More Than A Dozen Countries Lose PwC: Impact Of Recent Scandals

Table of Contents

The Nature of the Scandals and Their Global Reach

The PwC scandals are multifaceted, encompassing a range of issues that have eroded public trust and damaged the firm's reputation globally. These include: data breaches compromising sensitive client information, accusations of audit failures resulting in misstated financial reports, and allegations of conflicts of interest that undermined the independence and objectivity expected of auditors. The global reach of these scandals is undeniable.

-

Countries Significantly Affected: The impact has been felt across numerous jurisdictions. For example, [insert specific examples of lost contracts or severed relationships in at least three countries, citing reputable news sources]. The varying nature of the scandals across these regions highlights the need for a global, coordinated approach to regulatory oversight.

-

Keywords: PwC scandal, audit failure, reputational damage, global impact, regulatory scrutiny, data breach, conflict of interest.

The varying severity and nature of the scandals across different jurisdictions highlight the complexities of international regulatory frameworks and the challenges in enforcing consistent standards of ethical conduct.

Impact on PwC's Reputation and Market Share

The fallout from these scandals has been swift and significant. PwC's reputation has suffered considerable damage, leading to a decline in client trust and increased scrutiny from regulators worldwide. This translates directly into tangible losses:

-

Brand Damage & Market Share Decline: [Insert data on potential market share loss, citing reputable industry reports or financial news sources]. This decline isn't limited to large corporations; smaller businesses are also reconsidering their relationships with PwC.

-

Employee Morale and Recruitment: The scandals have undoubtedly impacted employee morale and recruitment efforts. The loss of contracts and the negative publicity create an uncertain environment, making it difficult to attract and retain top talent.

-

Keywords: Brand damage, market share decline, client trust, employee morale, competitive landscape, reputational risk.

Regulatory Responses and Future Implications

The regulatory response to the PwC scandals has been significant and varied across different jurisdictions. Investigations are ongoing, and penalties are likely.

-

Investigations and Actions: [Include details about specific regulatory investigations and actions taken in different countries, citing reliable sources like government websites or official press releases]. This includes potential fines, sanctions, and changes in auditing regulations.

-

Long-Term Implications: The long-term implications for PwC and the broader accounting industry are profound. Increased regulatory scrutiny, stricter compliance requirements, and a potential shift in market share towards smaller competitors are all foreseeable outcomes.

-

Keywords: Regulatory investigations, fines and penalties, auditing regulations, industry reform, corporate governance, increased oversight.

Increased Scrutiny of Big Four Accounting Firms

The PwC scandals have cast a shadow over all four major accounting firms. The heightened scrutiny they now face is forcing a re-evaluation of industry practices and the need for greater transparency and accountability. This intensified scrutiny might lead to:

- Increased Competition: Smaller accounting firms could see an opportunity to gain market share as clients seek alternatives.

- Greater Transparency and Accountability: The need for greater transparency in auditing practices and stronger corporate governance is paramount.

Conclusion

The PwC scandals represent a watershed moment for the accounting profession. More Than a Dozen Countries Lose PwC, highlighting the global reach and severe consequences of corporate misconduct. The damage to PwC's reputation, the regulatory responses, and the increased scrutiny of the Big Four firms will undoubtedly reshape the accounting landscape for years to come. The long-term implications for corporate governance, regulatory oversight, and the accounting industry as a whole cannot be overstated. Stay informed about developments related to PwC scandals and accounting industry reforms by following reputable news sources and industry publications. Further reading on corporate governance and auditing best practices is crucial to understanding and addressing the systemic issues revealed by these events.

Featured Posts

-

The Supreme Court Ruling And Its Impact On Gender Identity Politics

Apr 29, 2025

The Supreme Court Ruling And Its Impact On Gender Identity Politics

Apr 29, 2025 -

Re Examining The Fly Jeff Goldblums Performance And The Academys Oversight

Apr 29, 2025

Re Examining The Fly Jeff Goldblums Performance And The Academys Oversight

Apr 29, 2025 -

Goldman Sachs Exclusive Tariff Advice Navigating Trumps Trade Policies

Apr 29, 2025

Goldman Sachs Exclusive Tariff Advice Navigating Trumps Trade Policies

Apr 29, 2025 -

Update Search Continues For Missing British Paralympian Sam Ruddock In Las Vegas

Apr 29, 2025

Update Search Continues For Missing British Paralympian Sam Ruddock In Las Vegas

Apr 29, 2025 -

Yukon Mine Manager Faces Contempt Charges After Refusal To Testify

Apr 29, 2025

Yukon Mine Manager Faces Contempt Charges After Refusal To Testify

Apr 29, 2025

Latest Posts

-

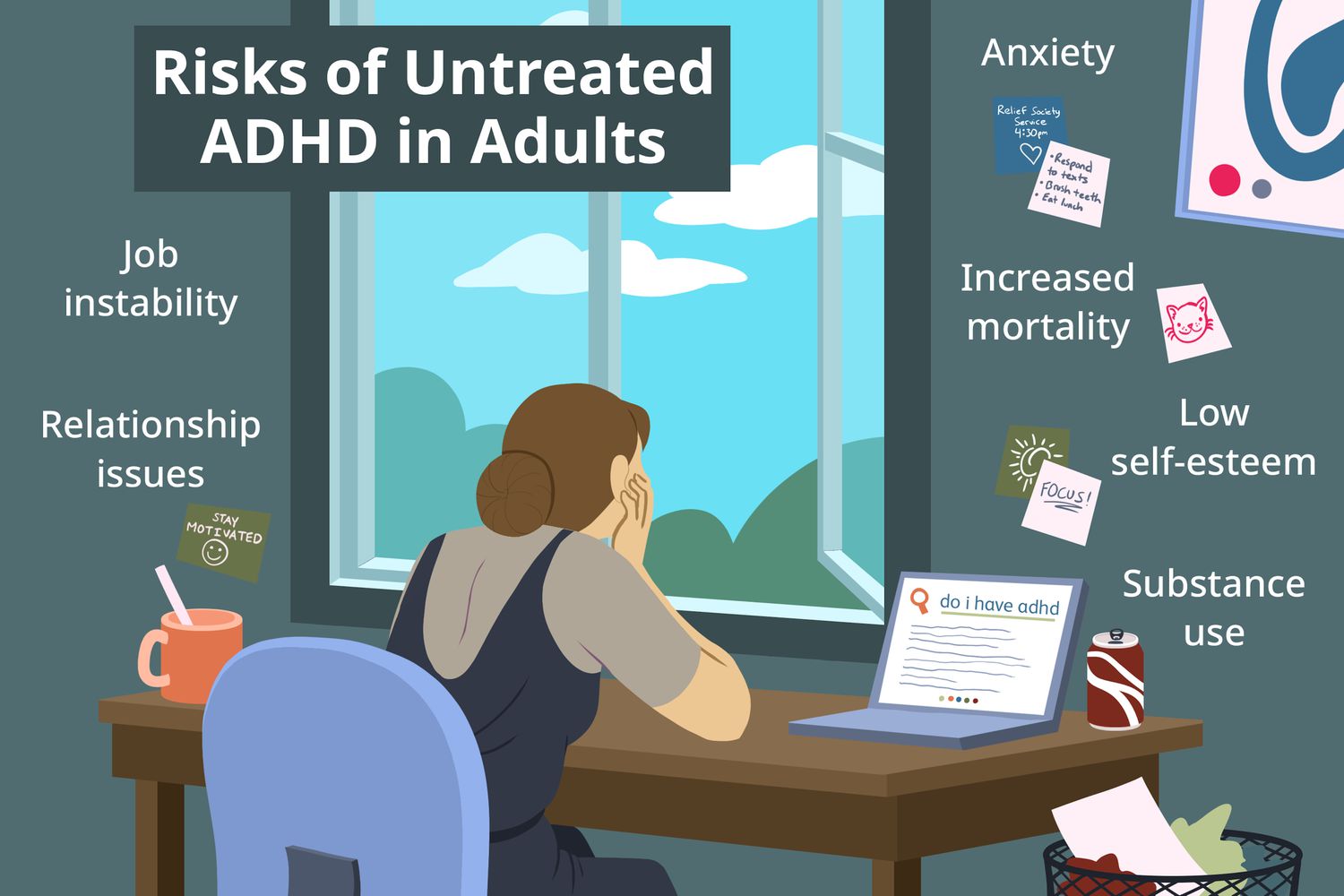

Adhd

Apr 29, 2025

Adhd

Apr 29, 2025 -

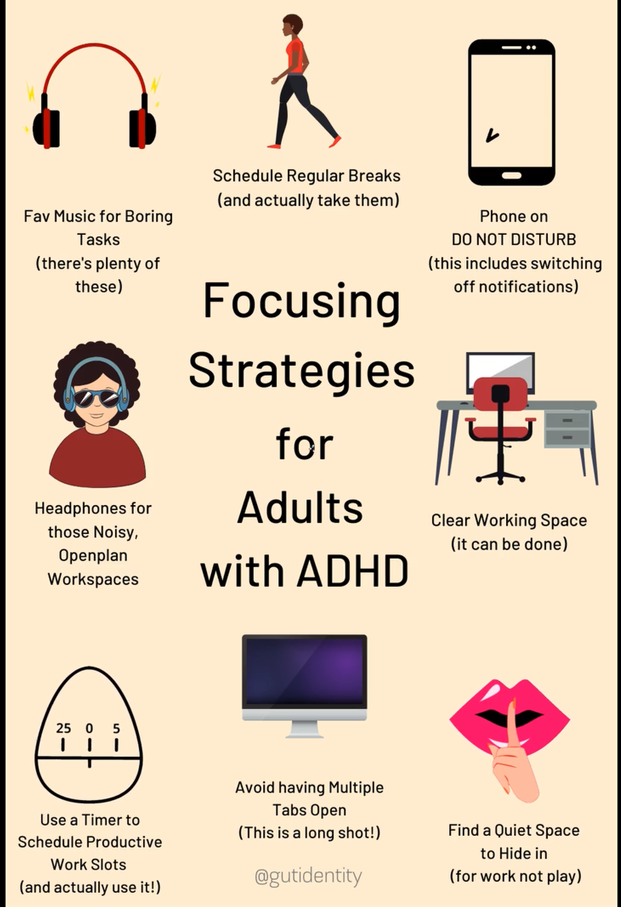

Adult Adhd From Suspicion To Support And Management

Apr 29, 2025

Adult Adhd From Suspicion To Support And Management

Apr 29, 2025 -

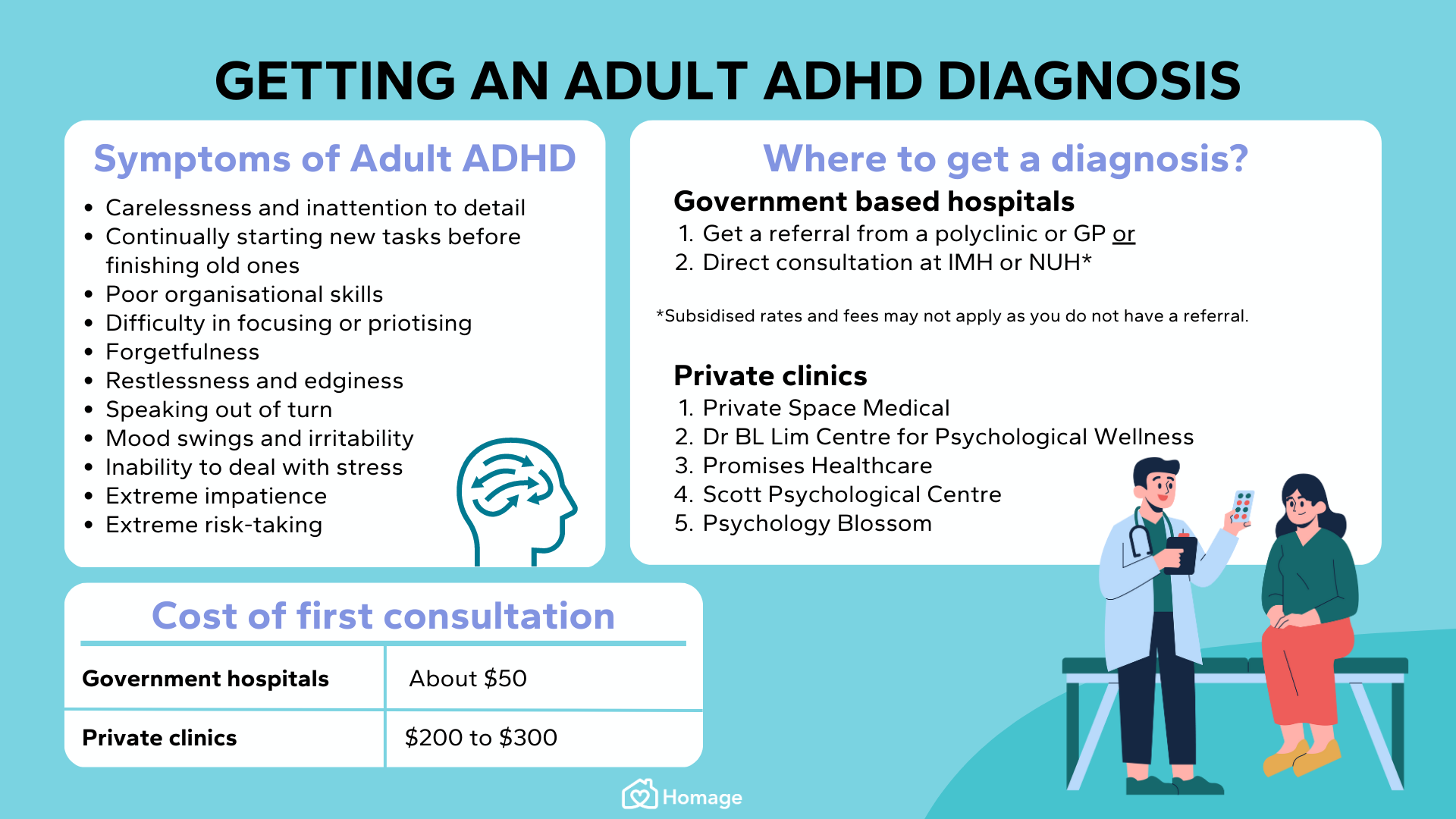

Understanding Adult Adhd Diagnosis Treatment And Support

Apr 29, 2025

Understanding Adult Adhd Diagnosis Treatment And Support

Apr 29, 2025 -

Adult Adhd Understanding Your Options After A Potential Diagnosis

Apr 29, 2025

Adult Adhd Understanding Your Options After A Potential Diagnosis

Apr 29, 2025 -

Coping With A Potential Adult Adhd Diagnosis

Apr 29, 2025

Coping With A Potential Adult Adhd Diagnosis

Apr 29, 2025