OPEC+ Meeting: Big Oil's Production Remains Unchanged

Table of Contents

The OPEC+ Decision: A Deep Dive into the Unchanged Production Levels

OPEC+, a coalition comprising the Organization of the Petroleum Exporting Countries (OPEC) and allied oil-producing nations, agreed to maintain its current production levels. While the precise figures vary depending on the member state and are subject to constant revision, the key takeaway is the absence of any significant increase or decrease in overall output. This decision, seemingly maintaining the status quo, is far more complex than it initially appears.

The rationale behind this decision is multifaceted:

- Global Demand Forecasts: OPEC+ likely considered forecasts predicting relatively stable or slightly increasing global oil demand. Maintaining current production levels helps avoid a potential oversupply scenario that could drive prices down.

- Geopolitical Considerations: The ongoing geopolitical instability in various parts of the world, including the war in Ukraine, plays a significant role. OPEC+ might be cautious about increasing production and potentially exacerbating market volatility.

- Concerns about Potential Market Oversupply: A sudden surge in production could lead to an oversupply, resulting in a price crash detrimental to member nations' economies. Therefore, maintaining the current output serves as a risk-averse strategy.

- Internal Disagreements Among Member Nations: Reaching a consensus within OPEC+ is often challenging, given the diverse economic and political interests of its member countries. Maintaining the current production levels might represent a compromise solution.

Data on daily barrel production, though constantly fluctuating and privately held by many member nations, will show a relatively flat trajectory following the meeting. Percentage changes compared to previous periods will likely be minimal, reflecting the intention to maintain the status quo.

Impact on Global Oil Prices: Analyzing Market Reactions

The immediate market reaction to the OPEC+ decision was mixed. While some analysts predicted a slight increase in oil prices due to continued supply constraints, others anticipated a more muted response given the relatively stable demand outlook.

The potential short-term and long-term impacts on oil prices are uncertain:

- Investor Sentiment: Investor confidence plays a crucial role. Positive sentiment could push prices higher, while negative sentiment could lead to price drops.

- Speculation about Future Production Adjustments: Market participants will closely watch for any signs of future production adjustments. Speculation alone can significantly influence prices.

- Influence of External Factors: Economic growth rates in major economies, geopolitical events, and even unexpected weather patterns can significantly influence oil prices independent of OPEC+ decisions.

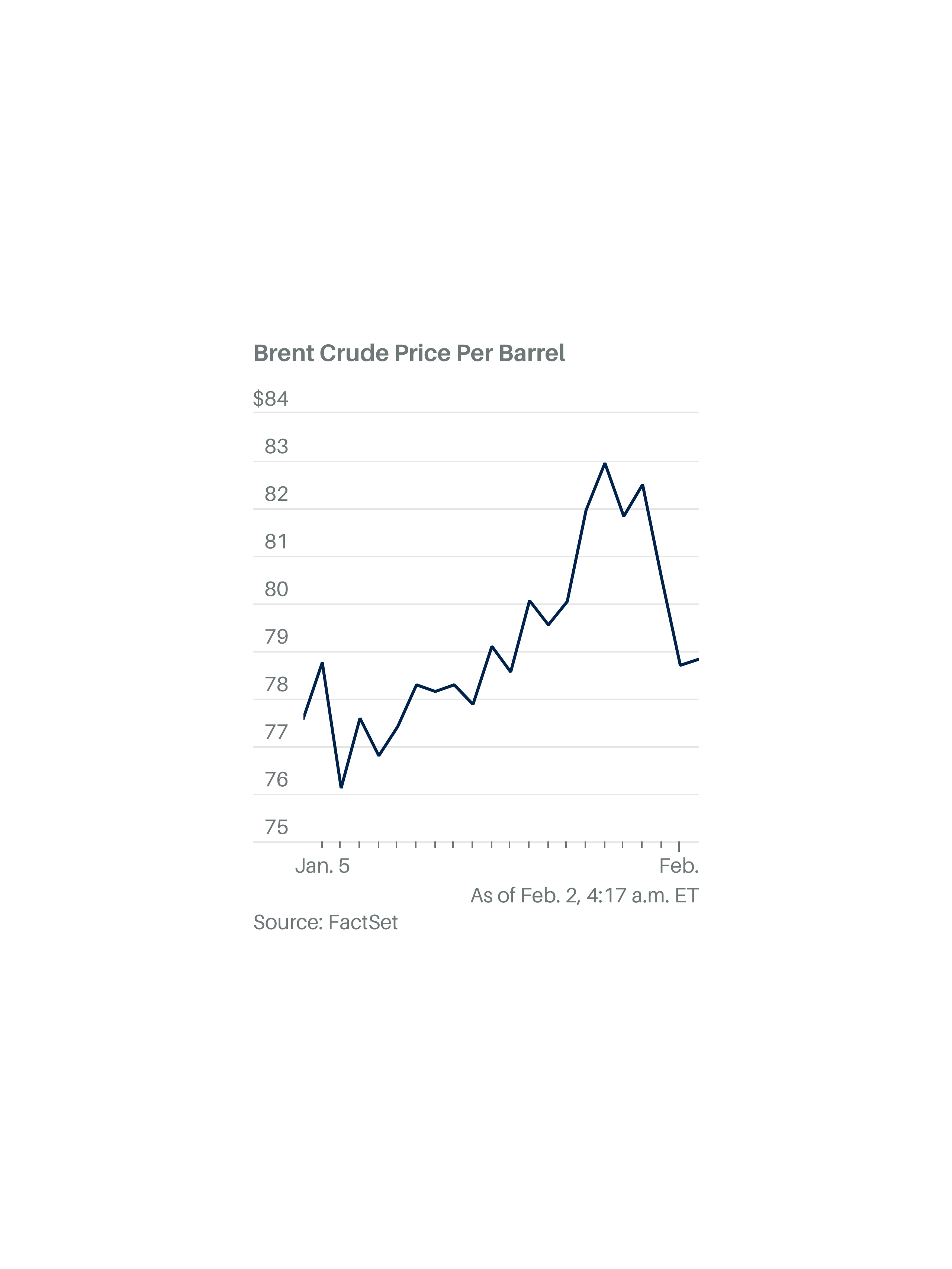

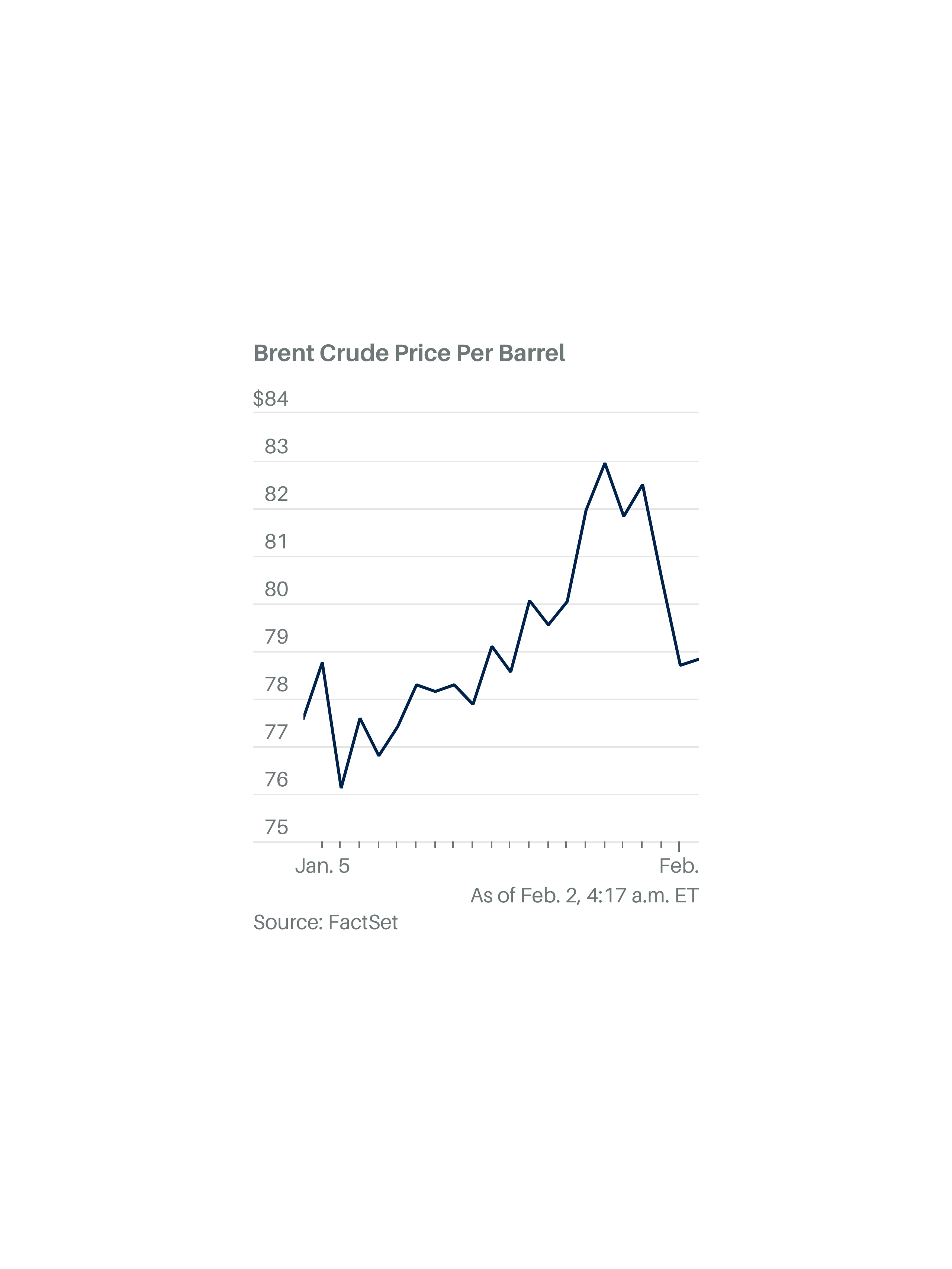

Visual representation of price fluctuations through charts and graphs during the period leading up to and following the OPEC+ announcement would clearly show the minimal impact of the meeting's decision on the immediate pricing.

Implications for Consumers and the Global Economy

The unchanged production levels from the OPEC+ meeting will likely have a direct impact on global consumers and the economy:

- Gasoline Prices: Stable or slightly increasing oil prices could translate into relatively stable or slightly higher gasoline prices for consumers, influencing their spending habits.

- Economic Sectors Reliant on Oil: The transportation, manufacturing, and aviation sectors are heavily reliant on oil. Price stability could provide some certainty, but significant fluctuations could disrupt these sectors.

- Macroeconomic Consequences: Stable oil prices generally contribute to macroeconomic stability. However, significant price increases can fuel inflationary pressures, potentially impacting economic growth negatively. Conversely, significant price drops can lead to deflationary pressures.

Alternative Energy Sources and the OPEC+ Decision

The OPEC+ decision to maintain production levels underscores the ongoing challenge of transitioning to a world powered by renewable energy sources. While demand for oil remains robust, the continued investment in and adoption of alternative energies like solar, wind, and hydroelectric power are gaining momentum.

- Accelerating or Hindering the Transition?: The decision could potentially hinder the transition to cleaner energy in the short term by maintaining the relative affordability of fossil fuels. However, it could also accelerate the transition indirectly by highlighting the need for diversification away from oil dependency.

- Government Policies and Investments: Government policies and investments in renewable energy play a crucial role in determining the pace of the energy transition, independent of OPEC+ decisions.

Looking Ahead: Future OPEC+ Meetings and Market Predictions

The timing of the next OPEC+ meeting and the factors influencing future decisions are key elements to consider. Future oil production levels and price trajectories will depend largely on:

- Global Economic Growth: Stronger global economic growth usually translates into higher oil demand.

- Geopolitical Stability: Reduced geopolitical uncertainty can foster a more stable oil market.

- Technological Advancements: Developments in renewable energy and oil extraction technologies can influence both supply and demand.

Various scenarios are possible. Increased global demand could pressure OPEC+ to increase production. Conversely, a global economic slowdown might lead to a reduction in output.

Conclusion: OPEC+ Meeting: The Unchanging Landscape of Oil Production and Its Future

The OPEC+ meeting's decision to maintain its current oil production levels has far-reaching consequences. While the immediate market reaction was muted, the long-term implications for global oil prices, consumers, and the global economy remain significant and uncertain. The interplay between this decision and the broader transition to renewable energy sources is equally crucial. To stay informed about future OPEC+ meetings and the constantly evolving dynamics of the global oil market, follow updates on "OPEC+ Meeting," "oil production," "crude oil prices," and the "global energy market." Understanding these factors is essential for navigating the complex landscape of global energy.

Featured Posts

-

Rare Novel Valued At 45 000 Found In Bookstore

May 04, 2025

Rare Novel Valued At 45 000 Found In Bookstore

May 04, 2025 -

Farage Outpolls Starmer As Preferred Prime Minister In Uk Constituencies

May 04, 2025

Farage Outpolls Starmer As Preferred Prime Minister In Uk Constituencies

May 04, 2025 -

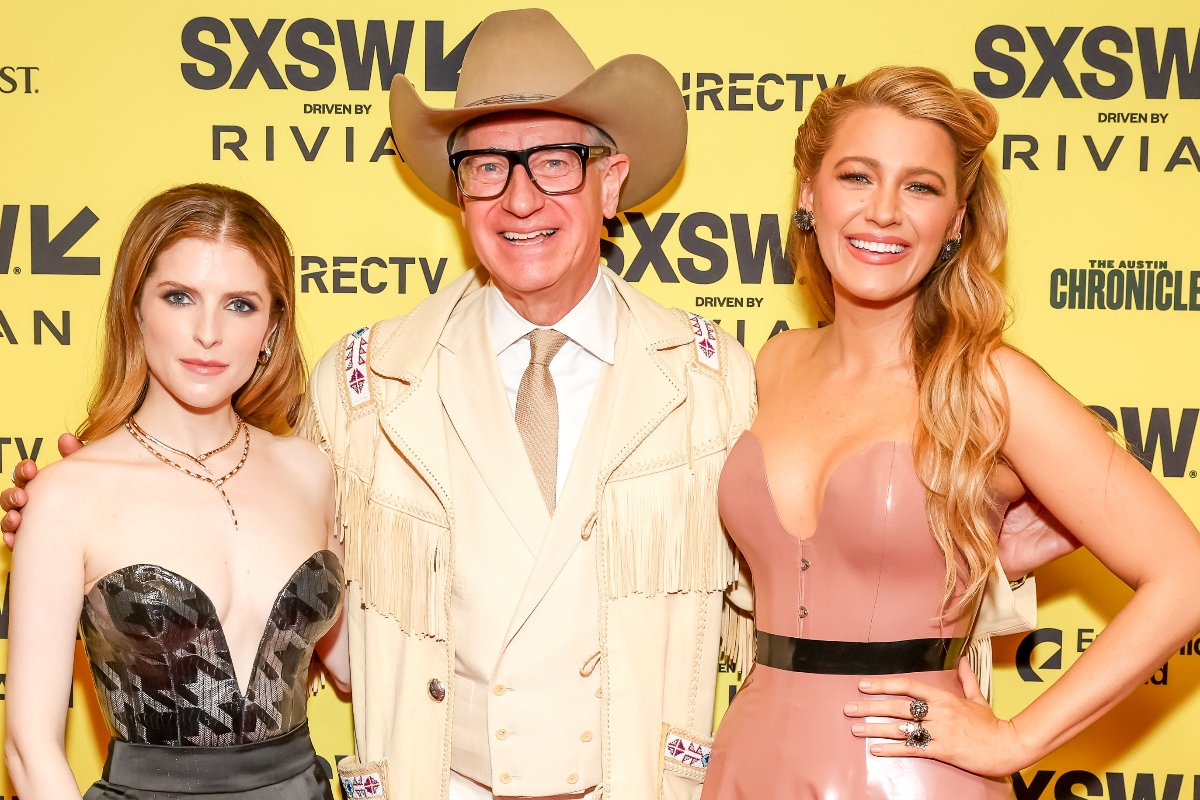

Anna Kendrick And Rebel Wilsons Unusual Friendship Story

May 04, 2025

Anna Kendrick And Rebel Wilsons Unusual Friendship Story

May 04, 2025 -

Kivinin Kabugu Yenir Mi Nasil Yenir Nelere Dikkat Edilmeli

May 04, 2025

Kivinin Kabugu Yenir Mi Nasil Yenir Nelere Dikkat Edilmeli

May 04, 2025 -

Capitals Announce All Caps 2025 Playoffs Initiatives A Vanda Pharmaceuticals Partnership

May 04, 2025

Capitals Announce All Caps 2025 Playoffs Initiatives A Vanda Pharmaceuticals Partnership

May 04, 2025

Latest Posts

-

Did On Set Tension Impact Another Simple Favor Director Weighs In

May 04, 2025

Did On Set Tension Impact Another Simple Favor Director Weighs In

May 04, 2025 -

The Blake Lively And Anna Kendrick Feud A Year By Year Look At The Alleged Drama

May 04, 2025

The Blake Lively And Anna Kendrick Feud A Year By Year Look At The Alleged Drama

May 04, 2025 -

Dispelling The Rumors Another Simple Favor Director On Lively And Kendricks Dynamic

May 04, 2025

Dispelling The Rumors Another Simple Favor Director On Lively And Kendricks Dynamic

May 04, 2025 -

Blake Lively Vs Anna Kendrick Tracing The Rumors Of A Hollywood Rift

May 04, 2025

Blake Lively Vs Anna Kendrick Tracing The Rumors Of A Hollywood Rift

May 04, 2025 -

Another Simple Favor Director Clarifies Behind The Scenes Drama

May 04, 2025

Another Simple Favor Director Clarifies Behind The Scenes Drama

May 04, 2025