Novo Nordisk's Ozempic: Falling Behind In The Weight-Loss Market?

Table of Contents

The Rise of Ozempic and the GLP-1 Agonist Market

Ozempic's success stems from its mechanism of action as a GLP-1 receptor agonist. This class of medications effectively mimics the body's natural hormones, regulating appetite and promoting satiety, leading to significant weight loss. The drug quickly gained popularity, becoming a household name and a frequent topic of discussion on social media. This surge in popularity, however, also led to significant supply shortages, highlighting the limitations of scaling production to meet unexpected demand.

- Ozempic's initial market penetration and success story: Its efficacy and relatively manageable side effects quickly established Ozempic as a leading contender in the weight loss medication market.

- The role of social media and influencer marketing in driving demand: Viral trends and endorsements significantly boosted awareness and desirability, creating a high level of demand exceeding initial supply capabilities.

- The impact of supply chain issues on Ozempic's availability: The unexpected surge in demand strained the supply chain, leading to prolonged waiting lists and frustrations amongst patients.

Emerging Competitors and Increased Competition

The weight-loss market is no longer a one-horse race. Several strong competitors are challenging Ozempic's dominance. Wegovy, also a semaglutide-based GLP-1 agonist, but with a higher dosage, offers the potential for even greater weight loss. Mounjaro, featuring the unique dual mechanism of action targeting both GLP-1 and GIP receptors, presents another formidable challenger.

- Wegovy's higher dosage and potential for greater weight loss: Wegovy, also produced by Novo Nordisk, benefits from a higher concentration of semaglutide, potentially leading to more significant weight reduction for some patients.

- Mounjaro's dual mechanism of action and its impact on weight loss: Eli Lilly's Mounjaro offers a distinct advantage with its dual mechanism, leading to potentially superior results compared to single-receptor agonists.

- Comparative analysis of side effect profiles: While all these medications share similar side effects like nausea and constipation, the severity and frequency may vary, influencing patient preference.

- Price comparisons and insurance coverage: Pricing and insurance coverage significantly impact accessibility, with variations across different medications affecting market penetration.

Challenges Faced by Novo Nordisk and Ozempic

Novo Nordisk faces significant challenges in maintaining Ozempic's market leadership. Increased competition is the most pressing concern, but patent expiration looms, opening the door to generic competition. Pricing pressures further complicate the landscape.

- The patent landscape surrounding Ozempic and future generic competition: The looming expiration of Ozempic's patents poses a substantial threat to Novo Nordisk's revenue streams.

- Pricing strategies and their impact on market accessibility: Balancing profitability with accessibility and affordability is crucial for maintaining market share in a competitive environment.

- The regulatory landscape and potential future changes: Changes in regulatory approvals and guidelines can dramatically impact market dynamics and the competitiveness of individual medications.

- The growing demand for non-pharmaceutical weight-loss solutions: The rise of alternative weight loss methods like lifestyle changes, surgical interventions, and other medications creates additional competition.

Marketing and Public Perception

Novo Nordisk's marketing strategy for Ozempic has been effective, but the brand faces scrutiny. Competitors are employing aggressive marketing campaigns, focusing on their own unique advantages. Negative publicity surrounding accessibility and affordability also challenges the public perception of Ozempic.

- Comparison of marketing strategies across competing brands: Each company employs different marketing approaches, targeting specific segments and emphasizing unique selling points.

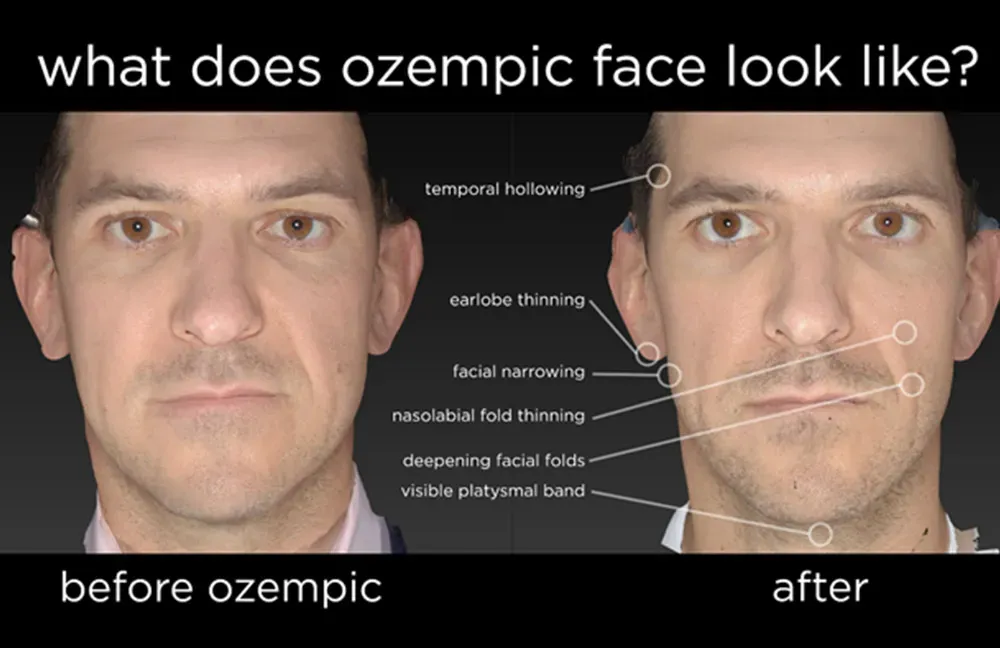

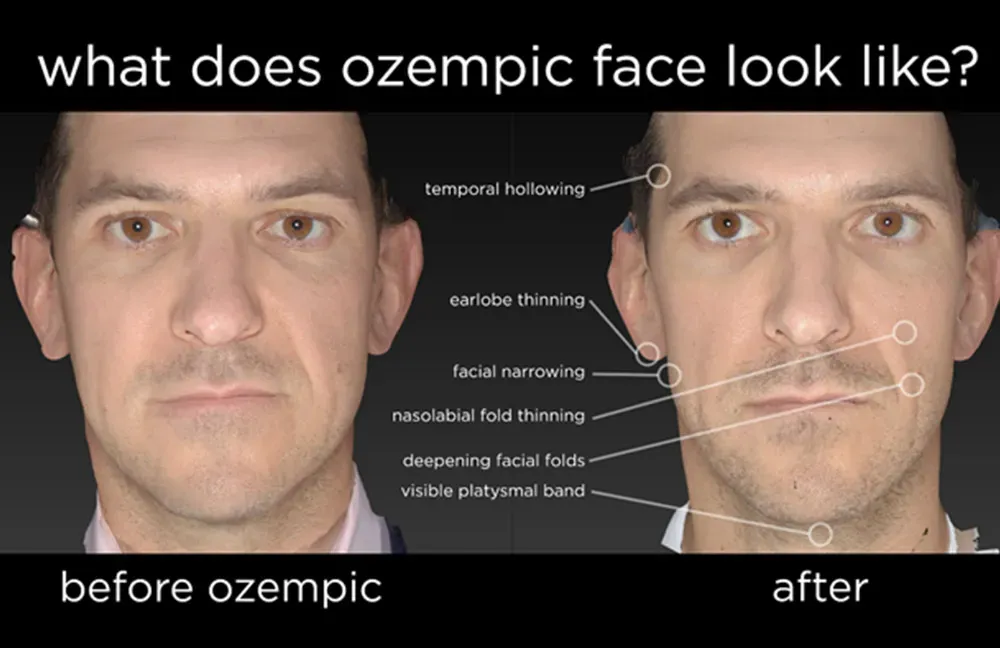

- Analysis of public perception and media coverage: Media portrayals, often influenced by social media trends, play a crucial role in shaping public opinion.

- Addressing concerns regarding accessibility and affordability: Addressing affordability concerns and ensuring equitable access are critical for long-term market success.

Conclusion

The weight-loss medication market is evolving rapidly, with increasing competition challenging Novo Nordisk's dominance with Ozempic. The emergence of strong competitors like Wegovy and Mounjaro, combined with looming patent expirations and pricing pressures, presents a significant hurdle. Continued innovation and adaptation will be critical for Novo Nordisk to maintain a substantial market share. Staying informed about new developments in this dynamic sector is crucial for both healthcare professionals and patients seeking effective weight-loss solutions. Learn more about Ozempic and its competitors to make informed decisions about your weight loss journey, and always consult your healthcare provider for personalized advice. The future of Ozempic's dominance in this increasingly competitive landscape remains uncertain.

Featured Posts

-

Gorillaz Full Album Shows London Ticket Acquisition Strategies

May 30, 2025

Gorillaz Full Album Shows London Ticket Acquisition Strategies

May 30, 2025 -

Japans Ev Future Kg Motors Mibot And The Road Ahead

May 30, 2025

Japans Ev Future Kg Motors Mibot And The Road Ahead

May 30, 2025 -

Memilih Motor Klasik Perbandingan Kawasaki W175 Dan Honda St 125 Dax

May 30, 2025

Memilih Motor Klasik Perbandingan Kawasaki W175 Dan Honda St 125 Dax

May 30, 2025 -

Sporting Cp Manager Questions Manchester United Players Reliability

May 30, 2025

Sporting Cp Manager Questions Manchester United Players Reliability

May 30, 2025 -

Instagram Die Stars Denen Steffi Graf Folgt

May 30, 2025

Instagram Die Stars Denen Steffi Graf Folgt

May 30, 2025