Market Rally: Sensex Climbs, Double-Digit Gains For Select BSE Stocks

Table of Contents

Sensex Climbs: Analyzing the Underlying Factors

The recent market rally wasn't a spontaneous event; it's the result of a confluence of global and domestic economic factors, coupled with a positive shift in investor sentiment.

Global Economic Indicators and Their Impact

Positive global economic news played a crucial role in boosting market confidence. Easing inflation concerns in several major economies, coupled with relatively stable interest rate decisions, contributed significantly to the overall positive sentiment.

- Positive US jobs report: The unexpectedly strong US jobs report for September indicated a resilient US economy, reducing fears of a significant recession.

- Easing inflation concerns in Europe: A slight decrease in inflation rates in the Eurozone eased fears of further aggressive interest rate hikes by the European Central Bank.

- Positive global growth forecasts: Several international financial institutions revised their global growth forecasts upwards, reflecting a more optimistic outlook for the global economy.

Domestic Economic Factors Driving the Rally

Positive domestic economic indicators further fueled the market rally in India. Strong corporate earnings and supportive government policies instilled confidence among investors.

- Strong Q3 earnings from the IT sector: Several leading IT companies reported strong Q3 earnings, exceeding market expectations and boosting investor confidence in the sector.

- Positive government spending announcements: Government announcements regarding increased infrastructure spending and other developmental initiatives signaled continued economic growth.

- Stable macroeconomic indicators: Positive GDP growth figures and stable inflation rates further reinforced the positive sentiment.

Investor Sentiment and Market Confidence

The market rally was significantly influenced by a surge in investor confidence. Increased foreign institutional investment (FII) inflows played a pivotal role.

- Increased FII inflows: FIIs invested heavily in the Indian stock market, injecting significant liquidity and driving up stock prices. Preliminary data suggests FII inflows increased by approximately 15% during the week of the rally.

- Positive investor outlook: Positive economic data and corporate earnings fueled a positive outlook among both domestic and international investors, leading to increased investment activity.

- Reduced risk aversion: Decreased uncertainty regarding global economic conditions led to a reduction in risk aversion among investors, encouraging them to invest in riskier assets, such as equities.

Double-Digit Gains: Top Performing BSE Stocks

The market rally saw several BSE stocks achieve impressive double-digit gains, with certain sectors outperforming others.

Sector-wise Performance Analysis

The IT, pharmaceutical, and banking sectors were among the top performers during the rally.

- IT Sector: The strong Q3 earnings, coupled with sustained demand for IT services globally, propelled the IT sector to significant gains.

- Pharmaceutical Sector: Positive regulatory approvals and strong export demand contributed to the impressive performance of pharmaceutical stocks.

- Banking Sector: Improved credit growth and positive outlook for the financial sector boosted investor sentiment in banking stocks.

| Sector | Percentage Gain |

|---|---|

| IT | 12% |

| Pharmaceuticals | 10% |

| Banking | 8% |

Individual Stock Analysis: High-Gainers

Several individual stocks on the BSE experienced remarkable double-digit gains.

| Stock Name | Percentage Gain | Reason for Performance |

|---|---|---|

| Infosys | 15% | Exceeded Q3 earnings expectations |

| Sun Pharma | 12% | Received positive regulatory approvals for a key drug |

| HDFC Bank | 9% | Strong credit growth and positive investor outlook |

Risks and Cautions for Investors

While the current market rally presents opportunities, investors should remain cautious and acknowledge potential risks.

- Market Corrections: Market rallies are not always linear; corrections are a normal part of the market cycle.

- Geopolitical Risks: Uncertain geopolitical events could impact market sentiment.

- Inflationary Pressures: Although easing, inflationary pressures could re-emerge.

It's crucial to avoid impulsive investment decisions based solely on short-term market movements. Thorough research and diversification are essential for managing risk.

Conclusion: Market Rally - Navigating the Upswing

The recent market rally, driven by a combination of positive global and domestic economic factors and increased investor confidence, resulted in a significant Sensex climb and double-digit gains for several BSE stocks. While the outlook appears positive, investors should remain mindful of potential risks and avoid impulsive decisions. Understanding the dynamics of market rallies, including the underlying factors and potential risks, is crucial for making informed investment choices. Stay informed on future market rallies and consult with a financial advisor before making any investment decisions. Remember, thorough research is key to navigating the complexities of the stock market effectively.

Featured Posts

-

Bmw I X 2026 Is This The Future Of Electric Driving

May 15, 2025

Bmw I X 2026 Is This The Future Of Electric Driving

May 15, 2025 -

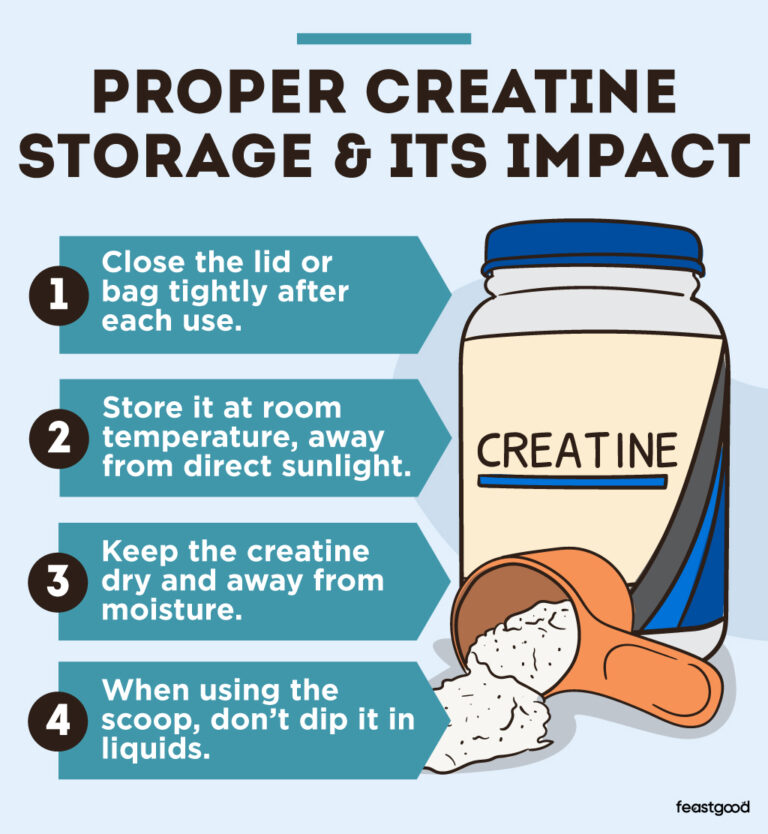

Is Creatine Safe And Effective A Comprehensive Review

May 15, 2025

Is Creatine Safe And Effective A Comprehensive Review

May 15, 2025 -

Will The Padres Win Outright Or Lose By 1 Against The Giants A Game Prediction

May 15, 2025

Will The Padres Win Outright Or Lose By 1 Against The Giants A Game Prediction

May 15, 2025 -

Sounders Vs Earthquakes Ticketmaster Presents Matchday Preview

May 15, 2025

Sounders Vs Earthquakes Ticketmaster Presents Matchday Preview

May 15, 2025 -

Game 3 Will Jimmy Butler Play Warriors Offer Positive Assessment

May 15, 2025

Game 3 Will Jimmy Butler Play Warriors Offer Positive Assessment

May 15, 2025

Latest Posts

-

Playoff Game 4 Johnstons Record Breaking Goal Leads Stars To Dominant Win Over Avalanche

May 15, 2025

Playoff Game 4 Johnstons Record Breaking Goal Leads Stars To Dominant Win Over Avalanche

May 15, 2025 -

Dallas Stars Clinch 3 2 Series Lead Johnstons Lightning Fast Goal Highlights Win

May 15, 2025

Dallas Stars Clinch 3 2 Series Lead Johnstons Lightning Fast Goal Highlights Win

May 15, 2025 -

Johnstons Speedy Goal Fuels Stars Victory Against Avalanche In Game 4

May 15, 2025

Johnstons Speedy Goal Fuels Stars Victory Against Avalanche In Game 4

May 15, 2025 -

Draisaitl Hellebuyck And Kucherov Vie For Prestigious Hart Trophy

May 15, 2025

Draisaitl Hellebuyck And Kucherov Vie For Prestigious Hart Trophy

May 15, 2025 -

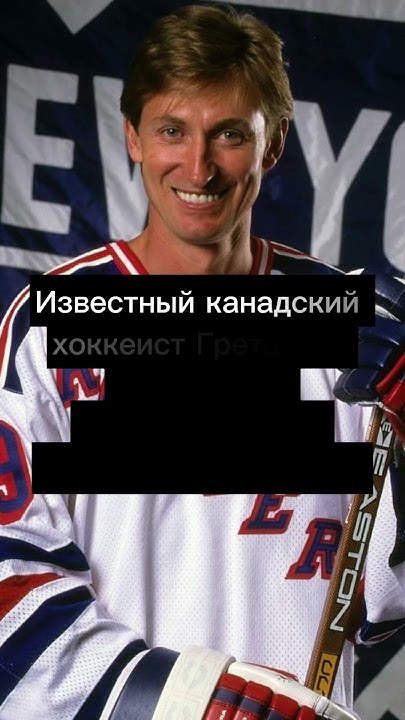

Ovechkin Priblizhaetsya K Rekordu Grettski Prognoz N Kh L

May 15, 2025

Ovechkin Priblizhaetsya K Rekordu Grettski Prognoz N Kh L

May 15, 2025