Ontario Budget 2024: Focus On Manufacturing Tax Credit Expansion

Table of Contents

Understanding the Expanded Manufacturing Tax Credit in Ontario Budget 2024

Prior to the 2024 budget, Ontario already offered a Manufacturing Tax Credit, providing a modest tax break to eligible businesses. However, the Ontario Budget 2024 significantly enhanced this incentive, making it far more attractive and impactful for a wider range of manufacturers. The key changes introduced include:

-

Increased Tax Credit Rate: The percentage of eligible expenses that qualify for the tax credit has been substantially increased. This directly translates to greater savings for businesses.

-

Expansion of Eligible Expenses: The definition of "eligible expenses" has broadened, now encompassing a wider range of investments, including advanced manufacturing technologies, automation equipment, and software upgrades. This allows for a more comprehensive tax benefit on crucial modernization initiatives.

-

Extended Eligibility Criteria: The 2024 budget has expanded eligibility to encompass a greater number of manufacturers, potentially including smaller businesses and those operating in emerging sectors. This inclusive approach ensures a wider reach of the tax incentives.

-

Simplified Claiming Process: The government has streamlined the application process, potentially introducing an online portal or other user-friendly tools. This simplification makes it easier for businesses to claim their credits without unnecessary bureaucratic hurdles. This change aims to reduce the administrative burden associated with Ontario Tax Reform and Business Tax Credits.

These changes represent a significant improvement in Ontario’s manufacturing tax incentives, creating a more supportive environment for manufacturing investment within the province.

Impact of the Expanded Credit on Ontario Businesses

The expanded Manufacturing Tax Credit in the Ontario Budget 2024 is poised to have a transformative effect on Ontario businesses. The increased incentives will likely lead to:

-

Increased Investment in Capital Equipment and Technology: Businesses will have greater financial capacity to invest in modernizing their facilities and adopting advanced technologies. This can lead to increased productivity and efficiency.

-

Job Creation and Economic Growth: The influx of investment will stimulate job growth within the manufacturing sector, creating new opportunities and strengthening the province’s economy. The direct and indirect economic impacts are expected to be substantial, contributing to overall economic growth.

-

Enhanced Competitiveness for Ontario Manufacturers: By reducing the tax burden, this incentive strengthens the competitiveness of Ontario manufacturers both domestically and internationally, enabling them to better compete in the global marketplace.

-

Attracting New Investment and Businesses to the Province: The improved tax environment makes Ontario a more attractive location for both domestic and foreign business investment, potentially leading to the creation of new manufacturing facilities and jobs.

For example, a small-batch craft brewery, previously unable to afford automation equipment, might now be able to implement a new bottling line, creating new jobs and significantly boosting production. Similarly, a larger automotive parts manufacturer could invest in advanced robotics, improving efficiency and competitiveness.

Eligibility Criteria and How to Claim the Manufacturing Tax Credit

To qualify for the expanded Manufacturing Tax Credit, businesses must meet specific criteria defined by the Ontario government. This includes, but may not be limited to, factors such as business type, location, and the nature of their manufacturing activities. Specific eligibility requirements will be outlined in official government documentation.

The claiming process is expected to be straightforward, potentially utilizing an online portal for easier submission. Businesses will need to gather relevant documentation, such as financial statements and expense records, and submit them according to the outlined procedures. Details on required Tax Forms and the complete application process will be available on the official website of the Ontario Ministry of Finance. Keep an eye out for updates regarding government resources and links to facilitate the claim process.

Future Implications and Long-Term Economic Outlook for Ontario Manufacturing

The expanded Manufacturing Tax Credit, as part of the Ontario Budget 2024, represents a strategic long-term investment in the province’s manufacturing sector. The government’s objective is to revitalize Ontario Manufacturing, improve its competitiveness, and create a thriving economic environment.

While the positive economic impacts are expected to be significant, potential challenges could include ensuring the credit effectively targets businesses in need of support and avoiding unintended consequences. However, the overall outlook for the manufacturing sector in Ontario is positive, with this tax credit potentially serving as a catalyst for sustained long-term growth and a renewed focus on innovation and advanced manufacturing technologies. This initiative aligns with the government's broader economic strategy for fostering growth and diversification across various industries.

Conclusion: Maximize the Benefits of the Ontario Budget 2024 Manufacturing Tax Credit Expansion

The expanded Manufacturing Tax Credit outlined in the Ontario Budget 2024 presents a significant opportunity for Ontario businesses. By significantly increasing the tax credit rate, expanding eligible expenses, and simplifying the application process, the government aims to stimulate investment, create jobs, and enhance the competitiveness of the province's manufacturing sector. The potential for long-term growth and increased economic impact is substantial.

Don't miss out on this opportunity to boost your business’s financial standing and contribute to Ontario’s economic prosperity. Explore the expanded Manufacturing Tax Credit Ontario and learn how you can claim your share of these considerable business tax benefits. Contact your accountant, or relevant government agencies, to understand how the expanded Manufacturing Tax Credit can help your business thrive. Claim your credit and contribute to Ontario economic growth today!

Featured Posts

-

Choosing Between Ps 5 And Xbox Series S A Buyers Guide

May 07, 2025

Choosing Between Ps 5 And Xbox Series S A Buyers Guide

May 07, 2025 -

Should The Wolves Trade For Julius Randle A Detailed Analysis

May 07, 2025

Should The Wolves Trade For Julius Randle A Detailed Analysis

May 07, 2025 -

Eyd Mylad Jaky Shan Wyl Smyth Yhtfl Balghnae Walrqs Waldhk

May 07, 2025

Eyd Mylad Jaky Shan Wyl Smyth Yhtfl Balghnae Walrqs Waldhk

May 07, 2025 -

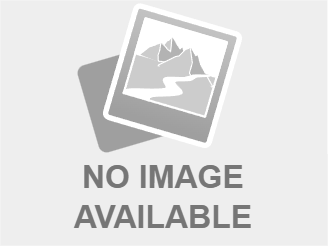

New Direct Flights From Stansted To Casablanca Everything You Need To Know

May 07, 2025

New Direct Flights From Stansted To Casablanca Everything You Need To Know

May 07, 2025 -

Conclave Explained A Step By Step Guide To Papal Election

May 07, 2025

Conclave Explained A Step By Step Guide To Papal Election

May 07, 2025

Latest Posts

-

Analyzing The Overvalued Canadian Dollar Economic Perspectives And Recommendations

May 08, 2025

Analyzing The Overvalued Canadian Dollar Economic Perspectives And Recommendations

May 08, 2025 -

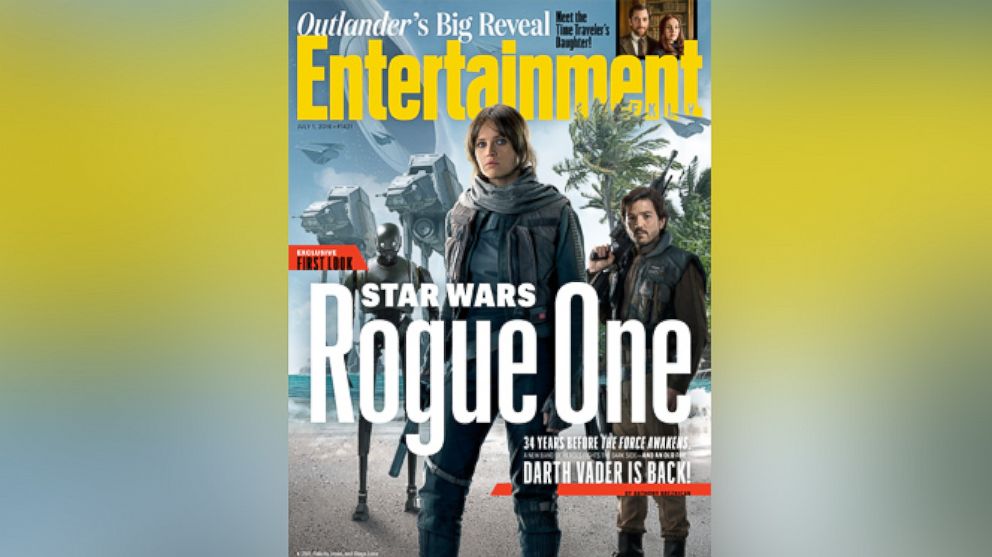

The Untold Story A Rogue One Heros Journey In The New Star Wars Show

May 08, 2025

The Untold Story A Rogue One Heros Journey In The New Star Wars Show

May 08, 2025 -

Rogue Unleashes Cyclops Powers A New X Men Development

May 08, 2025

Rogue Unleashes Cyclops Powers A New X Men Development

May 08, 2025 -

The Canadian Dollars Strength Concerns And Potential Solutions

May 08, 2025

The Canadian Dollars Strength Concerns And Potential Solutions

May 08, 2025 -

New Star Wars Series Explores The Past Of A Beloved Rogue One Character

May 08, 2025

New Star Wars Series Explores The Past Of A Beloved Rogue One Character

May 08, 2025