Market Movers: Sensex, Nifty Close Higher; Adani Ports, Eternal Performance

Table of Contents

Sensex and Nifty's Positive Trajectory

The Sensex closed at [Insert Closing Value] today, marking a [Insert Percentage]% increase compared to yesterday's closing. Similarly, the Nifty index ended the day at [Insert Closing Value], registering a [Insert Percentage]% gain. This positive market trajectory can be attributed to several factors, including positive global cues, improved investor sentiment, and encouraging economic indicators. The overall positive market sentiment is a significant driver of this upward trend.

- Numerical Data: The Sensex gained [Insert Numerical Value] points, while the Nifty added [Insert Numerical Value] points.

- Economic News: The recent [Insert Specific Economic News, e.g., positive GDP growth figures, favorable inflation data] contributed to the positive market sentiment.

- Trading Volume: Trading volumes were [Insert Description, e.g., robust, higher than average, indicating strong investor participation].

Adani Ports' Stellar Performance

Adani Ports witnessed a stellar day, with its stock price closing at [Insert Closing Price], representing a remarkable [Insert Percentage]% increase. This outstanding performance can be linked to several factors, including the securing of new contracts, positive industry trends within the port sector, and the company's demonstrable operational efficiency. The infrastructure sector, to which Adani Ports belongs, is currently experiencing a period of robust growth.

- Key Financial Indicators: Adani Ports reported [Insert Relevant Financial Data, e.g., increased cargo volume, improved profitability].

- Analyst Commentary: Several analysts have upgraded their rating for Adani Ports, citing its strong growth prospects.

- Future Prospects: The company's expansion plans and strategic initiatives suggest a continued positive outlook for Adani Ports' share price.

Eternal's Impressive Gains

Eternal, a prominent player in the [Insert Eternal's Sector, e.g., pharmaceutical] sector, also experienced significant gains, with its stock price closing at [Insert Closing Price], a [Insert Percentage]% increase. This impressive performance reflects the company's success in [Insert Reason, e.g., new product launches, strategic partnerships, strong earnings reports]. The overall positive sentiment in the [Insert Eternal's Sector] market contributed significantly to Eternal's stock market gains.

- Key Achievements: Eternal's recent [Insert Key Achievement, e.g., successful drug trial, major contract win] significantly boosted investor confidence.

- Significant Financial Data: The company reported [Insert Relevant Financial Data, e.g., increased revenue, strong profit margins] for the recent quarter.

- Future Outlook: Eternal's promising pipeline of new products and strategic initiatives point towards a bright future.

Broader Market Context and Analysis

The overall market sentiment was overwhelmingly positive today, with several key sectors experiencing significant gains. While Adani Ports and Eternal led the charge, other sectors like [Insert Other Performing Sectors] also showed considerable strength. This positive market trend suggests a bullish outlook, although it's crucial to consider potential risks and maintain a diversified investment strategy.

- Sector Performance: The [Insert Sector] and [Insert Sector] sectors also performed well, contributing to the overall positive market sentiment.

- Upcoming Economic Events: The upcoming [Insert Upcoming Economic Event, e.g., RBI monetary policy meeting, release of key economic data] could influence market trends in the coming days.

- Future Market Movement: While the current trend is positive, investors should carefully assess potential risks and maintain a balanced approach to their investment strategies.

Conclusion: Sensex and Nifty's Rise Signals Strong Market Performance

Today's market surge, highlighted by the strong performance of the Sensex and Nifty indices and the exceptional gains of market movers like Adani Ports and Eternal, signals a robust and potentially bullish market. Understanding the drivers behind these gains, as well as the broader market context, is crucial for informed investment decisions. Staying updated on the performance of these key market movers, monitoring the Sensex, Nifty, and other leading stocks, is essential for developing effective investment strategies. Keep a close watch on these market indicators for valuable investment insights and stay ahead in the dynamic world of stock market analysis.

Featured Posts

-

La Fire Aftermath Increased Rent And Allegations Of Price Gouging

May 10, 2025

La Fire Aftermath Increased Rent And Allegations Of Price Gouging

May 10, 2025 -

Is Palantir Stock A Good Investment Pros Cons And Analysis

May 10, 2025

Is Palantir Stock A Good Investment Pros Cons And Analysis

May 10, 2025 -

Kimbal Musk Elons Brother And His Public Stand Against Trumps Tariffs

May 10, 2025

Kimbal Musk Elons Brother And His Public Stand Against Trumps Tariffs

May 10, 2025 -

X Blocks Jailed Turkish Mayors Social Media Opposition Backlash

May 10, 2025

X Blocks Jailed Turkish Mayors Social Media Opposition Backlash

May 10, 2025 -

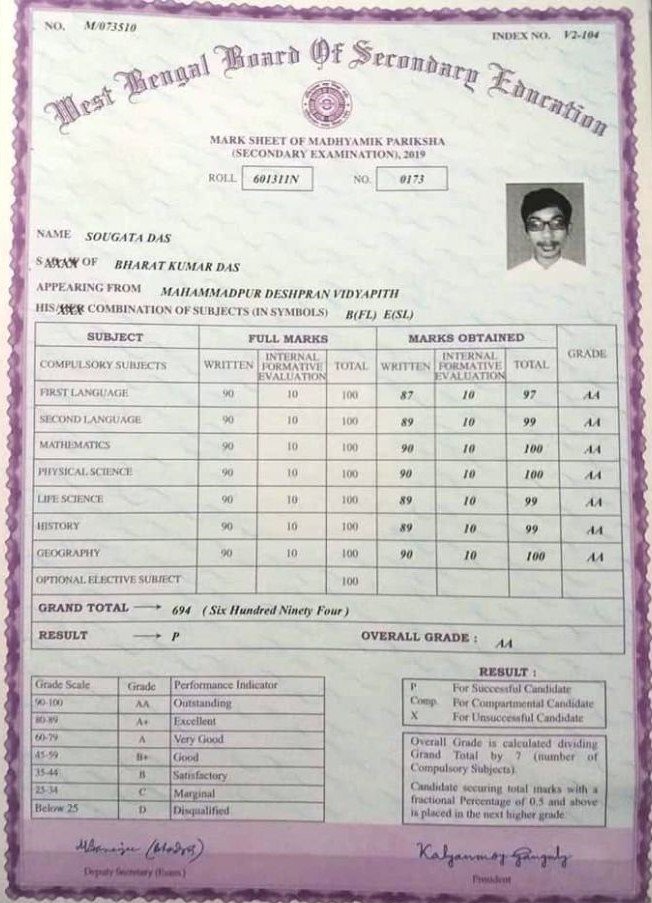

Madhyamik 2025 Merit List Date Time And Official Website

May 10, 2025

Madhyamik 2025 Merit List Date Time And Official Website

May 10, 2025