Palantir Investment: Wall Street's Unanimous Opinion Before May 5th

Table of Contents

Pre-May 5th Analyst Ratings and Price Targets for Palantir Stock

Before May 5th, the consensus among leading financial analysts regarding Palantir stock ($PLTR) was far from unanimous, despite a general air of cautious optimism. Analyzing Palantir Stock's analyst ratings and price targets reveals a mixed bag of opinions. Several key factors contributed to the diverse perspectives.

-

Buy Ratings and High Price Targets: Some investment banks issued "Buy" ratings, citing Palantir's strong government contracts and potential for growth in the commercial sector. These analysts often projected price targets significantly higher than the current market price. For example, [insert example of analyst firm and price target here]. Their reasoning often focused on Palantir's innovative technology and its potential to disrupt various industries.

-

Hold Ratings and Moderate Price Targets: Other analysts adopted a more cautious approach, issuing "Hold" ratings and setting more moderate price targets. Their concerns centered on [insert specific concerns, e.g., high valuation, competition, dependence on government contracts, profitability]. A prime example is [insert example of an analyst firm and their rationale].

-

Sell Ratings and Low Price Targets: While less common, some analysts even issued "Sell" ratings, emphasizing the risks associated with Palantir’s business model and the competitive landscape. These ratings often came with significantly lower price targets compared to the “Buy” recommendations. [Cite a source for a sell rating if available]. This highlights the divergent perspectives surrounding Palantir Stock.

Factors Influencing Palantir Investment Decisions Before May 5th

Several key factors shaped investor decisions surrounding Palantir investment before May 5th. Understanding these factors is crucial for evaluating the potential risks and rewards:

-

Recent Financial Performance: Palantir's revenue growth, profitability, and cash flow were closely scrutinized. Strong financial results would generally support a positive outlook, while underperformance could trigger concerns.

-

New Contracts and Partnerships: The securing of new contracts, particularly large government contracts, significantly influenced investor sentiment. These contracts represented reliable revenue streams and validated Palantir's technology. Conversely, a lack of new contract wins might indicate challenges in market penetration.

-

Government Contracts and Their Impact on Revenue Streams: Palantir's significant reliance on government contracts made it particularly sensitive to shifts in government spending and geopolitical factors. Any uncertainty in this area impacted investor confidence.

-

Market Sentiment and Tech Stock Performance: The overall market sentiment towards tech stocks played a substantial role. A positive market environment generally benefited Palantir, while a downturn could lead to increased volatility.

-

Upcoming Product Launches and Announcements: Any announcements regarding new product launches or significant updates to existing software had the potential to sway investor opinion either positively or negatively, depending on the market’s reception.

Palantir Investment Risks: Potential Downsides Before May 5th

While the potential upside of a Palantir investment was attractive to some, significant risks existed before May 5th.

-

Stock Market Volatility: The inherent volatility of the stock market always poses a risk, especially for a growth stock like Palantir. Market corrections could drastically impact the stock price irrespective of the company's fundamental performance.

-

Geopolitical Risks: Geopolitical events and shifts in government priorities could negatively impact Palantir's government contracts and revenue streams. Any instability in key markets could impact profitability.

-

Competition in Data Analytics and AI: The data analytics and AI sectors are fiercely competitive. New entrants and established players constantly vie for market share, increasing the pressure on Palantir.

-

Dependence on Large Clients: Palantir's reliance on a relatively small number of large clients introduces concentration risk. The loss of a significant client could negatively affect the company's financial performance.

Palantir Alternatives: Comparing Investment Opportunities

Before committing to a Palantir investment, it’s essential to consider alternative investment opportunities within the data analytics and AI space. Competitors such as [insert competitor names, e.g., Snowflake, Databricks, etc.] offer similar services and technologies, each with its own strengths and weaknesses. A comparative analysis of growth potential, financial stability, and risk profiles is crucial for making informed investment decisions. Consider factors like market capitalization, revenue streams, and technological differentiation when comparing Palantir to its alternatives.

Conclusion: Making Informed Palantir Investment Decisions

The sentiment surrounding Palantir investment before May 5th was far from unanimous. While some analysts saw significant growth potential driven by government contracts and technological innovation, others expressed concerns about the company's valuation, reliance on specific clients, and competitive pressures. Understanding the factors influencing Palantir's stock price, and weighing the potential risks and rewards, is crucial for making informed investment decisions. Conduct your own due diligence before making a Palantir investment, considering alternative opportunities and your personal risk tolerance. Inform yourself about Palantir investment opportunities thoroughly before committing your capital. Learn more about investing in Palantir and making smart financial choices.

Featured Posts

-

Suncor High Production Lower Sales Analyzing The Discrepancy

May 09, 2025

Suncor High Production Lower Sales Analyzing The Discrepancy

May 09, 2025 -

Cheveux Faire Un Don A Dijon

May 09, 2025

Cheveux Faire Un Don A Dijon

May 09, 2025 -

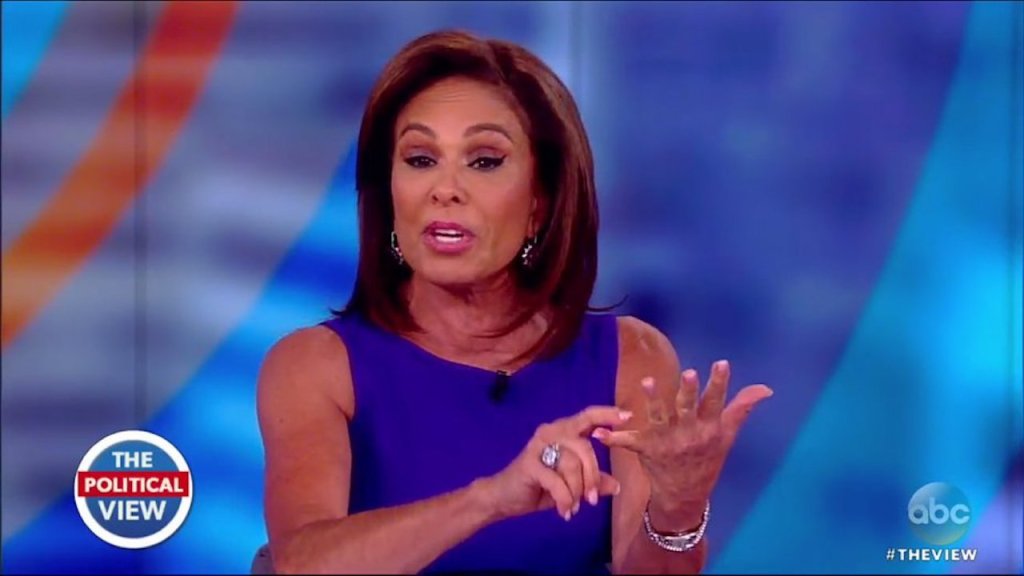

Fox News Jeanine Pirro Named Trumps Top Dc Prosecutor

May 09, 2025

Fox News Jeanine Pirro Named Trumps Top Dc Prosecutor

May 09, 2025 -

Arctic Comic Con 2025 Photos Of Characters Connections And The Ectomobile

May 09, 2025

Arctic Comic Con 2025 Photos Of Characters Connections And The Ectomobile

May 09, 2025 -

How To Watch Celebrity Antiques Road Trip A Complete Guide

May 09, 2025

How To Watch Celebrity Antiques Road Trip A Complete Guide

May 09, 2025