential areas for improvement: [Identify potential areas for improvement in each segment].

Conclusion

Palantir's Q1 2024 earnings reveal a mixed performance, with the government segment demonstrating consistent strength and the commercial segment exhibiting growth potential. While government contracts provide revenue stability and profitability, the expansion into the commercial market is crucial for Palantir's long-term growth and diversification. The relative strengths and weaknesses of each segment will ultimately shape the trajectory of Palantir stock. Understanding the dynamics between Palantir government contracts and commercial growth is vital for investors. Investors should carefully consider the risks and opportunities presented by each segment when assessing the overall investment potential of Palantir stock.

Investment Implications: The Q1 results present a complex picture for investors. While the government segment provides stability, the sustained growth of the commercial sector is crucial for long-term value creation. Investors should monitor the progress in customer acquisition, revenue diversification, and margin expansion in the commercial space.

Call to Action: Stay tuned for further analysis of Palantir stock and its performance, and continue to monitor the evolving landscape of government and commercial contracts to make informed investment decisions about Palantir.

Featured Posts

-

Zaderzhka Reysov V Aeroportu Permi Snegopad

May 09, 2025

Zaderzhka Reysov V Aeroportu Permi Snegopad

May 09, 2025 -

Benson Boone Addresses Harry Styles Copying Claims

May 09, 2025

Benson Boone Addresses Harry Styles Copying Claims

May 09, 2025 -

High Potential Season 2 Release Date Episode Count And Renewal Status

May 09, 2025

High Potential Season 2 Release Date Episode Count And Renewal Status

May 09, 2025 -

Proposed Uk Student Visa Changes Concerns For International Students From Pakistan

May 09, 2025

Proposed Uk Student Visa Changes Concerns For International Students From Pakistan

May 09, 2025 -

Mame Slovensku Dakotu Johnson Porovnanie Fotografii Ohromi

May 09, 2025

Mame Slovensku Dakotu Johnson Porovnanie Fotografii Ohromi

May 09, 2025

Latest Posts

-

Sharing Your Story The Impact Of Trumps Executive Orders On Transgender Lives

May 10, 2025

Sharing Your Story The Impact Of Trumps Executive Orders On Transgender Lives

May 10, 2025 -

How Trumps Executive Orders Affected The Transgender Community Personal Accounts

May 10, 2025

How Trumps Executive Orders Affected The Transgender Community Personal Accounts

May 10, 2025 -

Bangkok Post The Urgent Need For Transgender Rights Reform

May 10, 2025

Bangkok Post The Urgent Need For Transgender Rights Reform

May 10, 2025 -

Trump Executive Orders And Their Impact On Transgender Individuals Your Stories Matter

May 10, 2025

Trump Executive Orders And Their Impact On Transgender Individuals Your Stories Matter

May 10, 2025 -

Advocates Push For Transgender Equality Bangkok Post Reports

May 10, 2025

Advocates Push For Transgender Equality Bangkok Post Reports

May 10, 2025