Navigate The Private Credit Market: 5 Do's & Don'ts For Job Seekers

Table of Contents

Do's: Maximize Your Chances in the Private Credit Job Market

Do Your Research: Understand the Landscape

Before launching your job search, thorough research is paramount. The private credit industry encompasses various firms with diverse investment strategies and cultural nuances.

- Explore different firm types: Familiarize yourself with private equity firms, hedge funds specializing in private credit, and dedicated private debt funds. Each has unique investment focuses and operational structures.

- Understand the various roles: From entry-level Analyst positions requiring strong analytical and modeling skills to senior Portfolio Manager roles demanding extensive experience and leadership abilities, understand the career progression within the private credit market. Research specific job titles like "Private Credit Analyst," "Senior Associate, Private Debt," or "Private Credit Portfolio Manager."

- Identify your target firms: Don't apply randomly. Research firms whose investment strategies align with your interests and whose company culture resonates with your professional goals. Use keywords like "private credit investment strategies," "private debt fund roles," and "private equity job search" to refine your search.

- Analyze industry trends: Stay updated on current market conditions, regulatory changes, and emerging investment themes within private credit. This demonstrates your commitment and knowledge to potential employers.

Network Strategically: Build Connections

Networking is crucial in the private credit market. Building relationships with professionals in the field can significantly increase your chances of finding opportunities.

- Attend industry events: Conferences and networking events provide excellent platforms to meet recruiters, hiring managers, and professionals working in private credit. Search for events using keywords like "private credit networking events" and "private credit conferences."

- Leverage LinkedIn: Optimize your LinkedIn profile with relevant keywords like "private credit," "credit analysis," and "financial modeling." Actively connect with professionals in the industry, participate in relevant groups, and engage in discussions. Utilize keywords like "private credit LinkedIn groups" to find relevant communities.

- Conduct informational interviews: Reach out to individuals working in roles you aspire to and request informational interviews. These conversations can provide invaluable insights into the industry, specific firms, and potential job openings.

- Alumni networks: If you attended a reputable business school, leverage your alumni network to connect with those working in the private credit market.

Tailor Your Resume and Cover Letter: Highlight Relevant Skills

Generic applications rarely succeed in a competitive field like private credit. Your application materials must showcase your qualifications for each specific role.

- Quantify your achievements: Use numbers to demonstrate your impact in previous roles. For instance, instead of saying "Improved efficiency," say "Improved efficiency by 15% through process optimization."

- Highlight relevant skills: Emphasize skills such as financial modeling, valuation (DCF, LBO), credit analysis, debt structuring, and due diligence. Incorporate keywords found in job descriptions, such as "credit underwriting," "LBO modeling," "debt financing," and "private credit portfolio management."

- Customize for each application: Your resume and cover letter should be tailored to reflect the specific requirements and preferences of each firm and role. Show that you understand their investment strategy and recent activities.

Don'ts: Avoid These Common Mistakes

Don't Neglect the Fundamentals: Master Core Financial Skills

A strong foundation in finance is non-negotiable.

- Master core concepts: Ensure you possess a solid understanding of financial accounting, corporate finance, and valuation principles.

- Develop proficiency in financial modeling software: Excel proficiency, including advanced modeling techniques, is crucial for most private credit roles. Consider learning specialized software as well.

- Consider relevant certifications: The CFA charter or CAIA designation can significantly enhance your credentials and demonstrate your commitment to the field.

Don't Underestimate the Importance of Soft Skills

Technical skills alone aren't enough. Employers value soft skills equally.

- Highlight communication skills: Demonstrate your ability to communicate complex financial information clearly and concisely, both verbally and in writing.

- Emphasize teamwork and problem-solving: Private credit requires collaboration and the ability to navigate challenging situations effectively.

- Showcase adaptability and resilience: The market is dynamic; highlight your ability to learn quickly and adapt to changing circumstances.

Don't Send Generic Applications: Personalize Your Approach

A generic application shows a lack of interest and effort.

- Tailor your materials: Customize your resume and cover letter to each specific role and firm, showing you've researched their investment strategy and recent deals.

- Research the hiring manager: Understanding the hiring manager's background and experience can help you personalize your approach and demonstrate genuine interest.

- Show enthusiasm: Express your genuine interest in the specific opportunity and the firm's investment strategy.

Conclusion: Successfully Navigating the Private Credit Market

Securing a position in the private credit market requires a proactive and strategic approach. By following the "Do's" – conducting thorough research, networking effectively, and tailoring applications – and avoiding the "Don'ts" – neglecting fundamental skills, underestimating soft skills, and sending generic applications – you significantly increase your chances of success. Start your journey into the lucrative private credit market today by implementing these do's and don'ts! Remember, strategic preparation and a proactive approach are key to securing a position in this dynamic field.

Featured Posts

-

Mark Carneys White House Meeting With Trump What To Expect

May 04, 2025

Mark Carneys White House Meeting With Trump What To Expect

May 04, 2025 -

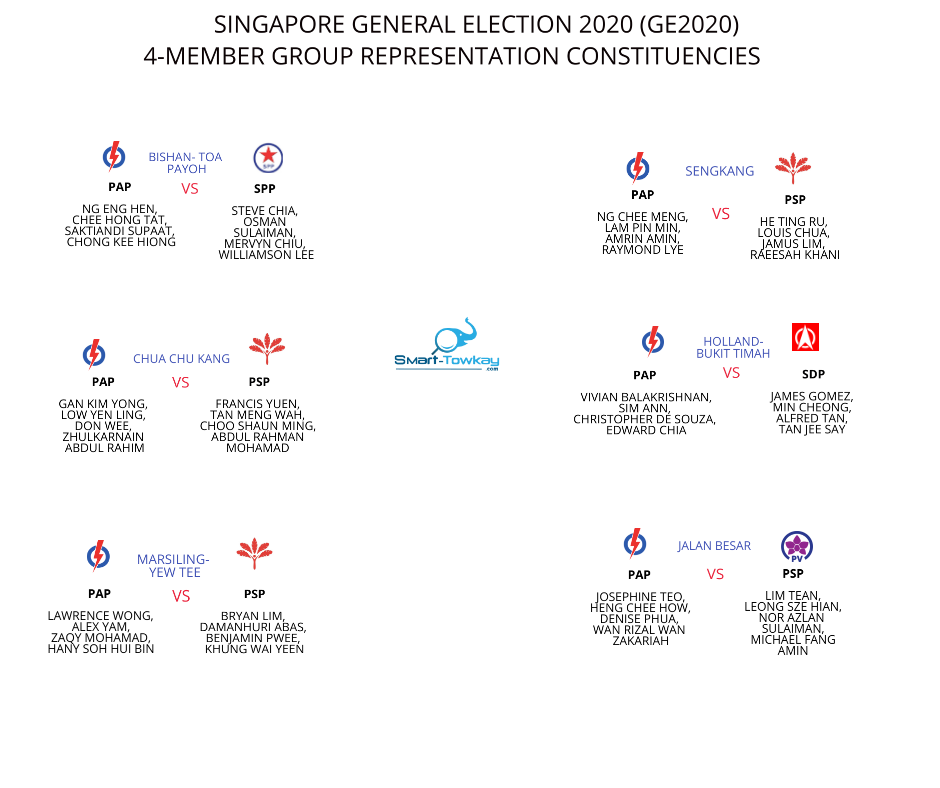

Singapore General Election A Pivotal Moment For The Nation

May 04, 2025

Singapore General Election A Pivotal Moment For The Nation

May 04, 2025 -

Thunderbolts A Deep Dive Into Marvels Latest Venture

May 04, 2025

Thunderbolts A Deep Dive Into Marvels Latest Venture

May 04, 2025 -

Nigel Farage Press Conference What I Saw And Heard

May 04, 2025

Nigel Farage Press Conference What I Saw And Heard

May 04, 2025 -

Remembering Ruth Buzzi A Legacy Of Laughter On Sesame Street And Laugh In

May 04, 2025

Remembering Ruth Buzzi A Legacy Of Laughter On Sesame Street And Laugh In

May 04, 2025

Latest Posts

-

Nhl Standings And Showdown Saturday Key Matchups To Watch

May 04, 2025

Nhl Standings And Showdown Saturday Key Matchups To Watch

May 04, 2025 -

Showdown Saturday Nhl Playoffs Crucial Games And Standings Update

May 04, 2025

Showdown Saturday Nhl Playoffs Crucial Games And Standings Update

May 04, 2025 -

Nhl Playoffs Showdown Saturday A Look At The Standings

May 04, 2025

Nhl Playoffs Showdown Saturday A Look At The Standings

May 04, 2025 -

Johnston And Rantanen Lead Avalanche To Victory Over Panthers In High Scoring Affair

May 04, 2025

Johnston And Rantanen Lead Avalanche To Victory Over Panthers In High Scoring Affair

May 04, 2025 -

Showdown Saturday A Look At The Tight Nhl Playoff Standings Race

May 04, 2025

Showdown Saturday A Look At The Tight Nhl Playoff Standings Race

May 04, 2025