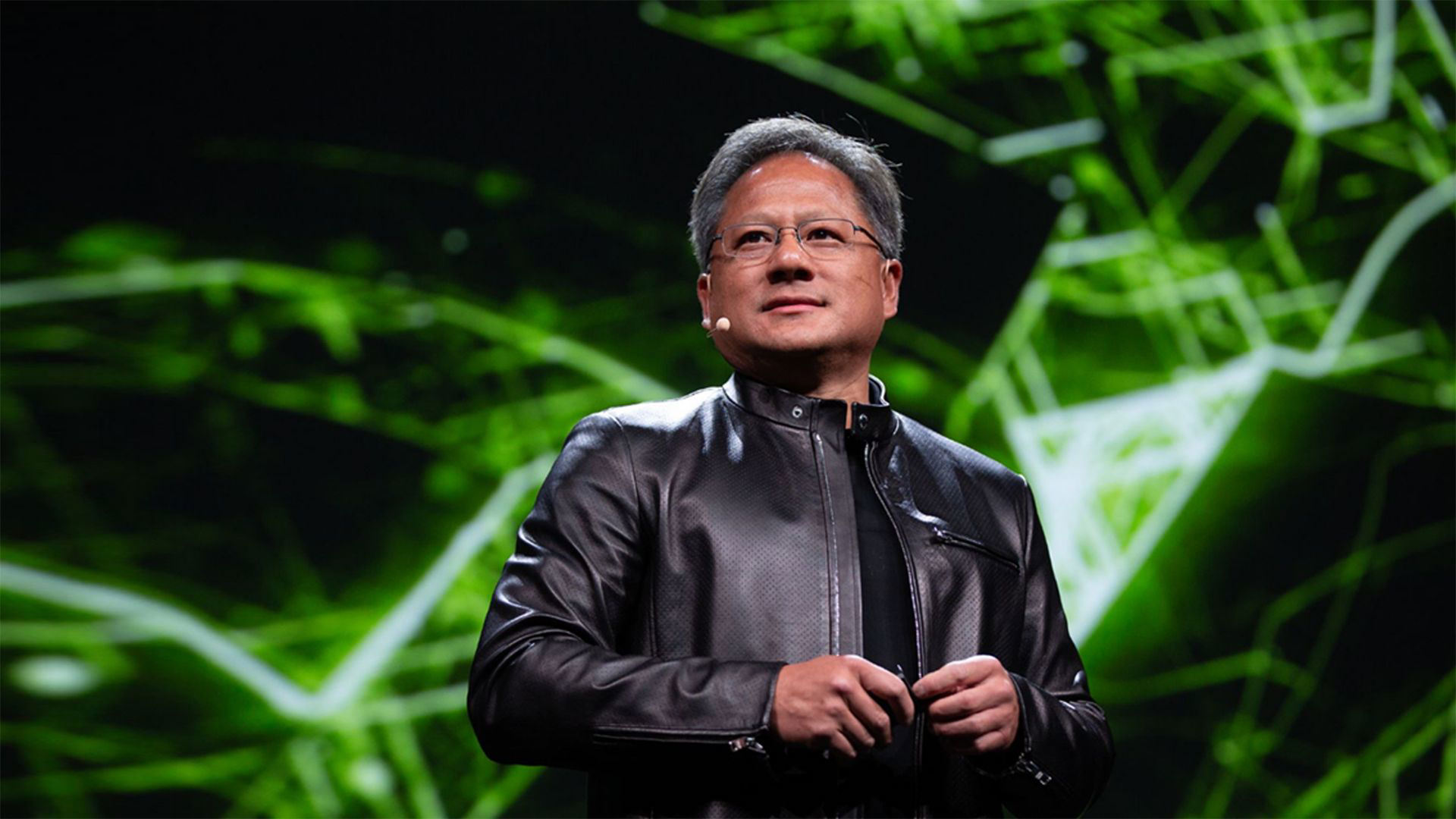

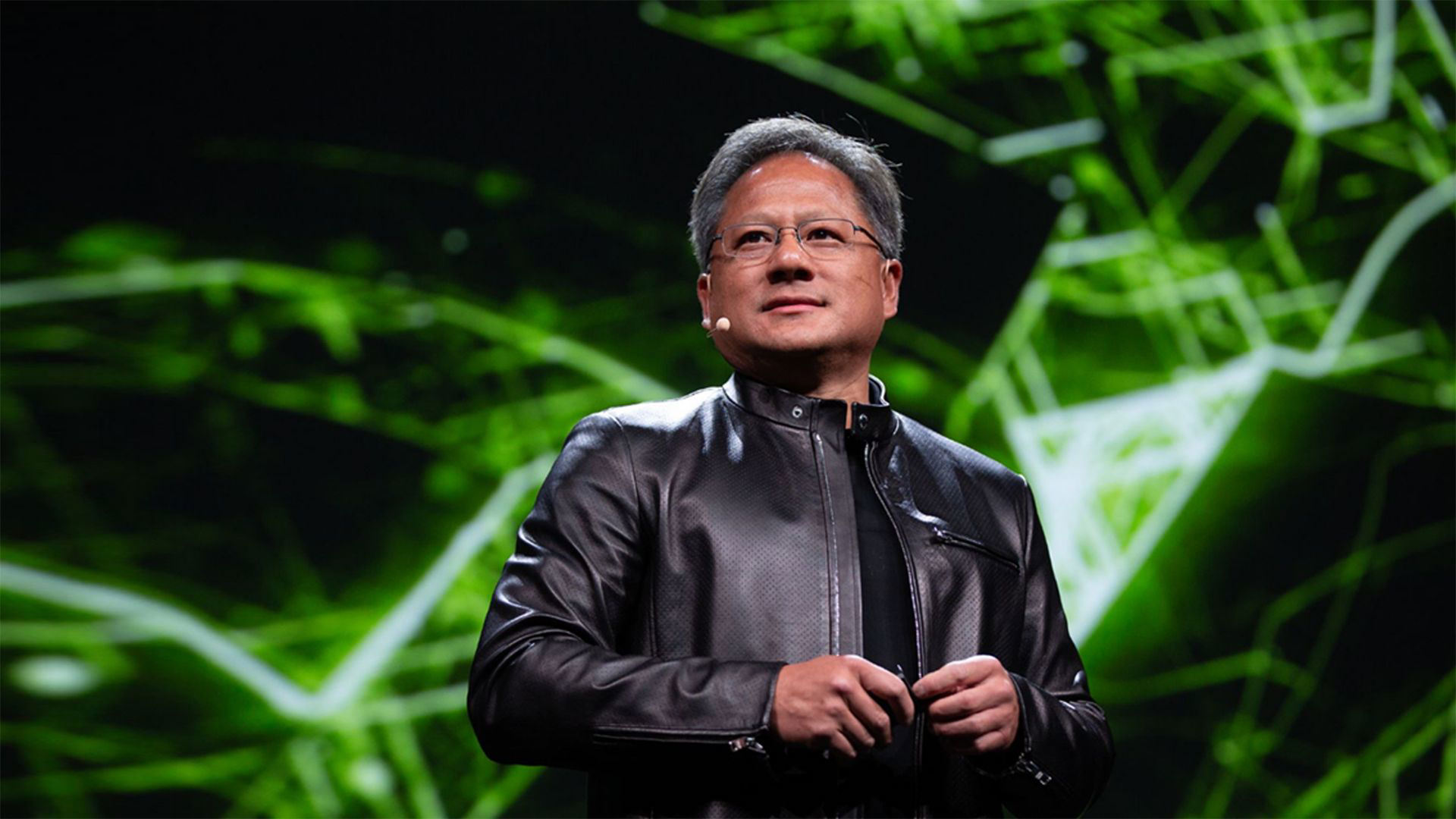

More Than Just China: Examining The Full Scope Of Nvidia's Geopolitical Risks

Table of Contents

The China Factor: Beyond Sales Figures

China represents a substantial market for Nvidia's products, but the relationship is fraught with complexity. The burgeoning US-China technological rivalry introduces significant uncertainty for Nvidia's operations and future growth.

The Impact of US-China Tech Tensions on Nvidia's Revenue

- Export controls on AI chips: Regulations restricting the export of advanced AI chips to China directly impact Nvidia's sales in this crucial market. These restrictions limit the availability of Nvidia's high-performance GPUs, crucial for AI development and high-performance computing.

- Workarounds and mitigation: Nvidia is actively exploring strategies to navigate these restrictions, including potentially designing chips specifically for the Chinese market that comply with export regulations, or focusing more on software solutions.

- Diversification of manufacturing and sales: To mitigate over-reliance on China, Nvidia is likely to explore expanding its manufacturing capacity and sales in other regions, such as Southeast Asia, Europe, and North America.

China's Domestic Semiconductor Development and Competition

- Rise of Chinese semiconductor companies: The rapid advancement of Chinese semiconductor companies poses a growing challenge to Nvidia's market share. These companies are increasingly developing competitive technologies, potentially impacting Nvidia's future revenue streams.

- Maintaining a competitive edge: Nvidia needs to leverage its technological leadership, intellectual property, and established brand recognition to maintain its competitive advantage. Strategic partnerships and a focus on innovation will be crucial. This might involve further R&D investment focusing on areas where Chinese companies lag behind.

The US Regulatory Landscape: Navigating Domestic Scrutiny

While a significant market, the US also presents a complex regulatory environment for Nvidia. Domestic scrutiny adds another layer to the company's geopolitical risk profile.

The Impact of US Export Controls and Sanctions on Nvidia's Operations

- Restrictions on technology exports: US export controls and sanctions can restrict Nvidia's ability to supply certain technologies to various countries, impacting its global sales and partnerships. This includes limitations on the export of specific chips or technologies related to military or other sensitive applications.

- Increased scrutiny and R&D implications: The ongoing scrutiny of US-China tech relations could lead to increased regulatory hurdles, impacting Nvidia's research and development efforts and the pace of innovation.

Competition Policy and Antitrust Concerns

- Antitrust investigations and mergers: Nvidia's large market share makes it a target for antitrust investigations, potentially impacting its mergers and acquisition strategy. Acquisitions, while potentially beneficial for growth, could face intense regulatory scrutiny.

- Regulatory hurdles for future growth: Potential regulatory roadblocks could hinder Nvidia's ability to expand its market dominance through acquisitions or expansion into new market segments.

Europe and the Rest of the World: Diversification and Emerging Risks

Nvidia's global presence exposes it to geopolitical risks beyond China and the US. Diversification is key to mitigating these risks.

Geopolitical Instability in Key Markets

- Political instability and trade wars: Political instability, trade wars, and sanctions in various regions can disrupt Nvidia's supply chains and market access. Examples include tensions in the Middle East, sanctions against Russia, or trade disputes with other nations.

- Robust risk mitigation strategies: Nvidia requires robust risk mitigation strategies that include diversified supply chains and a focus on markets less prone to sudden geopolitical shifts.

Data Privacy Regulations and Their Impact

- GDPR and other regulations: The General Data Protection Regulation (GDPR) in Europe and similar data privacy regulations worldwide impact Nvidia's data center business, requiring compliance with varying international standards.

- Compliance with global regulatory frameworks: Navigating the diverse landscape of data privacy regulations across the globe demands significant investment in compliance and legal expertise.

Supply Chain Vulnerabilities: Ensuring Resilience

Nvidia's supply chain is vulnerable to various geopolitical factors, highlighting the need for resilience.

Geopolitical Factors Affecting Semiconductor Manufacturing

- Disruptions to the supply chain: Natural disasters, pandemics, and political tensions can cause major disruptions to Nvidia's supply chain, which relies on a global network of suppliers. The concentration of manufacturing in specific regions exacerbates these risks.

- Diversification of suppliers and locations: Nvidia must prioritize diversification of its supplier base and geographic locations to minimize the impact of supply chain disruptions.

The Importance of Resource Security

- Reliance on rare earth minerals: Semiconductor production relies heavily on rare earth minerals and other resources, the sourcing of which is subject to geopolitical risks. Disruptions in the supply of these materials could severely impact production.

- Ensuring secure access to critical resources: Nvidia must actively engage in strategies to ensure reliable and secure access to critical resources, potentially through partnerships, diversification of suppliers, or investment in resource exploration and extraction.

Conclusion: Understanding and Mitigating Nvidia's Geopolitical Risks

Nvidia's geopolitical risks are multifaceted, extending far beyond its relationship with China. The company faces challenges related to US regulations, international trade tensions, supply chain vulnerabilities, and data privacy concerns. Understanding these risks and proactively developing robust mitigation strategies are critical for Nvidia's continued success. The key takeaways highlight the need for diversification, regulatory compliance, supply chain resilience, and a proactive approach to navigating the complex geopolitical landscape. Stay informed about the evolving landscape of Nvidia's geopolitical risks to understand the future of this vital technology company.

Featured Posts

-

Pamietaj O Zwierzetach Bezdomnych 4 Kwietnia

May 01, 2025

Pamietaj O Zwierzetach Bezdomnych 4 Kwietnia

May 01, 2025 -

Duurzame Scholen En De Realiteit Van Stroomuitval De Rol Van De Generator

May 01, 2025

Duurzame Scholen En De Realiteit Van Stroomuitval De Rol Van De Generator

May 01, 2025 -

Wildfire Woes Examining The Market For Los Angeles Wildfire Bets

May 01, 2025

Wildfire Woes Examining The Market For Los Angeles Wildfire Bets

May 01, 2025 -

Open Ais Chat Gpt Revolutionizing Online Shopping And Competing With Google

May 01, 2025

Open Ais Chat Gpt Revolutionizing Online Shopping And Competing With Google

May 01, 2025 -

Voordelig Elektrisch Rijden Enexis Oplaadtips Voor Noord Nederland

May 01, 2025

Voordelig Elektrisch Rijden Enexis Oplaadtips Voor Noord Nederland

May 01, 2025

Latest Posts

-

Zakharova O Rekorde Ovechkina Kommentariy Predstavitelya Mid Rf

May 01, 2025

Zakharova O Rekorde Ovechkina Kommentariy Predstavitelya Mid Rf

May 01, 2025 -

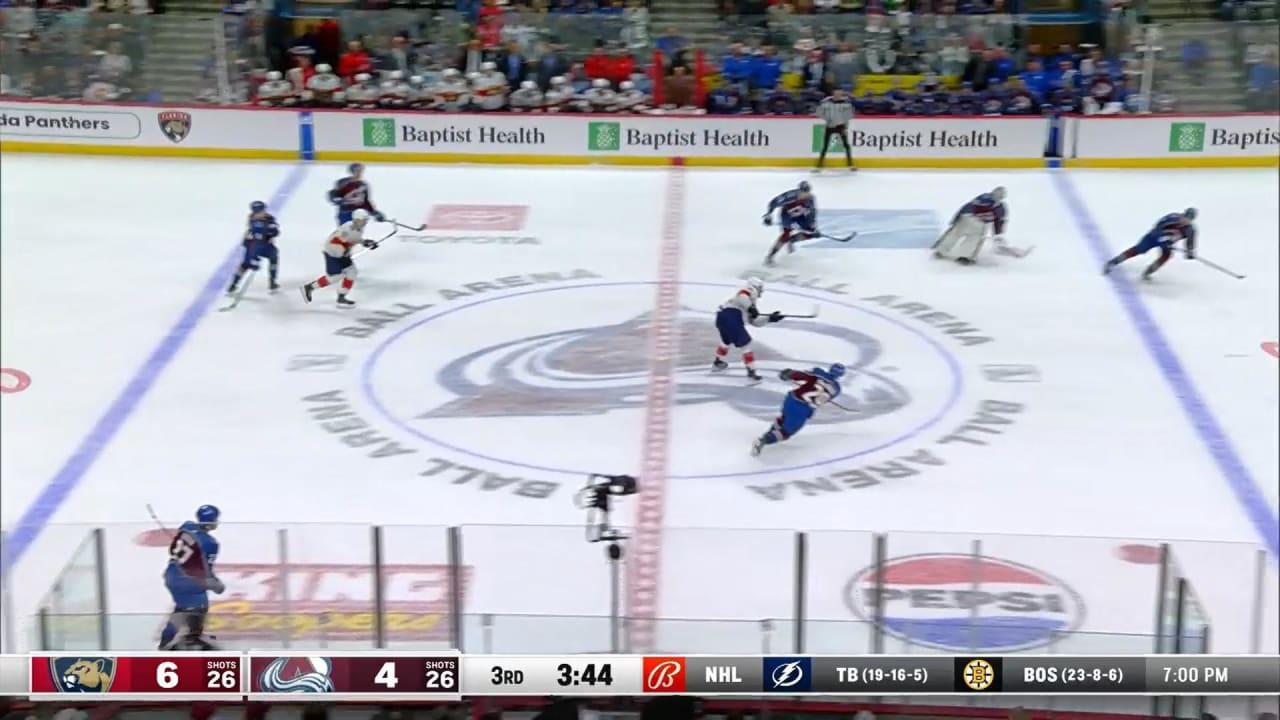

Tkachuk And Panthers Dominate Second Defeat Senators

May 01, 2025

Tkachuk And Panthers Dominate Second Defeat Senators

May 01, 2025 -

Panthers Explosive Second Period Sinks Senators Tkachuk Leads The Charge

May 01, 2025

Panthers Explosive Second Period Sinks Senators Tkachuk Leads The Charge

May 01, 2025 -

Johnstons Record Breaking Goal Propels Stars To Victory Over Avalanche

May 01, 2025

Johnstons Record Breaking Goal Propels Stars To Victory Over Avalanche

May 01, 2025 -

Stars Take 3 2 Series Lead With Johnstons Record Setting Playoff Goal

May 01, 2025

Stars Take 3 2 Series Lead With Johnstons Record Setting Playoff Goal

May 01, 2025