Nippon Steel & U.S. Steel Merger Receives Trump Administration Approval

Table of Contents

Details of the Merger Agreement

The merger brings together two titans of the steel industry: Nippon Steel, a Japanese steelmaking giant, and U.S. Steel, a major player in the American steel market. While the exact financial details might not be publicly available in their entirety, the deal structure involved a combination of stock and cash, resulting in a significant restructuring of the global steel landscape. This merger wasn't simply an acquisition; it was a strategic combination aiming for synergy and greater market influence.

- Key Players: Nippon Steel Corporation and U.S. Steel Corporation are the primary entities involved. Subsidiary companies and their respective roles in the integration process will likely play a significant part in the success of the combined entity.

- Deal Structure: The specifics of the deal's financial structure, including the equity split and the final purchase price, were likely subject to intense negotiation and remained confidential to a certain extent. However, the merger was structured to create a new entity, aiming to leverage the strengths of both parent companies.

- Anticipated Synergies: The merger anticipates substantial synergies. Economies of scale will likely lead to significant cost efficiencies in steel production. The combination of technological expertise from both companies promises enhanced innovation and improved product offerings. The projected result? Increased market share and a stronger competitive position in the global steel market. These synergies directly impact steel production costs and the long-term competitiveness of the combined company.

Trump Administration's Rationale for Approval

The Trump administration's approval of the Nippon Steel & U.S. Steel merger was a decision with far-reaching consequences. While the exact reasoning is complex, several factors likely contributed to the green light:

- National Security Concerns: Given the strategic importance of steel in various sectors (defense, infrastructure), national security concerns likely played a significant role in the evaluation process. The administration probably weighed the potential impact of the merger on domestic steel production and its contribution to national security.

- Job Creation and Economic Impact: The administration likely emphasized the potential for job creation and economic growth stemming from the merger's anticipated synergies. The promise of a stronger, more competitive American steel industry, potentially creating more high-paying jobs, is a significant driver. Keywords such as "economic growth" and "American jobs" were pivotal arguments during the approval process.

- Competition and Antitrust Considerations: Antitrust considerations are paramount in any major merger. The administration would have scrutinized the potential impact on market competition. Any concerns would have needed addressing through potential concessions, such as asset divestitures, to ensure the merger wouldn't stifle competition and create a monopoly in the steel market. The regulatory approval process carefully examined compliance with antitrust laws.

Industry Reactions and Future Implications

The announcement of the approved Nippon Steel & U.S. Steel merger triggered a wave of responses across the steel industry:

- Reactions from Competitors: Competitors likely reacted with a mix of concern and anticipation. Some might view the merger as a threat, requiring them to adapt their strategies. Others might see opportunities for collaboration or market expansion.

- Impact on Steel Prices: The merger's impact on steel prices remains to be seen. While increased efficiency might lead to lower prices, the potential for reduced competition could, conversely, cause prices to rise. The fluctuating dynamics of the global steel market make it difficult to predict with certainty.

- Long-Term Outlook for the Merged Entity: The long-term prospects of the new entity depend on various factors, including successful integration of operations, effective management of the combined workforce, and consistent innovation. Their future strategy and market penetration tactics will significantly shape their position within the global steel market. Maintaining and expanding their market share will be crucial.

Conclusion: The Nippon Steel & U.S. Steel Merger – A Turning Point for the American Steel Industry?

The approval of the Nippon Steel & U.S. Steel merger marks a significant moment for the American and global steel industries. While the merger offers the potential for increased efficiency, job creation, and economic growth, concerns about reduced competition and its impact on steel prices remain. The long-term success will hinge on the merged entity’s ability to adapt to market fluctuations and continue innovating in the global steel market. What are your thoughts on the Nippon Steel & U.S. Steel merger and its potential long-term effects? Share your insights in the comments section below! For further reading on related topics, visit our resources page, which covers the latest trends in the steel industry.

Featured Posts

-

Best Nike Running Shoes For 2025 Style Performance And The Right Fit

May 26, 2025

Best Nike Running Shoes For 2025 Style Performance And The Right Fit

May 26, 2025 -

Telos Epoxis I Mercedes Den Endiaferetai Pleon Gia Ton Ferstapen

May 26, 2025

Telos Epoxis I Mercedes Den Endiaferetai Pleon Gia Ton Ferstapen

May 26, 2025 -

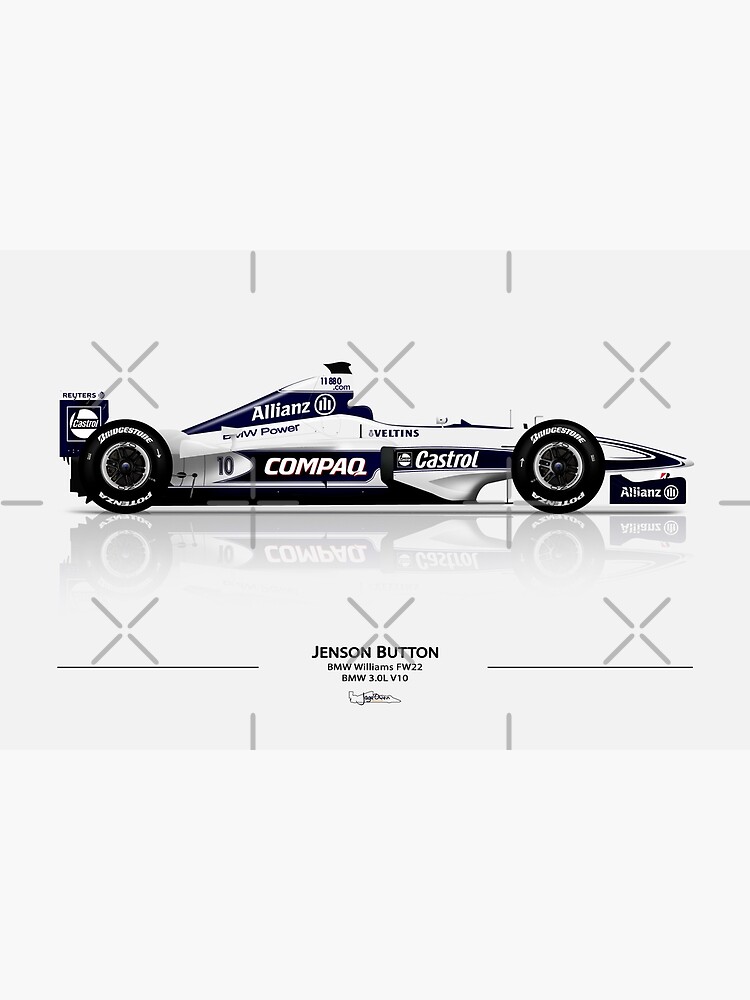

Understanding Jenson And The Fw 22 Extended Collection

May 26, 2025

Understanding Jenson And The Fw 22 Extended Collection

May 26, 2025 -

Itv 4 Tv Guide Find The Saint Air Times

May 26, 2025

Itv 4 Tv Guide Find The Saint Air Times

May 26, 2025 -

Amazon Primes Etoile Gideon Glicks Captivating Performance

May 26, 2025

Amazon Primes Etoile Gideon Glicks Captivating Performance

May 26, 2025

Latest Posts

-

Bennedict Mathurin Leads Pacers To Overtime Win Against Nets

May 28, 2025

Bennedict Mathurin Leads Pacers To Overtime Win Against Nets

May 28, 2025 -

Mathurins Heroics Pacers Edge Nets In Overtime Thriller

May 28, 2025

Mathurins Heroics Pacers Edge Nets In Overtime Thriller

May 28, 2025 -

Nba Playoffs Bennedict Mathurin Ejected From Game 4 Vs Cavaliers

May 28, 2025

Nba Playoffs Bennedict Mathurin Ejected From Game 4 Vs Cavaliers

May 28, 2025 -

Game 4 Ejection Mathurin Vs Hunter Pacers Cavaliers Playoff Series

May 28, 2025

Game 4 Ejection Mathurin Vs Hunter Pacers Cavaliers Playoff Series

May 28, 2025 -

Game 4 Ejection Mathurin And Hunters Altercation In Pacers Cavaliers Series

May 28, 2025

Game 4 Ejection Mathurin And Hunters Altercation In Pacers Cavaliers Series

May 28, 2025