New HMRC Rules For Side Hustles: Increased Scrutiny And Tax Compliance

Table of Contents

Understanding the New HMRC Guidelines for Side Hustle Income

What exactly constitutes a "side hustle" in the eyes of HMRC? Essentially, any activity undertaken for profit outside of your main employment is considered a side hustle. This includes, but isn't limited to, generating income through various avenues such as:

- Freelance work: Providing services like writing, design, or consulting on a project basis.

- Gig economy: Participating in platforms like Uber, Deliveroo, or TaskRabbit.

- Online selling: Selling goods through platforms like eBay, Etsy, or your own online store.

- Renting out property: Generating income from short-term lets via Airbnb or long-term rentals.

The crucial factor determining your tax obligations is your income level. HMRC has specific thresholds that trigger the need for tax registration and filing. If your side hustle income exceeds a certain amount (this threshold can vary depending on the type of income and your circumstances), you’re legally required to declare it and pay the appropriate taxes. Failure to comply can result in significant penalties, including back taxes, interest charges, and even prosecution in severe cases.

Record Keeping and Reporting Requirements for Side Hustle Tax

Meticulous record-keeping is paramount for successful side hustle tax compliance. This ensures you accurately report your income and claim any allowable expenses, minimizing your tax liability. Essential records to maintain include:

- Invoices: Detailed invoices issued to clients for services rendered or goods sold.

- Receipts: Proof of purchase for all business-related expenses.

- Bank statements: Records of all income and expense transactions.

- Expense tracking: A detailed log of all business-related expenses, categorized for easy reporting.

You can maintain records manually using spreadsheets or notebooks, or utilize dedicated accounting software designed for self-employed individuals. Accurate reporting is critical not only to avoid penalties but also to potentially reduce your tax bill by claiming legitimate business expenses. HMRC conducts audits, so maintaining accurate records protects you against potential disputes.

Tax Implications of Different Side Hustle Structures (Sole Trader, Limited Company)

Choosing the right business structure for your side hustle impacts your tax obligations significantly. The two most common structures are sole trader and limited company.

- Sole Trader: Simple to set up, profits are taxed as personal income. Tax rates are dependent on your overall income bracket.

- Limited Company: More complex to set up, requires more administrative work, but can offer tax advantages through corporation tax rates (currently lower than the highest income tax rates), and the ability to claim certain expenses and dividends.

The choice between these structures depends on your individual circumstances and projected income. Seeking professional advice from an accountant is highly recommended to determine the most tax-efficient structure for your specific side hustle. Understanding the implications of each structure ensures you optimize your tax position legally.

Using HMRC's Online Services for Side Hustle Tax Compliance

HMRC provides comprehensive online services to simplify tax compliance. Registering for Self Assessment is the first step for most side hustlers. This involves creating an online account and providing necessary information about your income and expenses. You'll then use this account to file your annual tax return online. HMRC’s website offers detailed guidance and support throughout this process.

- Online filing: Submit your tax return conveniently online, avoiding postal delays.

- Tax calculation tools: Utilize HMRC's online tools to calculate your tax liability accurately.

- Payment options: Make secure online payments to HMRC.

Utilizing these services ensures a smoother and more efficient tax filing process, reducing the risk of errors and delays. Remember to bookmark relevant HMRC pages for easy access to information and support.

Seeking Professional Help with Side Hustle Tax

While managing your side hustle taxes independently is possible, seeking professional help from an accountant or tax advisor offers significant advantages. They can provide expert guidance on:

- Choosing the optimal business structure.

- Optimizing your tax liability through legitimate deductions.

- Ensuring compliance with all relevant HMRC regulations.

- Managing complex tax situations.

Consider seeking professional advice if:

- Your side hustle income is substantial.

- Your business structure is complex.

- You are unsure about your tax obligations.

When choosing an advisor, ask about:

- Their experience with side hustles.

- Their fees and payment structures.

- Their availability and communication methods.

Staying Compliant with HMRC Rules for Your Side Hustle

Successfully managing your side hustle's tax implications requires diligent record-keeping, accurate reporting, understanding the differences in tax structures, and utilizing HMRC's online services. Remember, staying compliant with the latest HMRC rules for side hustles is crucial to avoid penalties and maintain a positive relationship with HMRC. Don't risk penalties – understand your HMRC obligations for your side hustle today! Take control of your side hustle taxes. Learn more about HMRC rules and regulations now!

Featured Posts

-

Diner Exclusif Le Rooftop Des Galeries Lafayette Biarritz Avant Pau Avec Imanol Harinordoquy Et Jean Michel Suhubiette

May 20, 2025

Diner Exclusif Le Rooftop Des Galeries Lafayette Biarritz Avant Pau Avec Imanol Harinordoquy Et Jean Michel Suhubiette

May 20, 2025 -

La Buena Nueva Que Recibio Michael Schumacher Y Conmovio Al Mundo

May 20, 2025

La Buena Nueva Que Recibio Michael Schumacher Y Conmovio Al Mundo

May 20, 2025 -

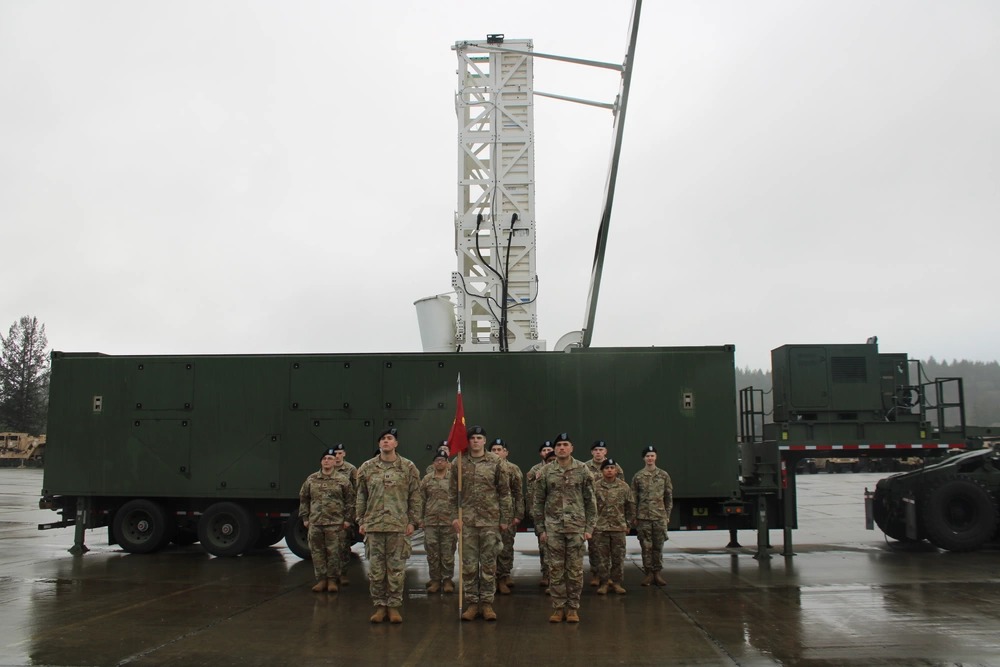

The Strategic Implications Of The Us Typhon Missile System In The Philippines A Case Study Of Chinas Growing Influence

May 20, 2025

The Strategic Implications Of The Us Typhon Missile System In The Philippines A Case Study Of Chinas Growing Influence

May 20, 2025 -

Schumacher Vuela De Mallorca A Suiza Para Reunirse Con Su Nieta

May 20, 2025

Schumacher Vuela De Mallorca A Suiza Para Reunirse Con Su Nieta

May 20, 2025 -

Presidentielle Cameroun 2032 La Strategie De Macron

May 20, 2025

Presidentielle Cameroun 2032 La Strategie De Macron

May 20, 2025

Latest Posts

-

I Tzenifer Lorens Kai O Koyki Maroni Goneis Gia Deyteri Fora

May 20, 2025

I Tzenifer Lorens Kai O Koyki Maroni Goneis Gia Deyteri Fora

May 20, 2025 -

Jennifer Lawrence Dvojnasobna Mama V Tajnosti

May 20, 2025

Jennifer Lawrence Dvojnasobna Mama V Tajnosti

May 20, 2025 -

I Tzenifer Lorens Egine Mitera Gia Deyteri Fora Anakoinosi Kai Leptomereies

May 20, 2025

I Tzenifer Lorens Egine Mitera Gia Deyteri Fora Anakoinosi Kai Leptomereies

May 20, 2025 -

Druhe Dieta Jennifer Lawrence Prekvapujuca Sprava Pre Fanusikov

May 20, 2025

Druhe Dieta Jennifer Lawrence Prekvapujuca Sprava Pre Fanusikov

May 20, 2025 -

I Tzenifer Lorens Mia Deyteri Egkymosyni Kai I Xara Tis Mitrotitas

May 20, 2025

I Tzenifer Lorens Mia Deyteri Egkymosyni Kai I Xara Tis Mitrotitas

May 20, 2025