Nike Q3 Performance And Its Implications For Foot Locker's Short-Term Prospects

Table of Contents

Nike's Q3 Financial Performance: A Deep Dive

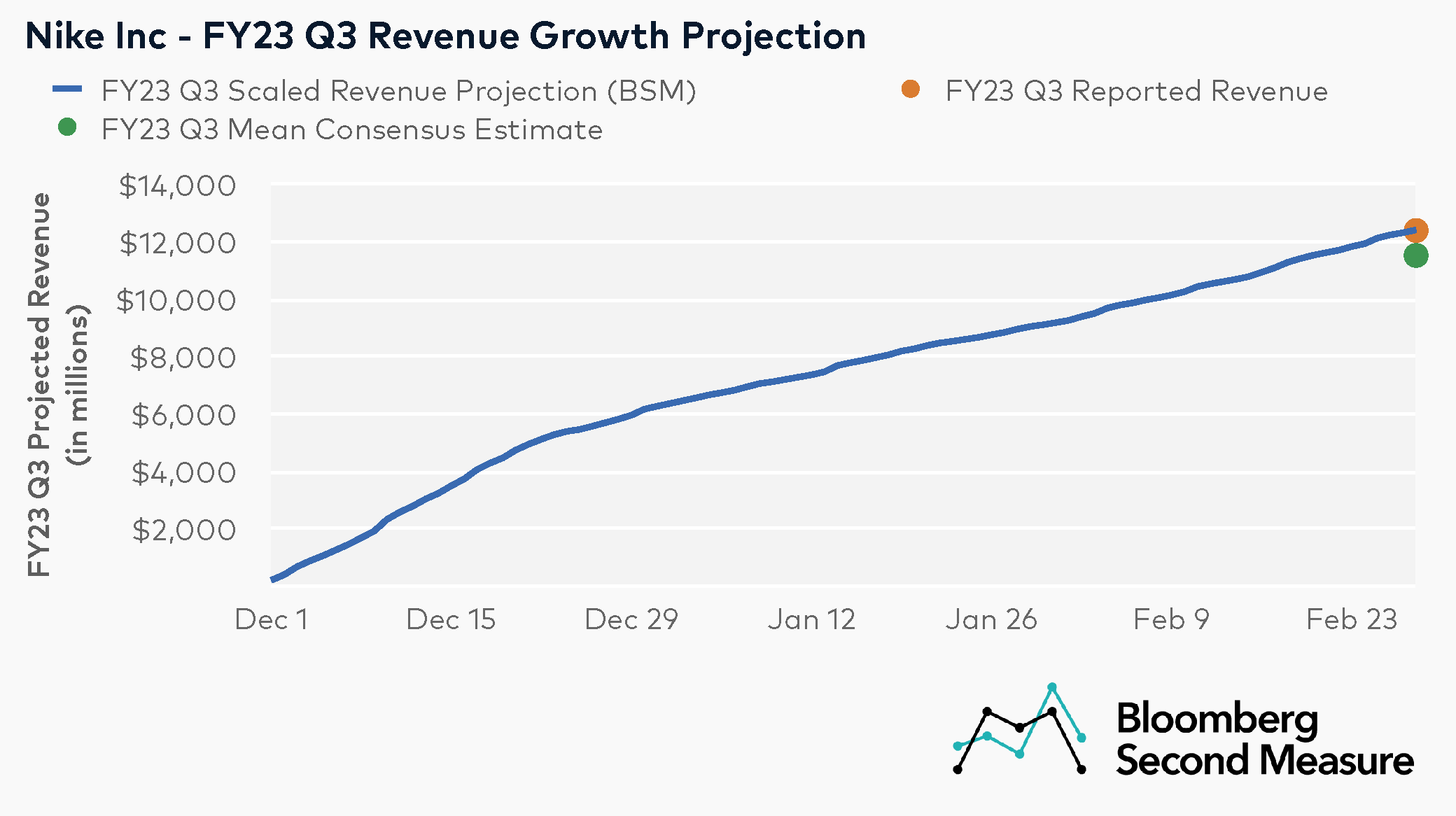

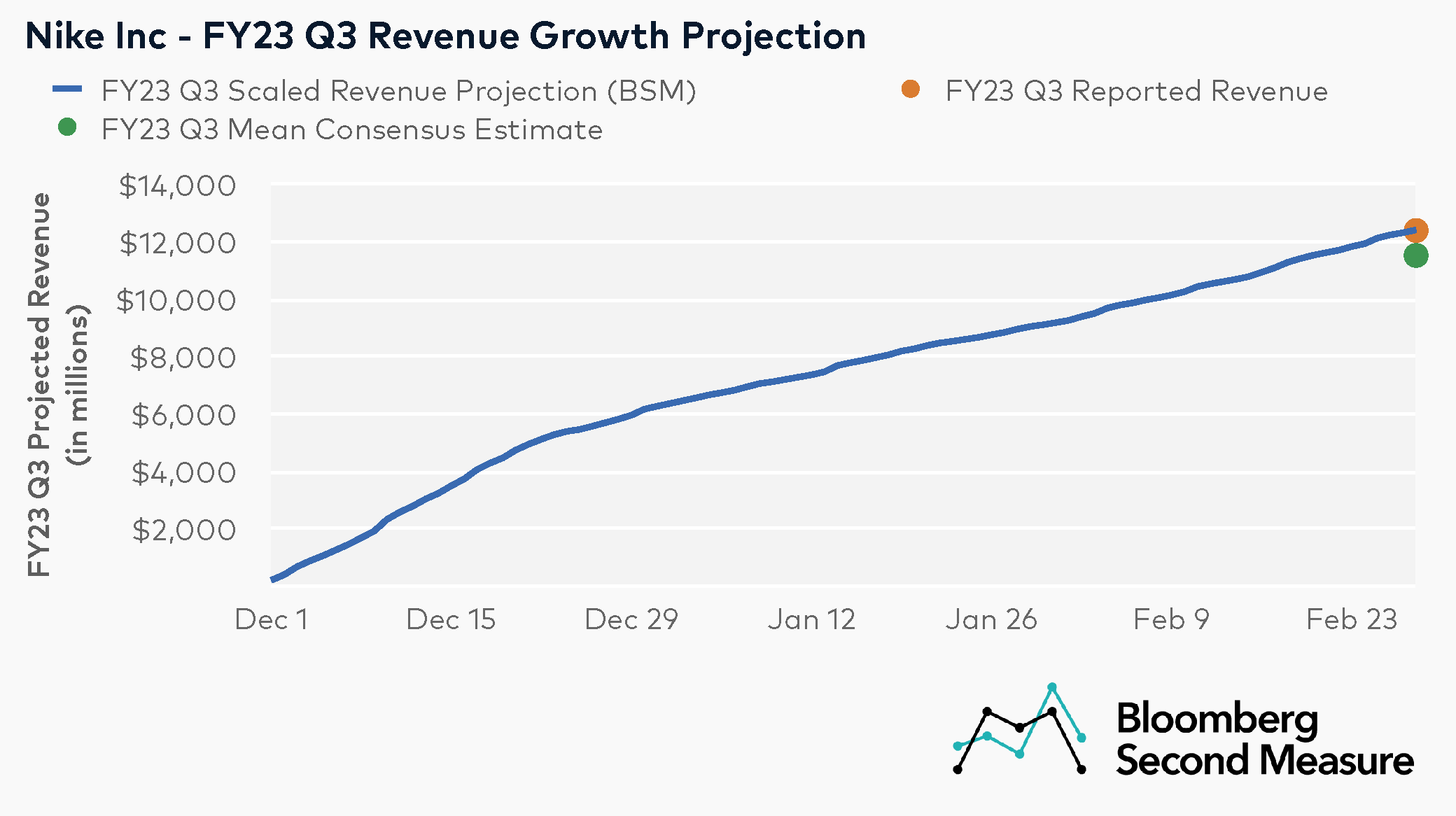

Nike Q3 Revenue: A Closer Look

Nike's overall revenue growth in Q3 is a critical factor impacting Foot Locker. Strong revenue growth usually translates to increased product availability and potentially more favorable terms for retailers like Foot Locker. Conversely, weaker revenue can lead to tighter inventory control and potentially less favorable pricing for retailers.

- Example Data Point (replace with actual data when available): Let's assume Nike reported a 5% year-over-year revenue increase in Q3, driven primarily by strong online sales growth in North America (10% increase) while international markets experienced slower growth (2%).

- Nike Q3 revenue was significantly influenced by the success of new product launches.

- Increased marketing spend contributed to stronger brand awareness, boosting Nike sales growth.

- Regional breakdowns in Nike financial results reveal variations in performance across different geographical markets.

Nike Gross Margin Analysis: Unpacking the Numbers

Changes in Nike's gross margin directly affect Foot Locker's profitability. Higher gross margins for Nike typically mean better profit margins for retailers. Conversely, lower gross margins can squeeze profit margins for retailers, forcing them to adjust their pricing strategies.

- Example Data Point (replace with actual data when available): Nike's Q3 gross margin might have been impacted by increased input costs (e.g., raw materials, transportation), potentially leading to a slight decrease compared to the previous quarter.

- Nike gross margin is a key indicator of the company's pricing power and efficiency.

- Nike pricing strategy plays a crucial role in maintaining profitability in a competitive market.

- Supply chain disruptions continue to impact Nike supply chain efficiency, affecting gross margins.

Nike Inventory Levels: A Look Ahead

Nike's inventory levels offer insights into potential future sales and the likelihood of discounts or markdowns. High inventory levels might indicate a need for promotional activities, potentially affecting Foot Locker's margins.

- Example Data Point (replace with actual data when available): Assume Nike's inventory levels increased slightly in Q3, raising concerns about potential markdowns in the coming quarters.

- Nike inventory management is crucial for maintaining healthy profit margins.

- High Nike stock levels might necessitate discounting strategies.

- The potential for Nike markdowns influences Foot Locker's short-term purchasing strategies.

Foot Locker's Dependence on Nike and its Vulnerability

Nike's Share of Foot Locker's Sales: A Key Relationship

Nike's products represent a substantial portion of Foot Locker's sales. This heavy reliance on a single supplier creates both opportunities and vulnerabilities.

- Example Data Point (replace with actual data when available): Let's assume Nike accounts for approximately 60% of Foot Locker's overall sales.

- Foot Locker Nike sales are a significant driver of its overall financial performance.

- Foot Locker dependence on Nike highlights the importance of this partnership.

- Nike's success significantly impacts Nike's impact on Foot Locker.

Potential Impact of Nike's Q3 Performance on Foot Locker's Sales: Scenario Planning

Nike's Q3 performance directly influences Foot Locker's short-term financial results. A strong performance by Nike likely translates to strong sales for Foot Locker, and vice-versa.

- Scenario 1 (Strong Nike Q3): Higher sales for Foot Locker, increased profitability, positive impact on Foot Locker Q4 forecast.

- Scenario 2 (Weak Nike Q3): Lower sales for Foot Locker, decreased profitability, potentially impacting Foot Locker earnings.

- Scenario 3 (Neutral Nike Q3): Foot Locker's performance mirrors the overall market trends, with moderate impact on Foot Locker stock price.

Foot Locker's Diversification Strategies: Reducing Reliance

Foot Locker is actively pursuing diversification strategies to reduce its reliance on Nike. This includes partnerships with other brands and investments in its private label offerings.

- Foot Locker is expanding its partnerships with brands like Adidas and Puma to diversify its product portfolio. This reduces Foot Locker dependence on Nike.

- The growth of Foot Locker other brands helps mitigate risk associated with a single supplier.

- Investing in Foot Locker private label strengthens its brand identity and reduces reliance on external suppliers.

Industry Analysis and Future Outlook

Competitive Landscape: The Athletic Footwear Market

The athletic footwear and apparel market is fiercely competitive, with major players like Adidas and Under Armour vying for market share. The performance of these competitors influences both Nike and Foot Locker.

- The competitive landscape for athletic footwear market includes Adidas, Under Armour, and other major players.

- Nike competitors such as Adidas and Under Armour impact Nike's market share and pricing strategies.

- Foot Locker competition includes other major retailers in the athletic footwear sector.

Short-Term Predictions for Foot Locker: A Cautious Outlook

Based on the analysis of Nike's Q3 results, we can offer a reasoned prediction for Foot Locker's short-term performance. This prediction depends heavily on the specifics of Nike's Q3 report and the factors outlined above.

- Foot Locker short-term outlook depends heavily on Nike's performance and broader market trends.

- Foot Locker stock prediction will likely be impacted by the actual financial reports from both Nike and Foot Locker.

- The Foot Locker future prospects will be shaped by its diversification strategies and the overall health of the athletic footwear market.

Conclusion: Nike Q3 Performance and Foot Locker's Short-Term Prospects – Key Takeaways and Call to Action

Nike's Q3 performance is intrinsically linked to Foot Locker's short-term prospects. A strong Nike Q3 typically translates to a strong Q4 for Foot Locker, while a weak Nike Q3 can significantly impact Foot Locker's financial performance. Foot Locker’s diversification strategies are crucial for mitigating this dependence. Monitoring Nike's financial reports is vital for understanding Foot Locker's future trajectory. Keep an eye on Nike's upcoming Q4 results to gain further insight into Foot Locker's performance and to stay updated on the Nike Q3 Performance and Foot Locker's future prospects.

Featured Posts

-

The Impact Of Apple Watches On Nhl Referee Accuracy And Efficiency

May 16, 2025

The Impact Of Apple Watches On Nhl Referee Accuracy And Efficiency

May 16, 2025 -

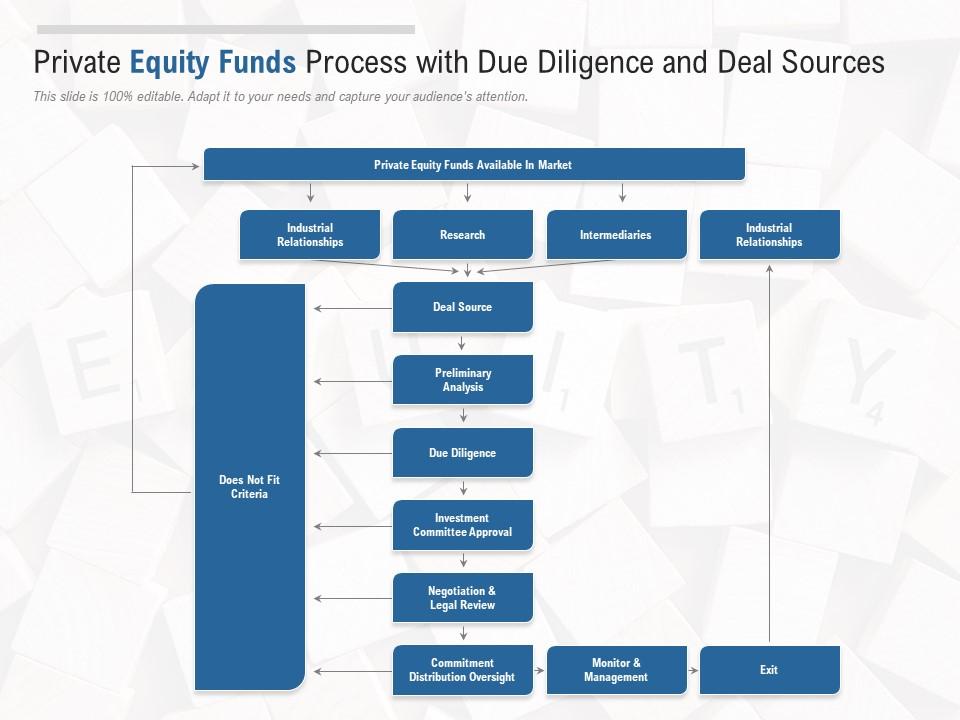

Celtics Sold For 6 1 Billion Private Equity Deal Sparks Fan Uncertainty

May 16, 2025

Celtics Sold For 6 1 Billion Private Equity Deal Sparks Fan Uncertainty

May 16, 2025 -

Kid Cudi Joopiter Auction Date Artwork And Bidding Details

May 16, 2025

Kid Cudi Joopiter Auction Date Artwork And Bidding Details

May 16, 2025 -

Spiker Na Zakhid Poslugi Dzho Baydena Za 300 000

May 16, 2025

Spiker Na Zakhid Poslugi Dzho Baydena Za 300 000

May 16, 2025 -

Tom Cruises Post Natal Gesture Towards Suri Cruise

May 16, 2025

Tom Cruises Post Natal Gesture Towards Suri Cruise

May 16, 2025

Latest Posts

-

New York Daily News Historical Archives May 2025

May 17, 2025

New York Daily News Historical Archives May 2025

May 17, 2025 -

Researching The New York Daily News May 2025

May 17, 2025

Researching The New York Daily News May 2025

May 17, 2025 -

Knicks Pistons Game Officials Confirm Late Game Missed Call

May 17, 2025

Knicks Pistons Game Officials Confirm Late Game Missed Call

May 17, 2025 -

Missed Call Controversy Nba Addresses Knicks Pistons Game Ending

May 17, 2025

Missed Call Controversy Nba Addresses Knicks Pistons Game Ending

May 17, 2025 -

Officials Admit Missed Call In Knicks Pistons Game

May 17, 2025

Officials Admit Missed Call In Knicks Pistons Game

May 17, 2025