NYSE Parent ICE Tops Q1 Earnings Forecasts On Robust Trading Activity

Table of Contents

Strong Trading Volumes Fuel Revenue Growth

ICE's impressive Q1 earnings are directly attributable to a significant surge in trading volume across its diverse portfolio of exchanges. This robust activity translated into substantial revenue growth, exceeding even the most optimistic analyst predictions. The increase wasn't confined to a single market segment; instead, it represented a broad-based expansion across multiple asset classes.

- Increased trading in equities: The NYSE, a cornerstone of ICE's operations, saw a notable rise in equity trading volume, contributing significantly to the overall increase. This reflects heightened investor activity and increased market participation.

- Higher volumes in derivatives markets: ICE's derivatives exchanges also experienced a substantial jump in trading activity. This segment benefits from market volatility, as traders utilize derivatives for hedging and speculative purposes.

- Growth in fixed income trading: The fixed income market, a crucial component of ICE's business, also contributed to the increased trading volumes. This area experienced growth driven by shifts in interest rates and investor demand for fixed-income securities.

- Contribution from specific ICE exchanges: Beyond the NYSE, other ICE exchanges, such as ICE Futures U.S. and ICE Futures Europe, also reported strong trading volume increases, underscoring the broad-based nature of this growth.

This remarkable surge in trading activity, fueled by a combination of market volatility and increased investor participation, created the perfect storm for record-breaking revenue generation for ICE. The interplay of equity trading, derivatives trading, and fixed income trading all contributed to the exceptional Q1 performance.

Exceeding Earnings Forecasts and Key Financial Metrics

ICE's Q1 earnings results significantly surpassed analyst expectations, demonstrating the company's resilience and strategic prowess even amidst market uncertainty. The key financial metrics paint a clear picture of exceptional performance:

- Revenue growth: ICE reported a double-digit percentage increase in revenue compared to Q1 of the previous year. This substantial growth reflects the direct impact of the increased trading volumes discussed earlier.

- EPS compared to analysts' consensus estimates: Earnings per share (EPS) far exceeded analysts' consensus estimates, indicating strong profitability and efficiency within the company.

- Growth in net income: Net income also experienced significant growth, reflecting the substantial increase in revenue and effective cost management.

- Significant contributions: While all segments performed well, certain segments, such as the equity and derivatives markets, contributed disproportionately to the positive results.

These exceptional financial results highlight the effectiveness of ICE's business model and its ability to capitalize on market opportunities. The strong Q1 results positively impacted ICE's market capitalization, solidifying its position as a leader in the global financial markets.

ICE's Strategic Initiatives and Future Outlook

ICE's strong Q1 performance is not just a result of market conditions; it also reflects the company's strategic initiatives and forward-thinking approach. While specific details may be confidential, several factors likely contributed to their success:

- New product offerings and services: The launch of new products and services tailored to evolving market needs likely contributed to increased trading volume and revenue.

- Acquisitions and mergers: Strategic acquisitions or mergers may have expanded ICE's market reach and product offerings, enhancing its ability to capitalize on new opportunities.

- Long-term growth strategy: ICE's consistent focus on a long-term growth strategy, combining technological advancements with market-driven innovations, positions it for continued success.

- Future performance predictions: Based on the robust Q1 performance and the positive market outlook, analysts predict continued strong performance for ICE in the coming quarters.

ICE's commitment to innovation, strategic acquisitions, and efficient operations establishes a solid foundation for sustained future growth. The company's ability to adapt to changing market dynamics and leverage technological advancements is crucial to its long-term success.

Conclusion

In summary, ICE's exceeding Q1 earnings forecasts was primarily driven by exceptionally robust trading activity across its various exchanges, resulting in strong revenue and profit growth. This outstanding performance underscores ICE's resilience and strategic capabilities. The strong Q1 results significantly bolster ICE's future prospects, positioning it for continued growth in the dynamic global financial markets. To learn more about ICE's performance and investment opportunities, visit the company's investor relations website or consult your financial advisor for further analysis of NYSE parent ICE's Q1 earnings and robust trading activity.

Featured Posts

-

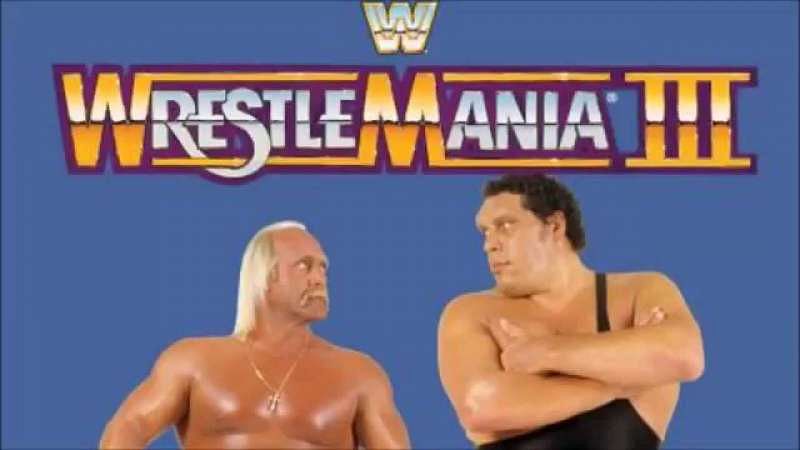

Wwe Vault Wrestle Mania Iii Livestream Event This Sunday

May 14, 2025

Wwe Vault Wrestle Mania Iii Livestream Event This Sunday

May 14, 2025 -

Kanye West And Bianca Censori An Insiders Look At Their Relationship Dynamics

May 14, 2025

Kanye West And Bianca Censori An Insiders Look At Their Relationship Dynamics

May 14, 2025 -

Suomalainen Voitti Eurojackpotissa 4 8 Miljoonaa Euroa Naein Se Tapahtui

May 14, 2025

Suomalainen Voitti Eurojackpotissa 4 8 Miljoonaa Euroa Naein Se Tapahtui

May 14, 2025 -

Investigacion Sobre El Trafico Ilegal De Armas El Caso De Republica Dominicana

May 14, 2025

Investigacion Sobre El Trafico Ilegal De Armas El Caso De Republica Dominicana

May 14, 2025 -

Snow White 2025 When Will It Stream On Disney

May 14, 2025

Snow White 2025 When Will It Stream On Disney

May 14, 2025