Navigate The Private Credit Boom: 5 Do's And Don'ts To Land Your Dream Job

Table of Contents

Do's: Maximize Your Chances in the Private Credit Job Market

Securing a coveted private credit job requires a proactive and strategic approach. Here are five essential "do's" to significantly boost your chances:

1. Network Strategically: Build Your Private Credit Connections

Building a strong network is paramount in the private credit industry. Don't underestimate the power of personal connections.

- Attend industry conferences and networking events: Events like the SuperReturn conferences, industry-specific webinars, and local finance meetups offer unparalleled opportunities to meet professionals in private credit, private equity, and credit fund management.

- Leverage LinkedIn to connect with recruiters and hiring managers: Optimize your LinkedIn profile with relevant keywords like "private credit analyst," "credit underwriting," and "financial modeling." Actively engage with industry leaders and recruiters.

- Informational interviews are invaluable for gaining insight and making connections: Reach out to professionals in private credit for informational interviews. These conversations offer invaluable insights and can lead to unexpected opportunities. These connections may even lead you to unadvertised private credit jobs.

2. Tailor Your Resume and Cover Letter: Highlight Your Private Credit Skills

Your resume and cover letter are your first impression. Make them count.

- Quantify your achievements whenever possible: Instead of simply stating responsibilities, showcase quantifiable results. For example, "increased portfolio returns by 15%" is far more impactful than "managed portfolio investments."

- Use keywords relevant to private credit job descriptions: Carefully review job descriptions and incorporate relevant keywords like "credit analysis," "due diligence," "portfolio management," "LBO modeling," and "distressed debt" naturally into your resume and cover letter.

- Showcase your understanding of financial modeling and valuation techniques: Demonstrate your proficiency in tools like Excel, and mention specific modeling experiences, such as discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and comparable company analysis. This is critical for private credit roles.

3. Showcase Your Financial Acumen: Demonstrate Expertise in Private Credit Analysis

Private credit firms demand strong financial skills. Highlight your expertise.

- Highlight experience with financial modeling, valuation, and credit risk assessment: Demonstrate a clear understanding of these core competencies through concrete examples in your resume and during interviews.

- Obtain relevant certifications: Consider pursuing certifications such as the Chartered Financial Analyst (CFA) charter or the Chartered Alternative Investment Analyst (CAIA) designation to bolster your credibility and enhance your private credit resume.

- Develop strong analytical and problem-solving skills: Private credit involves complex situations; showcase your ability to analyze data, identify risks, and devise effective solutions.

4. Master the Private Credit Interview Process: Prepare for Success

The interview is your chance to shine. Prepare thoroughly.

- Practice your responses to common interview questions: Practice behavioral questions ("Tell me about a time you failed") and technical questions ("Explain your understanding of covenant compliance").

- Research the firm and interviewer thoroughly: Demonstrate your genuine interest by showcasing your knowledge of the firm's investment strategy, portfolio, and recent transactions.

- Demonstrate your enthusiasm for the private credit industry: Convey your passion for the field and your understanding of its unique challenges and opportunities.

- Ask insightful questions to show your engagement: Prepare thoughtful questions about the firm's culture, investment strategy, and future plans to showcase your genuine interest.

5. Leverage Your Online Presence: Build Your Private Credit Brand

Your online presence matters. Present a professional image.

- Optimize your LinkedIn profile with relevant keywords and experience: Use keywords related to private credit and your specific skill set. Make your profile comprehensive and visually appealing.

- Maintain a professional online presence across all platforms: Ensure your social media profiles reflect your professional image.

- Consider starting a blog or contributing to industry publications to showcase expertise: This is a powerful way to demonstrate your knowledge and build your brand within the private credit community.

Don'ts: Avoid These Common Mistakes in Your Private Credit Job Search

Avoiding common pitfalls is just as crucial as following best practices.

1. Don't Neglect Your Networking: Go Beyond Online Applications

Relying solely on online job boards is a recipe for limited success.

- Actively seek out networking opportunities: Attend industry events, connect with alumni, and leverage your existing network.

- Build genuine relationships with industry professionals: Networking is about building long-term relationships, not just collecting contacts.

2. Don't Submit Generic Applications: Tailor Your Materials

Generic applications show a lack of effort and interest.

- Research the company and the role thoroughly: Demonstrate your understanding of their investment strategy and target market.

- Highlight skills and experiences relevant to the specific job description: Customize your resume and cover letter to each application.

3. Don't Underestimate the Importance of Soft Skills: Communication is Key

Technical skills are essential, but soft skills are equally crucial.

- Practice your communication skills: Your ability to communicate effectively, both verbally and in writing, is critical.

- Highlight collaborative experiences in your resume and interviews: Showcase your teamwork and interpersonal abilities.

4. Don't Be Afraid to Negotiate: Know Your Worth

Negotiating your salary and benefits is a crucial part of the job search process.

- Research salary ranges for similar roles: Understand your market value before entering negotiations.

- Prepare your negotiation strategy beforehand: Know your minimum acceptable salary and benefits package.

5. Don't Give Up: Persistence Pays Off

The job search can be challenging, but persistence is key.

- Stay positive and persistent in your job search: Don't let rejections discourage you.

- Learn from rejections and continue to improve your application materials and interview skills: Analyze your performance and make necessary adjustments.

Conclusion: Launch Your Private Credit Career Today

The private credit boom presents incredible opportunities for ambitious professionals. By following these do's and don'ts, you can significantly improve your chances of landing your dream job in this dynamic field. Remember to network strategically, tailor your applications, showcase your financial expertise, master the interview process, and maintain a strong online presence. Don't be afraid to negotiate and stay persistent in your job search. Successfully navigating the private credit job market takes effort and preparation, but the rewards are well worth it. Start building your career in private credit today!

Featured Posts

-

Loyle Carner 3 Arena Dublin Concert Announced

May 03, 2025

Loyle Carner 3 Arena Dublin Concert Announced

May 03, 2025 -

Gabon Macron Annonce La Fin De L Ere Francafrique

May 03, 2025

Gabon Macron Annonce La Fin De L Ere Francafrique

May 03, 2025 -

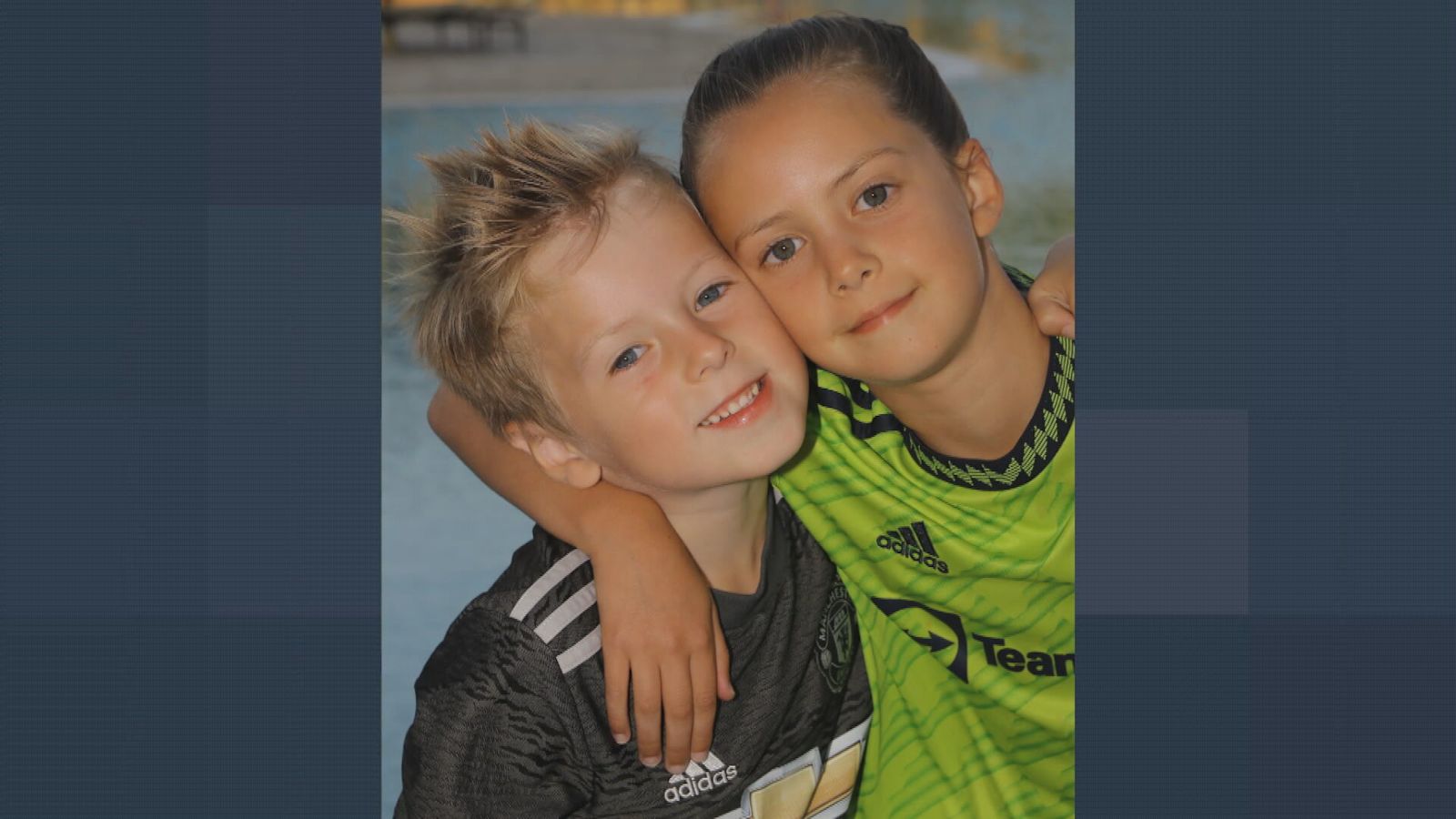

Kendal Community Rallies Poppy Atkinson Fundraiser Surpasses Goal

May 03, 2025

Kendal Community Rallies Poppy Atkinson Fundraiser Surpasses Goal

May 03, 2025 -

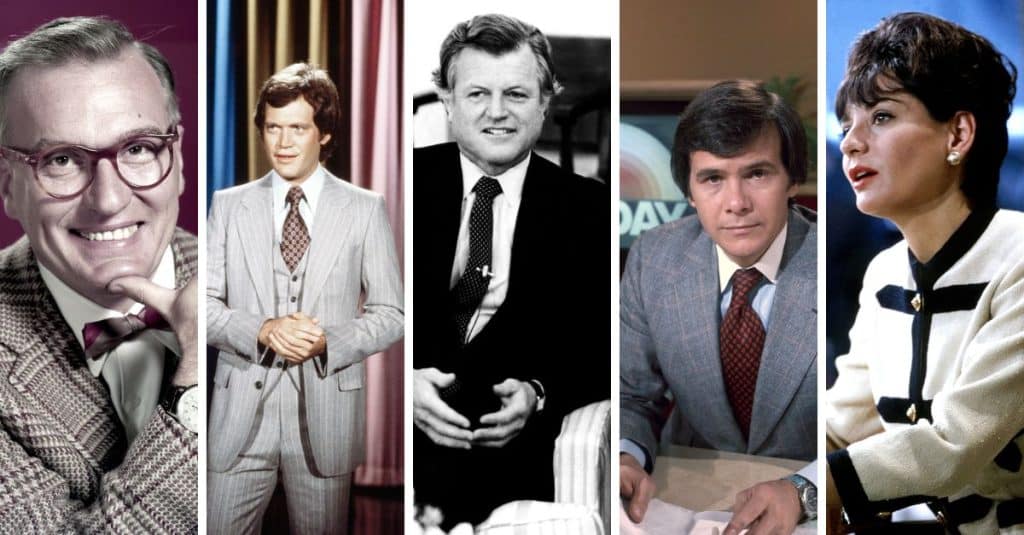

Talk Tv Show In Chaos After Presenters Sudden Withdrawal

May 03, 2025

Talk Tv Show In Chaos After Presenters Sudden Withdrawal

May 03, 2025 -

Nat West Reaches Settlement With Nigel Farage Over Account Closure

May 03, 2025

Nat West Reaches Settlement With Nigel Farage Over Account Closure

May 03, 2025