Oil Supply Shocks: How The Airline Industry Is Feeling The Heat

Table of Contents

Soaring Fuel Costs: The Core Impact of Oil Supply Shocks

Oil prices are the lifeblood of the airline industry. A direct correlation exists between crude oil prices and the cost of jet fuel, the single largest operational expense for most airlines. Recent price spikes have dramatically increased fuel costs, squeezing profit margins and forcing airlines to make difficult decisions. For example, jet fuel prices have risen by X% in the last Y months (replace X and Y with current data). Fuel typically accounts for between 20-40% of an airline's operating costs, meaning even a modest price increase significantly impacts profitability.

- Increased jet fuel prices lead to higher operating expenses. This directly impacts the bottom line, reducing profitability and potentially leading to financial instability.

- Airlines have limited ability to quickly pass on all increased costs to consumers. While ticket price increases are inevitable, the elasticity of demand means airlines must carefully balance price hikes with the risk of reduced passenger numbers.

- Reduced profit margins and potential financial strain on airlines. This is especially true for smaller airlines with less financial resilience.

- Impact on smaller, less financially stable airlines disproportionately greater. These carriers may struggle to absorb these increased costs, potentially leading to bankruptcies or mergers.

Rising Ticket Prices: Passing the Burden to the Consumer

To counteract increased fuel costs, airlines are forced to increase ticket prices. This, however, is a delicate balancing act. The elasticity of demand for air travel varies depending on factors such as the time of year, the destination, and the traveler's purpose. While some passengers may be willing to absorb higher fares, others may postpone or cancel their travel plans altogether.

- Analysis of recent airfare increases and their correlation with oil prices. Data demonstrating the direct link between oil price fluctuations and airfare changes is crucial here.

- Discussion of consumer behavior in response to higher airfares. Examining booking patterns and demand shifts provides valuable insight.

- Impact on air travel demand and potential decrease in passenger numbers. This could lead to reduced revenue, despite higher ticket prices.

- Geographical variations in price sensitivity. Consumers in certain regions may be more sensitive to price increases than others. Airlines must adjust pricing strategies accordingly.

Besides price hikes, airlines are exploring alternative strategies to mitigate rising fuel costs. These include route optimization to reduce unnecessary flight distances, increased focus on ancillary revenue (baggage fees, seat selection, etc.), and a greater emphasis on fuel-efficient operational practices.

Operational Changes and Efficiency Measures

Faced with the pressure of rising fuel costs, airlines are actively implementing various strategies to improve efficiency and reduce their fuel consumption. These changes involve adjustments across the board, from flight routes and scheduling to aircraft utilization and technology adoption.

- Route optimization to minimize fuel consumption per flight. Airlines are analyzing flight paths to identify the most fuel-efficient routes.

- Implementation of fuel-efficient flight procedures. This might involve optimizing cruising altitudes, reducing taxi times, and improving air traffic management coordination.

- Investment in newer, more fuel-efficient aircraft. Modern aircraft are significantly more fuel-efficient than older models, leading to a greater emphasis on fleet modernization.

- Grounding of less fuel-efficient planes. Older aircraft may be retired early to reduce operational costs and carbon emissions.

Long-Term Implications of Persistent Oil Supply Shocks

If oil prices remain high or volatile for an extended period, the long-term implications for the airline industry could be significant. This could lead to substantial restructuring and consolidation within the sector.

- Potential for bankruptcies among smaller airlines. Smaller airlines with less financial cushion will be particularly vulnerable.

- Increased focus on sustainable aviation fuel (SAF). The need to reduce reliance on fossil fuels will accelerate the adoption of SAF.

- Potential for changes in consumer travel patterns. Consumers may adjust their travel habits in response to higher airfares, opting for alternative modes of transport or shorter trips.

- Long-term impact on air travel accessibility and affordability. Higher costs could make air travel less accessible for some segments of the population.

Conclusion: Navigating the Turbulence of Oil Supply Shocks

Oil supply shocks present significant challenges to the airline industry. Increased fuel costs inevitably lead to higher ticket prices, impacting consumer demand and potentially triggering operational changes and industry consolidation. Understanding these oil supply shocks is crucial for navigating the industry's future. While the short-term outlook may seem daunting, the industry's inherent adaptability and resilience will be tested. The focus on fuel-efficient technologies and sustainable alternatives indicates a pathway towards a more stable future. Stay informed about future oil supply shocks and their effect on airfares by following relevant news and industry updates. Understanding these fluctuations will be key to planning your travels and understanding the complex dynamics of the global aviation sector.

Featured Posts

-

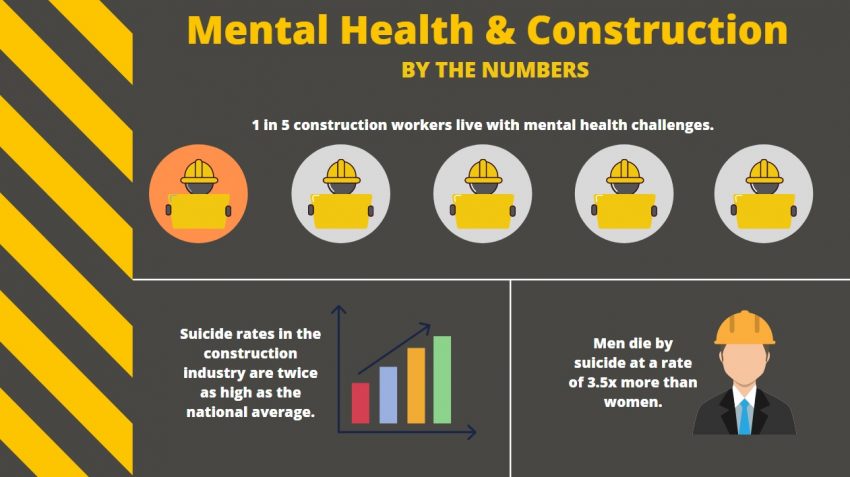

Mental Health Claim Rates High Costs And Stigma Limit Access

May 03, 2025

Mental Health Claim Rates High Costs And Stigma Limit Access

May 03, 2025 -

Office365 Hack Millions Made From Executive Inbox Compromise

May 03, 2025

Office365 Hack Millions Made From Executive Inbox Compromise

May 03, 2025 -

Analysis Abu Jinapors Remarks On The Npps 2024 Election Setback

May 03, 2025

Analysis Abu Jinapors Remarks On The Npps 2024 Election Setback

May 03, 2025 -

Sydney Harbour Surveillance Intensifies Amidst Rise In Chinese Ship Sightings

May 03, 2025

Sydney Harbour Surveillance Intensifies Amidst Rise In Chinese Ship Sightings

May 03, 2025 -

Lucien Jean Baptiste Dans Joseph Critique De La Serie Policiere Tf 1

May 03, 2025

Lucien Jean Baptiste Dans Joseph Critique De La Serie Policiere Tf 1

May 03, 2025