Norway's Nicolai Tangen And The Impact Of Trump's Tariffs

Table of Contents

Trump's Tariffs and Their Global Impact

Understanding the Tariff Landscape

The Trump administration implemented a series of tariffs, primarily targeting steel and aluminum imports, ostensibly to protect American industries and national security. These protectionist policies, however, triggered a global trade war.

- Rationale: The stated goals were to boost domestic production, counter what was perceived as unfair trade practices, and strengthen national security.

- Consequences: The tariffs led to increased prices for businesses reliant on imported materials, reduced consumer purchasing power due to higher prices on finished goods, and significant disruptions to global supply chains. Retaliatory tariffs from other countries, including China and the European Union, further exacerbated the situation, creating a complex web of trade restrictions.

- Keywords: "Trade war," "protectionist policies," "global trade disruptions," "steel tariffs," "aluminum tariffs."

The Impact on Global Markets

The ripple effects of these tariffs were felt across global markets. The increased costs for businesses translated into higher prices for consumers, fueling inflation in many countries. Supply chains were disrupted, leading to shortages and delays. Market volatility increased significantly as investors grappled with uncertainty.

- Market Volatility: The unpredictability of trade policies created considerable uncertainty, leading to fluctuations in stock markets and commodity prices.

- Specific Sectors: Industries heavily reliant on imported materials, such as manufacturing and construction, experienced particularly severe impacts. The automotive industry, for example, faced significant challenges due to increased costs for steel and aluminum.

- Keywords: "Global supply chains," "market volatility," "inflation," "commodity prices," "global financial markets."

The Norwegian Sovereign Wealth Fund and its Exposure

NBIM's Investment Strategy and Portfolio Diversification

The GPFG employs a globally diversified investment strategy, aiming to maximize returns while managing risk. Its portfolio spans various asset classes, including equities, fixed income, and real estate, across numerous countries and sectors.

- Portfolio Holdings: A significant portion of the fund's holdings is invested in equities, with exposure to companies in sectors potentially impacted by tariffs, such as technology and manufacturing.

- ESG Considerations: NBIM incorporates Environmental, Social, and Governance (ESG) factors into its investment decisions, demonstrating a commitment to responsible investing.

- Keywords: "Norges Bank Investment Management," "Government Pension Fund Global," "portfolio diversification," "ESG investing," "global investment strategy."

Direct and Indirect Impacts on NBIM's Investments

The Trump tariffs had both direct and indirect impacts on NBIM's investments. Direct impacts arose from investments in companies directly affected by the tariffs. Indirect impacts stemmed from broader market fluctuations and supply chain disruptions.

- Company-Specific Impacts: Companies in the fund's portfolio that relied heavily on imports or exported significant volumes of goods experienced reduced profitability and valuation.

- Valuation and Profitability: The overall impact on the fund's returns was likely a mix of positive and negative effects, depending on the specific holdings and the nature of their exposure to the trade war. Thorough risk management strategies were crucial for mitigating these impacts.

- Keywords: "Investment returns," "portfolio performance," "risk management," "equity investments."

Long-Term Implications for Norway and its Economy

Economic Growth and Stability

Norway's economy, while robust, is not immune to global trade disruptions. Its dependence on exports, particularly within the energy sector, makes it vulnerable to fluctuations in global demand and trade policies.

- Export Dependence: Changes in global trade dynamics directly affect Norway's export-oriented industries, potentially impacting economic growth and employment.

- Role of the Sovereign Wealth Fund: The GPFG plays a crucial role in stabilizing the Norwegian economy by providing a buffer against external shocks and contributing to long-term economic sustainability.

- Keywords: "Economic growth," "export dependence," "economic stability," "macroeconomic impact," "Norwegian economy."

Policy Responses and Adjustments

The Norwegian government responded to the challenges posed by the trade war through a combination of strategies, focusing on diversification and risk mitigation.

- Diversification Strategies: Efforts were made to diversify the Norwegian economy, reducing its reliance on specific sectors vulnerable to global trade uncertainties. Investment in renewable energy and other sustainable industries has been prioritized.

- Government Response: The government's response primarily focused on maintaining fiscal prudence and using the sovereign wealth fund as a tool for macroeconomic stability, rather than directly intervening in trade disputes.

- Keywords: "Government policy," "economic diversification," "risk mitigation," "trade policy," "fiscal policy."

Conclusion: Navigating Global Trade Uncertainty – The Legacy of Trump's Tariffs on Nicolai Tangen and Norway

Trump's tariffs presented significant challenges for Nicolai Tangen and the management of Norway's sovereign wealth fund. The impact on NBIM's investments was multifaceted, reflecting the complex and far-reaching consequences of the trade war. The experience underscores the importance of robust risk management strategies and the need for diversification in navigating global trade uncertainty. For sovereign wealth funds like the GPFG, understanding global trade dynamics and their potential implications is crucial for long-term success. Further research into the long-term effects of protectionist policies on global finance and the role of sovereign wealth funds in managing such risks is vital. Continue learning about "Nicolai Tangen," "Trump tariffs," "Norway's economy," "global trade," "sovereign wealth fund," and "investment strategies" to gain a deeper understanding of this complex interplay.

Featured Posts

-

Kentucky Derby 151 Countdown Your Guide To Race Day

May 05, 2025

Kentucky Derby 151 Countdown Your Guide To Race Day

May 05, 2025 -

2025 Kentucky Derby Horse Profile Betting Outlook For Chunk Of Gold

May 05, 2025

2025 Kentucky Derby Horse Profile Betting Outlook For Chunk Of Gold

May 05, 2025 -

Nhl Standings Update Analyzing Fridays Playoff Implications

May 05, 2025

Nhl Standings Update Analyzing Fridays Playoff Implications

May 05, 2025 -

Chinas Impact On Bmw And Porsche Sales Market Analysis And Future Outlook

May 05, 2025

Chinas Impact On Bmw And Porsche Sales Market Analysis And Future Outlook

May 05, 2025 -

Cocaines Global Surge The Role Of Potent Powder And Narco Submarines

May 05, 2025

Cocaines Global Surge The Role Of Potent Powder And Narco Submarines

May 05, 2025

Latest Posts

-

Ufc 314 Results Who Won And Lost At Volkanovski Vs Lopes

May 05, 2025

Ufc 314 Results Who Won And Lost At Volkanovski Vs Lopes

May 05, 2025 -

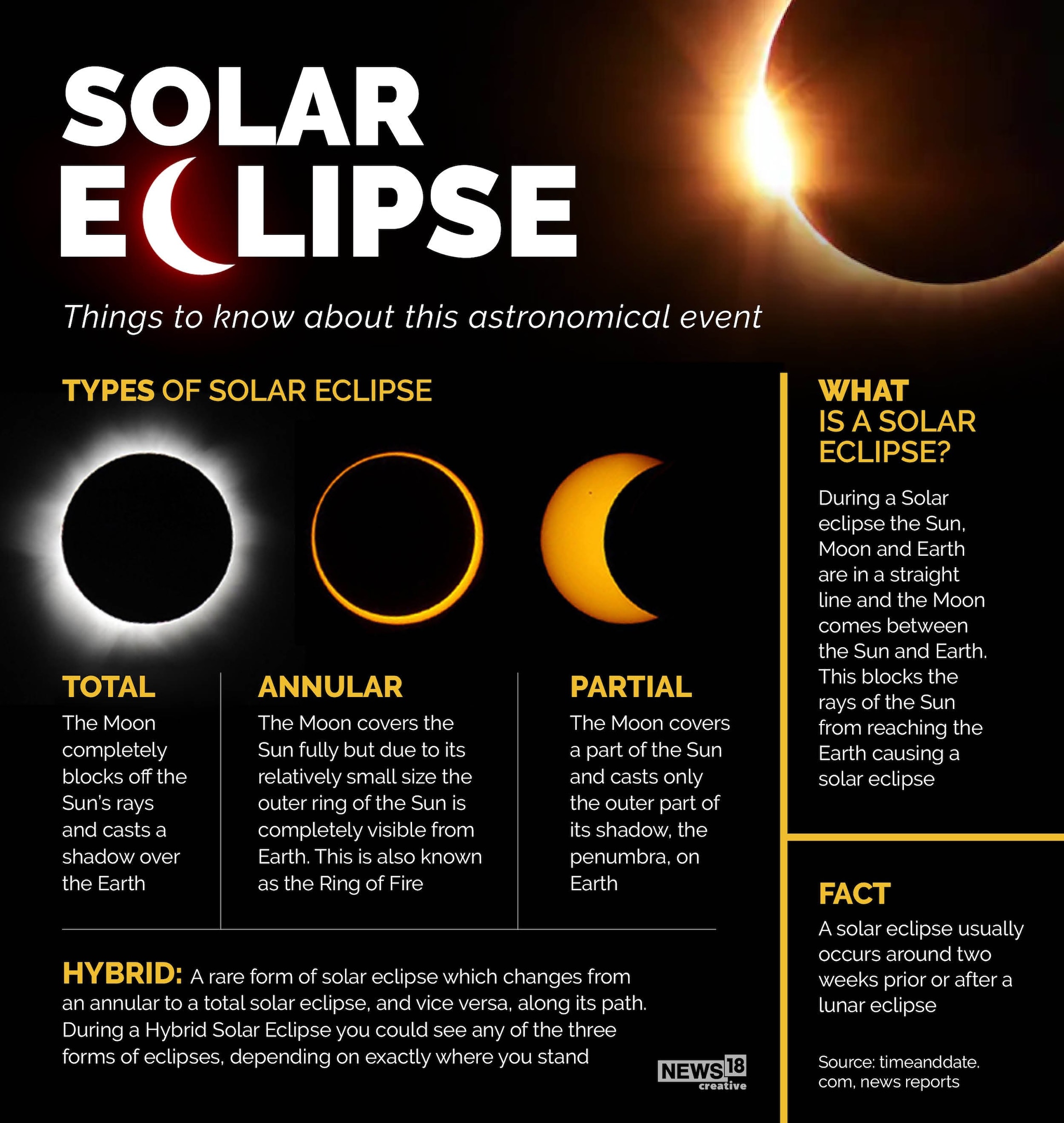

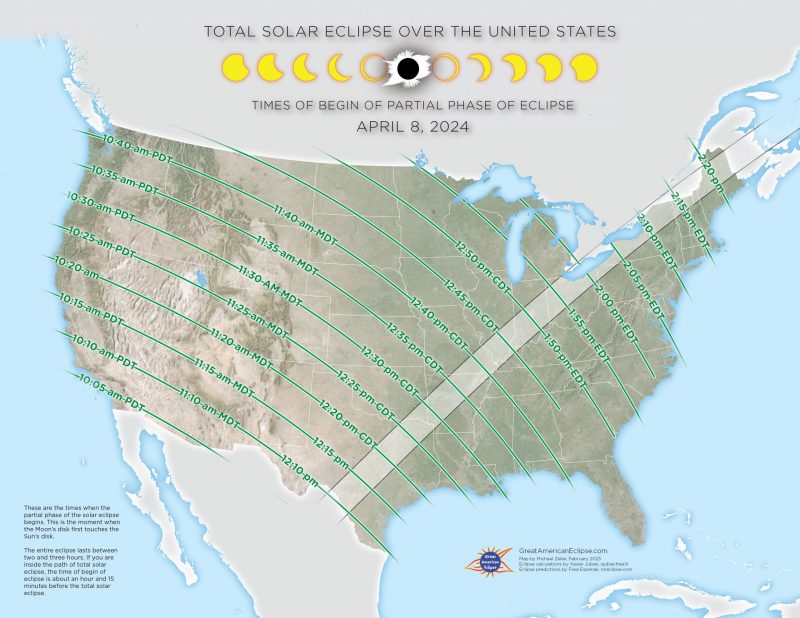

Partial Solar Eclipse Over Nyc This Saturday Time And Viewing Information

May 05, 2025

Partial Solar Eclipse Over Nyc This Saturday Time And Viewing Information

May 05, 2025 -

Ufc 314 Complete Fight Card Results Volkanovski Vs Lopes Breakdown

May 05, 2025

Ufc 314 Complete Fight Card Results Volkanovski Vs Lopes Breakdown

May 05, 2025 -

Saturdays Partial Solar Eclipse In New York City What Time And How To Watch

May 05, 2025

Saturdays Partial Solar Eclipse In New York City What Time And How To Watch

May 05, 2025 -

Nyc Partial Solar Eclipse On Saturday Timing And Safe Viewing

May 05, 2025

Nyc Partial Solar Eclipse On Saturday Timing And Safe Viewing

May 05, 2025