Massive Whistleblower Payout: Credit Suisse Settles For $150 Million

Table of Contents

The Whistleblower's Allegations

The whistleblower's allegations against Credit Suisse center around serious claims of financial misconduct and regulatory violations. Specific details remain confidential due to the settlement agreement; however, reports suggest the claims involve allegations of fraud, potentially impacting multiple areas of the bank's operations. These allegations include:

- Securities fraud: The whistleblower reportedly alleged the bank engaged in practices designed to artificially inflate the value of certain securities.

- Market manipulation: Claims of manipulating market prices to benefit specific clients or traders were allegedly made.

- Internal controls failures: The whistleblower pointed to weaknesses in Credit Suisse’s internal controls, suggesting a systemic failure to prevent and detect fraudulent activities.

The potential impact of these alleged activities is far-reaching. Not only could they severely damage Credit Suisse's reputation and erode investor confidence, but they also raise questions about the bank's overall governance and compliance practices. The scale of the alleged wrongdoing, if proven, could have significant repercussions for the bank's future profitability and stability.

The Investigation and Settlement Process

The investigation into the whistleblower's allegations involved a complex interplay of internal Credit Suisse investigations and external regulatory scrutiny. While specifics remain undisclosed due to confidentiality agreements, it's likely that multiple regulatory bodies, potentially including the Securities and Exchange Commission (SEC), the Department of Justice (DOJ), and the Financial Industry Regulatory Authority (FINRA), played a role.

Key milestones in the investigation and settlement process include:

- Initial Whistleblower Report: The process began with a confidential report submitted by the whistleblower, detailing the alleged misconduct.

- Internal Investigation: Credit Suisse conducted its own internal investigation, which likely influenced the subsequent settlement negotiations.

- Regulatory Scrutiny: Regulatory bodies conducted their own independent inquiries, potentially leading to further evidence and pressure on Credit Suisse to settle.

- Settlement Negotiations: Lengthy negotiations between Credit Suisse, the whistleblower, and regulatory agencies led to the final $150 million settlement.

Beyond the monetary payout, the settlement likely includes other terms, such as corporate reforms designed to strengthen internal controls and prevent future misconduct. While the exact details are confidential, this type of comprehensive settlement often involves admissions of failures, though not necessarily formal admissions of guilt.

Implications of the $150 Million Payout

The $150 million payout is significant not just for its sheer size but also for its implications for Credit Suisse and the broader financial industry. This massive whistleblower payout represents a substantial financial burden for the bank, potentially impacting its profitability and share price.

- Financial Impact: The settlement represents a considerable expense for Credit Suisse, potentially affecting its financial stability and future investments.

- Reputational Damage: Even with a settlement, the allegations themselves cast a shadow on Credit Suisse's reputation, potentially leading to a loss of customers and business opportunities.

- Message to Whistleblowers: The size of the payout sends a strong message to potential whistleblowers, highlighting the potential rewards for reporting wrongdoing.

- Impact on Future Cases: This settlement sets a precedent that could influence future whistleblower cases and encourage individuals to come forward with information about potential financial misconduct.

The payout significantly impacts future corporate governance practices, potentially incentivizing companies to invest more heavily in compliance and risk management to avoid similar situations.

The Importance of Whistleblower Protection Laws

The Credit Suisse case underscores the vital role of whistleblower protection laws in ensuring corporate accountability and preventing financial fraud. These laws safeguard individuals who report wrongdoing, protecting them from retaliation and encouraging them to come forward with crucial information.

Key legislation supporting whistleblowers includes:

- Dodd-Frank Act: This act significantly strengthened whistleblower protections in the financial industry, providing incentives and protections for individuals who report fraud.

- Sarbanes-Oxley Act: This act, enacted in response to major corporate accounting scandals, also includes provisions to protect whistleblowers.

Strong whistleblower protection benefits not only the individuals who report misconduct but also the companies themselves and the public. By encouraging the reporting of wrongdoing, these laws help to prevent larger-scale fraud, protect investors, and maintain the integrity of financial markets.

Massive Whistleblower Payout: Key Takeaways and Call to Action

The $150 million settlement reached by Credit Suisse highlights the severe consequences of financial misconduct and the critical role of whistleblowers in uncovering and preventing fraud. The size of the payout underscores the importance of robust internal controls, effective regulatory oversight, and strong whistleblower protection laws. This massive whistleblower payout serves as a stark reminder of the potential cost of ignoring ethical and legal responsibilities.

We urge anyone with knowledge of suspected financial misconduct to report it. Protecting whistleblowers and preventing fraud are crucial for maintaining the integrity of our financial system. Learn more about whistleblower protection laws and how to report fraud by visiting the SEC whistleblower website [insert link here] and other relevant resources. Don't let massive whistleblower payouts become the norm; help us build a more ethical and transparent financial world.

Featured Posts

-

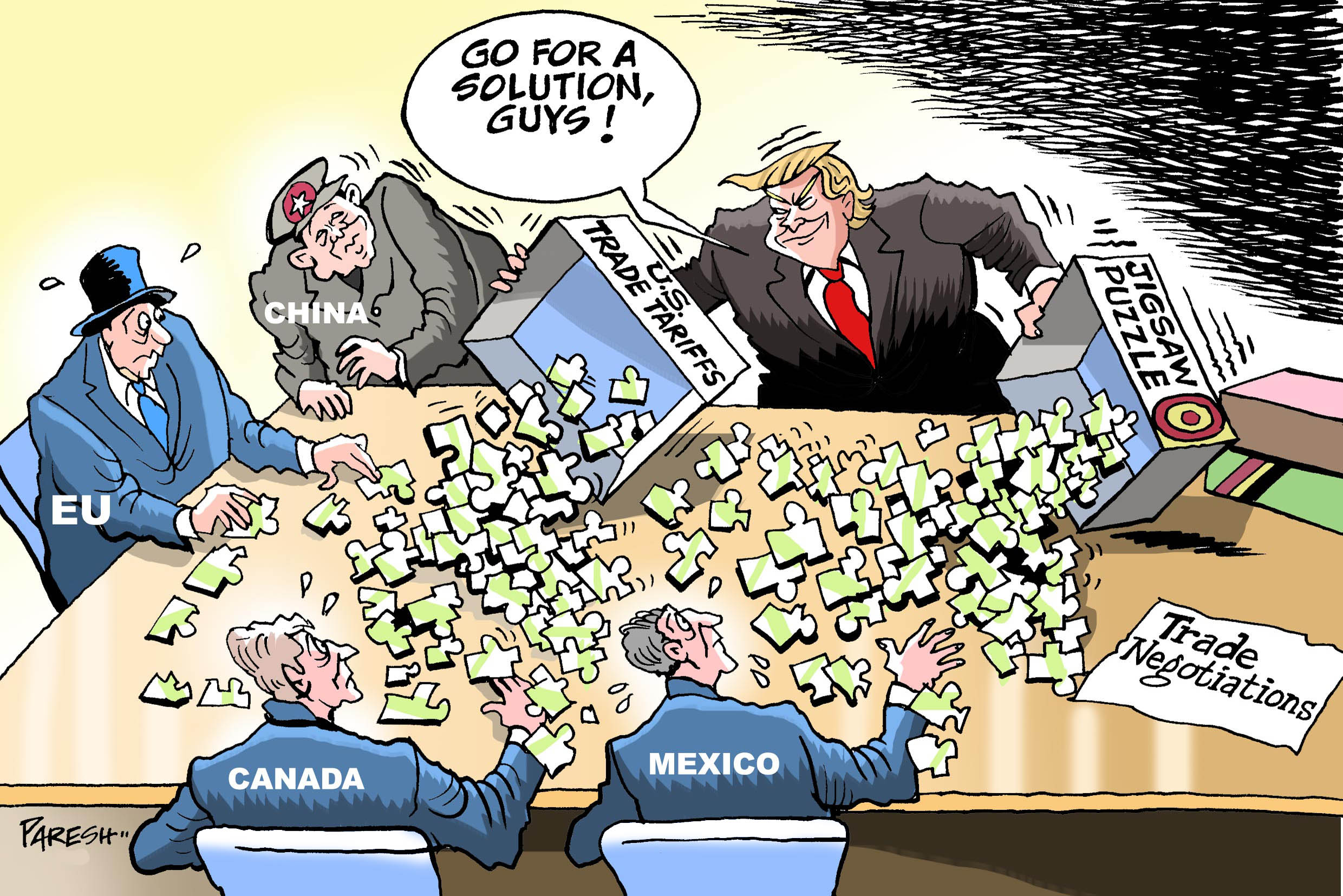

The Trump Tariffs A Political Weapon According To Mark Warner

May 09, 2025

The Trump Tariffs A Political Weapon According To Mark Warner

May 09, 2025 -

Daycare Debate Expert Opinion Vs Working Parent Reality

May 09, 2025

Daycare Debate Expert Opinion Vs Working Parent Reality

May 09, 2025 -

Elon Musks Financial Empire From Pay Pal To Space X And Beyond

May 09, 2025

Elon Musks Financial Empire From Pay Pal To Space X And Beyond

May 09, 2025 -

Bitcoin Madenciliginde Yeni Bir Doenem Son Mu Baslangic Mi

May 09, 2025

Bitcoin Madenciliginde Yeni Bir Doenem Son Mu Baslangic Mi

May 09, 2025 -

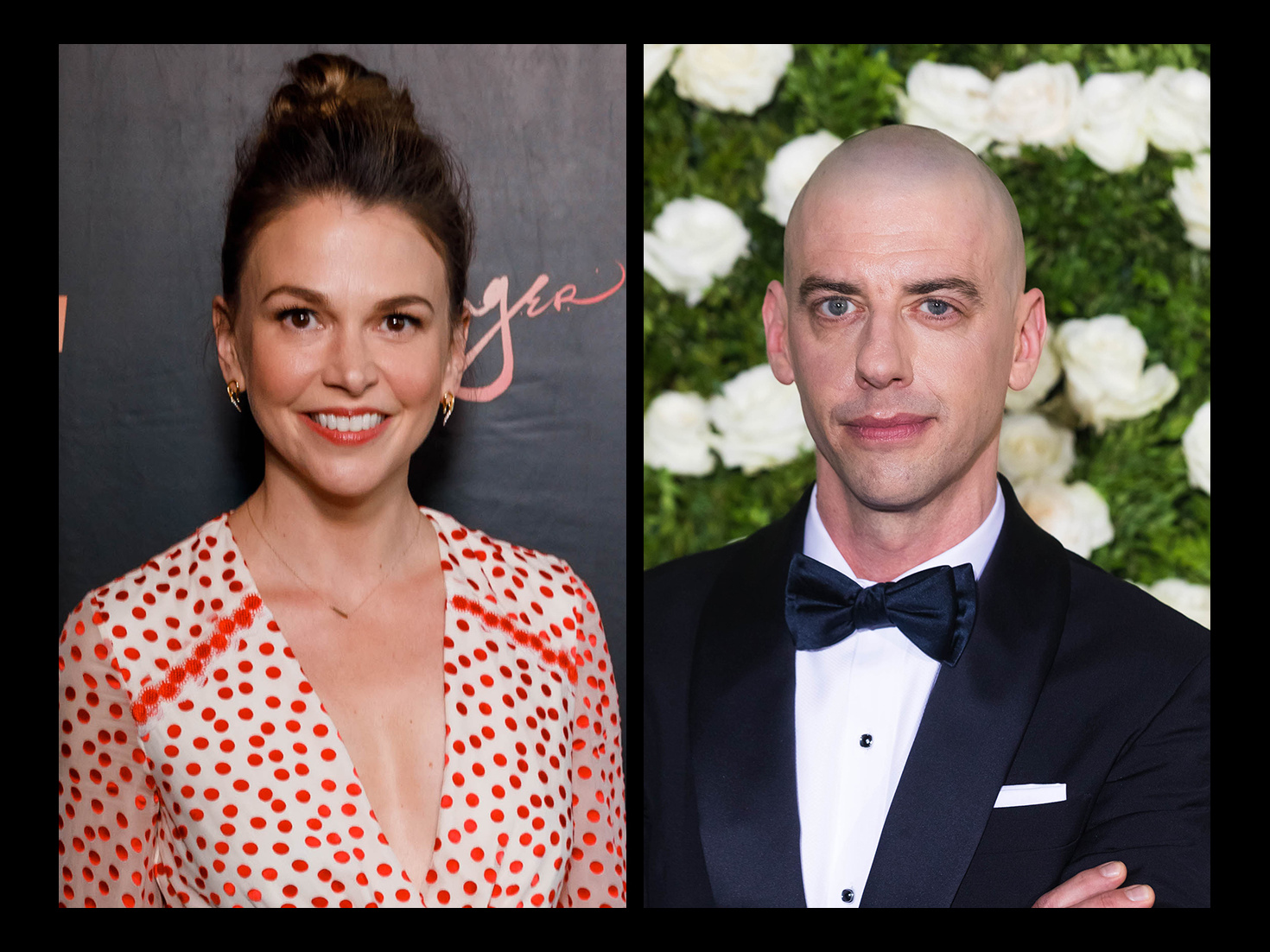

Seven Year Absence Ends Two Actors Reunite In High Potential Finale

May 09, 2025

Seven Year Absence Ends Two Actors Reunite In High Potential Finale

May 09, 2025