Net Asset Value (NAV) For Amundi Dow Jones Industrial Average UCITS ETF (Distributing) Investors

Table of Contents

What is Net Asset Value (NAV)?

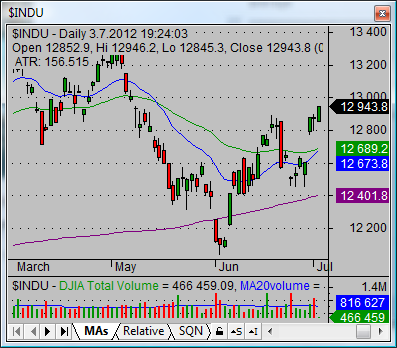

Net Asset Value (NAV) represents the net worth of an ETF's underlying assets. For an ETF tracking an index like the Dow Jones Industrial Average, the NAV reflects the total market value of the stocks within that index held by the ETF, less any liabilities. Understanding NAV is crucial because it provides a snapshot of the ETF's intrinsic value at a specific point in time. This contrasts with the market price, which can fluctuate throughout the trading day based on supply and demand. A key difference between the market price and the NAV is that the market price can trade at a premium or discount to the NAV.

How NAV is Calculated for the Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) is calculated daily, typically at the close of the market. This calculation involves several steps:

- Market value of underlying assets: The fund manager determines the market value of each holding in the ETF's portfolio, reflecting the closing prices of the 30 Dow Jones Industrial Average components.

- Less: Liabilities: This includes all expenses associated with running the fund, such as management fees, administrative costs, and any accrued liabilities.

- Equals: Net Asset Value per share: The total net asset value is then divided by the total number of outstanding shares to arrive at the NAV per share. This figure represents the theoretical value of a single share in the ETF.

The fund manager plays a vital role in ensuring the accurate and timely calculation of the NAV, adhering to strict regulatory guidelines and valuation principles.

The Importance of NAV for Investment Decisions

Monitoring the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) is crucial for several reasons:

- Buying and selling prices: While the market price fluctuates, investors may find opportunities to buy below the NAV (indicating potential undervaluation) or sell above the NAV (potentially realizing a profit). Understanding this relationship informs strategic buying and selling decisions.

- Assessing ETF performance: Tracking the NAV over time allows investors to gauge the ETF's performance against its benchmark index, the Dow Jones Industrial Average. Consistent tracking allows for effective performance measurement.

- Comparison with similar investments: Comparing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) to other similar ETFs allows investors to make informed choices based on relative value and performance.

Accessing the Daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Reliable NAV information is easily accessible through various sources:

- Amundi's official website: The fund manager, Amundi, publishes the daily NAV on its website, ensuring accurate and timely data.

- Major financial data providers: Reputable sources like Bloomberg, Refinitiv, and others will include the NAV for the ETF in their market data services.

- Brokerage platforms: Most online brokerage platforms provide real-time or near real-time NAV information for ETFs held in client accounts.

It's crucial to rely on reputable sources to avoid inaccurate or outdated NAV information, which could lead to poor investment decisions. Minor delays in NAV publication can occur, usually due to the time required to process end-of-day market data, but these are typically minimal.

NAV and Dividend Distributions

The Amundi Dow Jones Industrial Average UCITS ETF (Distributing) distributes dividends periodically. These distributions directly impact the NAV:

- NAV decreases after dividend distribution: When a dividend is paid, the NAV per share decreases by the amount of the dividend. This is because the ETF's assets have been reduced by the dividend payout.

- Reinvested dividends: Investors who opt to reinvest their dividends will see an increase in the number of shares they hold, offsetting the reduction in NAV per share. This process is automatic for many brokerage accounts.

Understanding this dynamic is key to interpreting NAV changes accurately and making informed decisions about dividend reinvestment.

Conclusion: Making Informed Investment Decisions with Amundi Dow Jones Industrial Average UCITS ETF (Distributing) NAV

Understanding the Net Asset Value (NAV) is paramount for successful investing in the Amundi Dow Jones Industrial Average UCITS ETF (Distributing). By regularly monitoring the NAV, comparing it to market prices, and understanding its relationship to dividend distributions, you can make better-informed investment decisions. Mastering your Amundi Dow Jones Industrial Average UCITS ETF (Distributing) NAV allows you to assess performance, identify potential opportunities, and ultimately optimize your investment strategy. Therefore, we encourage you to regularly check the NAV of your holdings and utilize this knowledge to build a robust investment plan. Start understanding your Amundi Dow Jones Industrial Average UCITS ETF (Distributing) NAV today!

Featured Posts

-

Zhizn Posle Evrovideniya Sudby Pobediteley Za Poslednee Desyatiletie

May 25, 2025

Zhizn Posle Evrovideniya Sudby Pobediteley Za Poslednee Desyatiletie

May 25, 2025 -

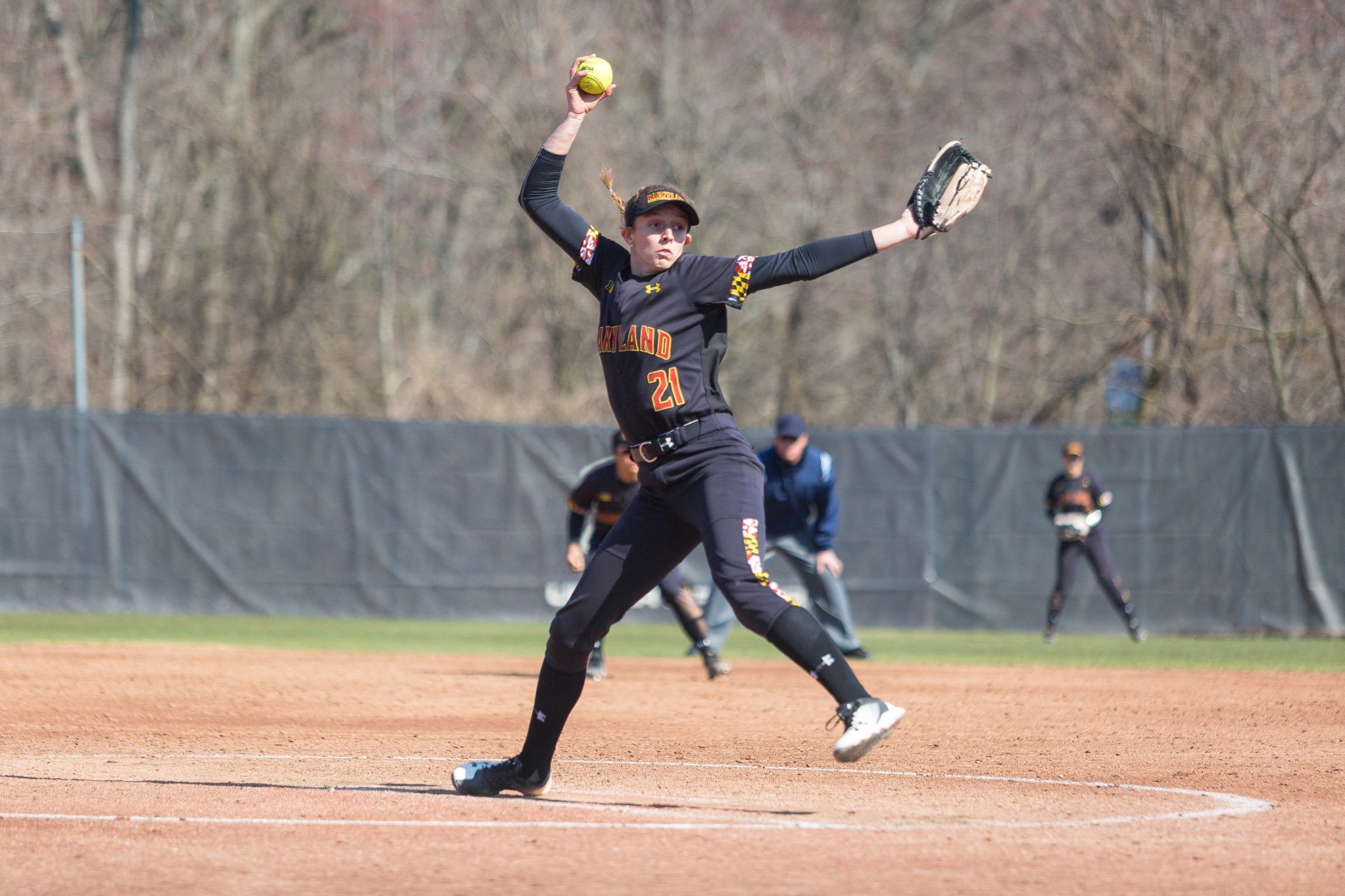

Maryland Softball Defeats Delaware After Late Game Surge 5 4

May 25, 2025

Maryland Softball Defeats Delaware After Late Game Surge 5 4

May 25, 2025 -

M62 Westbound Resurfacing Manchester To Warrington Road Closure

May 25, 2025

M62 Westbound Resurfacing Manchester To Warrington Road Closure

May 25, 2025 -

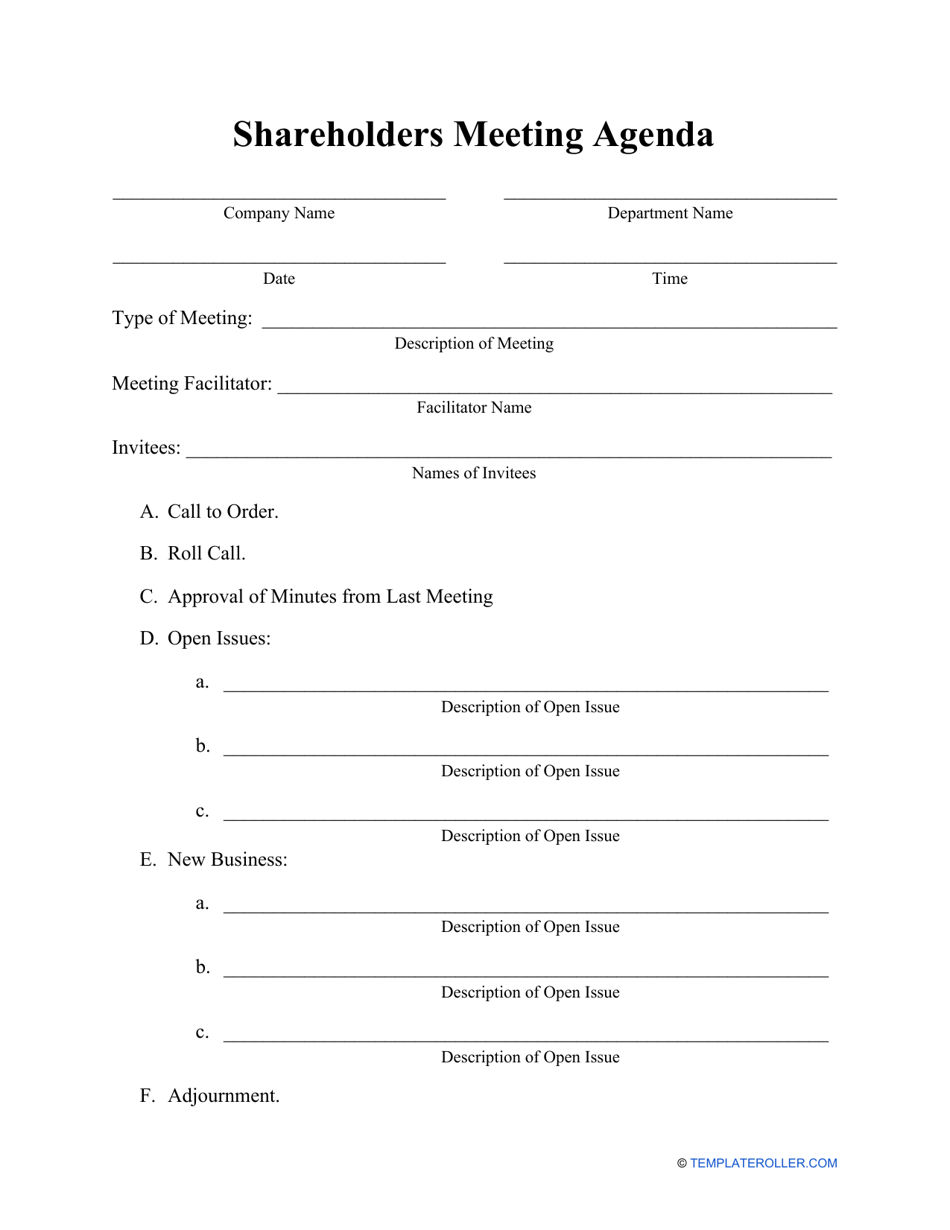

Philips Announces 2025 Annual General Meeting Agenda What Shareholders Need To Know

May 25, 2025

Philips Announces 2025 Annual General Meeting Agenda What Shareholders Need To Know

May 25, 2025 -

Escape To The Country Affordable Luxury Under 1 Million

May 25, 2025

Escape To The Country Affordable Luxury Under 1 Million

May 25, 2025

Latest Posts

-

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details On The Jan 6 Claims

May 25, 2025

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details On The Jan 6 Claims

May 25, 2025 -

Palisades Fire A List Of Celebrities Who Lost Their Homes

May 25, 2025

Palisades Fire A List Of Celebrities Who Lost Their Homes

May 25, 2025 -

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025 -

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025