Network18 Media & Investments: Share Price, Technical Analysis & Expert Forecasts (April 21, 2025)

Table of Contents

H2: Current Network18 Share Price and Market Performance

H3: Analyzing the Current Share Price:

As of the close of trading on April 21, 2025, the Network18 share price stood at ₹[Insert Current Closing Price]. The day's trading saw a high of ₹[Insert Day's High] and a low of ₹[Insert Day's Low], with a volume of [Insert Volume Traded] shares changing hands. This represents a [Insert Percentage Change]% change from the previous day's closing price.

- Key Metrics:

- Opening Price: ₹[Insert Opening Price]

- Closing Price: ₹[Insert Closing Price]

- 52-Week High: ₹[Insert 52-Week High]

- 52-Week Low: ₹[Insert 52-Week Low]

- Benchmark Comparison: Compared to the Nifty Media index, Network18's performance has been [Insert Comparison - e.g., slightly above, below, in line with] the overall market trend. Its performance relative to the Sensex was [Insert Comparison].

- Recent News Impact: [Insert any significant recent news affecting Network18's share price, e.g., "The recent announcement of a new strategic partnership with [Partner Name] has positively influenced investor sentiment." or "The company's Q4 earnings report, released on [Date], showed [Positive or Negative result], impacting the Network18 stock price."]

H2: Network18 Media & Investments: Technical Analysis

H3: Chart Patterns and Indicators:

A technical analysis of the Network18 stock chart reveals [Describe the overall trend – e.g., "a short-term uptrend"]. The 50-day moving average is currently at [Value], while the 200-day moving average is at [Value]. The Relative Strength Index (RSI) stands at [Value], indicating [Overbought/Oversold/Neutral]. The Moving Average Convergence Divergence (MACD) shows [Explain MACD signal]. [Mention any significant chart patterns, e.g., "The formation of a head and shoulders pattern suggests potential downside risk."]

- Interpretation of Indicators: [Detailed explanation of the buy/sell/hold signals derived from the technical indicators mentioned above].

- Support and Resistance Levels: Key support levels are observed at [Values], while resistance is anticipated at [Values].

- Trend Analysis: The prevailing trend appears to be [Uptrend/Downtrend/Sideways], based on the analysis of moving averages and other indicators.

- Visual Aids: [Insert relevant charts and graphs illustrating the technical analysis].

H2: Expert Forecasts and Predictions for Network18 Stock

H3: Consensus Estimates:

Several reputable financial analysts have offered their outlooks on Network18's future performance. [Source 1] predicts a price target of ₹[Value] within the next 12 months, citing [Reason]. [Source 2] offers a more conservative estimate of ₹[Value], emphasizing [Reason]. The overall consensus among analysts surveyed seems to be [Buy/Sell/Hold].

- Analyst Ratings Summary: A majority of analysts currently rate Network18 stock as a [Buy/Sell/Hold].

- Price Targets and Rationale: The range of price targets suggests a potential upside/downside of [Percentage] from the current share price. The rationale behind these targets varies, with some analysts emphasizing growth potential in the digital media space, while others express concerns about [Potential concerns].

- Potential Catalysts: Positive catalysts include potential acquisitions, expansion into new markets, and successful digital content strategies. Negative catalysts could include increased competition, regulatory hurdles, or economic slowdown.

- Investment Strategies: Both long-term and short-term investors might find Network18 attractive depending on their risk tolerance and investment goals.

H2: Risks and Opportunities Investing in Network18 Media

H3: Potential Risks:

Investing in Network18, like any stock, carries inherent risks.

- Industry-Specific Risks: Fluctuations in advertising revenue, competition from other media companies, and changing consumer preferences pose significant challenges.

- Company-Specific Risks: Network18's debt levels, management changes, and execution of its strategic plans all contribute to the overall risk profile.

- Geopolitical Risks: Broader economic conditions and geopolitical events could also influence the Network18 share price.

H3: Investment Opportunities:

Despite the risks, Network18 presents compelling opportunities.

- Growth Potential: The Indian media sector is experiencing robust growth, creating opportunities for expansion and market share gains.

- Strategic Initiatives: Network18's strategic initiatives in digital media and content creation could unlock significant value.

- Potential for Dividend Payouts: [Mention dividend history and potential future payouts if applicable].

3. Conclusion:

Network18 Media & Investments' share price currently stands at ₹[Insert Current Closing Price] as of April 21, 2025. While technical analysis shows [Summary of technical outlook], expert forecasts offer a mixed outlook with price targets ranging from ₹[Lowest Target] to ₹[Highest Target]. Investing in Network18 presents both opportunities, driven by the growth potential of the Indian media market and the company’s strategies, and risks, stemming from market volatility and industry-specific challenges. It's crucial to carefully weigh these factors before making any investment decisions.

Call to Action: Conduct thorough due diligence, consult with a qualified financial advisor, and regularly monitor the Network18 share price and relevant news before investing. Stay informed on Network18’s share price and make well-informed investment choices.

Featured Posts

-

Jazz Fest New Orleans The Ultimate Guide

May 17, 2025

Jazz Fest New Orleans The Ultimate Guide

May 17, 2025 -

From The Closet To The Pitch Josh Cavallos Inspirational Story

May 17, 2025

From The Closet To The Pitch Josh Cavallos Inspirational Story

May 17, 2025 -

Srbi Kupuju Stanove U Inostranstvu Popularne Destinacije I Trendovi

May 17, 2025

Srbi Kupuju Stanove U Inostranstvu Popularne Destinacije I Trendovi

May 17, 2025 -

List Of Celebrities Whose Homes Were Destroyed In The La Palisades Fires

May 17, 2025

List Of Celebrities Whose Homes Were Destroyed In The La Palisades Fires

May 17, 2025 -

Top Rated Real Money Online Casino 7 Bit Casino Features And Bonuses

May 17, 2025

Top Rated Real Money Online Casino 7 Bit Casino Features And Bonuses

May 17, 2025

Latest Posts

-

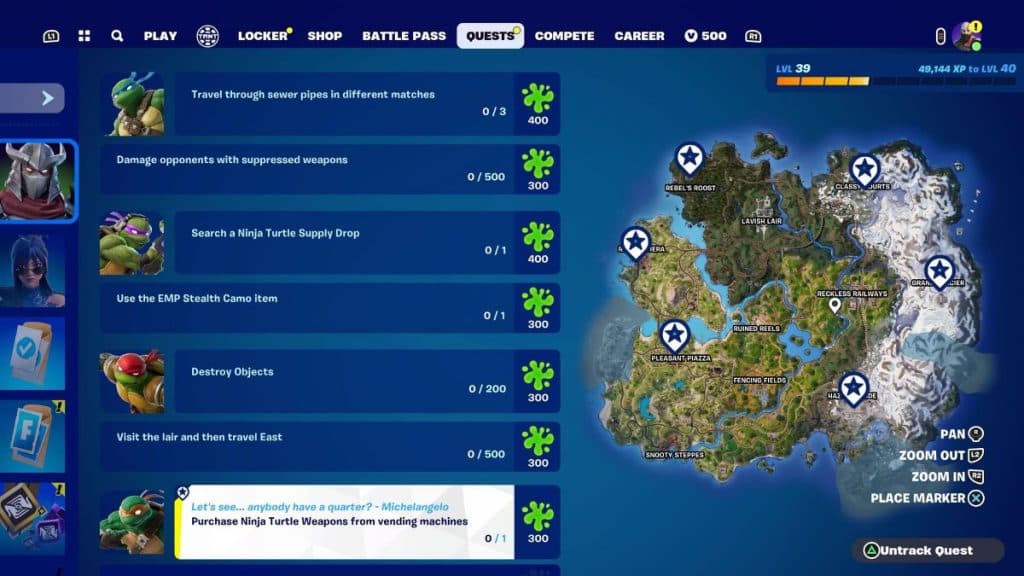

Epic Games Hit With New Fortnite Lawsuit In Game Store Practices Under Fire

May 17, 2025

Epic Games Hit With New Fortnite Lawsuit In Game Store Practices Under Fire

May 17, 2025 -

Unlock All Fortnite Teenage Mutant Ninja Turtles Skins

May 17, 2025

Unlock All Fortnite Teenage Mutant Ninja Turtles Skins

May 17, 2025 -

Complete List Of Fortnite Tmnt Skins And Unlock Methods

May 17, 2025

Complete List Of Fortnite Tmnt Skins And Unlock Methods

May 17, 2025 -

How To Get Every Teenage Mutant Ninja Turtles Skin In Fortnite

May 17, 2025

How To Get Every Teenage Mutant Ninja Turtles Skin In Fortnite

May 17, 2025 -

Fortnite Cowboy Bebop Faye Valentine And Spike Spiegel Skin Bundle Price

May 17, 2025

Fortnite Cowboy Bebop Faye Valentine And Spike Spiegel Skin Bundle Price

May 17, 2025