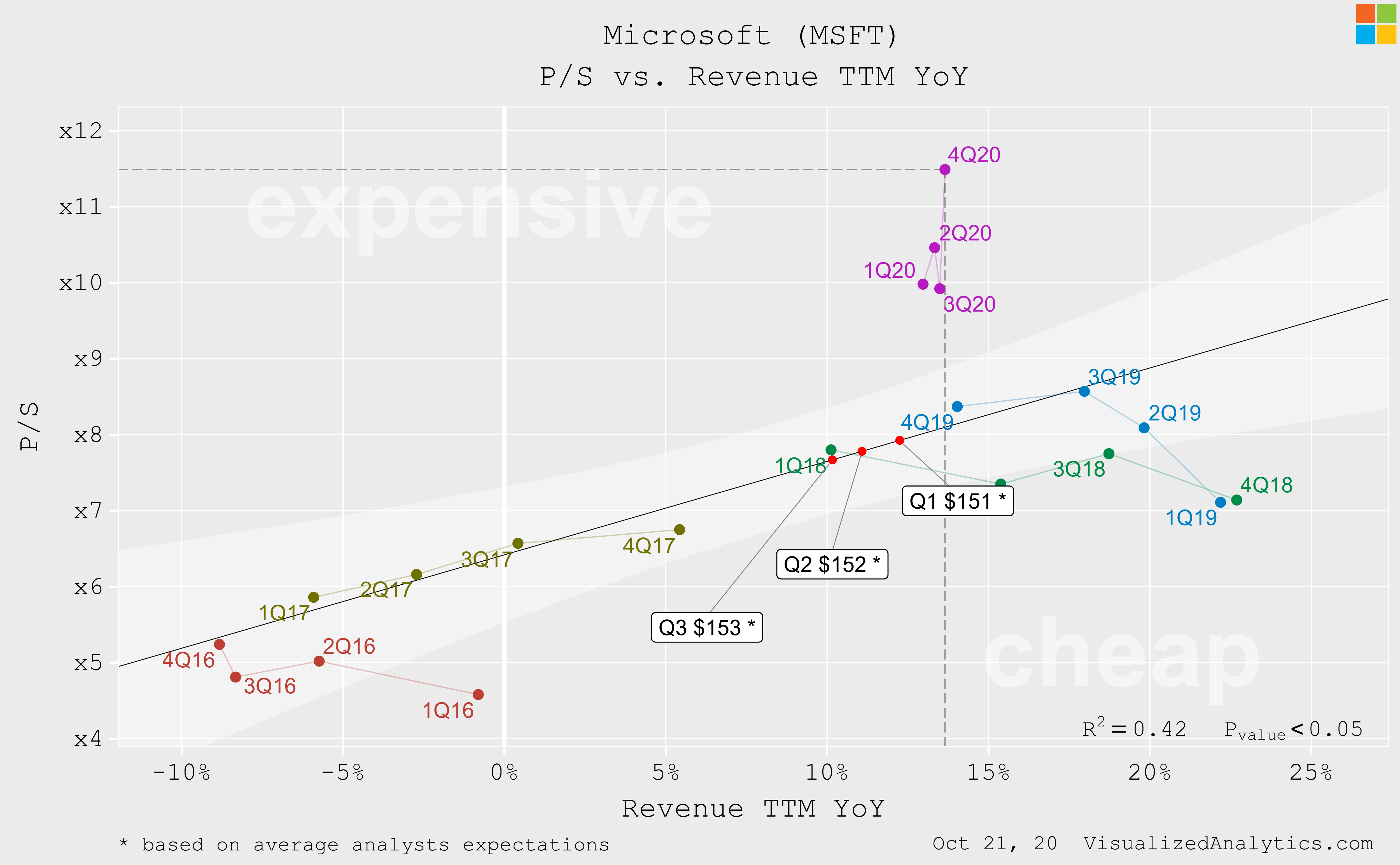

Microsoft Leads Software Stocks In Tariff-Proof Growth

Table of Contents

Microsoft's Cloud Dominance: A Key Driver of Tariff-Proof Growth

Microsoft's Azure cloud platform is a cornerstone of its tariff-proof growth strategy. Azure's rapidly expanding market share is largely due to its global infrastructure and scalable services. This contrasts sharply with companies heavily reliant on specific geographical manufacturing or distribution hubs, making them vulnerable to tariffs.

- Global Infrastructure: Azure's extensive network of data centers spans the globe, reducing reliance on any single region and mitigating the impact of localized tariff increases. This global reach ensures business continuity and minimizes disruptions from trade wars.

- Diverse Customer Base: Azure serves a vast and diverse customer base across numerous industries and geographical locations. This diversification minimizes the impact of any single market's tariff changes on overall revenue. The effect of a tariff on one customer is negligible compared to the overall revenue stream.

- Recurring Revenue Model: The subscription-based nature of cloud services generates predictable recurring revenue, providing stability and consistent growth even amidst economic uncertainty. This contrasts with one-time sales models that are more vulnerable to market fluctuations.

Diversified Software Portfolio: Mitigating Tariff Risks

Beyond Azure's cloud computing dominance, Microsoft's diverse software portfolio plays a crucial role in its tariff-proof growth. The company's strength lies not in a single product, but in a collection of established and innovative software solutions.

- Reduced Dependence: This diversification reduces dependence on any single product or market sector. If one area experiences a downturn, others can compensate, ensuring overall stability.

- Resilience of Established Products: Flagship products like Windows and Office 365 enjoy widespread adoption and generate substantial, consistent revenue, contributing significantly to Microsoft's stable growth. These established products provide a solid foundation, even as newer technologies emerge.

- Enterprise Software Solutions: Microsoft's Dynamics 365 enterprise software solutions cater to a broad range of industries, further reducing vulnerability to sector-specific tariff impacts. This wide reach across diverse sectors provides resilience against localized economic downturns.

Strategic Acquisitions & Innovation: Fueling Continued Growth

Microsoft's history of strategic acquisitions and commitment to R&D are integral to its sustained tariff-proof growth. These investments continually expand its market reach and technological capabilities, ensuring it stays ahead of the competition.

- Strategic Acquisitions: Acquisitions like GitHub (for strengthening its developer ecosystem) and LinkedIn (for bolstering its enterprise solutions) have significantly enhanced Microsoft's capabilities and market position. These moves strengthen existing product lines and expand into new markets.

- Ongoing R&D: Continuous investment in research and development fuels innovation, leading to the introduction of new technologies and features that maintain a competitive edge. This commitment to innovation ensures that Microsoft remains at the forefront of the tech industry.

- Technological Leadership: This proactive approach to innovation helps Microsoft stay ahead of the competition and maintain its tariff-proof advantage. Continuous improvement ensures its products remain relevant and desirable, even in the face of changing market dynamics.

Strong Balance Sheet & Financial Stability: Weathering Economic Uncertainty

Microsoft's exceptional financial health significantly contributes to its ability to weather economic downturns and navigate the complexities of global trade. Its strong balance sheet provides a buffer against external shocks.

- Robust Financials: Microsoft consistently demonstrates strong revenue growth, healthy profit margins, and substantial cash reserves. These metrics illustrate its financial strength and resilience.

- Navigating Uncertainty: This financial strength allows Microsoft to make strategic investments and navigate unpredictable market conditions without significant disruption to its growth trajectory. This ensures continued expansion during times of instability.

- Strategic Investments: Microsoft strategically invests in its future growth, further strengthening its financial position and ability to withstand economic headwinds. These investments ensure continued innovation and expansion into new markets.

Conclusion: Investing in Microsoft's Tariff-Proof Growth

In summary, Microsoft's remarkable tariff-proof growth stems from a combination of factors: its cloud dominance (Azure), diversified software portfolio, strategic acquisitions, and robust financial stability. This resilience makes Microsoft a leader among software stocks, demonstrating its ability to navigate global trade uncertainties and maintain a strong growth trajectory. Microsoft's tariff-proof growth is a testament to its adaptability and innovative spirit. Learn more about how Microsoft's tariff-proof growth can benefit your investment portfolio. Explore Microsoft's stock performance and future projections today!

Featured Posts

-

Everest Speed Climb Anesthetic Gas Risks And Criticisms

May 16, 2025

Everest Speed Climb Anesthetic Gas Risks And Criticisms

May 16, 2025 -

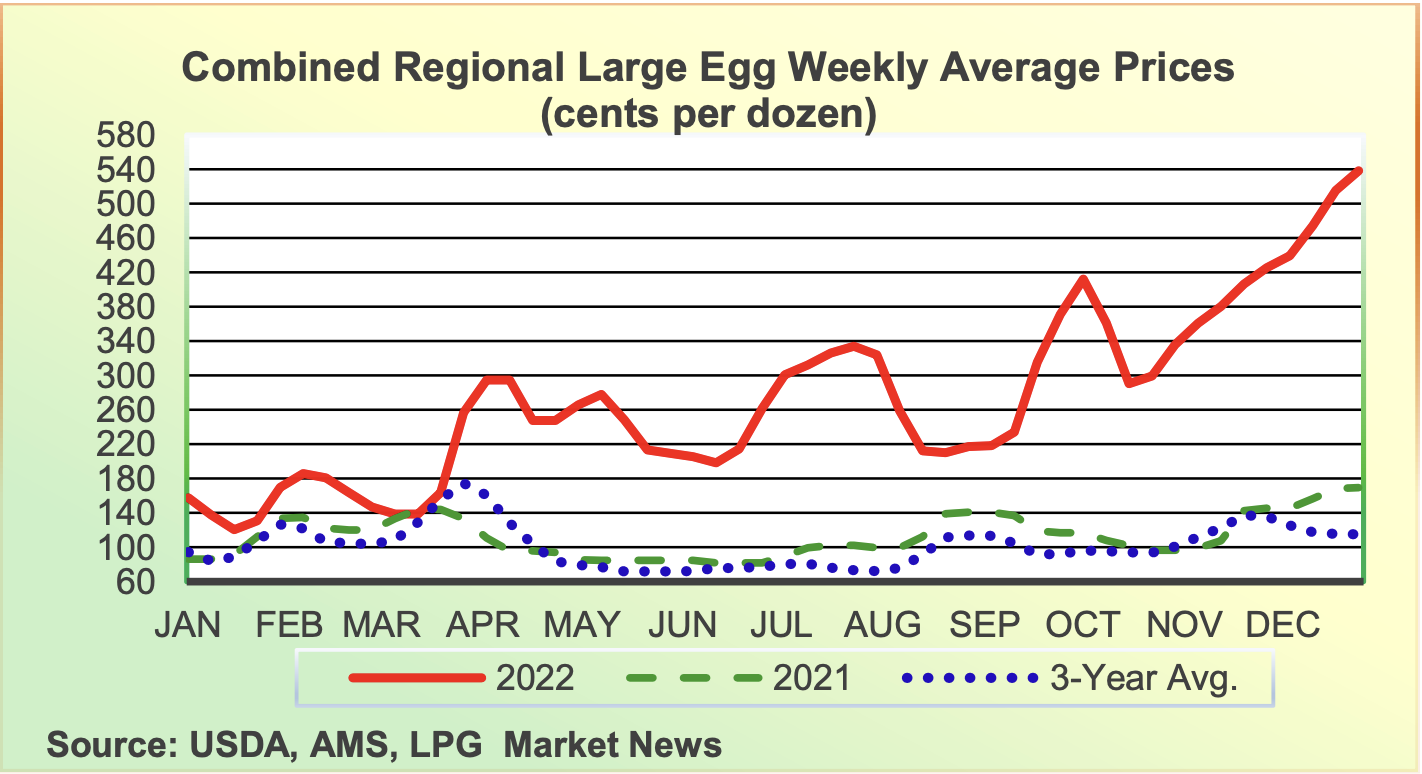

Us Egg Prices Drop To 5 A Dozen Relief For Consumers

May 16, 2025

Us Egg Prices Drop To 5 A Dozen Relief For Consumers

May 16, 2025 -

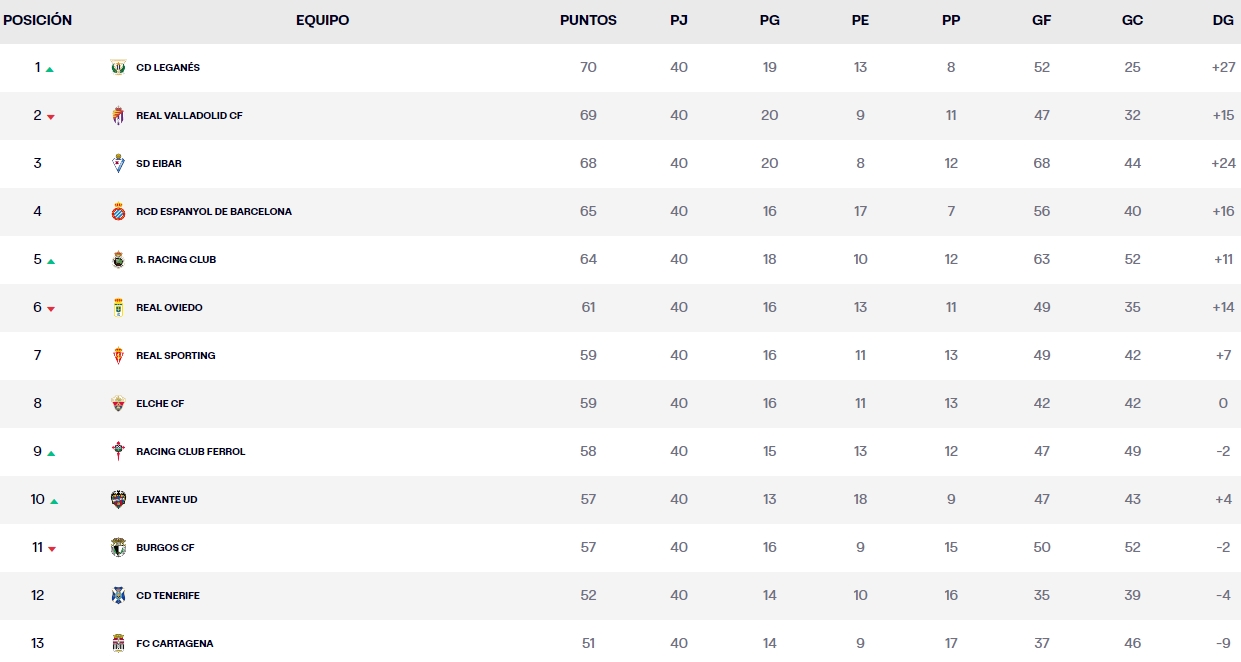

Almeria Eldense Alineaciones Y Previa Del Partido De La Liga Hyper Motion

May 16, 2025

Almeria Eldense Alineaciones Y Previa Del Partido De La Liga Hyper Motion

May 16, 2025 -

Padres Vs Yankees Prediction Will San Diego Continue Their Winning Streak In New York

May 16, 2025

Padres Vs Yankees Prediction Will San Diego Continue Their Winning Streak In New York

May 16, 2025 -

Trumps Trade Policies And Californias Economy A 16 Billion Decrease

May 16, 2025

Trumps Trade Policies And Californias Economy A 16 Billion Decrease

May 16, 2025

Latest Posts

-

Dodgers Lefty Hitters Overcoming The Slump And Re Establishing Their Power

May 16, 2025

Dodgers Lefty Hitters Overcoming The Slump And Re Establishing Their Power

May 16, 2025 -

Max Muncy Loses Fly Ball To Former Nfl Quarterback In Japan

May 16, 2025

Max Muncy Loses Fly Ball To Former Nfl Quarterback In Japan

May 16, 2025 -

Nfl Veterans Casual Fly Ball Grab From Max Muncy In Japan

May 16, 2025

Nfl Veterans Casual Fly Ball Grab From Max Muncy In Japan

May 16, 2025 -

Los Angeles Dodgers Left Handed Hitters Aim For A Strong Finish

May 16, 2025

Los Angeles Dodgers Left Handed Hitters Aim For A Strong Finish

May 16, 2025 -

Ex Nfl Quarterbacks Unexpected Japanese Baseball Catch

May 16, 2025

Ex Nfl Quarterbacks Unexpected Japanese Baseball Catch

May 16, 2025