Missed Student Loan Payments: Understanding The Credit Score Consequences

Table of Contents

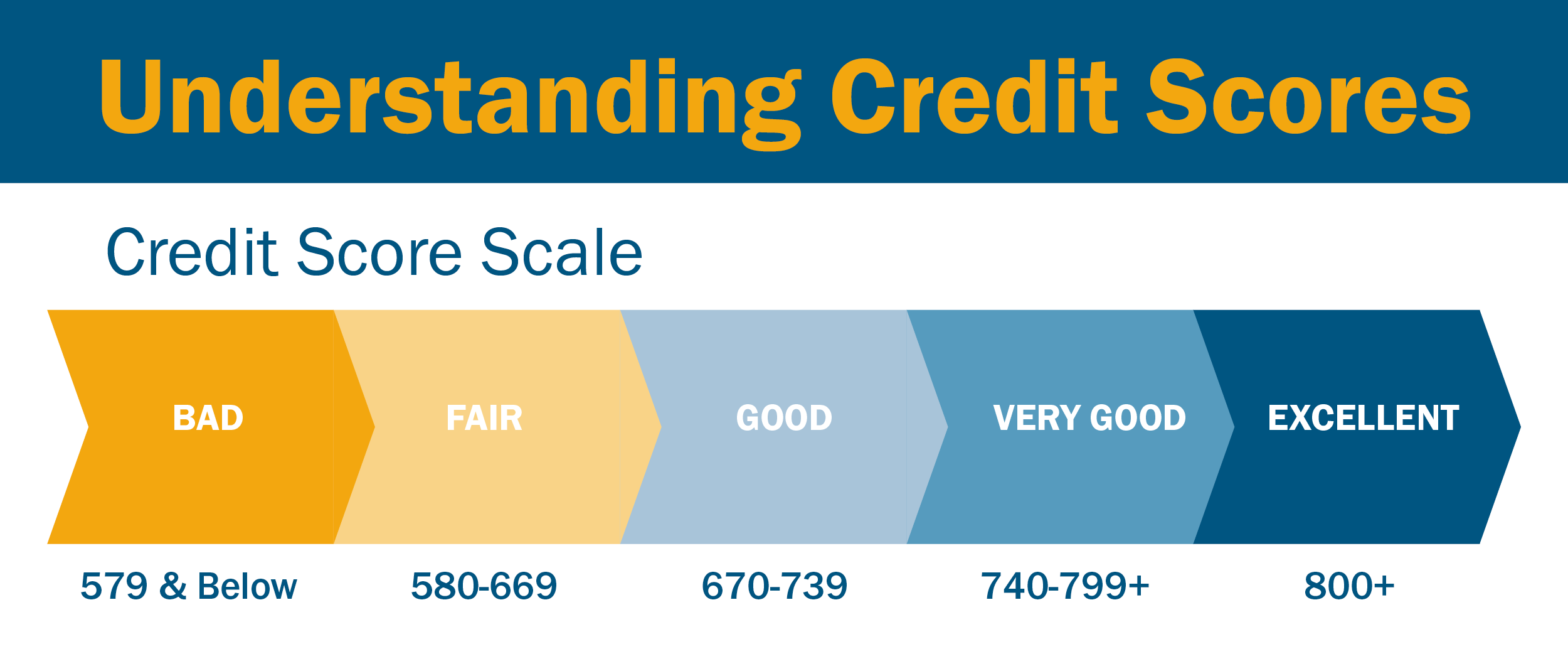

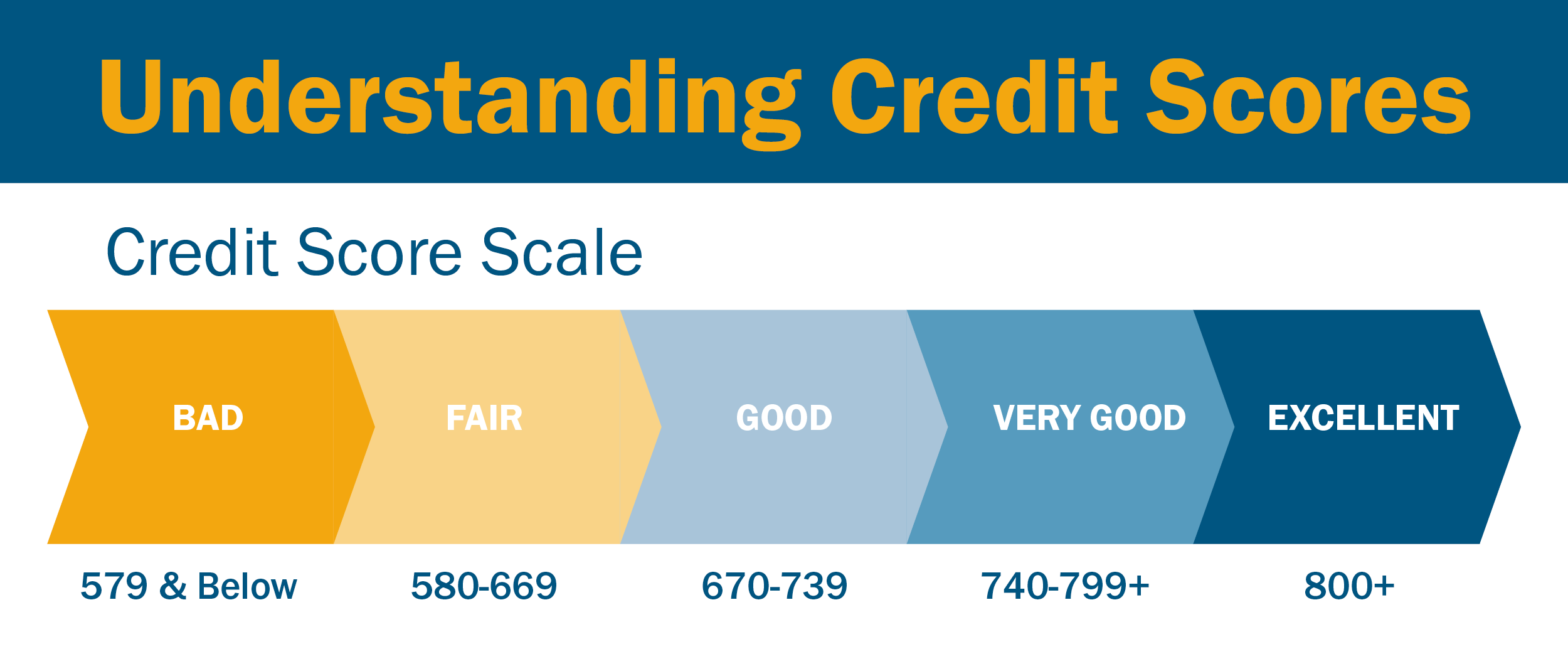

How Missed Student Loan Payments Affect Your Credit Score

Missed student loan payments immediately impact your credit score. A negative mark appears on your credit report, directly lowering your score. This negative impact is felt across all major credit scoring models, including FICO and VantageScore. These models use algorithms that heavily weigh late and missed payments.

- Negative marks remain on your credit report for 7 years. This long-lasting effect can make it difficult to secure loans, rent an apartment, or even get a job in the future.

- Late payments significantly lower your credit score. Even a single missed payment can drop your score by a substantial amount, making it harder to obtain favorable interest rates on future borrowing.

- Repeated missed payments can lead to default. Defaulting on your student loans has severe consequences, including wage garnishment and damage to your credit history for years to come.

- Impact on credit utilization ratio. While not directly related to a missed payment itself, consistent late payments often lead to higher credit utilization (the percentage of available credit you are using), negatively affecting your credit score.

Understanding the Different Stages of Delinquency

Delinquency is a term used to describe the increasing severity of late student loan payments. Understanding these stages is crucial to prevent more significant financial problems.

- 30 days late: The first stage of delinquency. While the impact on your credit score is relatively minor at this point, it's a warning sign. You may receive a notice from your lender.

- 60 days late: The impact on your credit score increases significantly. You'll likely receive more urgent calls and letters from your lender.

- 90 days late: This is considered a serious delinquency. Your credit score will take a considerable hit, and you might face collection calls.

- Default: This is the most severe stage. Defaulting on your student loans can lead to wage garnishment, tax refund offset, and even legal action. The negative impact on your credit score is severe and long-lasting.

The Long-Term Effects of Student Loan Default

Defaulting on your student loan is a serious matter with long-lasting and far-reaching consequences.

- Difficulty securing future loans: A defaulted student loan will severely damage your creditworthiness, making it nearly impossible to get a mortgage, car loan, or even a credit card for many years.

- Potential legal repercussions: The government can take legal action against you, including wage garnishment and the seizure of assets.

- Impact on employment opportunities: Some employers conduct credit checks as part of the hiring process. A poor credit history due to defaulted student loans could negatively affect your employment prospects.

Strategies to Avoid Missed Student Loan Payments

Proactive management of your student loan debt is essential to avoid missed payments and protect your credit score.

- Budgeting and financial planning: Create a realistic budget that accounts for all your expenses, including your student loan payments.

- Exploring different repayment options: Consider income-driven repayment plans, deferment, or forbearance if you're struggling to make your payments.

- Contacting your lender to discuss hardship: If you anticipate difficulty making your payments, contact your lender immediately. They may offer options to help you avoid default.

- Automating payments: Set up automatic payments to ensure you never miss a payment due to oversight.

Rebuilding Your Credit After Missed Student Loan Payments

Rebuilding your credit after missed student loan payments takes time and effort, but it's achievable.

- Monitoring your credit report regularly: Check your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) regularly for errors.

- Dispute any inaccuracies on your credit report: If you find any errors, dispute them immediately with the credit bureau.

- Using credit responsibly: Once you've addressed your missed payments, focus on responsible credit use. Pay all bills on time and keep your credit utilization low.

Conclusion

Missed student loan payments have serious and long-lasting consequences for your credit score and overall financial health. Understanding the stages of delinquency, the long-term effects of default, and the strategies for avoiding missed payments is crucial. Remember that even after experiencing missed payments, you can rebuild your credit through responsible financial management and proactive steps. Don't let missed student loan payments ruin your financial future. Take control of your student loan debt today by exploring repayment options and proactively communicating with your lender.

Featured Posts

-

Uber Mumbai Pet Travel Policy And Booking Guide

May 17, 2025

Uber Mumbai Pet Travel Policy And Booking Guide

May 17, 2025 -

Choosing The Right Bitcoin And Crypto Casino In 2025

May 17, 2025

Choosing The Right Bitcoin And Crypto Casino In 2025

May 17, 2025 -

Get More For Less Practical Tips For Finding Cheap Stuff That Doesnt Suck

May 17, 2025

Get More For Less Practical Tips For Finding Cheap Stuff That Doesnt Suck

May 17, 2025 -

Mirax Casino Review Is It Ontarios Best Online Casino In 2025

May 17, 2025

Mirax Casino Review Is It Ontarios Best Online Casino In 2025

May 17, 2025 -

Reynosa En La Olimpiada Nacional El Desempeno De David Del Valle Uribe

May 17, 2025

Reynosa En La Olimpiada Nacional El Desempeno De David Del Valle Uribe

May 17, 2025

Latest Posts

-

Nba Playoffs Magic Johnsons Take On The Knicks Pistons Matchup

May 17, 2025

Nba Playoffs Magic Johnsons Take On The Knicks Pistons Matchup

May 17, 2025 -

Knicks Vs Pistons Magic Johnsons Bold Prediction

May 17, 2025

Knicks Vs Pistons Magic Johnsons Bold Prediction

May 17, 2025 -

How To Watch The Celtics Vs Knicks Game Live Stream And Tv Channels

May 17, 2025

How To Watch The Celtics Vs Knicks Game Live Stream And Tv Channels

May 17, 2025 -

Eid Al Fitr 2025 Dubais Dxb Airport Braces For Increased Passenger Traffic

May 17, 2025

Eid Al Fitr 2025 Dubais Dxb Airport Braces For Increased Passenger Traffic

May 17, 2025 -

Emirates Id For Newborns A Guide To Fees And Application In The Uae March 2025

May 17, 2025

Emirates Id For Newborns A Guide To Fees And Application In The Uae March 2025

May 17, 2025