Market Turmoil Doesn't Deter Investors: ETF Investments Hit New Highs

Table of Contents

The Resilience of ETFs in Volatile Markets

ETFs have proven remarkably resilient in the face of market volatility. Their inherent structure and design contribute significantly to this strength, making them a compelling choice for investors seeking to navigate turbulent markets.

Diversification as a Key Factor

One of the primary reasons for the resilience of ETFs is their inherent diversification. Unlike investing in individual stocks, which carries significant risk, ETFs offer exposure to a basket of assets. This diversification across various asset classes significantly mitigates the risk associated with market downturns.

- Reduced Volatility: Diversification smooths out the peaks and valleys of individual asset performance, resulting in a less volatile portfolio.

- Lower Risk: By spreading investments across multiple securities, the overall risk profile of the portfolio is significantly reduced.

- Reduced Impact of Individual Stock Performance: A poor performance by a single stock within an ETF has a proportionally smaller impact on the overall ETF value compared to holding that stock individually.

Examples of diversified ETFs include those tracking the S&P 500, offering broad market exposure, or sector-specific ETFs, providing targeted diversification within specific industries like technology or healthcare.

Liquidity and Accessibility

The ease of buying and selling ETFs contributes significantly to their popularity, especially during periods of market uncertainty. Their liquidity is a key differentiator.

- Ease of Trading: ETFs trade like individual stocks on major exchanges, allowing investors to buy and sell them throughout the trading day.

- Low Transaction Costs: Compared to other investment options, ETFs generally have low transaction costs, making them more accessible to a wider range of investors.

- Transparency: Investors can easily see the underlying holdings of an ETF, providing clarity and facilitating informed investment decisions.

Compared to other investment options like mutual funds, which may have restrictions on trading frequency, ETFs offer unmatched liquidity, making them ideal instruments for navigating market uncertainty.

Why Investors are Choosing ETFs During Market Turmoil

The recent surge in ETF investments during periods of market turmoil is not accidental. Several factors contribute to their increasing popularity.

Cost-Effectiveness

One of the most significant advantages of ETFs is their cost-effectiveness. Compared to actively managed funds, ETFs typically have much lower expense ratios.

- Lower Expense Ratios: ETFs often charge significantly lower annual fees (expense ratios) than actively managed mutual funds.

- Long-Term Cost Savings: These seemingly small differences in expense ratios can accumulate to substantial savings over the long term, enhancing investment returns.

This cost advantage is particularly appealing during periods of market uncertainty, where preserving capital and maximizing returns are paramount.

Transparency and Simplicity

ETFs offer a transparent and simple investment structure, which is highly appealing to investors, especially during times of uncertainty.

- Easy to Understand Holdings: Investors can easily see the precise holdings of an ETF, understanding exactly what they are investing in.

- Simple Investment Strategy: Investing in ETFs often involves a simpler investment strategy compared to complex individual stock picking or actively managed funds.

- Easy to Track Performance: Tracking the performance of an ETF is straightforward, allowing investors to monitor their investments and make informed decisions.

The ease of understanding and managing ETF investments contributes significantly to their rising popularity.

Specific Examples of ETF Growth During Recent Market Volatility

Recent market volatility has not deterred investor interest in ETFs. Data indicates significant inflows into various ETF categories.

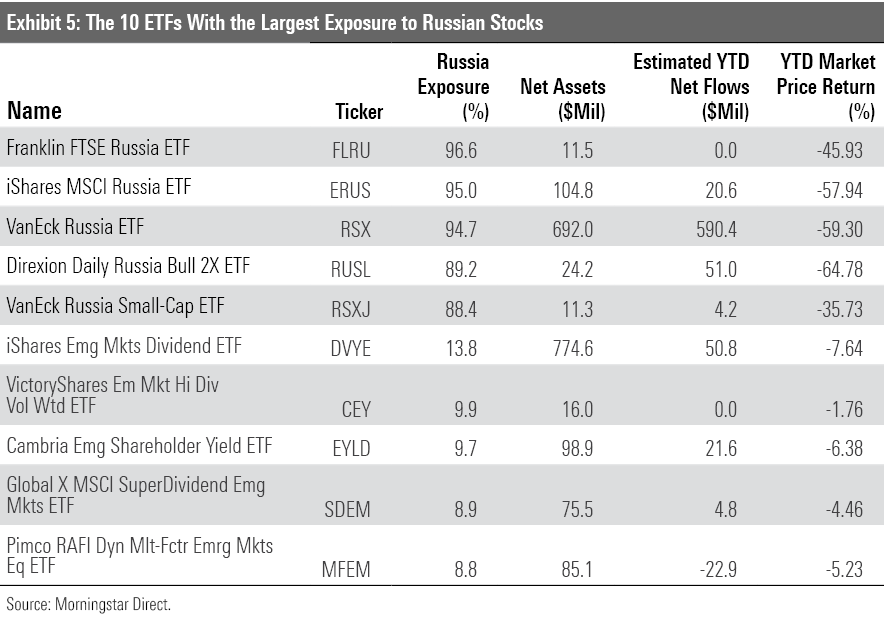

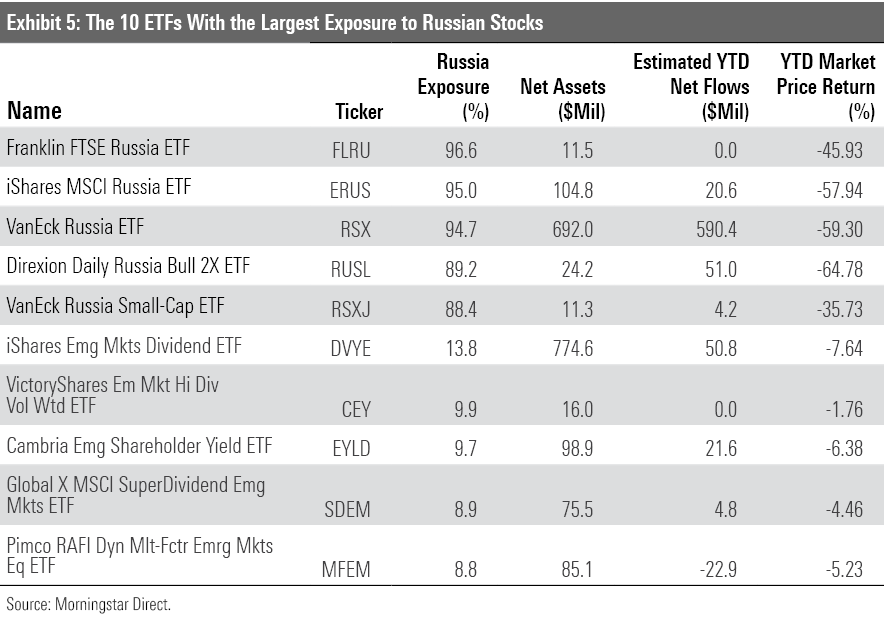

Data-driven Insights

(Insert chart/graph here showing ETF inflow data during a specific period of market volatility. Source the data from a reputable financial news source, e.g., Bloomberg, Financial Times, etc. Example: "Data from Bloomberg shows a 25% increase in inflows into technology sector ETFs during Q3 2023, despite the overall market downturn.")

Analysis of Performance

While overall market performance may have been negative, certain ETF categories, such as those focused on defensive sectors like consumer staples or utilities, have shown relative resilience. (Provide examples and analysis of specific ETF performance during the period shown in the graph. Explain potential reasons for outperformance, e.g., less sensitivity to economic downturns). This highlights the strategic advantage of diversification within an ETF portfolio.

Conclusion

The continued growth of ETF investments despite recent market turmoil underscores their resilience and appeal as an investment vehicle. The factors driving this trend – diversification, liquidity, cost-effectiveness, and transparency – make them an attractive option for investors seeking to navigate uncertainty. Don't let market turmoil deter your investment strategy. Explore the diverse world of ETFs and discover how you can potentially mitigate risk and achieve your financial goals. Start researching different ETF investments today!

Featured Posts

-

Prakiraan Cuaca Bandung 22 April Hujan Siang Hari

May 28, 2025

Prakiraan Cuaca Bandung 22 April Hujan Siang Hari

May 28, 2025 -

St Louis Cardinals Sweep Diamondbacks Behind Masyn Winns Home Run

May 28, 2025

St Louis Cardinals Sweep Diamondbacks Behind Masyn Winns Home Run

May 28, 2025 -

The Phoenician Scheme Critical Reception At The Cannes Film Festival

May 28, 2025

The Phoenician Scheme Critical Reception At The Cannes Film Festival

May 28, 2025 -

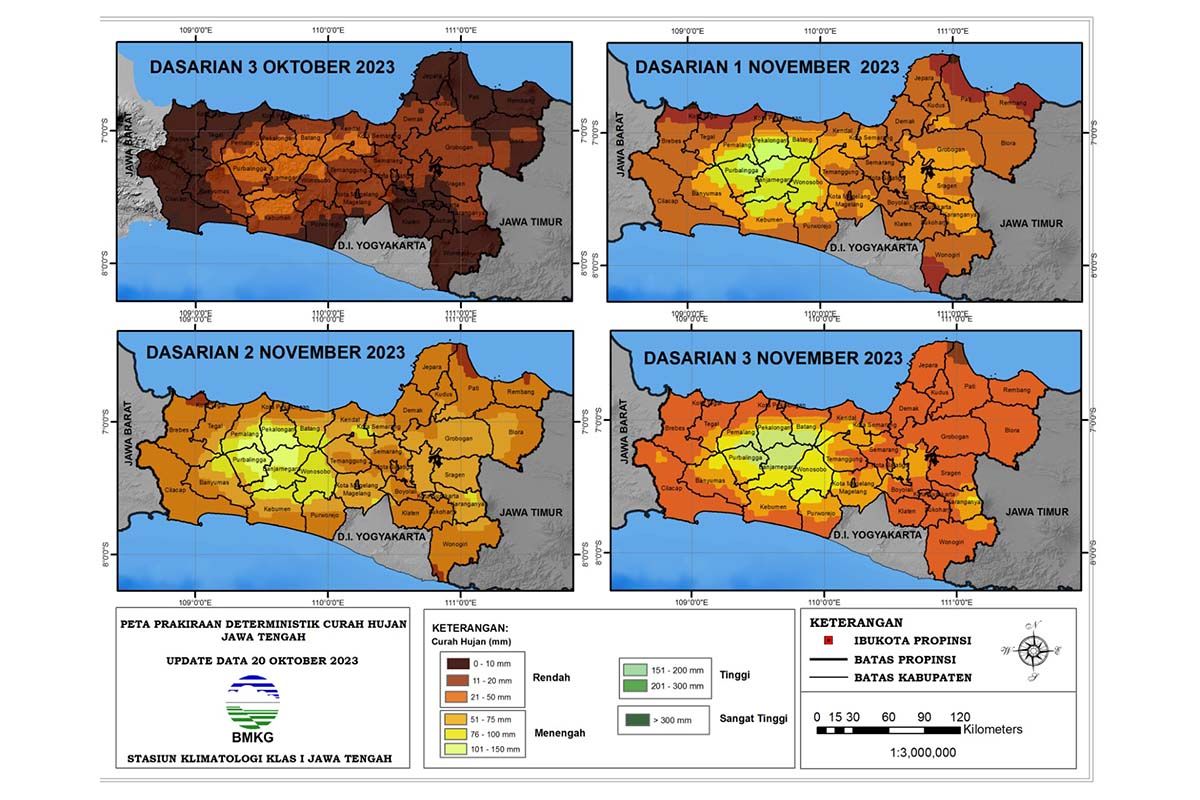

Prakiraan Cuaca 23 April 2024 Hujan Di Jawa Tengah

May 28, 2025

Prakiraan Cuaca 23 April 2024 Hujan Di Jawa Tengah

May 28, 2025 -

Is Taylor Swift And Travis Kelces Relationship Different From What Josh Allen Wants

May 28, 2025

Is Taylor Swift And Travis Kelces Relationship Different From What Josh Allen Wants

May 28, 2025