Nine African Countries Affected By PwC's Operational Closure

Table of Contents

Affected Countries and the Extent of PwC's Operations

The nine African countries impacted by PwC's operational closure are: [Insert the nine countries here]. The scale of PwC's presence varied across these nations. In some, PwC held a dominant market share, providing a wide range of services including auditing, tax advisory, consulting, and assurance. In others, their presence was more focused, perhaps concentrating on specific sectors or offering a narrower scope of services.

- Country 1: [Brief description of PwC's presence and services, e.g., "PwC Country 1 had a large office employing over 200 professionals, offering comprehensive audit and consulting services to major corporations and government bodies."]

- Country 2: [Brief description of PwC's presence and services]

- Country 3: [Brief description of PwC's presence and services]

- Country 4: [Brief description of PwC's presence and services]

- Country 5: [Brief description of PwC's presence and services]

- Country 6: [Brief description of PwC's presence and services]

- Country 7: [Brief description of PwC's presence and services]

- Country 8: [Brief description of PwC's presence and services]

- Country 9: [Brief description of PwC's presence and services]

The closure of these PwC offices in Africa represents a significant loss of expertise and capacity within the professional services sector across the continent.

Reasons Behind the Operational Closure

The reasons behind PwC's decision to cease operations in these nine African countries remain somewhat opaque. However, several contributing factors are likely at play. These include navigating increasingly complex regulatory environments, reacting to economic instability in certain regions, and potentially, a larger internal restructuring strategy within PwC globally.

- Regulatory hurdles and compliance issues: Stringent regulations and compliance requirements in certain African markets may have made operating increasingly challenging and costly for PwC.

- Economic instability and market volatility: Economic downturns and fluctuating currency values in some of these countries could have impacted PwC's profitability and made the long-term viability of operations questionable.

- Internal strategic decision-making by PwC: PwC's decision might be part of a broader global restructuring effort to streamline operations and focus resources on more profitable markets.

- Impact of global economic trends on African operations: Global economic headwinds and uncertainty may have led PwC to reassess its risk profile and strategically withdraw from certain markets.

Understanding the specific drivers behind this PwC restructuring in Africa is crucial for assessing the long-term impact on the affected economies.

Impact on Businesses and Economies

The PwC impact in Africa following this closure is expected to be multifaceted and substantial. Businesses that relied on PwC's services will face immediate challenges in finding suitable replacements, potentially leading to delays in projects and increased costs. The broader economic consequences include job losses, disruption to auditing and financial services, and a potential chilling effect on foreign direct investment (FDI).

- Job losses and unemployment rates: The closure will undoubtedly result in job losses for PwC employees and potentially ripple effects on related industries.

- Disruption to auditing and accounting services: Businesses will need to quickly find alternative auditing and accounting firms, which might lead to temporary service disruptions and increased competition for limited resources.

- Impact on investor confidence and foreign direct investment (FDI): The closure could negatively affect investor confidence, particularly among foreign investors who rely heavily on the services of reputable international firms like PwC.

- Potential for increased costs and inefficiencies for businesses: Finding replacement services may prove more expensive and less efficient, potentially hindering business growth and competitiveness.

The long-term consequences of this significant shift in the African business landscape require careful consideration.

Alternative Auditing and Consulting Firms in Africa

Fortunately, a number of reputable auditing and consulting firms operate across Africa, offering comparable services to those previously provided by PwC. Businesses affected by the closure should explore these alternatives.

- [Firm Name 1]: [Brief description and website link]

- [Firm Name 2]: [Brief description and website link]

- [Firm Name 3]: [Brief description and website link]

These African audit firms and consulting companies represent viable options for businesses seeking reliable and experienced professional services.

Long-Term Implications and Future Outlook

The PwC operational closure in Africa marks a turning point for the auditing and consulting industry on the continent. In the long term, we might see increased consolidation among existing firms, the emergence of new players catering to the increased demand, and a greater focus on developing local expertise and capacity. The need for clearer regulations and enhanced investor protection will become even more critical.

- Potential for consolidation within the industry: Existing firms may acquire clients and assets previously held by PwC, leading to industry consolidation.

- Emergence of new players and opportunities for local firms: This closure could create opportunities for smaller, local firms to expand their operations and gain market share.

- Need for greater regulatory clarity and investor protection: The situation highlights the need for a more transparent and robust regulatory framework to protect investors and ensure the stability of the financial services sector.

The future of auditing in Africa will be shaped by how the industry adapts to this significant change.

Conclusion

The PwC operational closure in Africa impacting nine countries is a significant development with far-reaching implications for businesses and economies across the continent. The reasons behind the closure are complex, encompassing regulatory challenges, economic instability, and internal strategic decisions. The impact will be felt in job losses, disrupted services, and potentially decreased investor confidence. Businesses must quickly identify alternative auditing and consulting firms to maintain operational efficiency. Stay updated on developments regarding the PwC operational closure in Africa and make informed decisions for your business. Understanding the long-term implications and the evolving African business landscape is crucial for navigating this period of change.

Featured Posts

-

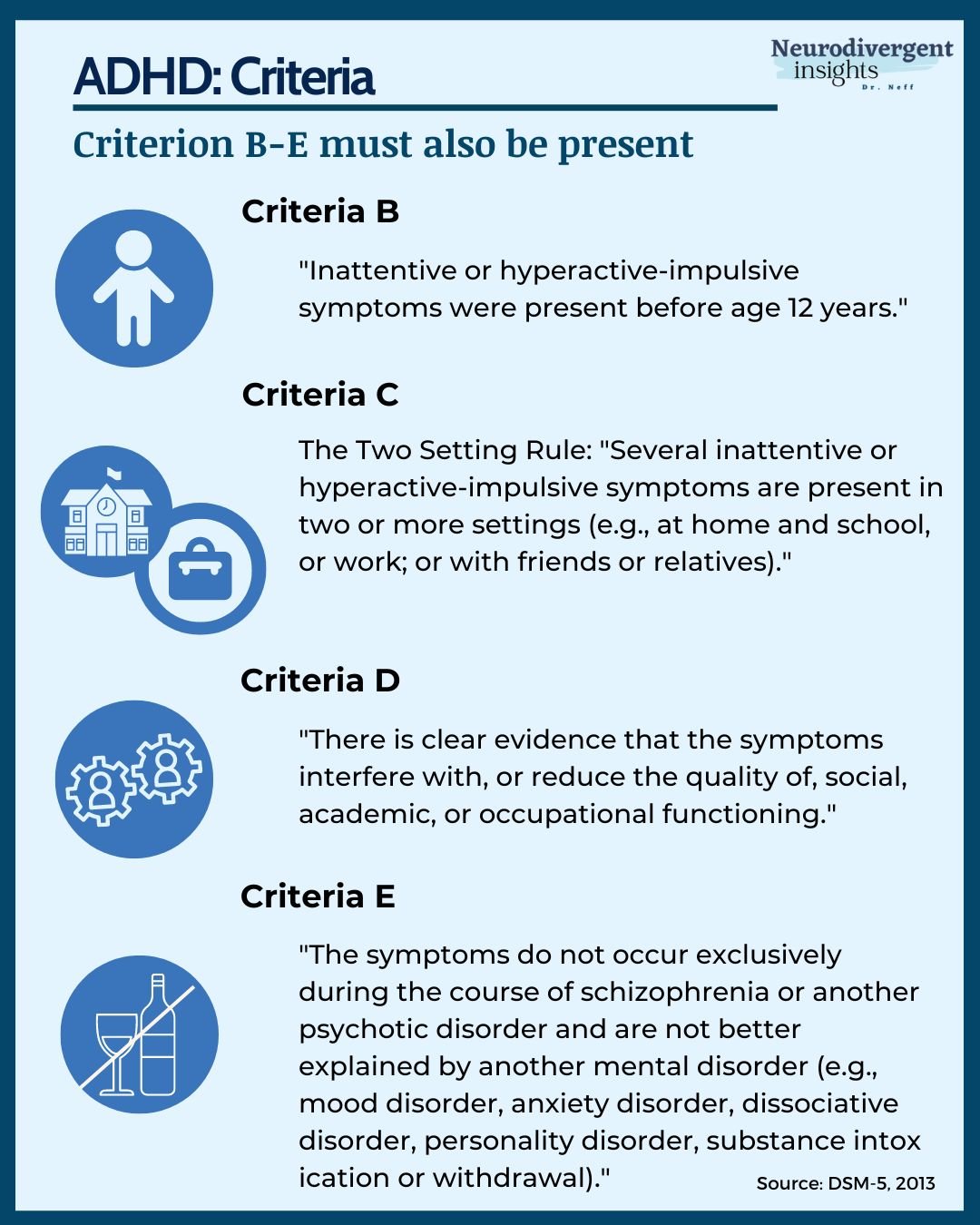

Navigating An Adult Adhd Diagnosis A Practical Guide

Apr 29, 2025

Navigating An Adult Adhd Diagnosis A Practical Guide

Apr 29, 2025 -

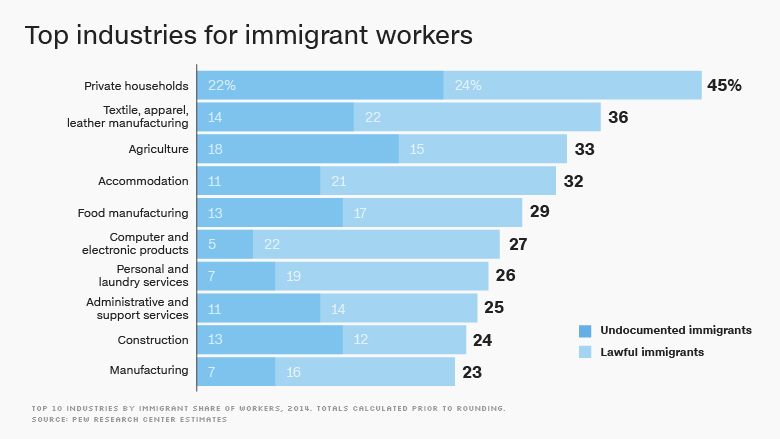

New Study Minnesota Immigrant Workers See Increased Earnings

Apr 29, 2025

New Study Minnesota Immigrant Workers See Increased Earnings

Apr 29, 2025 -

Kortere Levensduur Bij Adhd Feiten En Fabels Over De Levensverwachting Van Volwassenen

Apr 29, 2025

Kortere Levensduur Bij Adhd Feiten En Fabels Over De Levensverwachting Van Volwassenen

Apr 29, 2025 -

Nyt Spelling Bee April 1 2025 Hints Answers And Pangram

Apr 29, 2025

Nyt Spelling Bee April 1 2025 Hints Answers And Pangram

Apr 29, 2025 -

Canadian Filipinos Mourn After Deadly Car Ramming Attack

Apr 29, 2025

Canadian Filipinos Mourn After Deadly Car Ramming Attack

Apr 29, 2025

Latest Posts

-

Increase In Adhd Diagnoses At Aiims Investigating Environmental And Genetic Influences

Apr 29, 2025

Increase In Adhd Diagnoses At Aiims Investigating Environmental And Genetic Influences

Apr 29, 2025 -

Adhd In Young People Aiims Data Reveals A Growing Concern

Apr 29, 2025

Adhd In Young People Aiims Data Reveals A Growing Concern

Apr 29, 2025 -

The Rise Of Adhd Among Young Adults A Case Study From Aiims Opd

Apr 29, 2025

The Rise Of Adhd Among Young Adults A Case Study From Aiims Opd

Apr 29, 2025 -

Aiims Reports Increase In Young People With Adhd Understanding The Contributing Factors

Apr 29, 2025

Aiims Reports Increase In Young People With Adhd Understanding The Contributing Factors

Apr 29, 2025 -

Adhd

Apr 29, 2025

Adhd

Apr 29, 2025