NCLH Stock Soars: Strong Earnings And Upgraded Guidance

Table of Contents

Norwegian Cruise Line Holdings (NCLH) stock experienced a significant surge following the release of its latest earnings report. The company not only exceeded analyst expectations but also provided upgraded guidance for the remainder of the year, sending a powerful signal of a robust recovery for the cruise industry and presenting a compelling investment opportunity for discerning investors. This article delves into the key factors driving this remarkable NCLH stock performance.

Exceeding Earnings Expectations

Keywords: NCLH earnings, Q[Quarter] earnings, revenue growth, profitability, EPS, earnings per share, net income.

NCLH's recent earnings report showcased impressive financial results that significantly surpassed analyst predictions. For [Specify Quarter, e.g., Q3 2024], the company reported an Earnings Per Share (EPS) of $[EPS figure], exceeding the consensus estimate of $[Analyst Estimate] by $[Difference]. Revenue reached $[Revenue Figure], a substantial increase compared to the same period last year and reflecting strong growth. This positive performance was driven by several key factors:

-

Strong Booking Numbers and Increased Occupancy Rates: NCLH reported a significant increase in bookings, indicating strong consumer demand for cruises. Occupancy rates also climbed to [Percentage]%, demonstrating a high level of demand and translating into higher revenue generation.

-

Effective Cost-Cutting Measures: The company implemented strategic cost-cutting measures, enhancing operational efficiency and improving profitability. These measures, including [Mention specific examples, e.g., optimized fuel consumption, streamlined staffing], contributed significantly to the improved bottom line.

-

Outperforming Competitors: Compared to its main competitors in the cruise industry, such as [Mention competitors, e.g., Carnival Corporation (CCL), Royal Caribbean Cruises (RCL)], NCLH demonstrated superior financial performance in this reporting period, highlighting its effective strategies and strong market position.

Upgraded Guidance for Future Growth

Keywords: NCLH guidance, future outlook, revenue projections, growth forecast, positive outlook, market share.

Further bolstering investor confidence, NCLH provided upgraded guidance for the remainder of the year. The company projected [Specify projections, e.g., revenue growth of X%, increased EPS of Y%]. This positive outlook is underpinned by several factors:

-

Revised Projections for Upcoming Quarters: NCLH anticipates continued strong performance in the coming quarters, with projected revenue and EPS exceeding previous estimates. [Provide specific figures if available].

-

Impact of External Factors: While acknowledging the potential impact of factors like fluctuating fuel costs and global economic uncertainty, management expressed confidence in the company's ability to navigate these challenges and maintain its strong growth trajectory.

-

Management Commentary: NCLH's management team expressed optimism about the future, citing the robust demand for cruises, the company's strong brand recognition, and its effective operational strategies as key drivers of future growth. Their positive commentary further reinforced the upgraded guidance and fueled investor enthusiasm.

Industry-Wide Recovery Driving NCLH Stock

Keywords: cruise industry recovery, travel rebound, post-pandemic recovery, consumer confidence, pent-up demand, tourism sector.

The remarkable performance of NCLH stock is not solely attributable to its internal achievements. It also reflects the broader recovery of the cruise industry after the significant disruptions caused by the pandemic.

-

Positive Industry Trends: The cruise industry is experiencing a strong rebound, driven by increased consumer confidence in travel, pent-up demand, and the easing of travel restrictions worldwide. Bookings are surging, and average fares are rising, indicating a healthy and growing market.

-

NCLH's Competitive Positioning: NCLH's strong performance within the recovering cruise industry highlights its effective strategies and ability to capitalize on the positive market trends. The company's innovative offerings and strong brand reputation are contributing factors to its success.

-

Addressing Industry Challenges: While the cruise industry still faces some challenges, such as fluctuating fuel prices and potential economic headwinds, NCLH is proactively addressing these issues through strategic cost management, efficient operations, and a focus on delivering exceptional customer experiences.

Conclusion

The surge in NCLH stock is a clear reflection of the company's strong financial performance, exceeding earnings expectations and providing upgraded guidance. This positive trend is further amplified by the broader recovery of the cruise industry. The combination of these factors presents a compelling investment opportunity. However, remember to conduct thorough due diligence and consider your own risk tolerance before investing in NCLH stock or any other cruise stocks. Consider researching NCLH stock further to see if it aligns with your investment strategy.

Featured Posts

-

Ray Epps Sues Fox News For Defamation Over January 6th Claims

Apr 30, 2025

Ray Epps Sues Fox News For Defamation Over January 6th Claims

Apr 30, 2025 -

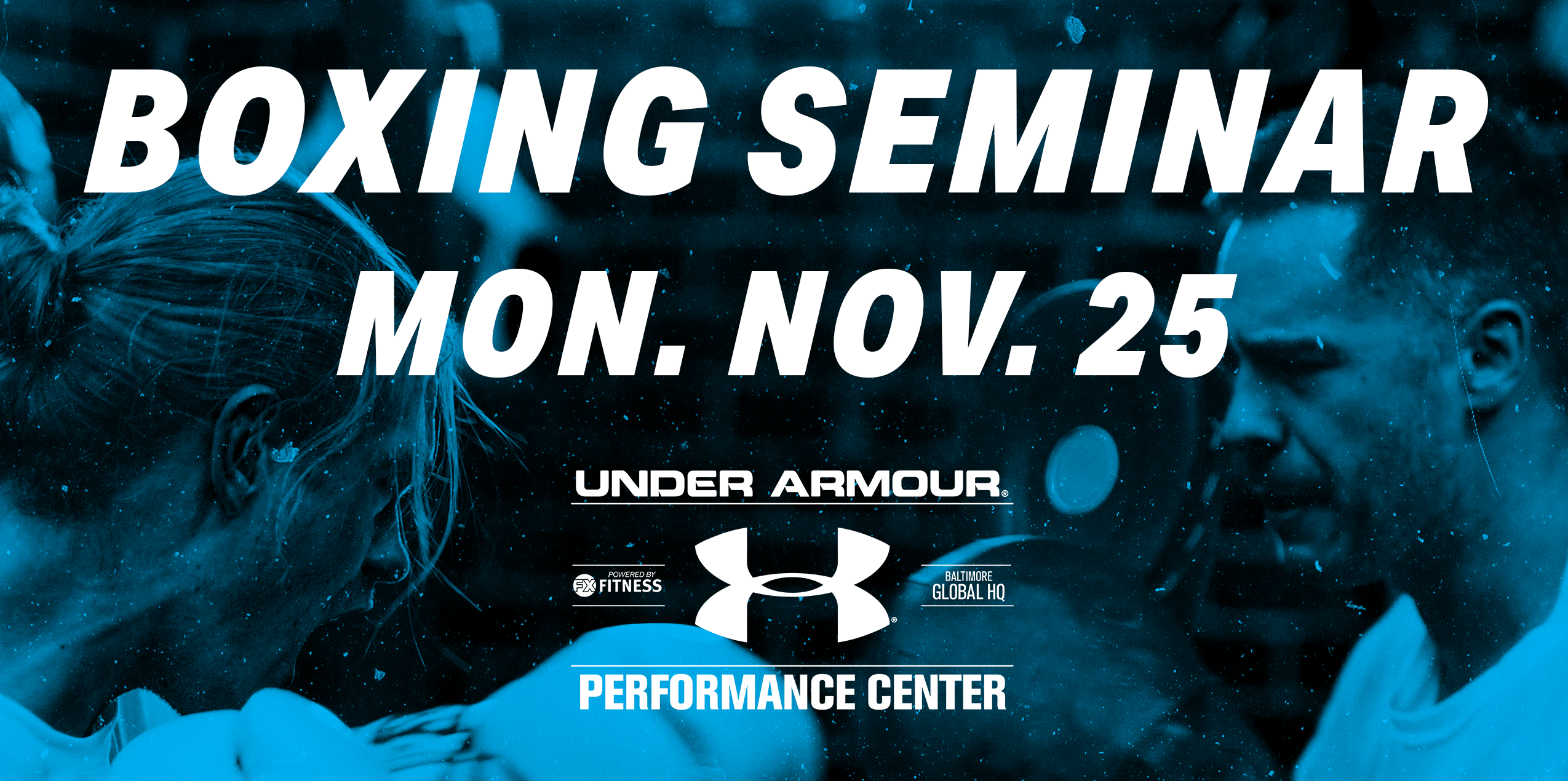

Ace Power Promotions March 26th Boxing Seminar Enhance Your Skills

Apr 30, 2025

Ace Power Promotions March 26th Boxing Seminar Enhance Your Skills

Apr 30, 2025 -

Nigerian Armys Week Long Operation 35 Illegal Refineries Destroyed 99 Apprehended

Apr 30, 2025

Nigerian Armys Week Long Operation 35 Illegal Refineries Destroyed 99 Apprehended

Apr 30, 2025 -

Predicting The Eurovision 2025 Winner Early Contenders

Apr 30, 2025

Predicting The Eurovision 2025 Winner Early Contenders

Apr 30, 2025 -

Channing Tatum And Inka Williams A New Chapter After Zoe Kravitz Separation

Apr 30, 2025

Channing Tatum And Inka Williams A New Chapter After Zoe Kravitz Separation

Apr 30, 2025