Pakistan Stock Market Crisis: Operation Sindoor Triggers Sharp Decline

Table of Contents

Understanding Operation Sindoor and its Impact

Operation Sindoor, a recent crackdown targeting alleged market manipulation and insider trading, has had a profound and immediate impact on the Pakistan Stock Market. Its stated goals include curbing illegal activities and restoring investor trust. However, the operation's aggressive approach has inadvertently created uncertainty and fear, triggering a significant sell-off.

How did Operation Sindoor directly impact the stock market? The increased regulatory scrutiny, arrests of key market players, and uncertainty surrounding future regulatory actions have all contributed to the crisis.

- Increased regulatory scrutiny on specific sectors: This has led to increased volatility and uncertainty as investors grapple with the implications for various sectors.

- Arrest of key market players: The arrests have disrupted established networks and created a climate of fear, prompting many to divest from the market.

- Uncertainty surrounding future regulatory actions: The lack of clarity on the scope and future direction of Operation Sindoor has fueled further uncertainty and panic selling.

- Erosion of investor trust and confidence: This is perhaps the most significant consequence, with many investors losing faith in the market's stability and transparency.

- Impact on foreign investment: The crisis has negatively impacted foreign investment, further exacerbating the decline in the PSX.

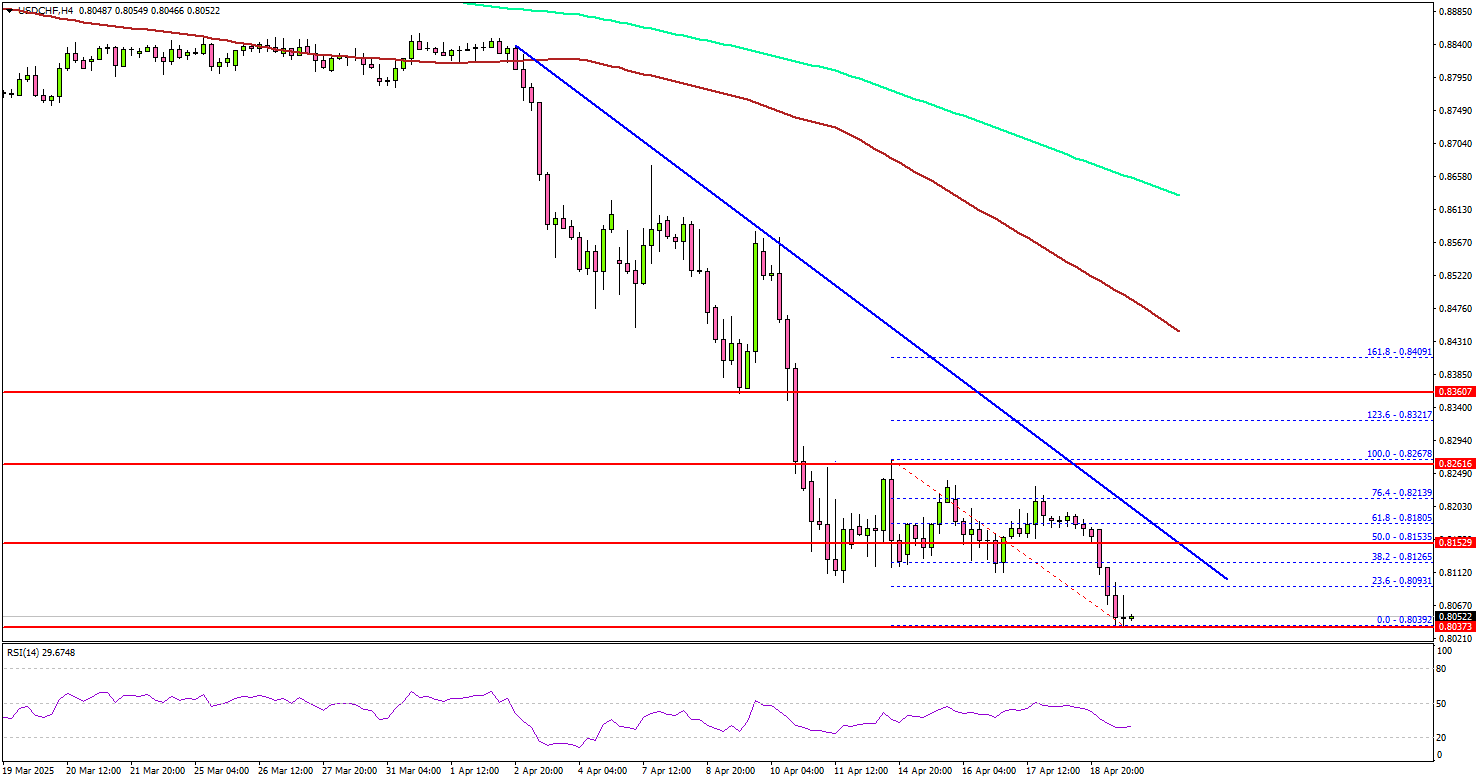

Analyzing the Sharp Decline in the Pakistan Stock Exchange (PSX)

The Pakistan Stock Market crisis has resulted in a steep decline in the PSX. The KSE-100 index, a key benchmark, experienced a significant percentage drop (specific percentage should be inserted here based on current data). This decline wasn't uniform; specific sectors and companies were disproportionately affected. For instance, (insert examples of specific companies and sectors heavily impacted).

- Daily trading volume changes: The daily trading volume has (increased/decreased – insert data) reflecting the heightened volatility and investor activity.

- Impact on different market capitalization segments (large, mid, small cap): (Discuss the differential impact on various market capitalization segments, providing data to support the analysis.)

- Analysis of investor sentiment – panic selling vs. strategic adjustments: While some investors engaged in panic selling, others adopted a more strategic approach, attempting to capitalize on the downturn.

- Comparison with previous market downturns in Pakistan: (Compare the current crisis with previous market downturns, highlighting similarities and differences).

Causes Beyond Operation Sindoor Contributing to the Crisis

While Operation Sindoor played a significant role, other macroeconomic factors contributed to the Pakistan Stock Market crisis. The existing economic instability and political uncertainty exacerbated the situation.

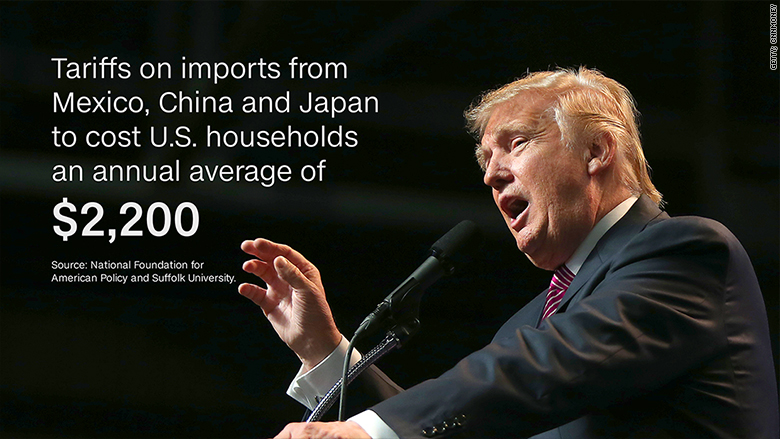

- Impact of inflation and currency devaluation: High inflation and currency devaluation eroded purchasing power and investor confidence.

- Foreign exchange reserves situation: The dwindling foreign exchange reserves heightened concerns about the country's economic stability.

- Government policies and their effect on market sentiment: Government policies (specify relevant policies) have impacted market sentiment negatively.

- Global economic factors impacting Pakistan's economy: Global economic headwinds (e.g., rising interest rates, geopolitical instability) have further strained the Pakistani economy.

The Role of Speculation and Market Manipulation

The Pakistan Stock Market has a history of speculation and potential market manipulation. While Operation Sindoor aimed to address these issues, it's crucial to analyze whether pre-existing speculative activities might have amplified the crisis's impact.

- Examples of suspected manipulative activities: (Insert examples, if available, citing reliable sources).

- The regulatory framework's effectiveness in preventing manipulation: (Evaluate the effectiveness of the existing regulatory framework in preventing and detecting market manipulation).

- The impact of speculative trading on market volatility: (Analyze how speculative trading contributed to the market's volatility during the crisis).

Potential Consequences and Future Outlook for the Pakistan Stock Market

The Pakistan Stock Market crisis has short-term and long-term implications for the Pakistani economy. The short-term consequences include reduced investor confidence, decreased economic activity, and potential job losses. Long-term consequences could include hampered economic growth and development and difficulty attracting foreign investment.

- Impact on economic growth and development: The crisis will likely hinder economic growth and development.

- Potential for investor flight and capital outflow: The crisis may lead to capital flight and reduce foreign direct investment.

- Government's response and potential policy changes: The government's response and potential policy changes will be critical in determining the market's recovery.

- Long-term prospects for the PSX's recovery and stability: The PSX's long-term recovery depends on a combination of factors, including macroeconomic stability, improved regulatory frameworks, and restored investor confidence.

Conclusion

The Pakistan Stock Market crisis triggered by Operation Sindoor represents a significant challenge for the nation's economy. The sharp decline reflects not only the immediate impact of the operation but also underlying vulnerabilities in the market and the broader economy. Understanding the complexities of this crisis, including the role of Operation Sindoor, macroeconomic factors, and market manipulation, is crucial for developing effective recovery strategies. The future stability of the Pakistan Stock Market hinges on addressing these issues and restoring investor confidence. For continued updates and in-depth analysis of the Pakistan Stock Market Crisis, stay tuned to our website.

Featured Posts

-

Predicting The Top Storylines In The Nhls 2024 25 Season

May 09, 2025

Predicting The Top Storylines In The Nhls 2024 25 Season

May 09, 2025 -

6

May 09, 2025

6

May 09, 2025 -

Local Journalisms Role In Supporting Anchorages Arts Community

May 09, 2025

Local Journalisms Role In Supporting Anchorages Arts Community

May 09, 2025 -

Uy Scuti Release Date Young Thug Offers Clues

May 09, 2025

Uy Scuti Release Date Young Thug Offers Clues

May 09, 2025 -

Massive Fentanyl Bust Bondis Announcement Shakes The Nation

May 09, 2025

Massive Fentanyl Bust Bondis Announcement Shakes The Nation

May 09, 2025

Latest Posts

-

Strengthening The Eu Response To Us Tariffs A French Ministers Plea

May 09, 2025

Strengthening The Eu Response To Us Tariffs A French Ministers Plea

May 09, 2025 -

Us Tariffs French Minister Pushes For Stronger Eu Countermeasures

May 09, 2025

Us Tariffs French Minister Pushes For Stronger Eu Countermeasures

May 09, 2025 -

Further Eu Action Needed On Us Tariffs French Ministers Statement

May 09, 2025

Further Eu Action Needed On Us Tariffs French Ministers Statement

May 09, 2025 -

French Minister Urges More Robust Eu Action Against Us Tariffs

May 09, 2025

French Minister Urges More Robust Eu Action Against Us Tariffs

May 09, 2025 -

French Minister Advocates For Collaborative Nuclear Defense In Europe

May 09, 2025

French Minister Advocates For Collaborative Nuclear Defense In Europe

May 09, 2025