Palantir At 30% Down: Investment Strategy And Risks

Table of Contents

Understanding Palantir's Current Market Position

Analyzing the 30% Drop

The recent 30% decline in Palantir stock price is a multifaceted issue stemming from a confluence of factors. Understanding these contributing elements is crucial for informed investment decisions.

- Recent Earnings Reports: Palantir's recent earnings reports may have fallen short of market expectations, impacting investor sentiment. A detailed analysis of these reports is essential to gauge the company's true financial health.

- Macroeconomic Headwinds: The current macroeconomic climate, characterized by inflation and rising interest rates, has negatively impacted many growth stocks, including Palantir. Investors are becoming more risk-averse, leading to sell-offs in higher-risk sectors.

- Increased Competition: The data analytics market is increasingly competitive, with established players and new entrants vying for market share. Palantir faces pressure to maintain its competitive edge through innovation and strategic partnerships.

Palantir's Revenue Streams and Growth Potential

Despite the recent downturn, Palantir boasts diverse revenue streams and significant growth potential. Its revenue is derived from both government contracts and commercial sales, providing a degree of diversification.

- Government Contracts: Palantir's strong presence in government contracts, particularly within the defense and intelligence sectors, provides a stable revenue base and access to cutting-edge technologies. Continued success in securing these contracts will be crucial for future growth.

- Commercial Sales: Palantir is actively expanding its commercial business, targeting various sectors like finance, healthcare, and energy. Successful penetration into these markets will be a key driver of revenue growth. The company's focus on artificial intelligence (AI), big data, and cybersecurity solutions positions it well within these burgeoning industries.

- Future Growth Projections: Analysts offer varying projections for Palantir's future revenue growth. Understanding these projections, along with the company's strategic initiatives, is vital for assessing its long-term investment potential.

Assessing the Risks of Investing in Palantir

Valuation Concerns

Determining whether Palantir is currently overvalued or undervalued is a complex task requiring a thorough analysis of its financial metrics. Key indicators like the price-to-sales ratio (P/S) and other key performance indicators (KPIs) must be carefully evaluated against industry benchmarks and future growth projections.

- Different Valuation Models: Various valuation models, including discounted cash flow (DCF) analysis, can be applied to arrive at a fair market value for Palantir stock. The discrepancies between these models highlight the uncertainty surrounding its true worth.

Competition and Market Saturation

Palantir operates in a highly competitive market, facing challenges from both established players and agile startups. The risk of market saturation in specific sectors cannot be ignored.

- Key Competitors: Companies like Microsoft, Amazon, and Google Cloud offer competing data analytics and AI solutions, posing a significant threat to Palantir's market share.

Dependence on Government Contracts

Palantir's significant reliance on government contracts presents inherent risks. Changes in government spending or policy could significantly impact the company's revenue.

- Political and Regulatory Landscape: Shifts in political priorities or regulatory changes could affect the demand for Palantir's services, leading to revenue instability.

Developing an Investment Strategy for Palantir

Buy, Hold, or Sell?

The decision to buy, hold, or sell Palantir stock depends heavily on individual risk tolerance and investment goals.

- Conservative Investors: Given the current market volatility and risks associated with Palantir, conservative investors might prefer to adopt a "wait-and-see" approach or diversify their portfolios extensively.

- Aggressive Investors: Aggressive investors with a higher risk tolerance might view the recent price drop as a buying opportunity, believing in Palantir's long-term growth potential.

Diversification and Risk Management

Regardless of your investment strategy, diversification and risk management are paramount. Don't put all your eggs in one basket.

- Diversification Strategies: Diversifying your portfolio across different asset classes and sectors can mitigate the risk associated with investing in a single stock like Palantir.

Long-Term vs. Short-Term Investment

Investing in Palantir requires careful consideration of both long-term and short-term perspectives.

- Long-Term Investment: A long-term investment strategy might be suitable for investors who believe in Palantir's long-term growth prospects, despite the inherent risks.

- Short-Term Investment: Short-term investments in Palantir are inherently riskier due to the stock's volatility. Such investments require careful monitoring and a clear exit strategy.

Conclusion

Palantir's recent 30% decline presents both opportunities and risks for investors. While the company's innovative technology and diverse revenue streams offer long-term growth potential, significant risks remain, particularly concerning valuation, competition, and dependence on government contracts. Before making any investment decisions regarding Palantir stock (PLTR), conduct thorough due diligence, assess your risk tolerance, and develop a well-defined investment plan. Invest wisely in Palantir, understanding that it's crucial to assess your risk tolerance before investing in Palantir and learn more about Palantir's investment potential.

Featured Posts

-

Us Immigration Policy In The Spotlight The Case Of Kilmar Abrego Garcia

May 10, 2025

Us Immigration Policy In The Spotlight The Case Of Kilmar Abrego Garcia

May 10, 2025 -

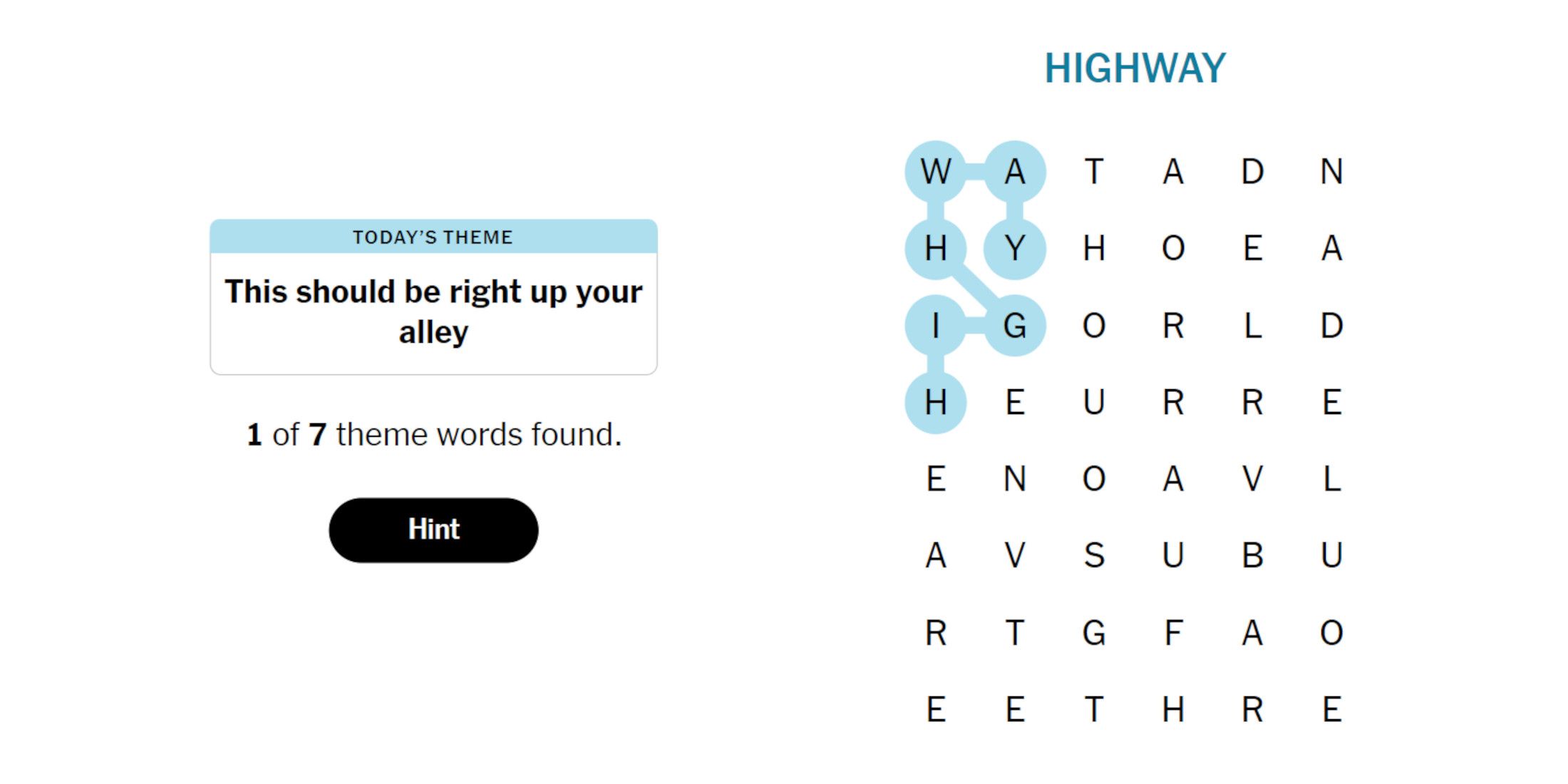

Solutions For Nyt Strands Sunday February 23 2024 Game 357

May 10, 2025

Solutions For Nyt Strands Sunday February 23 2024 Game 357

May 10, 2025 -

Queen Elizabeth 2 Post Makeover Exploring The 2000 Passenger Vessel

May 10, 2025

Queen Elizabeth 2 Post Makeover Exploring The 2000 Passenger Vessel

May 10, 2025 -

Trump Executive Orders And Their Impact On Transgender Individuals Your Stories Matter

May 10, 2025

Trump Executive Orders And Their Impact On Transgender Individuals Your Stories Matter

May 10, 2025 -

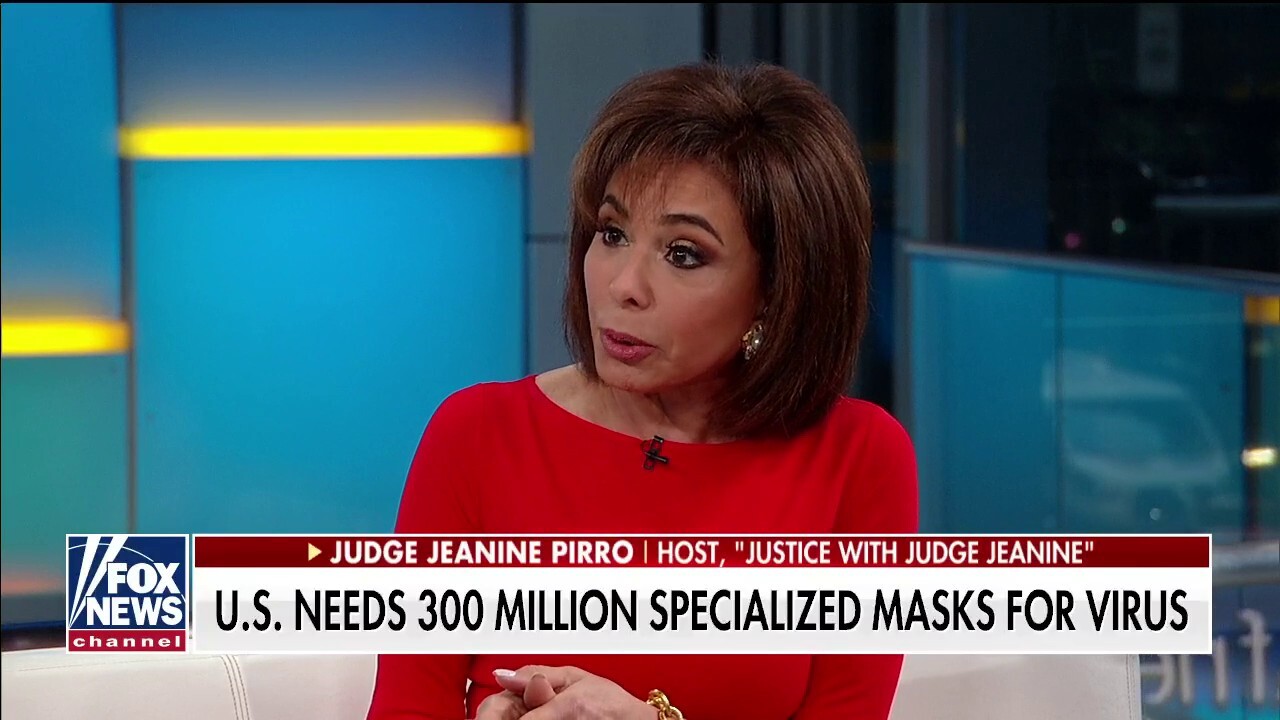

Jeanine Pirros Dc Attorney Nomination Controversy Surrounding A Past Incident

May 10, 2025

Jeanine Pirros Dc Attorney Nomination Controversy Surrounding A Past Incident

May 10, 2025