Nippon-U.S. Steel Deal Receives Trump Administration Approval

Table of Contents

Details of the Nippon-U.S. Steel Merger

The merger agreement details remain somewhat opaque, but reports suggest a complex structure involving equity stakes, joint ventures, and potentially asset swaps. The exact financial terms haven't been fully disclosed, but the deal represents a significant investment in the future of steel production.

- Anticipated Market Share Increase: The combined entity is expected to significantly increase its market share, both domestically and internationally, making it a major player in the global steel industry. This increased market share could influence pricing and competition.

- Strategic Rationale: For Nippon Steel, the merger provides access to the vast North American market and resources. For U.S. Steel, it offers access to Nippon Steel's advanced technologies and global network, boosting its competitiveness. The merger aims to leverage the strengths of both companies.

- Financial Aspects: While the precise deal value remains undisclosed, analysts estimate it to be in the billions of dollars. The expected synergies from combining operations and streamlining processes are predicted to generate significant cost savings and boost profitability.

- Geographical Reach and Global Impact: The combined entity will boast a significantly expanded geographical reach, with operations spanning North America, Asia, and potentially other regions. This global presence will enhance its ability to compete effectively in the international steel market and influence global steel prices.

Trump Administration's Approval and its Implications

The Trump Administration's approval of the Nippon-U.S. Steel merger came with certain conditions, though the specifics haven't been publicly revealed. This suggests a degree of negotiation and consideration of potential concerns.

- Reasoning Behind Approval: The administration likely approved the merger based on its potential to create jobs, bolster national security (through a more resilient domestic steel industry), and enhance America's global competitiveness in the steel sector.

- Political Ramifications: The approval has faced both support and criticism. Supporters highlight the potential economic benefits, while critics raise concerns about reduced competition and potential job losses in certain sectors. The political landscape surrounding trade deals significantly influenced the approval process.

- Impact on American Steel Competitiveness: The merger aims to enhance the competitiveness of the American steel industry by leveraging advanced technologies and global market access. However, the impact will depend on the specific conditions imposed by the administration and the success of post-merger integration.

- Trade and the Approval: The Trump administration’s "America First" trade policies played a significant role in the approval process. The merger was likely viewed as a way to strengthen the domestic steel industry and reduce reliance on foreign steel imports.

Economic and Market Impacts of the Merger

The Nippon-U.S. Steel merger is projected to have significant economic and market impacts, both positive and negative.

- Potential Benefits: Increased efficiency through economies of scale, advancements in steel manufacturing technology, and potential job creation are potential upsides. The combined entity could also invest heavily in research and development.

- Potential Drawbacks: Concerns exist about potential price increases due to reduced competition and possible job losses in less efficient plants. The merger could also lead to consolidation and the elimination of smaller steel producers.

- Impact on Steel Consumers and Downstream Industries: Higher steel prices could negatively impact downstream industries that rely heavily on steel, potentially leading to increased costs for consumers.

- Impact on Steel Prices: The merger's impact on steel prices is difficult to predict with certainty. It could lead to both price increases and decreases depending on various market factors, including global supply and demand.

- Long-Term Effects on the Global Steel Supply Chain: The merger will likely reshape the global steel supply chain, potentially leading to new alliances and partnerships, and changing the balance of power within the industry.

Potential for Job Creation and Economic Growth

The merger holds the potential for both job creation and economic growth in the U.S. and Japan.

- Job Creation: While some job losses are possible in certain areas, the merger could lead to new jobs in research, development, and high-tech manufacturing, particularly in technologically advanced sectors.

- Investment in New Technologies and Infrastructure: The combined entity is likely to invest in modernizing facilities and adopting new technologies, creating both direct and indirect employment opportunities.

- Long-Term Impact on Economic Growth: The merger’s long-term impact on economic growth will depend on its success in achieving synergies, boosting efficiency, and increasing competitiveness. Increased exports and technological advancements could contribute positively to GDP growth in both countries.

- Investment in Research and Development: The combined resources could facilitate substantial investment in R&D, leading to innovations in steel production and application.

Concerns and Criticisms of the Merger

Despite the potential benefits, the Nippon-U.S. Steel merger has drawn significant criticism and raised several concerns.

- Antitrust Concerns: Regulators will need to carefully consider potential antitrust implications to ensure fair competition in the steel market.

- Negative Impacts on Smaller Steel Producers: The merger could negatively impact smaller steel producers, potentially forcing them out of business due to increased competition from the much larger combined entity.

- Job Losses in Specific Regions: Plant closures or consolidation could lead to job losses in specific regions, requiring significant mitigation efforts.

- Environmental Concerns: Critics raise concerns about the environmental impact of increased steel production, emphasizing the need for sustainable practices.

- Consumer Backlash: If the merger results in significantly higher steel prices, consumers could experience a backlash, impacting demand and potentially hindering the overall economic benefits.

Conclusion

The approval of the Nippon-U.S. Steel merger by the Trump Administration marks a pivotal moment for the global steel industry. The deal's potential benefits include increased efficiency, technological advancements, and the possibility of job creation. However, concerns remain about reduced competition, potential price increases, and job losses in specific sectors. The conditions attached to the approval by the Trump Administration, though largely undisclosed, suggest a careful balancing act between economic growth and potential drawbacks. The long-term impact will depend on the successful integration of the two companies and the effectiveness of measures to mitigate potential negative consequences.

The Nippon-U.S. Steel deal represents a significant turning point for the global steel industry. Stay informed on the unfolding developments and the ongoing impact of this landmark merger by following our coverage of the Nippon-U.S. Steel deal and its ramifications for the future of steel manufacturing. Keep checking back for further updates on the Nippon and U.S. Steel merger and its impact on the global steel market.

Featured Posts

-

Avrupa Piyasalarinda Duesues Stoxx 600 Ve Dax 40 In Gerilemesi 16 Nisan 2025

May 25, 2025

Avrupa Piyasalarinda Duesues Stoxx 600 Ve Dax 40 In Gerilemesi 16 Nisan 2025

May 25, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Calculation And Implications

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Calculation And Implications

May 25, 2025 -

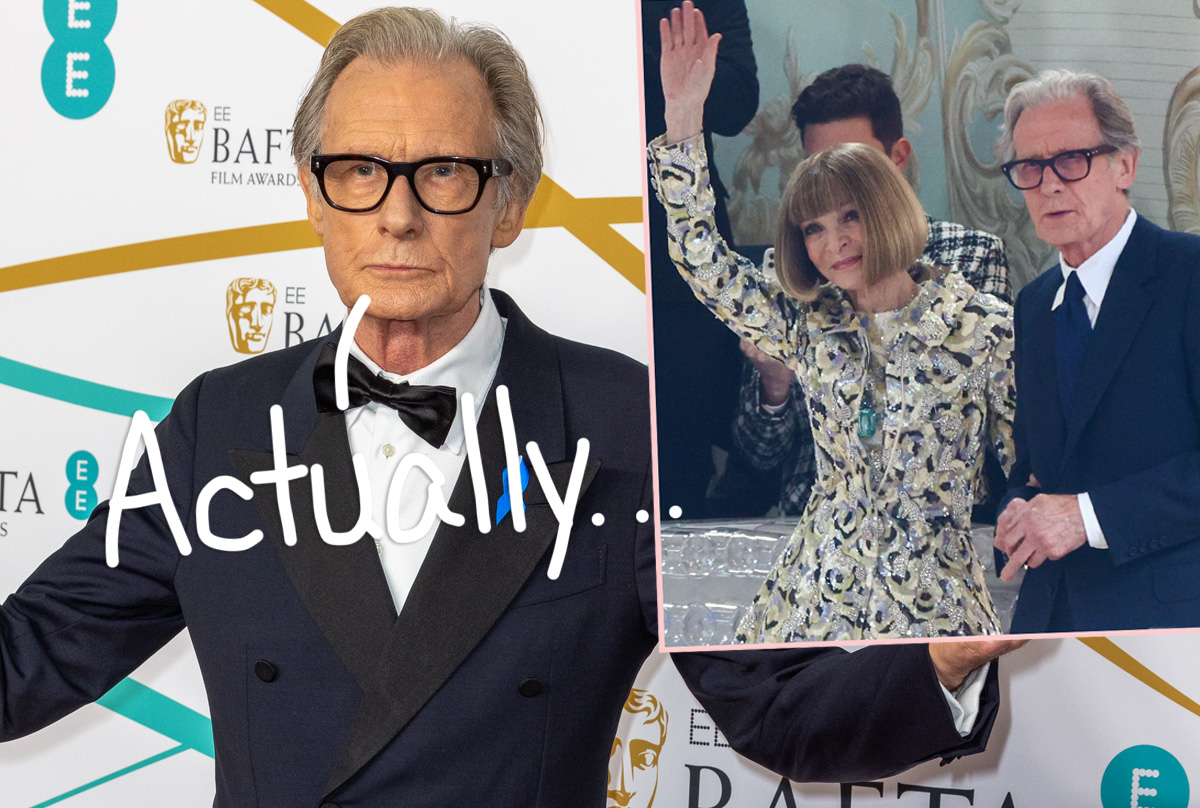

Met Gala 2025 Naomi Campbells Absence Sparks Rumors Of Anna Wintour Fallout

May 25, 2025

Met Gala 2025 Naomi Campbells Absence Sparks Rumors Of Anna Wintour Fallout

May 25, 2025 -

Konchita Vurst Predskazala Pobediteley Evrovideniya 2025 Chetyre Strany V Prognoze Unian

May 25, 2025

Konchita Vurst Predskazala Pobediteley Evrovideniya 2025 Chetyre Strany V Prognoze Unian

May 25, 2025 -

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 25, 2025

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 25, 2025

Latest Posts

-

Analyzing Armando Iannuccis Comedy Techniques A Review By Roland White

May 25, 2025

Analyzing Armando Iannuccis Comedy Techniques A Review By Roland White

May 25, 2025 -

Imagine The Academy Of Armando Roland Whites Analysis Of Bbc 1s Comedy Show

May 25, 2025

Imagine The Academy Of Armando Roland Whites Analysis Of Bbc 1s Comedy Show

May 25, 2025 -

David Hockneys A Bigger Picture An In Depth Look At His Landscape Paintings

May 25, 2025

David Hockneys A Bigger Picture An In Depth Look At His Landscape Paintings

May 25, 2025 -

Bbc 1s Imagine The Academy Of Armando A Comedy Writing Critique By Roland White

May 25, 2025

Bbc 1s Imagine The Academy Of Armando A Comedy Writing Critique By Roland White

May 25, 2025 -

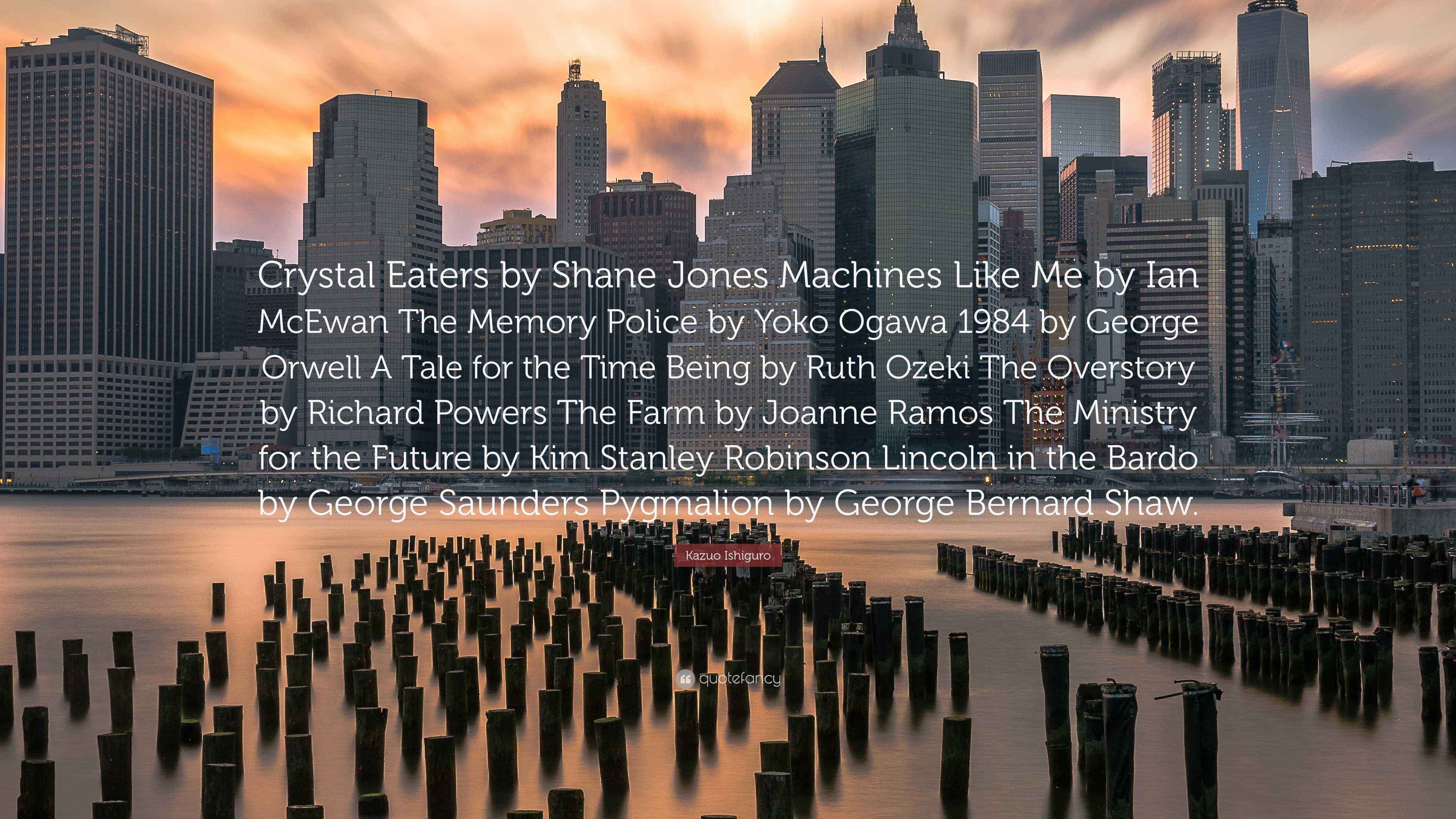

Kazuo Ishiguro How Memory Shapes Identity And Imagination

May 25, 2025

Kazuo Ishiguro How Memory Shapes Identity And Imagination

May 25, 2025