Pakistan Economic Crisis: IMF Review Of $1.3 Billion Loan Package

Table of Contents

The Current State of Pakistan's Economy

The Pakistan Economic Crisis is characterized by a confluence of severe economic challenges. The situation is complex and requires a multifaceted approach to address its root causes.

Inflation and its Impact on the Population

Pakistan is grappling with soaring inflation rates, significantly eroding the purchasing power of its citizens.

- Current Inflation Rates: Inflation has reached double-digit figures, impacting every aspect of daily life. The exact figures fluctuate, but consistently high inflation is a major concern.

- Impact on Purchasing Power: The rising cost of essential goods, from food and fuel to housing and transportation, has led to widespread economic hardship. Many families struggle to meet their basic needs.

- Social Unrest: The cost of living crisis fueled by rupee devaluation and price hikes has triggered social unrest and protests across the country.

Foreign Exchange Reserves and Debt Sustainability

Pakistan's dwindling foreign exchange reserves pose a significant threat to its economic stability.

- Dwindling Reserves: The country's foreign exchange reserves have fallen to critically low levels, limiting its ability to import essential goods and services.

- External Debt Burden: A massive external debt burden further exacerbates the situation, requiring a substantial portion of the country's resources for debt servicing.

- Balance of Payments Crisis: The combination of low reserves and high debt creates a precarious balance of payments situation, increasing the risk of default. This impacts import capabilities and overall economic health.

Energy Crisis and its Economic Ripple Effects

Severe energy shortages and frequent power outages are crippling Pakistan's economy.

- Power Outages: Load shedding, or planned power cuts, is commonplace, disrupting businesses, industries, and daily life.

- Fuel Prices: High fuel prices further exacerbate the energy crisis, adding to the inflationary pressures and increasing the cost of production across various sectors.

- Industrial Production: The energy crisis has significantly hampered industrial production, leading to reduced output and job losses.

The IMF Loan Package and its Conditions

The $1.3 billion IMF Loan is contingent upon Pakistan implementing significant economic reforms.

Details of the $1.3 Billion Loan Package

The loan is disbursed in tranches, with each release subject to the fulfillment of specific conditions.

- Disbursement Schedule: The IMF will release the funds in installments, subject to the implementation of agreed-upon reforms.

- Loan Conditions: The loan is attached to stringent conditions, including fiscal consolidation, structural reforms, and monetary tightening.

- Timelines: Meeting the timelines set by the IMF is critical for receiving the full amount of the loan.

Key Reforms Demanded by the IMF

The IMF has demanded a series of reforms to address Pakistan's economic woes.

- Fiscal Consolidation: This involves reducing the fiscal deficit through measures like tax reforms and expenditure cuts.

- Monetary Tightening: This involves raising interest rates to curb inflation and stabilize the currency.

- Structural Reforms: These include measures aimed at improving governance, enhancing the business environment, and privatizing state-owned enterprises. This includes crucial tax reforms and addressing issues in governance and transparency.

Potential Challenges in Implementing the Reforms

Implementing these reforms faces significant hurdles.

- Political Instability: Political instability and resistance to unpopular reforms pose a significant challenge.

- Social Unrest: The austerity measures required by the IMF could trigger further social unrest and protests.

- Economic Hardship: The reforms could lead to short-term economic hardship for some segments of the population.

Potential Outcomes of the IMF Review

The success or failure of the IMF review will have profound consequences.

Positive Outcomes: Successful Review and its Impact

A successful review would unlock much-needed funds and pave the way for economic recovery.

- Access to Funds: Pakistan would gain access to the full $1.3 billion, providing some much-needed financial relief.

- Economic Recovery: The infusion of funds, combined with successful reforms, could lead to an economic recovery.

- Improved Investor Confidence: Successful implementation of reforms could improve investor confidence and attract foreign investment.

Negative Outcomes: Failure to Meet Conditions

Failure to meet the IMF's conditions could lead to a further economic downturn.

- Further Economic Downturn: Failure to secure the loan could lead to a deeper economic crisis, with potentially severe consequences.

- Default Risk: The risk of default on external debt would significantly increase, further isolating Pakistan in the international financial markets.

- Financial Crisis: A complete failure to address the Pakistan Economic Crisis could trigger a full-blown financial crisis.

Conclusion: Pakistan Economic Crisis: A Path Forward?

The IMF review of the $1.3 billion loan package is a pivotal moment for Pakistan. The current economic situation is dire, marked by high inflation, dwindling foreign exchange reserves, and an energy crisis. The IMF Loan, while crucial, comes with stringent conditions that demand significant reforms in fiscal, monetary, and structural policies. The successful implementation of these reforms is paramount to unlocking the funds and avoiding a potentially catastrophic economic collapse. Failure to meet these conditions could lead to a further deepening of the crisis. Stay updated on the latest developments concerning the Pakistan Economic Crisis and the crucial IMF Loan review. Follow reliable news sources for informed insights into this evolving situation.

Featured Posts

-

Wall Street Predicts 110 Surge The Billionaire Backed Black Rock Etf

May 09, 2025

Wall Street Predicts 110 Surge The Billionaire Backed Black Rock Etf

May 09, 2025 -

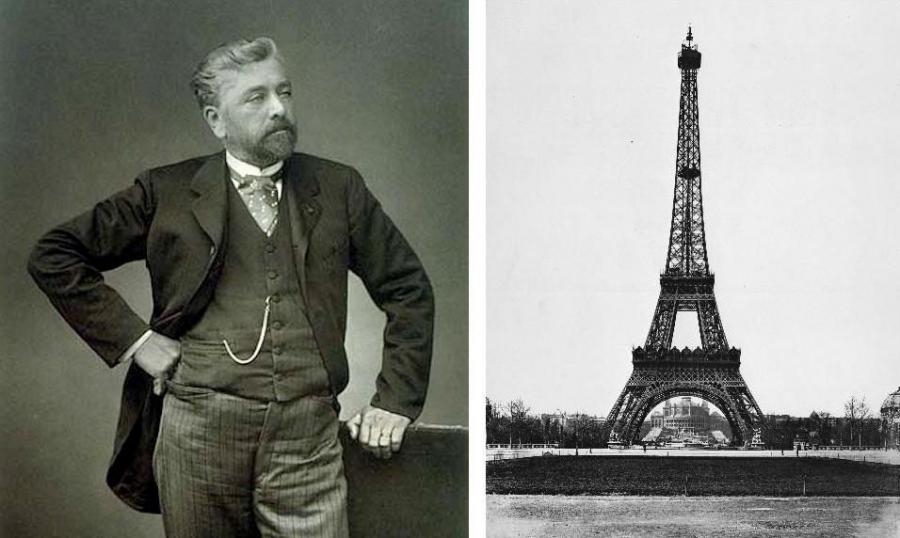

Dijon Une Nouvelle Lumiere Sur Gustave Eiffel Et Son Heritage Maternel

May 09, 2025

Dijon Une Nouvelle Lumiere Sur Gustave Eiffel Et Son Heritage Maternel

May 09, 2025 -

Tougher Uk Immigration Rules English Language Proficiency Key

May 09, 2025

Tougher Uk Immigration Rules English Language Proficiency Key

May 09, 2025 -

Stalking Charges Woman Who Claimed To Be Madeleine Mc Cann Arrested

May 09, 2025

Stalking Charges Woman Who Claimed To Be Madeleine Mc Cann Arrested

May 09, 2025 -

The Snl Impression That Left Harry Styles Devastated

May 09, 2025

The Snl Impression That Left Harry Styles Devastated

May 09, 2025