NCLH Stock: What Hedge Fund Activity Reveals About Its Investment Potential

Table of Contents

Recent Hedge Fund Positions in NCLH Stock

Analyzing the shifts in hedge fund holdings of NCLH stock provides valuable insights into market sentiment. Examining recent notable buys and sells reveals a complex picture, suggesting a mix of bullish and bearish sentiment amongst institutional investors.

Analyzing Notable Buys and Sells

Tracking significant changes in hedge fund ownership is crucial for understanding the prevailing market outlook for NCLH. While precise real-time data requires access to proprietary databases, publicly available information often reveals significant trends. For example, (Note: Replace this with actual data obtained from reliable financial news sources and databases. Include specific examples, dates, and the names of hedge funds, citing sources).

- [Hedge Fund A]: Increased stake by [percentage]% on [Date].

- [Hedge Fund B]: Exited their position entirely on [Date].

- [Hedge Fund C]: Established a new position of [number] shares on [Date].

- [Hedge Fund D]: Decreased stake by [percentage]% on [Date].

These actions could be motivated by various factors, including:

- A bullish outlook on the cruise industry's recovery from the pandemic.

- Concerns about NCLH's debt levels and its ability to manage future liabilities.

- Speculation about new strategic initiatives or partnerships.

- Assessment of NCLH's competitive positioning within the cruise market.

The motivations behind these shifts in NCLH holdings are varied and complex, reflecting the multifaceted nature of the cruise industry and the company's financial standing. Further analysis is needed to definitively understand the full picture.

Understanding Hedge Fund Investment Strategies and NCLH

Hedge fund activity around NCLH doesn't occur in a vacuum; it's shaped by their diverse investment approaches. Analyzing these strategies sheds light on the long-term versus short-term perspectives on NCLH's prospects.

Long-Term vs. Short-Term Strategies

Hedge funds employ a variety of strategies, each influencing their involvement with NCLH:

- Value Investing: Some funds may see NCLH as undervalued, betting on long-term growth and potential future earnings.

- Growth Investing: Others might focus on NCLH's growth potential, driven by anticipated market share gains or new product/service launches.

- Arbitrage: Some hedge funds might engage in arbitrage strategies, profiting from price discrepancies between NCLH stock and related derivatives.

The market conditions, coupled with NCLH's specific financial circumstances, heavily influence which strategies are most attractive to hedge fund managers. The current environment, with its lingering post-pandemic uncertainties, likely influences the predominance of either long-term or short-term strategies in the NCLH investment landscape. A careful analysis of the specific hedge fund strategies employed provides crucial insight into the overall market sentiment.

Financial Performance and Market Sentiment Affecting NCLH Stock

NCLH's financial health directly impacts hedge fund decisions and overall market sentiment. A thorough examination of key financial metrics reveals trends influencing investment choices.

Analyzing NCLH's Financial Health

NCLH's recent financial performance, relative to industry benchmarks, offers crucial context for understanding hedge fund activity. Analyzing key performance indicators (KPIs) is essential:

- Revenue Growth: [Insert data and analysis of revenue trends]

- Earnings Per Share (EPS): [Insert data and analysis of EPS trends]

- Debt Levels: [Insert data and analysis of debt levels and their impact]

- Operating Margins: [Insert data and analysis of operating margins]

By analyzing these financial indicators over time, investors can gain a better understanding of the financial health of NCLH and how this might correlate with hedge fund activity. A strong financial performance, particularly compared to competitors, is likely to attract more bullish investment, while weaker results may lead to reduced interest or even divestment. Understanding this correlation helps interpret the signals sent by hedge fund investment decisions.

Risk Assessment and Potential Returns of NCLH Stock

Investing in NCLH stock, like any investment, carries inherent risks. A comprehensive risk assessment is crucial for making informed investment decisions.

Evaluating the Risks and Rewards

Investing in NCLH stock involves numerous considerations:

- Industry Competition: The cruise industry is competitive; new entrants and established players pose ongoing challenges.

- Economic Downturns: Economic recessions can severely impact discretionary spending, including cruise travel.

- Geopolitical Events: Global events can disrupt travel patterns and affect the cruise industry's profitability.

- Fuel Prices: Fluctuations in fuel prices significantly affect operating costs.

However, potential rewards exist:

- Industry Recovery: The post-pandemic recovery of the cruise industry presents significant upside potential for NCLH.

- Market Share Gains: NCLH might increase its market share through strategic initiatives.

- Operational Efficiency Improvements: Cost-cutting measures could boost profitability.

Weighing these risks and rewards, while considering the observed hedge fund activity, allows for a more thorough assessment of the potential return on investment (ROI). A careful analysis should involve different scenarios, accounting for both optimistic and pessimistic market conditions.

Conclusion: Making Informed Decisions on NCLH Stock Based on Hedge Fund Insights

Analyzing hedge fund activity surrounding NCLH stock provides valuable, albeit incomplete, insights into its investment potential. While the observed shifts in hedge fund holdings suggest a mixed outlook, with some investors displaying bullishness and others expressing caution, it’s crucial to understand that these are just pieces of a larger puzzle. The company's financial health, industry trends, and broader economic conditions also heavily influence the stock's performance.

Before making any NCLH stock investment, conduct thorough due diligence. Consider multiple perspectives, analyze independent financial forecasts, and consult with a qualified financial advisor. Remember that past hedge fund activity doesn't guarantee future success. Thoroughly analyzing NCLH's investment potential requires a comprehensive approach that goes beyond simply tracking hedge fund behavior. Only through careful research and consideration of multiple factors can you make well-informed decisions concerning NCLH stock investment.

Featured Posts

-

Live Coverage Explosions Rock Yate As House Burns

Apr 30, 2025

Live Coverage Explosions Rock Yate As House Burns

Apr 30, 2025 -

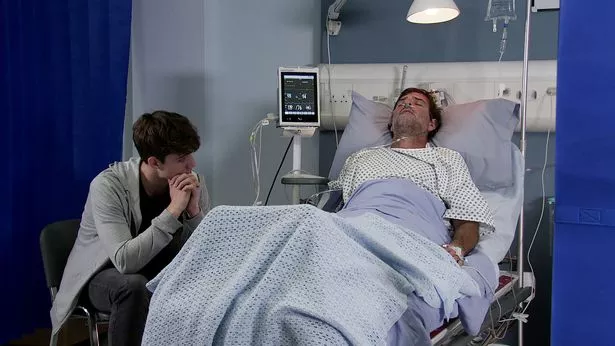

Coronation Street Actor Speaks Out After Heartbreaking Departure

Apr 30, 2025

Coronation Street Actor Speaks Out After Heartbreaking Departure

Apr 30, 2025 -

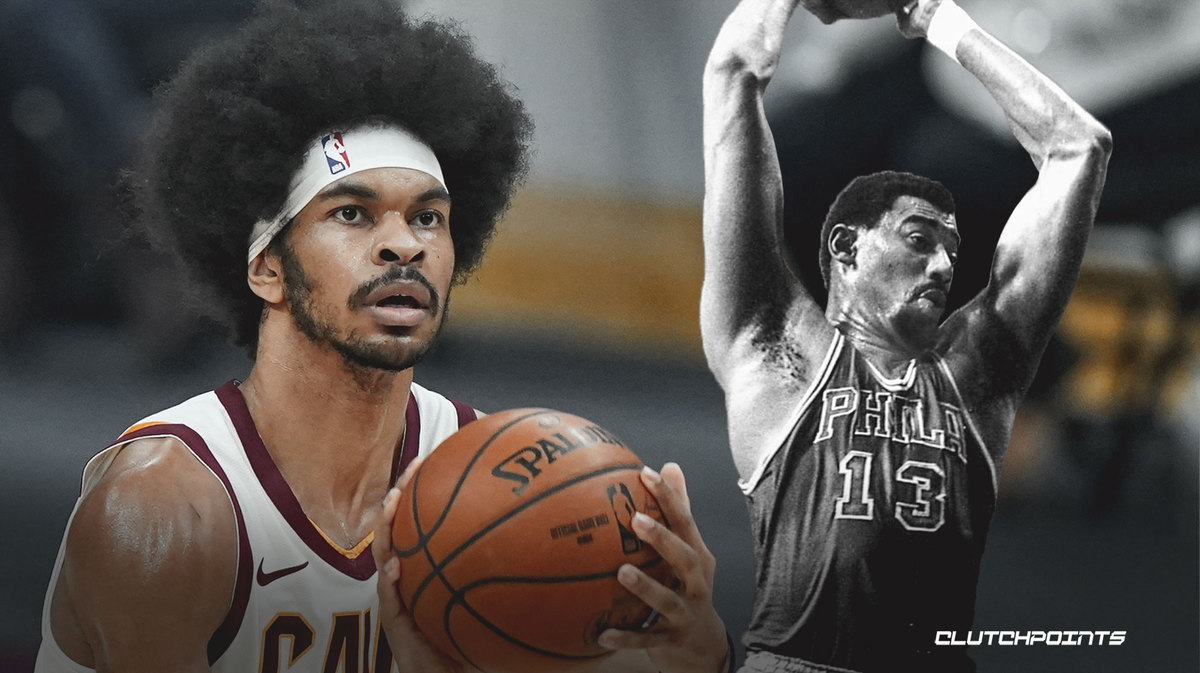

Jarrett Allens Impressive Dunk Cavs Defeat Knicks

Apr 30, 2025

Jarrett Allens Impressive Dunk Cavs Defeat Knicks

Apr 30, 2025 -

Becciu Chat Segrete E Accuse Al Vaticano Il Cardinale Parla Di Complotto

Apr 30, 2025

Becciu Chat Segrete E Accuse Al Vaticano Il Cardinale Parla Di Complotto

Apr 30, 2025 -

Appello Processo Becciu Inizio Il 22 Settembre La Sua Dichiarazione

Apr 30, 2025

Appello Processo Becciu Inizio Il 22 Settembre La Sua Dichiarazione

Apr 30, 2025