Monday's D-Wave Quantum (QBTS) Stock Decline: A Deep Dive

Table of Contents

Market Sentiment and Overall Tech Sector Performance

Monday's decline in QBTS stock wasn't isolated; it occurred within a broader context of market sentiment and tech sector performance. Analyzing the overall market conditions is crucial to understanding the specific impact on D-Wave Quantum. Did a general market downturn contribute to QBTS's decline? The answer is likely yes, at least in part.

- Specific market indices and their performance on Monday: The NASDAQ Composite, a tech-heavy index, experienced a [Insert Percentage]% decline on Monday, indicating a negative overall market sentiment affecting the technology sector. Similarly, the S&P 500, a broader market index, showed a [Insert Percentage]% decrease, highlighting a more widespread market correction.

- Comparison of QBTS performance against competitors: While QBTS experienced a significant drop, it's important to compare its performance against other companies in the quantum computing sector. Did similar declines occur for competitors like [Mention Competitor Names]? If so, it suggests a sector-wide correction rather than company-specific issues. If not, further investigation into company-specific factors is warranted.

- Relevant news impacting the tech sector: Any significant news affecting the overall technology sector, such as announcements regarding interest rate hikes, regulatory changes, or geopolitical events, can influence investor sentiment and contribute to market volatility and influence the price of QBTS stock.

Analysis of D-Wave Quantum's Recent News and Announcements

Examining D-Wave Quantum's recent news and announcements is critical to understanding the stock price movement. Any negative news or investor concerns preceding or coinciding with Monday's decline could have triggered increased selling pressure.

- Specific news items impacting investor sentiment: Were there any press releases, announcements, or reports concerning D-Wave Quantum released before or on Monday that might have negatively impacted investor confidence? This could include delays in project timelines, missed earnings expectations, or concerns about future funding.

- Analysis of any financial reports or earnings announcements: Recent financial reports and earnings announcements are key to understanding a company's financial health. Did D-Wave Quantum release any disappointing financial results that might have caused investors to sell off their shares?

- Regulatory changes impacting the company: New regulations or changes in existing regulations can significantly impact a company's operations and future prospects. Any significant regulatory changes affecting D-Wave Quantum could have contributed to the stock decline.

Technical Analysis of QBTS Stock Chart

A technical analysis of the QBTS stock chart provides further insights into the reasons behind Monday's decline. Studying key technical indicators helps identify potential factors that contributed to the price drop.

- Key technical indicators and their values: Analyzing support and resistance levels, moving averages (e.g., 50-day, 200-day), and relative strength index (RSI) can reveal potential technical factors. For example, a breakout below a key support level could indicate a significant bearish trend. [Insert Chart/Graph here].

- Interpretation of chart patterns and their implications: Identifying chart patterns such as head and shoulders, double tops, or other bearish formations can provide insights into potential future price movements. These patterns can often precede a significant price decline. [Insert Chart/Graph here].

- Discussion of trading volume and its significance: High trading volume during the decline suggests increased selling pressure, while low volume might indicate a less significant event. Examining trading volume in relation to price changes helps assess the strength of the bearish movement.

Future Outlook and Investment Implications of the D-Wave Quantum Stock Decline

Based on the analysis, what is the future outlook for D-Wave Quantum (QBTS) and what are the implications for investors? This section provides insights to help navigate the uncertainty.

- Possible scenarios for future QBTS stock price: Considering the various factors discussed, several scenarios are possible. These could range from a continued decline to a rebound, depending on the resolution of market conditions and company-specific issues.

- Recommendations for investors (buy, hold, or sell): This requires considering individual risk tolerance and investment goals. Investors with a high-risk tolerance and a long-term horizon might see the decline as a buying opportunity, while risk-averse investors might prefer to hold or even sell their shares.

- Risk assessment and mitigation strategies: Investing in quantum computing is inherently risky due to the nascent nature of the technology and the potential for significant volatility. Investors should diversify their portfolios and only invest what they can afford to lose.

Conclusion: Navigating the Future of D-Wave Quantum (QBTS) Stock

Monday's D-Wave Quantum (QBTS) stock decline was likely influenced by a combination of broader market conditions, company-specific news, and technical factors. Understanding these factors is crucial for investors to make informed decisions. The analysis highlights the importance of considering both market sentiment and company-specific news when assessing the potential for future growth or decline in the volatile quantum computing sector. Before making any investment decisions in D-Wave Quantum (QBTS) stock or other quantum computing stocks, thorough due diligence is paramount. Carefully analyze D-Wave Quantum (QBTS) stock trends, understand QBTS stock fluctuations, and conduct comprehensive research before participating in this potentially high-risk, high-reward investment landscape.

Featured Posts

-

Le 15 Avril Restrictions Pour Les Deux Roues Sur Le Boulevard Fhb Ex Vge

May 20, 2025

Le 15 Avril Restrictions Pour Les Deux Roues Sur Le Boulevard Fhb Ex Vge

May 20, 2025 -

Lou Gala And The Decameron A Detailed Analysis Of Her Success

May 20, 2025

Lou Gala And The Decameron A Detailed Analysis Of Her Success

May 20, 2025 -

Solve The Nyt Mini Crossword March 16 2025 Answers And Hints

May 20, 2025

Solve The Nyt Mini Crossword March 16 2025 Answers And Hints

May 20, 2025 -

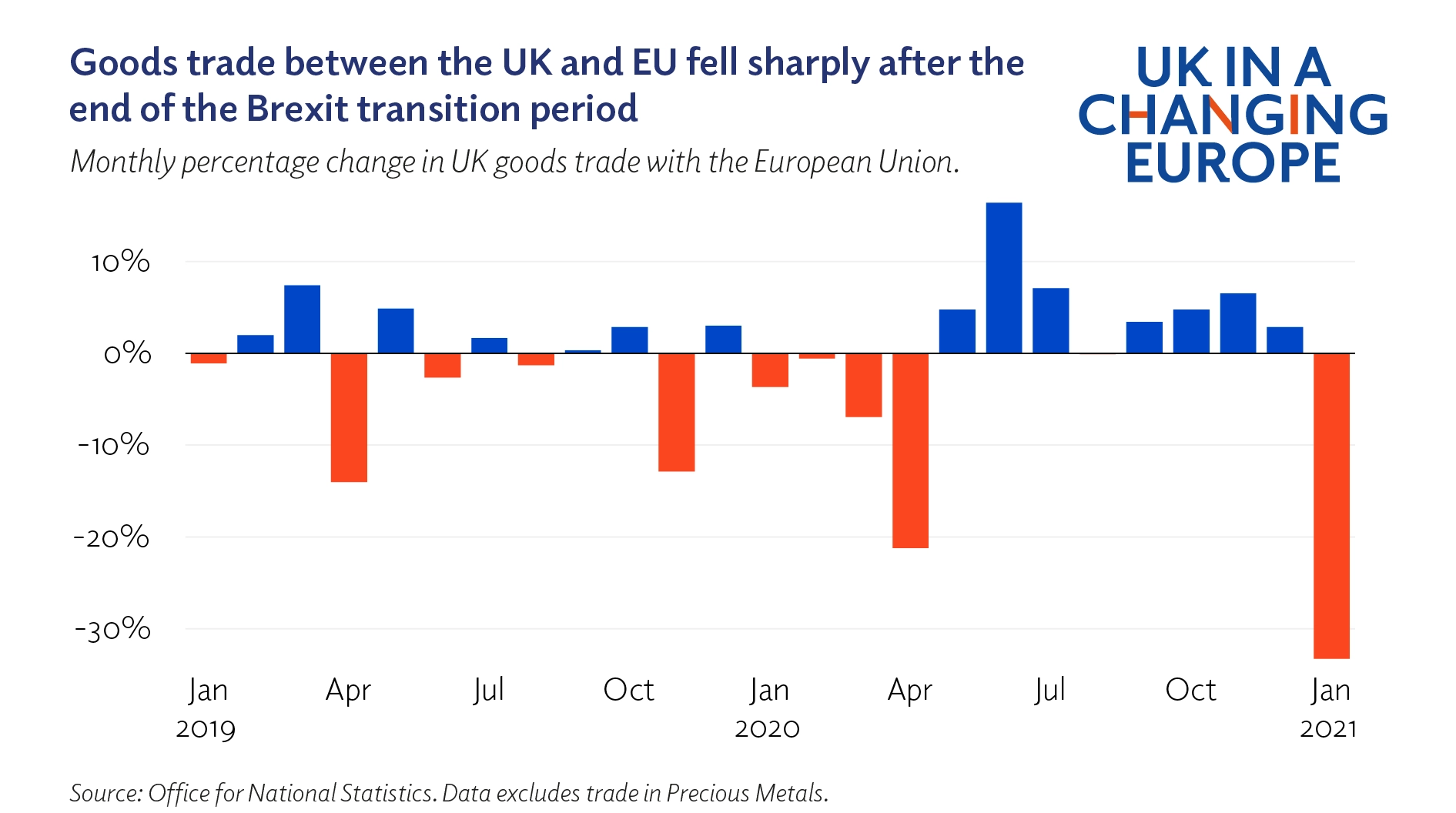

Brexit And The Uk Luxury Goods Sector An Export Analysis

May 20, 2025

Brexit And The Uk Luxury Goods Sector An Export Analysis

May 20, 2025 -

Tampoy I Martha Kai I Deyteri Eykairia Ston Gamo Tis

May 20, 2025

Tampoy I Martha Kai I Deyteri Eykairia Ston Gamo Tis

May 20, 2025

Latest Posts

-

Kaksi Suomalaista Jalkapalloilijaa Jaettaevaet Puolalaisseuran

May 20, 2025

Kaksi Suomalaista Jalkapalloilijaa Jaettaevaet Puolalaisseuran

May 20, 2025 -

Jalkapallo Kaellman Ja Hoskonen Laehtevaet Puolasta

May 20, 2025

Jalkapallo Kaellman Ja Hoskonen Laehtevaet Puolasta

May 20, 2025 -

Huuhkajataehtien Kaellmanin Ja Hoskosen Seuraura Paeaettyy Puolassa

May 20, 2025

Huuhkajataehtien Kaellmanin Ja Hoskosen Seuraura Paeaettyy Puolassa

May 20, 2025 -

Kaellman Ja Hoskonen Puolalaisura Paeaettynyt

May 20, 2025

Kaellman Ja Hoskonen Puolalaisura Paeaettynyt

May 20, 2025 -

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuran

May 20, 2025

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuran

May 20, 2025