Navigating The Financial Gap: When Your Wife Is An A-List Star

Table of Contents

Understanding the Unique Financial Landscape of Celebrity Marriages

The financial realities of a marriage where one spouse is an A-list celebrity are significantly different from the average marriage. Understanding this unique landscape is the first step towards navigating it successfully.

The Sheer Scale of Celebrity Income

A-list celebrities generate income on a scale unimaginable to most. Income streams can include: blockbuster movie roles, lucrative endorsement deals with major brands, substantial residuals from previous projects, publishing deals (books, memoirs), and even their own product lines. This translates to:

- High Earning Potential: Annual incomes can reach tens of millions, even hundreds of millions of dollars.

- Unpredictable Income Streams: Income isn't consistent; some years are massively lucrative, while others may be less so.

- Significant Assets: High earners often amass significant assets including multiple properties (often in prime locations), substantial investment portfolios, and valuable collections.

- Tax Implications of High Income: The tax burden on such high incomes is substantial, requiring expert tax planning and strategies.

The Importance of Prenuptial Agreements

Before the wedding bells chime, a prenuptial agreement (prenup) is crucial for protecting both parties' financial interests. A well-drafted prenup clearly outlines:

- Asset Protection: Protecting pre-marital assets from being entangled with post-marital assets.

- Spousal Support (Alimony): Determining the amount and duration of spousal support in case of separation or divorce.

- Division of Property: Specifying how assets will be divided in the event of divorce.

- Post-nuptial Agreements: The possibility of amending the prenup after marriage if circumstances change.

- Seeking Legal Counsel: Both parties should obtain independent legal counsel to ensure the agreement is fair and protects their interests.

Managing Expectations and Defining Financial Roles

Open communication is paramount. Discussions about financial goals, expectations, and individual financial comfort levels are crucial. Key areas to address include:

- Joint Accounts vs. Separate Accounts: Deciding which accounts should be joint and which should remain separate.

- Financial Transparency: Maintaining open and honest communication regarding all income and expenses.

- Budgeting: Creating a shared budget that reflects both partners' financial contributions and spending habits.

- Spending Habits: Addressing any significant differences in spending styles and establishing guidelines.

- Financial Independence: Maintaining a degree of financial independence, even within the context of a shared financial life.

Seeking Professional Financial Guidance

Given the complexity and high stakes involved, seeking professional financial guidance is not a luxury but a necessity.

The Role of a Financial Advisor

A qualified financial advisor specializing in high-net-worth individuals and celebrity finances can offer invaluable support. Their expertise encompasses:

- Estate Planning: Developing a comprehensive estate plan to minimize taxes and ensure assets are distributed according to wishes.

- Tax Optimization: Implementing strategies to minimize tax liabilities given the complexities of high-income taxation.

- Investment Strategies: Developing and managing an investment portfolio aligned with financial goals and risk tolerance.

- Asset Management: Managing a diverse portfolio of assets, including real estate, investments, and other valuable holdings.

- Charitable Giving: Advising on effective charitable giving strategies.

- Retirement Planning: Planning for a secure retirement, considering the unique circumstances of high-income earners.

Building a Comprehensive Financial Plan

A tailored financial plan is essential. This plan should include:

- Budgeting and Cash Flow Management: Tracking income and expenses to ensure financial stability.

- Long-Term Financial Goals: Establishing clear financial goals, such as retirement planning, children's education, and philanthropic endeavors.

- Risk Management: Identifying and mitigating potential financial risks, such as market volatility and unforeseen events.

- Insurance Planning: Securing adequate life, disability, and health insurance coverage.

Maintaining a Healthy Relationship Amidst Financial Disparity

Despite the financial success of one partner, a healthy and strong relationship requires ongoing effort.

Open Communication and Shared Financial Goals

Maintaining open dialogue about finances, anxieties, and shared financial vision is vital. This includes:

- Regular Financial Meetings: Scheduling regular meetings to discuss financial matters openly and honestly.

- Discussing Financial Anxieties: Creating a safe space for both partners to express their concerns and anxieties about finances.

- Shared Financial Vision: Developing a shared understanding of long-term financial goals and priorities.

- Building Financial Literacy Together: Working together to improve financial understanding and decision-making.

Preserving Individual Identity and Independence

It's important for both partners to maintain a sense of self and financial independence:

- Personal Pursuits: Maintaining individual interests and hobbies outside of shared financial matters.

- Separate Investments: Considering separate investments to maintain personal financial autonomy.

- Career Aspirations: Supporting individual career aspirations and professional growth.

- Maintaining Personal Finances: Managing personal finances separately, even with shared accounts.

- Philanthropy: Pursuing individual philanthropic endeavors to maintain personal values and goals.

Conclusion

Navigating the financial gap in a marriage where your wife is an A-list star requires careful planning, open communication, and professional guidance. Prenuptial agreements, a comprehensive financial plan, and ongoing financial advice are crucial for ensuring financial security and maintaining a healthy relationship. Don't navigate the complexities of a celebrity marriage's finances alone. Seek professional advice to develop a personalized plan for navigating the financial gap and securing your future. Contact a financial advisor specializing in high-net-worth individuals today to start planning your financial security.

Featured Posts

-

Ubers Resilience During A Recession A Deep Dive

May 19, 2025

Ubers Resilience During A Recession A Deep Dive

May 19, 2025 -

Gilbert Burns Vs Michael Morales Live Ufc Fight Night Blog And Analysis

May 19, 2025

Gilbert Burns Vs Michael Morales Live Ufc Fight Night Blog And Analysis

May 19, 2025 -

Hayastan Eurovision In Concert 2025 I Hamar Haytararvyel E Masnakicy

May 19, 2025

Hayastan Eurovision In Concert 2025 I Hamar Haytararvyel E Masnakicy

May 19, 2025 -

Mairon Santos Vs Francis Marshall Ufc 313 Controversy Revisited

May 19, 2025

Mairon Santos Vs Francis Marshall Ufc 313 Controversy Revisited

May 19, 2025 -

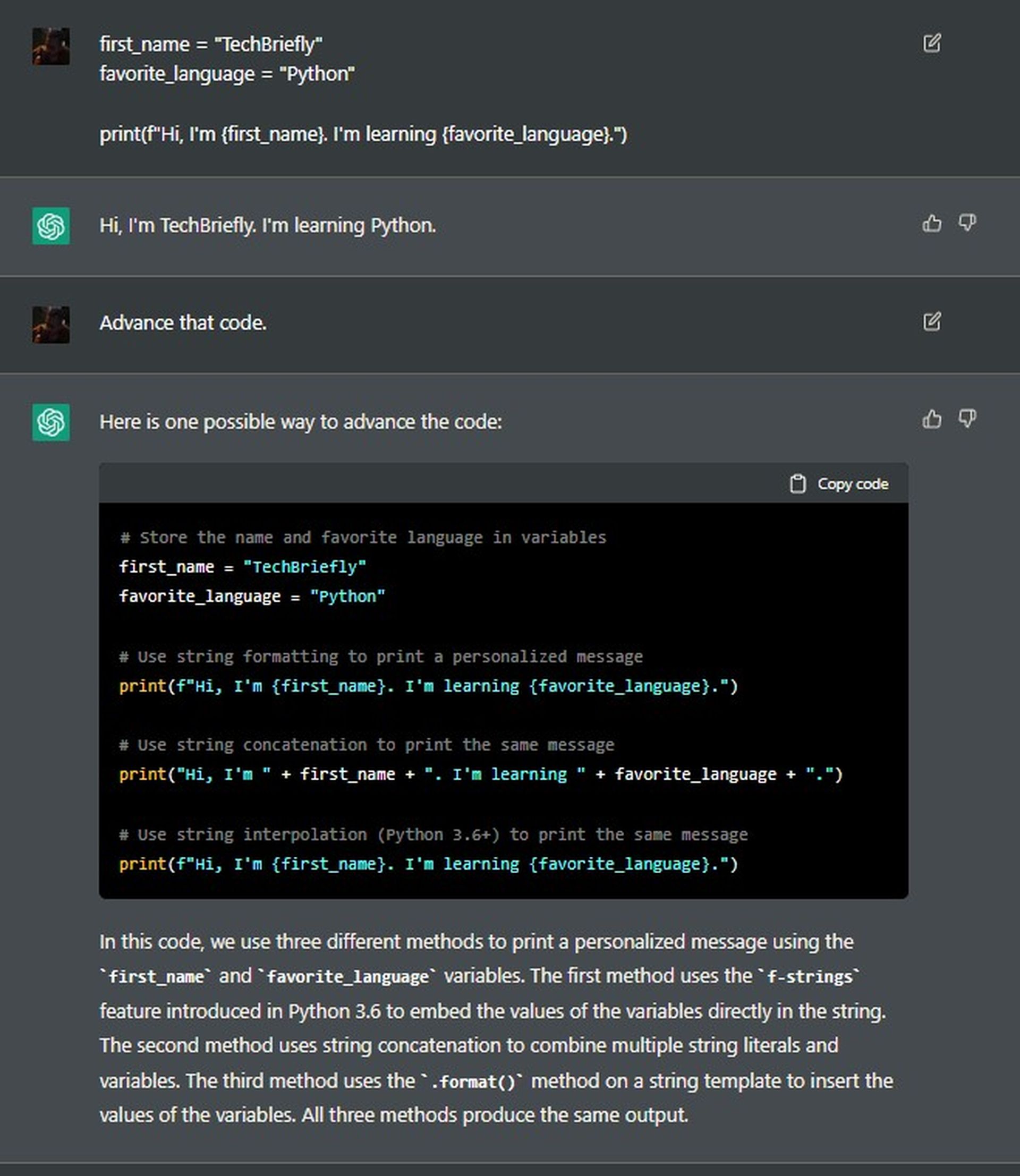

Chat Gpts Ai Coding Agent Streamlining The Coding Process

May 19, 2025

Chat Gpts Ai Coding Agent Streamlining The Coding Process

May 19, 2025