Nicolai Tangen's Investment Strategies Amidst Trump's Tariffs

Table of Contents

Tangen's Pre-Tariff Investment Philosophy

Before the implementation of Trump's tariffs, NBIM, under Tangen's leadership (though he took the helm later), already operated on a well-defined investment philosophy centered on several key principles:

Keywords: Long-term investing, passive investing, index funds, global diversification, sustainable investing, ESG factors

- Long-Term Vision: NBIM's investment horizon is exceptionally long-term, focusing on generating sustainable returns over decades, rather than chasing short-term gains. This approach inherently reduces the impact of short-term market fluctuations, including those caused by trade wars.

- Passive Investing and Index Funds: NBIM primarily employs a passive investment strategy, heavily relying on index funds that track broad market indices. This minimizes management fees and reduces the risk associated with active stock picking. The sheer size of the fund makes active management impractical and potentially detrimental to overall returns.

- Global Diversification: NBIM's portfolio is remarkably diversified across various asset classes and geographies. This global diversification helps reduce exposure to any single market or sector, thereby mitigating the impact of events like trade wars that might disproportionately affect specific regions or industries.

- ESG Integration: Environmental, Social, and Governance (ESG) factors are integral to NBIM's investment decisions. While not explicitly a response to tariffs, this approach fosters long-term value creation by considering the sustainability and ethical implications of investments, potentially reducing exposure to companies vulnerable to shifts in global regulations.

Responding to the Impact of Trump's Tariffs

Trump's tariffs created significant market volatility, impacting various sectors differently. NBIM, with its massive portfolio, felt these ripples. How did Tangen and his team respond?

Keywords: Trade war impact, market volatility, sector-specific adjustments, strategic asset allocation, risk mitigation, hedging strategies

- Sector-Specific Analysis: The imposition of tariffs necessitated a granular analysis of how different sectors would be affected. Industries heavily reliant on international trade, such as manufacturing and certain agricultural sectors, were likely to experience greater short-term challenges. NBIM likely adjusted its holdings accordingly, potentially reducing exposure to the most heavily impacted sectors.

- Strategic Asset Allocation Shifts: In response to the uncertainty, NBIM may have subtly shifted its asset allocation. This might have involved increasing allocations to sectors less susceptible to trade disruptions or geographical regions less affected by the trade war. For example, increased investment in domestic markets or sectors less reliant on global supply chains might have been considered.

- Hedging Strategies: To mitigate currency fluctuations and other risks associated with the tariffs, NBIM likely employed various hedging strategies. These could include currency hedging to protect against exchange rate volatility or using derivatives to offset potential losses in specific sectors.

- US and China Exposure: The trade war primarily focused on the US and China. NBIM, as a large global investor, would have had considerable exposure to both markets. Managing this exposure through strategic adjustments to portfolio allocations was crucial in mitigating the impact of the trade conflict.

Post-Tariff Performance and Lessons Learned

Analyzing NBIM's performance during and after the period of tariff imposition offers crucial insights into the effectiveness of Tangen's strategies.

Keywords: Portfolio performance, adaptation strategies, long-term outlook, future investment trends, successful risk management, resilience

- Performance Assessment: While specific performance data might be confidential, it's reasonable to assume that NBIM's diversified portfolio and long-term approach helped cushion the blow of the tariffs. The overall impact on the portfolio likely remained relatively muted compared to more concentrated or short-term investment strategies.

- Successful Adaptations: NBIM's ability to analyze sector-specific impacts, adjust its asset allocation, and utilize hedging strategies demonstrated the effectiveness of its proactive risk management approach. This adaptability is a key takeaway from this period.

- Lessons Learned: The experience underscored the importance of maintaining a robust and diversified portfolio, coupled with a long-term perspective. It also highlights the need for continuous monitoring and adjustment of investment strategies in response to evolving geopolitical and economic landscapes.

- Long-Term Outlook: While the specific impact of Trump's tariffs eventually subsided, the experience has likely informed NBIM's approach to future investment trends. A heightened focus on geopolitical risks and supply chain resilience might be expected. Tangen's focus on ESG factors and long-term sustainability aligns with the growing importance of climate change considerations in global investment strategies.

Conclusion

This article explored Nicolai Tangen's investment strategies when faced with the significant challenges posed by Trump's tariffs. His approach, marked by long-term vision, diversification across asset classes, and a commitment to ESG principles, showcased the importance of proactive risk management in uncertain economic environments. By analyzing NBIM's response, we've gained insights into successful adaptation strategies applicable to investors navigating global trade complexities. Tangen's experience underscores the significance of adaptability and a robust investment philosophy, even amidst periods of substantial market volatility.

Call to Action: Learn more about navigating economic uncertainty and refining your investment strategies. Research Nicolai Tangen's approach to understand how leading investors manage risk and achieve long-term success in a dynamic global market, even when affected by fluctuating trade policies like the Trump-era tariffs. Understanding Nicolai Tangen's investment strategies provides invaluable lessons for all investors seeking resilience and long-term growth.

Featured Posts

-

Ruling Partys Future At Stake Analyzing The Singaporean Election Results

May 05, 2025

Ruling Partys Future At Stake Analyzing The Singaporean Election Results

May 05, 2025 -

Unexpected Spring Snow Nyc Suburbs To See 1 2 Inches

May 05, 2025

Unexpected Spring Snow Nyc Suburbs To See 1 2 Inches

May 05, 2025 -

Cnn Migrant Seeks Refuge In Tree To Escape Ice For Eight Hours

May 05, 2025

Cnn Migrant Seeks Refuge In Tree To Escape Ice For Eight Hours

May 05, 2025 -

Luxury Car Sales In China The Bmw And Porsche Case Study

May 05, 2025

Luxury Car Sales In China The Bmw And Porsche Case Study

May 05, 2025 -

Get Ready For The Kentucky Derby 151 A Pre Race Checklist

May 05, 2025

Get Ready For The Kentucky Derby 151 A Pre Race Checklist

May 05, 2025

Latest Posts

-

Ufc 314 Results Who Won And Lost At Volkanovski Vs Lopes

May 05, 2025

Ufc 314 Results Who Won And Lost At Volkanovski Vs Lopes

May 05, 2025 -

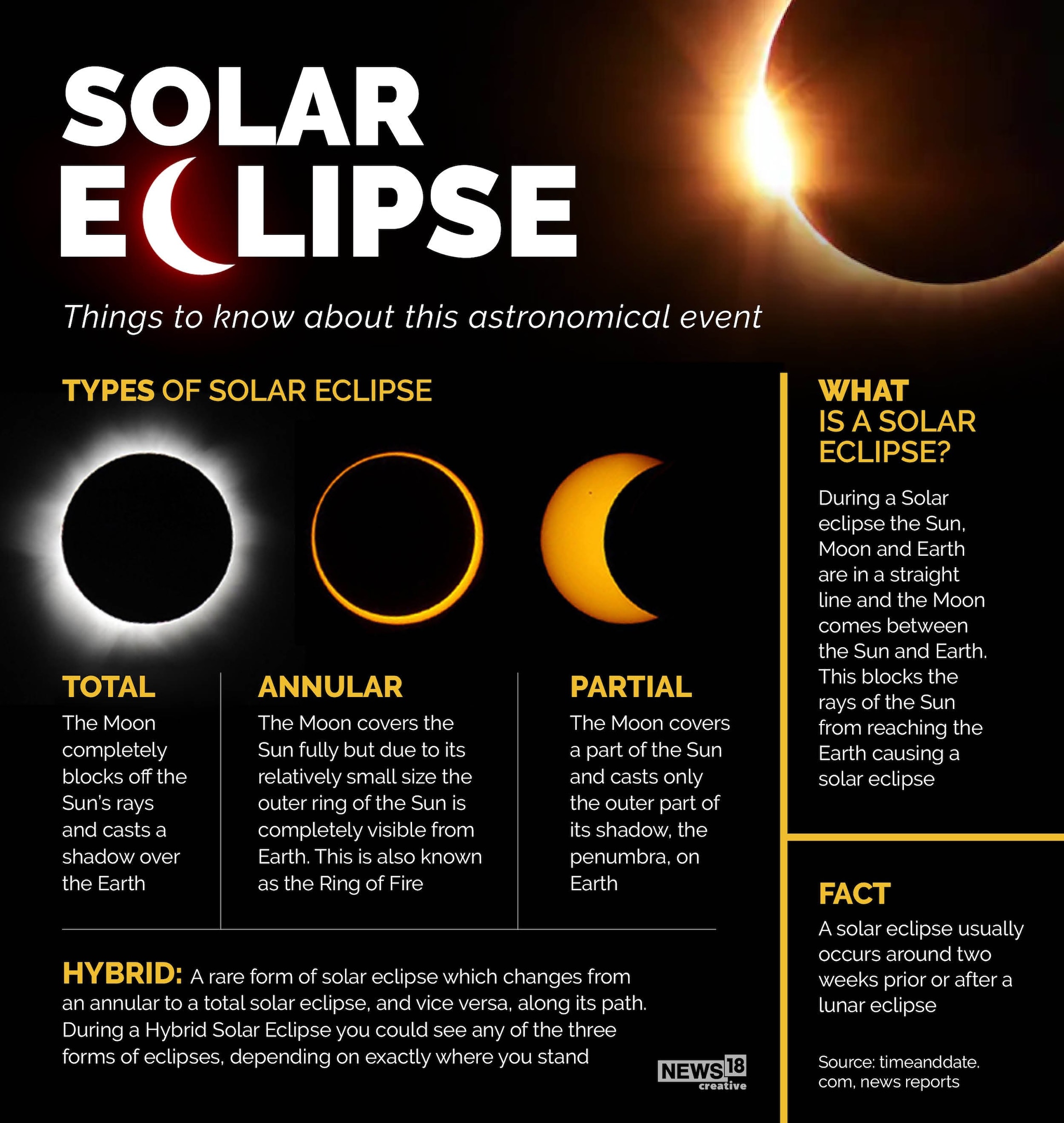

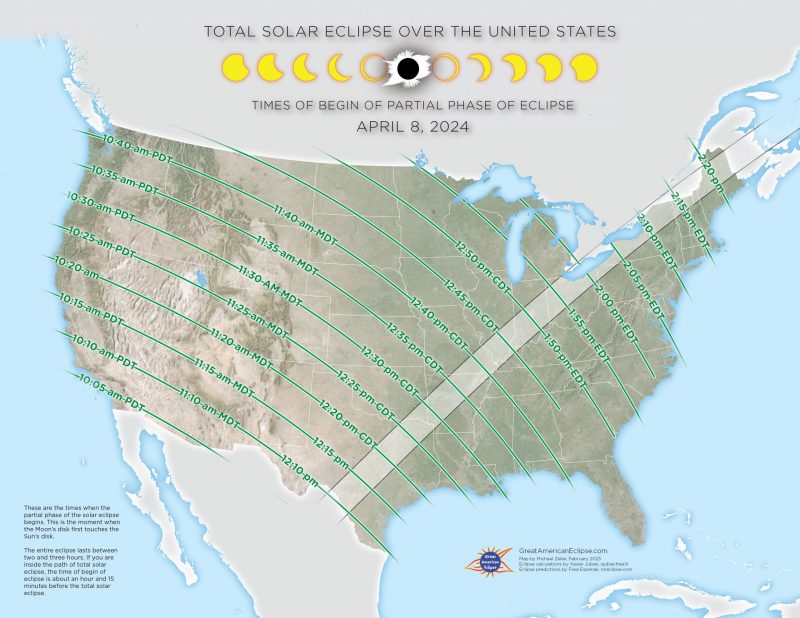

Partial Solar Eclipse Over Nyc This Saturday Time And Viewing Information

May 05, 2025

Partial Solar Eclipse Over Nyc This Saturday Time And Viewing Information

May 05, 2025 -

Ufc 314 Complete Fight Card Results Volkanovski Vs Lopes Breakdown

May 05, 2025

Ufc 314 Complete Fight Card Results Volkanovski Vs Lopes Breakdown

May 05, 2025 -

Saturdays Partial Solar Eclipse In New York City What Time And How To Watch

May 05, 2025

Saturdays Partial Solar Eclipse In New York City What Time And How To Watch

May 05, 2025 -

Nyc Partial Solar Eclipse On Saturday Timing And Safe Viewing

May 05, 2025

Nyc Partial Solar Eclipse On Saturday Timing And Safe Viewing

May 05, 2025