Omada Health's US IPO: A Look At The Andreessen Horowitz-Backed Company

Table of Contents

Omada Health's Business Model and Target Market

Omada Health's business model centers around delivering digital therapeutic programs designed to prevent and manage chronic conditions, primarily focusing on type 2 diabetes and hypertension. These programs leverage a sophisticated telehealth platform to provide personalized care at scale.

- Target demographics: Omada Health primarily targets adults aged 40-65 with pre-diabetes, type 2 diabetes, or hypertension. However, their programs are adaptable and can be tailored to other at-risk populations.

- Key features of their digital platform: The Omada Health platform combines remote patient monitoring (RPM) through connected devices, personalized coaching from certified health coaches, and engaging educational materials to promote behavioral changes. This integrated approach aims to improve patient engagement and clinical outcomes.

- Revenue streams: Omada Health generates revenue through employer-sponsored wellness programs, which represent a significant portion of their business. They also offer direct-to-consumer options, providing individuals with access to their programs. This diversified revenue model strengthens their financial resilience.

This approach to chronic disease management using Omada Health digital therapeutics positions them strategically within the rapidly growing telehealth market.

The Andreessen Horowitz Investment and its Significance

Andreessen Horowitz (a16z), a leading venture capital firm with a strong track record in technology investments, has been a significant investor in Omada Health. This involvement lends substantial credibility and financial backing to the company.

- History of a16z's investment: A16z's investment in Omada Health spans several funding rounds, demonstrating their continued belief in the company's potential. This long-term commitment showcases a strong vote of confidence.

- Impact on Omada's growth and market positioning: The substantial funding secured from a16z has fueled Omada Health's growth, enabling them to expand their platform, enhance their programs, and broaden their market reach. This backing has significantly contributed to their competitive advantage in the digital therapeutics space.

- A16z's portfolio and focus on digital health: A16z's portfolio includes numerous successful companies in the digital health sector, demonstrating their expertise and strategic focus on this rapidly evolving market. Their involvement with Omada Health aligns perfectly with this strategy.

The Andreessen Horowitz investment in Omada Health signifies a crucial endorsement of their innovative approach and market potential within the broader context of venture capital in telehealth.

Omada Health IPO Performance and Financial Analysis

The Omada Health IPO generated considerable interest from investors, reflecting the growing market demand for digital health solutions. A thorough financial analysis is crucial to understanding its performance and future trajectory.

- IPO pricing and valuation: The IPO pricing and the resulting market capitalization provide valuable insights into investor sentiment and the company's perceived value. (Specific numbers would need to be added here, obtained from reputable financial sources at the time of writing).

- Key financial metrics: Analyzing key metrics such as revenue growth, profitability (or the path to profitability), and customer acquisition costs is crucial for assessing the long-term viability of the business model. (Specific financial data, again, would need to be inserted here, citing the source.)

- Investor reaction and stock performance post-IPO: Post-IPO stock performance provides a real-time assessment of how the market views Omada Health's prospects. Tracking the stock price and trading volume can provide valuable information. (Real-time data would need to be incorporated here.)

Analyzing these aspects of the Omada Health IPO price and performance provides a comprehensive picture of the company's financial health and its prospects.

Competitive Landscape and Future Outlook for Omada Health

Omada Health operates in a dynamic and competitive telehealth market, facing established players and emerging startups. Understanding this competitive landscape is critical for assessing their future outlook.

- Major competitors and their strategies: Omada Health competes with various companies offering digital therapeutics and telehealth services, each with unique strengths and strategies. (Specific competitors need to be named and their approaches described here.)

- Potential growth opportunities and challenges: The growth of the telehealth market presents significant opportunities for Omada Health, but challenges remain, including securing reimbursements, maintaining patient engagement, and adapting to regulatory changes.

- Long-term prospects and sustainability of the business model: The long-term sustainability of Omada Health's business model depends on factors such as continued technological innovation, strategic partnerships, and effective expansion into new markets.

Omada Health's success in navigating this competitive landscape and capitalizing on growth opportunities will be crucial to its long-term prospects in the digital therapeutics market outlook.

Conclusion

Omada Health's IPO represents a pivotal moment for both the company and the broader digital health sector. Its success hinges on continued innovation, effective market penetration, and maintaining a competitive edge within the telehealth market analysis. While the future holds both opportunities and challenges, the company's strong backing, innovative approach to chronic disease management, and the growing demand for telehealth services position it for potential long-term growth. For those interested in investing in the future of healthcare, further research into the Omada Health IPO and its trajectory is strongly recommended. Stay informed about the evolving landscape of the Omada Health IPO and its impact on the digital health market.

Featured Posts

-

Uruguay La Historia Detras Del Nombre Semana De Turismo Y Su Significado

May 11, 2025

Uruguay La Historia Detras Del Nombre Semana De Turismo Y Su Significado

May 11, 2025 -

Mtv Movie And Tv Awards No Show In 2025

May 11, 2025

Mtv Movie And Tv Awards No Show In 2025

May 11, 2025 -

Denmark Chooses Sissal For Eurovision 2025

May 11, 2025

Denmark Chooses Sissal For Eurovision 2025

May 11, 2025 -

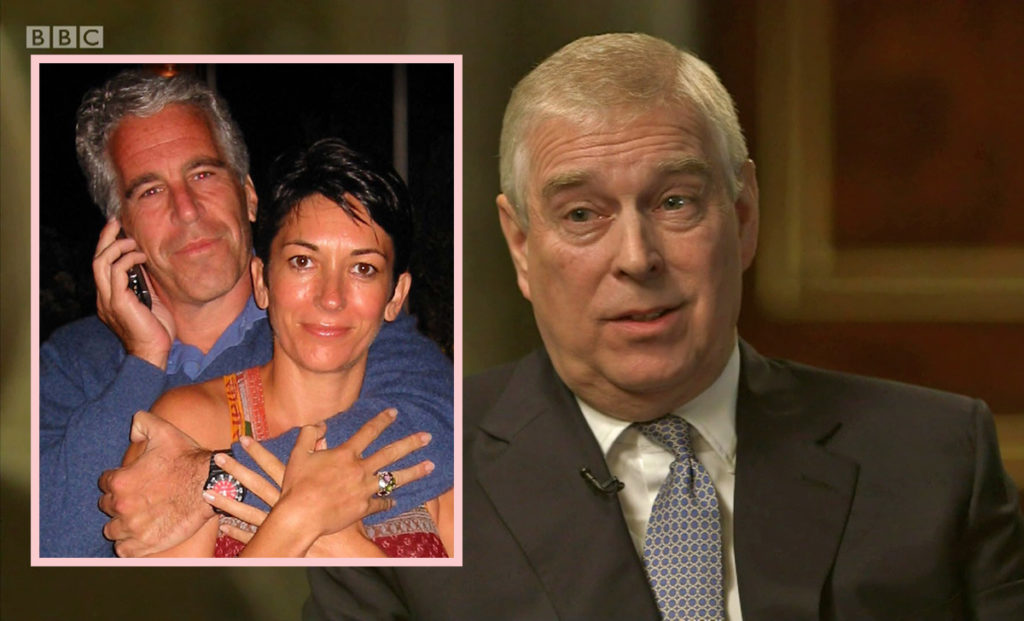

Undercover Investigation Explosive Allegations Against Prince Andrew Regarding Underage Girl

May 11, 2025

Undercover Investigation Explosive Allegations Against Prince Andrew Regarding Underage Girl

May 11, 2025 -

The Next Pope Nine Cardinals Likely To Succeed Francis

May 11, 2025

The Next Pope Nine Cardinals Likely To Succeed Francis

May 11, 2025