Navigating The Trump Era: The Challenges Facing The Next Federal Reserve Chairman

Table of Contents

The Legacy of Trump-Era Fiscal Policy

The Trump administration's fiscal policies significantly impacted the US economy, leaving a complex legacy for the next Federal Reserve Chairman to navigate.

Increased National Debt and Deficit

The substantial increase in the national debt and budget deficit during the Trump years presents a major challenge for monetary policy.

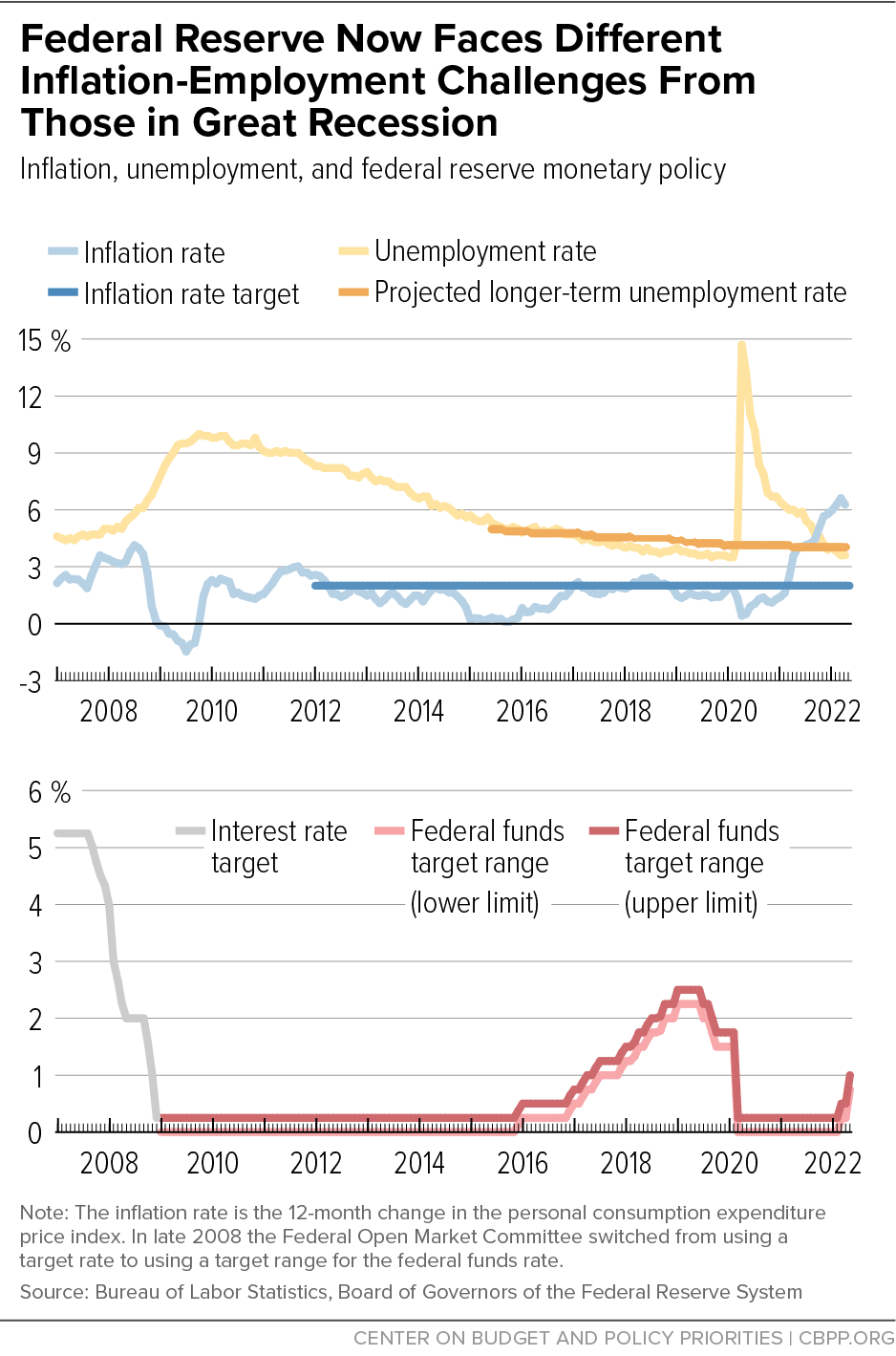

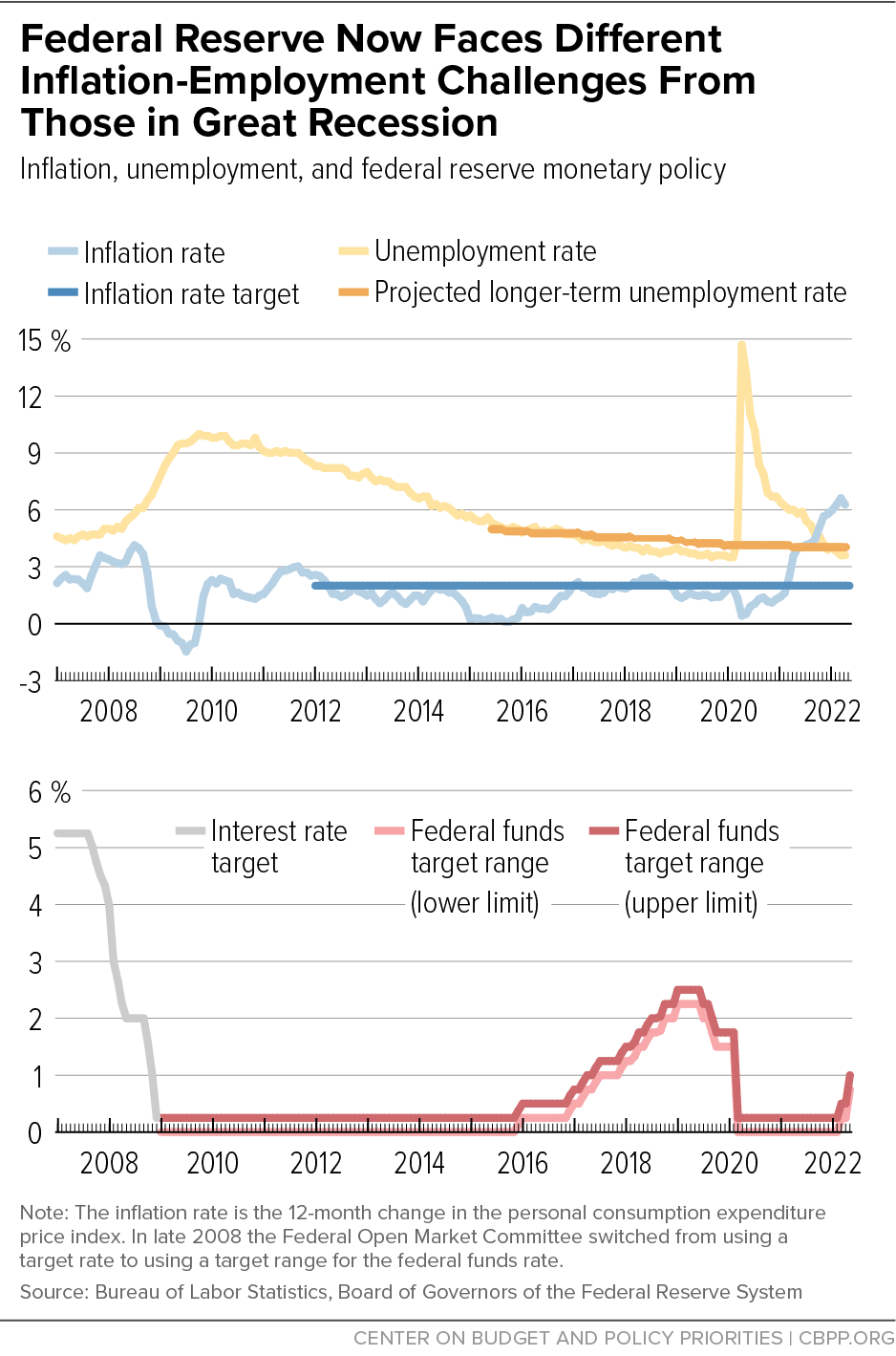

- Impact on Interest Rates: The increased borrowing needs of the government directly compete with private sector borrowing, potentially driving up interest rates. This makes the Fed's job of managing inflation and economic growth more difficult.

- Inflation Targets: Higher debt levels can fuel inflationary pressures, forcing the Fed to adopt more restrictive monetary policies, potentially slowing economic growth.

- Monetary Policy Independence: The need to finance the rising national debt could put pressure on the Fed to prioritize government borrowing needs over its mandate of price stability and maximum employment, potentially compromising its independence. The national debt currently stands at over $31 trillion, a significant increase from pre-Trump levels.

Tax Cuts and Their Economic Effects

The 2017 tax cuts, while boosting short-term economic growth, also had significant long-term consequences.

- Income Inequality: Critics argue the tax cuts disproportionately benefited high-income earners, exacerbating income inequality and potentially hindering sustainable economic growth.

- Long-Term Consequences: The decreased government revenue resulting from the tax cuts limits the government's ability to invest in crucial social programs and infrastructure, potentially impacting future economic growth. Some economic models suggest long-term inflationary pressures could emerge due to increased aggregate demand without a corresponding increase in aggregate supply.

- Fiscal Sustainability: The combination of increased spending and reduced revenue raises concerns about the long-term fiscal sustainability of the US economy. Maintaining a healthy balance between stimulating economic growth and ensuring fiscal responsibility is a significant challenge.

Navigating Geopolitical Uncertainty and Trade Wars

The Trump administration's protectionist trade policies created significant geopolitical uncertainty that will continue to impact the US economy.

The Impact of Trade Disputes

The trade wars initiated during the Trump era left lasting scars on the global economy and continue to pose challenges.

- Supply Chain Disruptions: Tariffs and trade disputes disrupted global supply chains, leading to increased costs and uncertainties for businesses. This makes it difficult for the Fed to accurately forecast inflation and economic growth.

- Inflationary Pressures: Tariffs directly increase the prices of imported goods, contributing to inflationary pressures. The Fed must carefully manage monetary policy to avoid exacerbating inflation without triggering a recession.

- Case Study: Soybean Exports to China: The trade war with China significantly impacted US soybean exports, demonstrating the vulnerability of the US agricultural sector to geopolitical tensions.

Maintaining International Monetary Cooperation

Restoring and maintaining international monetary cooperation will be crucial for the next Fed chair.

- Global Financial Regulation: The Trump administration's unilateral approach to international relations strained cooperation on global financial regulation. Rebuilding trust and fostering collaboration will be essential to ensure the stability of the global financial system.

- Monetary Policy Coordination: Coordinating monetary policy across different countries with varying economic priorities and political agendas requires skillful diplomacy and understanding. International organizations like the IMF and the Bank for International Settlements play a vital role in this process.

- Economic Diplomacy: The next Fed chair must be adept at economic diplomacy, navigating complex international relationships to ensure a stable global economic environment.

Maintaining the Fed's Independence and Credibility

Maintaining the Fed's independence and restoring public trust are paramount for the next chair.

Political Pressure and Independence

The Fed's independence from political pressure is crucial for its effectiveness.

- Historical Precedents: History demonstrates that attempts to politicize the Fed can undermine its credibility and effectiveness. The next chair must strategically navigate potential political interference while remaining steadfast in their commitment to the Fed's mandate.

- Communication Strategy: Clear and transparent communication of the Fed's policies to the public and the government is critical in maintaining its independence. This includes providing explanations for policy decisions, addressing public concerns, and fostering understanding of the Fed's role.

- Central Bank Autonomy: Protecting the Fed's autonomy from political influence will require a strong commitment to transparency, accountability, and effective communication.

Restoring Public Trust and Confidence

Restoring public trust in the Fed after a period of political polarization is essential for its effectiveness.

- Transparency and Accountability: Increased transparency in the Fed's decision-making processes and improved accountability mechanisms can help regain public trust. This includes more accessible data and clearer explanations of policy decisions.

- Communication Channels: Effective use of multiple communication channels, including press conferences, public appearances, and social media, is crucial for engaging the public and conveying the Fed's message effectively. Explaining complex economic concepts in a clear and accessible manner is critical.

- Building Credibility: Consistent and effective management of the economy, along with transparent communication, will be key to rebuilding public trust and confidence in the Fed's ability to manage the economy.

The Path Forward for the Next Federal Reserve Chairman

The next Federal Reserve Chairman faces formidable challenges: navigating the legacy of Trump-era fiscal policies, addressing lingering geopolitical uncertainty, and restoring the Fed's independence and credibility. The next chair needs exceptional economic expertise, political acumen, and superior communication skills to successfully lead the institution. Understanding the multifaceted implications of the Trump era for the US economy and the Federal Reserve is crucial. The successful navigation of these challenges hinges on the next chair's ability to effectively manage monetary policy while preserving the independence and credibility of the Federal Reserve. To delve deeper into this critical topic, explore further resources on central bank independence and monetary policy in times of economic and political uncertainty. Successfully navigating the Trump era's complex legacy will be paramount in ensuring the long-term health and stability of the US economy.

Featured Posts

-

Access To Birth Control The Impact Of Over The Counter Availability Post Roe

Apr 26, 2025

Access To Birth Control The Impact Of Over The Counter Availability Post Roe

Apr 26, 2025 -

Lab Owner Pleads Guilty To Falsifying Covid Test Results

Apr 26, 2025

Lab Owner Pleads Guilty To Falsifying Covid Test Results

Apr 26, 2025 -

2024 Nfl Draft Green Bays First Round

Apr 26, 2025

2024 Nfl Draft Green Bays First Round

Apr 26, 2025 -

Colgates Q Quarter Earnings Sales And Profit Decline Due To Tariffs

Apr 26, 2025

Colgates Q Quarter Earnings Sales And Profit Decline Due To Tariffs

Apr 26, 2025 -

The Countrys New Business Hot Spots A Geographic Analysis

Apr 26, 2025

The Countrys New Business Hot Spots A Geographic Analysis

Apr 26, 2025

Latest Posts

-

Charleston Open Pegulas Dramatic Victory Against Collins

Apr 27, 2025

Charleston Open Pegulas Dramatic Victory Against Collins

Apr 27, 2025 -

Us Open 2024 Svitolinas Impressive First Round Win

Apr 27, 2025

Us Open 2024 Svitolinas Impressive First Round Win

Apr 27, 2025 -

Former Dubai Champ Svitolinas Strong Us Open Start

Apr 27, 2025

Former Dubai Champ Svitolinas Strong Us Open Start

Apr 27, 2025 -

Pegulas Charleston Open Comeback Stunning Victory Over Collins

Apr 27, 2025

Pegulas Charleston Open Comeback Stunning Victory Over Collins

Apr 27, 2025 -

Wta Tennis Final Matches Set In Austria And Singapore

Apr 27, 2025

Wta Tennis Final Matches Set In Austria And Singapore

Apr 27, 2025