Nvidia Q[Quarter] Earnings: Growth Forecast Despite China Headwinds

![Nvidia Q[Quarter] Earnings: Growth Forecast Despite China Headwinds Nvidia Q[Quarter] Earnings: Growth Forecast Despite China Headwinds](https://genussprofessional.de/image/nvidia-q-quarter-earnings-growth-forecast-despite-china-headwinds.jpeg)

Table of Contents

Strong Revenue Growth Despite Geopolitical Uncertainty

Nvidia's Q3 performance showcased robust revenue growth across key segments, highlighting the company's adaptability in a complex global environment.

Data Center Segment Dominance

Nvidia's data center business continues to be a major driver of revenue growth. The demand for AI acceleration and high-performance computing fueled substantial gains.

- Revenue: Nvidia reported a [Insert actual Q3 data center revenue figure] in Q3, representing a [Insert percentage] year-over-year increase.

- Market Share: Nvidia maintains a dominant market share in the accelerated computing market, solidifying its position as a leader in AI and cloud computing infrastructure.

- Key Drivers: The surging demand for AI infrastructure, including large language models and generative AI, significantly boosted Nvidia's data center revenue. The increasing adoption of cloud computing further contributed to this impressive growth. Strong growth in Nvidia data center revenue highlights the increasing reliance on AI acceleration.

Gaming Segment Performance

While the gaming segment faced headwinds from economic slowdowns and increased competition, Nvidia still demonstrated resilience.

- Sales Figures: Nvidia reported [Insert actual Q3 gaming revenue figure], showcasing [Insert percentage change] compared to the same period last year. This indicates a [positive/negative] trend in GPU sales.

- Market Share Trends: Nvidia's market share in the gaming GPU market [increased/decreased/remained stable], reflecting the competitive landscape and consumer spending patterns.

- Impact of New Product Releases: The launch of [mention any new products] impacted sales positively/negatively, contributing to the overall performance of the gaming segment. The success of these releases demonstrates Nvidia's ability to innovate within the gaming market.

China Market Challenges and Mitigation Strategies

The ongoing US-China trade tensions and geopolitical uncertainty significantly impacted Nvidia's operations in China.

Impact of US-China Trade Tensions

Trade restrictions and regulatory hurdles presented substantial challenges to Nvidia's Chinese operations.

- Sales Decline in China: [Insert data on sales decline in China, if applicable. If no decline, mention stability or slight growth and explain the factors.] The complexity of navigating the evolving regulatory landscape in China requires careful strategy.

- Supply Chain Disruptions: [Mention any potential supply chain disruptions or difficulties faced due to trade tensions.] Maintaining a robust and diversified supply chain is critical for Nvidia's ongoing success.

- Regulatory Hurdles: [Discuss any specific regulatory hurdles Nvidia encountered in China and how they impacted operations.] Adapting to the evolving regulatory environment is a key aspect of Nvidia's China strategy.

Nvidia's Response to China Headwinds

Nvidia is actively implementing strategies to mitigate the risks and navigate the challenges in the Chinese market.

- Market Diversification: Nvidia is actively expanding its presence in other key markets to reduce dependence on any single region. This diversification strategy helps to mitigate risks associated with geopolitical instability.

- Localization Efforts: [Describe any efforts by Nvidia to localize its products or operations within China.] This approach demonstrates a commitment to engaging with the local market effectively.

- Strategic Partnerships: [Discuss any strategic partnerships formed to enhance its position in the Chinese market or navigate regulatory complexities.] Collaborations play a vital role in overcoming challenges and capitalizing on opportunities.

Future Growth Projections and Outlook

Nvidia's future growth hinges on several factors, primarily the continued expansion of the AI market and strategic management of geopolitical risks.

AI-Driven Growth

Artificial intelligence is a significant driver of Nvidia's future revenue growth.

- Market Forecasts for AI: The AI market is projected to experience [insert market forecast data] growth in the coming years, presenting immense opportunities for Nvidia.

- Nvidia's AI-Related Products and Services: Nvidia's diverse portfolio of AI-related products and services positions it favorably to capitalize on this market expansion.

- Potential Partnerships: Strategic partnerships with key players in the AI ecosystem will further accelerate Nvidia's growth in this sector. Nvidia AI revenue is poised for significant growth.

Long-Term Financial Predictions

Analysts project [insert analyst predictions for Nvidia's long-term growth], indicating a positive outlook.

- Analyst Predictions: [Summarize key predictions from reputable financial analysts.] These predictions highlight the potential for continued strong performance.

- Potential Risks and Opportunities: While the long-term outlook is positive, potential risks include increased competition, economic downturns, and further geopolitical uncertainty.

- Overall Financial Outlook: Nvidia's robust financial performance, strong market position, and focus on innovation suggest a promising long-term outlook. However, careful management of geopolitical risks and competition will be crucial for maintaining this positive trajectory. The Nvidia stock forecast reflects a largely positive sentiment among analysts.

Conclusion: Nvidia Q3 Earnings: A Resilient Performance Despite Headwinds

Nvidia's Q3 earnings demonstrated strong revenue growth across key segments, particularly in the data center sector, driven by the growing demand for AI acceleration. While the Chinese market presented challenges, Nvidia's strategic response, including diversification and localization efforts, showcases its resilience. The company's long-term growth prospects are promising, largely driven by the expanding AI market. Key takeaways include the dominance of the data center segment, the successful navigation of China headwinds, and the strong potential for continued growth fueled by AI.

Stay tuned for further updates on Nvidia Q4 earnings and continue to follow our analysis of the evolving landscape of Nvidia's growth and the global semiconductor market. Keep an eye on future Nvidia earnings reports for further insights into the company's performance.

![Nvidia Q[Quarter] Earnings: Growth Forecast Despite China Headwinds Nvidia Q[Quarter] Earnings: Growth Forecast Despite China Headwinds](https://genussprofessional.de/image/nvidia-q-quarter-earnings-growth-forecast-despite-china-headwinds.jpeg)

Featured Posts

-

Innovative Materials For A Cooler India Addressing Urban Heat Island Effects

May 30, 2025

Innovative Materials For A Cooler India Addressing Urban Heat Island Effects

May 30, 2025 -

Perviy Treyler Filma Frankenshteyn Ot Gilermo Del Toro Premera V Subbotu

May 30, 2025

Perviy Treyler Filma Frankenshteyn Ot Gilermo Del Toro Premera V Subbotu

May 30, 2025 -

Djokovic And Sinners French Open Showdown A Step By Step Analysis

May 30, 2025

Djokovic And Sinners French Open Showdown A Step By Step Analysis

May 30, 2025 -

Autoroute A69 Le Gouvernement Tente De Relancer Les Travaux

May 30, 2025

Autoroute A69 Le Gouvernement Tente De Relancer Les Travaux

May 30, 2025 -

Der Rauswurf Des Augsburger Trainers Fakten Meinungen Und Ausblick

May 30, 2025

Der Rauswurf Des Augsburger Trainers Fakten Meinungen Und Ausblick

May 30, 2025

Latest Posts

-

Skubals Focus Shifts Ahead Of Rematch Following Game 5 Home Run

May 31, 2025

Skubals Focus Shifts Ahead Of Rematch Following Game 5 Home Run

May 31, 2025 -

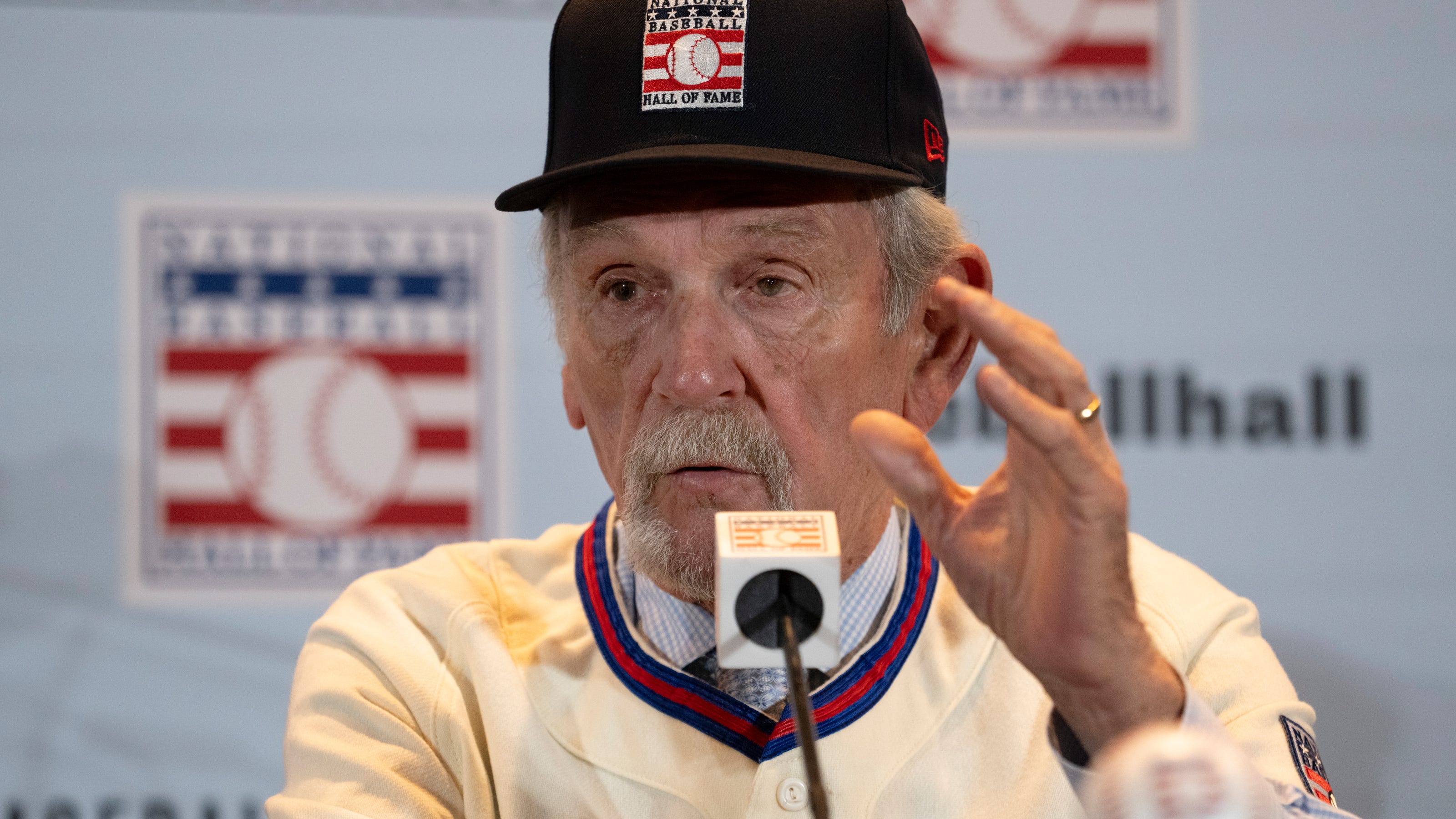

Jack Whites Tigers Broadcast Appearance Baseball Talk And Hall Of Fame Reflections

May 31, 2025

Jack Whites Tigers Broadcast Appearance Baseball Talk And Hall Of Fame Reflections

May 31, 2025 -

Detroit Tigers Lose Opening Home Series To Texas Rangers

May 31, 2025

Detroit Tigers Lose Opening Home Series To Texas Rangers

May 31, 2025 -

Jack White Joins Detroit Tigers Broadcast Hall Of Fame Discussion And Baseball Insights

May 31, 2025

Jack White Joins Detroit Tigers Broadcast Hall Of Fame Discussion And Baseball Insights

May 31, 2025 -

Tigers Drop First Home Series Bats Silent Against Rangers

May 31, 2025

Tigers Drop First Home Series Bats Silent Against Rangers

May 31, 2025