Market Corrections: A Case Study Of Professional Selling And Individual Buying

Table of Contents

Professional Selling Strategies During Market Corrections

Professional sellers approach market corrections with a calculated and disciplined strategy, leveraging years of experience and sophisticated tools. Their actions differ significantly from the typical individual investor response.

Identifying Potential Corrections

Professional sellers don't wait for a correction to hit before reacting. They actively monitor the market for early warning signs. This involves:

-

Utilizing technical analysis: Professionals utilize various technical indicators such as moving averages (e.g., 50-day and 200-day), Relative Strength Index (RSI), and other momentum indicators to identify potential market downturns. These tools help them predict shifts in market trends and potential corrections.

-

Monitoring economic indicators: A weakening economy is often a precursor to a market correction. Professionals closely track key economic indicators like inflation rates (CPI, PPI), unemployment figures, and GDP growth to gauge the overall health of the economy and anticipate potential market weakness.

-

Analyzing market sentiment and investor behavior: Professionals analyze market sentiment through news articles, social media trends, and investor surveys to understand the prevailing mood among investors. Extreme optimism or pessimism often precedes significant market shifts.

-

Diversification: Professional sellers often diversify their portfolios, mitigating risk across asset classes (stocks, bonds, real estate, commodities). This reduces their overall exposure to any single market downturn.

-

Hedging Strategies: They utilize hedging strategies, such as options trading or short selling, to protect against potential losses during a market correction.

Managing Risk and Hedging

Risk management is paramount for professional sellers. They employ sophisticated strategies to limit potential losses and preserve capital:

-

Stop-loss orders: These orders automatically sell a security when it reaches a predetermined price, limiting potential losses.

-

Options strategies: Professionals utilize options contracts to hedge against market declines or to profit from volatility.

-

Diversification (reiterated): Maintaining a diversified portfolio across asset classes is a cornerstone of their risk management strategy.

-

Sophisticated Risk Management Models: Professional traders employ advanced quantitative models and simulations to assess and manage risk, going beyond simple diversification.

-

Capital Preservation: During periods of market volatility, their primary goal is often to preserve capital rather than maximizing returns.

Strategic Selling Techniques

Professional sellers don't typically panic sell. Instead, they employ calculated selling techniques:

-

Gradual selling: To avoid significantly impacting market prices, professionals often sell their holdings gradually over time, rather than dumping them all at once.

-

Tax-efficient strategies: They carefully time their sales to minimize their tax liability.

-

Exploiting short-term opportunities: Market corrections can create short-term trading opportunities. Professionals may actively look for these, capitalizing on temporary price dips to generate profits.

-

Strategic Timing: Professionals often time their selling strategically, based on market signals and their technical analysis. They don't necessarily aim to perfectly time the bottom, but rather to reduce risk and capitalize on opportunities.

-

Short-Term Opportunities: They actively seek out short-term opportunities to profit from price fluctuations during a correction.

Individual Investor Behavior During Market Corrections

Individual investors often react differently to market corrections, frequently driven by emotion rather than a calculated strategy.

Emotional Reactions and Panic Selling

Market corrections often trigger emotional responses in individual investors:

-

Panic selling: Fear and uncertainty often lead to panic selling, where investors sell their assets at a loss to avoid further declines.

-

Psychological impact: Market corrections can significantly impact investor confidence, leading to poor decision-making.

-

Confirmation bias: Investors may selectively seek out information that confirms their negative market outlook, reinforcing their fear and leading to further poor decisions.

-

Emotional Decision-Making: Individuals are significantly more susceptible to emotional decision-making during market corrections, often leading to suboptimal outcomes.

-

Avoidable Losses: Panic selling frequently leads to substantial losses that could have been avoided with a more disciplined and long-term approach.

Missed Opportunities for Value Investing

Market corrections create opportunities for value investing, but many individuals miss them:

-

Undervalued assets: Corrections often create opportunities to acquire undervalued assets at discounted prices.

-

Long-term horizon: A long-term investment horizon is crucial to weathering market corrections and benefiting from eventual recovery.

-

Market timing difficulty: Accurately timing the market bottom is exceptionally difficult, even for professionals.

-

Missed Opportunities: Many individual investors miss the chance to buy low and sell high, instead reacting emotionally and selling at the worst possible time.

-

Value Investing Strategy: Disciplined value investing, focusing on fundamental analysis and long-term growth, can yield substantial returns during market corrections.

Lack of Diversification and Risk Management

Many individual investors lack the resources and expertise for proper risk management:

-

Insufficient diversification: A lack of diversification increases vulnerability to market fluctuations.

-

Inadequate risk management: Without a solid risk management strategy, losses can be amplified during a correction.

-

Investment plan: A well-defined investment plan is essential for navigating market volatility.

-

Limited Expertise: Individual investors often lack the sophisticated risk management tools and expertise used by professionals.

-

Importance of Diversification: Diversifying across different asset classes is crucial in mitigating risk during market corrections and reducing the impact of any single market downturn.

Key Differences and Lessons Learned

The contrasting approaches of professional and individual investors highlight several crucial differences:

-

Data vs. Emotion: Professionals rely heavily on data-driven decision-making, while individuals are more susceptible to emotional biases.

-

Risk Management: Professionals have sophisticated risk management strategies, while individuals often lack such planning.

-

Long-Term Perspective: Professionals generally maintain a long-term perspective, while individuals may have shorter time horizons.

-

Data-Driven Decisions: Professionals are more likely to use quantitative data and technical analysis to inform their investment decisions.

-

Learning from Professionals: By studying the strategies and risk management techniques employed by professionals, individual investors can significantly improve their ability to navigate market corrections effectively.

Conclusion

Market corrections are inevitable, but understanding how professionals and individuals approach these events reveals valuable insights. Professional sellers employ disciplined strategies focusing on risk management and strategic selling, while individual investors often struggle with emotional reactions and poor decision-making. By learning from these contrasting approaches, individual investors can improve their ability to navigate market corrections effectively. Develop a well-defined investment plan, diversify your portfolio, and manage your emotional responses to market volatility. Don't let fear drive your decisions during a market correction; instead, utilize this opportunity to acquire undervalued assets and build a stronger investment portfolio. Understanding market corrections and applying sound strategies will be key to your long-term investment success. Start planning your market correction strategy today!

Featured Posts

-

Gpu Prices Soar Are They Unreachable Again

Apr 28, 2025

Gpu Prices Soar Are They Unreachable Again

Apr 28, 2025 -

Yankees Judge And Goldschmidt Lead Team To Victory Avoiding Series Sweep

Apr 28, 2025

Yankees Judge And Goldschmidt Lead Team To Victory Avoiding Series Sweep

Apr 28, 2025 -

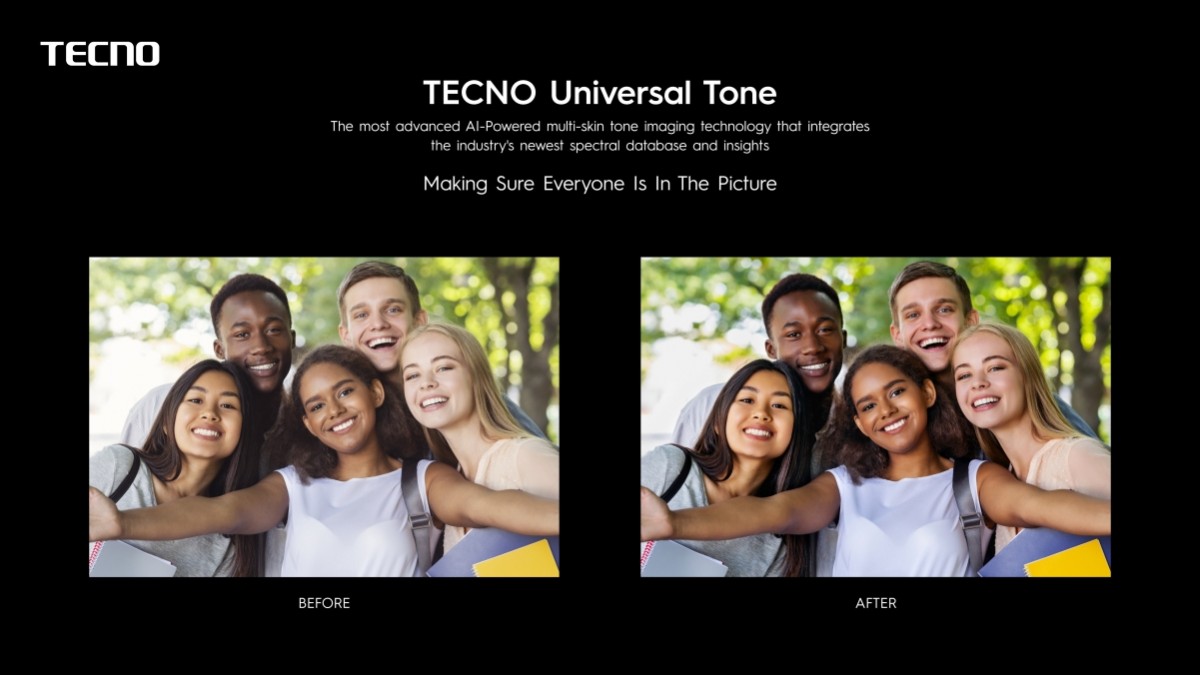

Investment Opportunities Mapping The Countrys Business Hotspots

Apr 28, 2025

Investment Opportunities Mapping The Countrys Business Hotspots

Apr 28, 2025 -

Eva Longorias Delight World Renowned Chefs Fishermans Stew

Apr 28, 2025

Eva Longorias Delight World Renowned Chefs Fishermans Stew

Apr 28, 2025 -

East Palestine Ohio Prolonged Presence Of Toxic Chemicals After Train Derailment

Apr 28, 2025

East Palestine Ohio Prolonged Presence Of Toxic Chemicals After Train Derailment

Apr 28, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

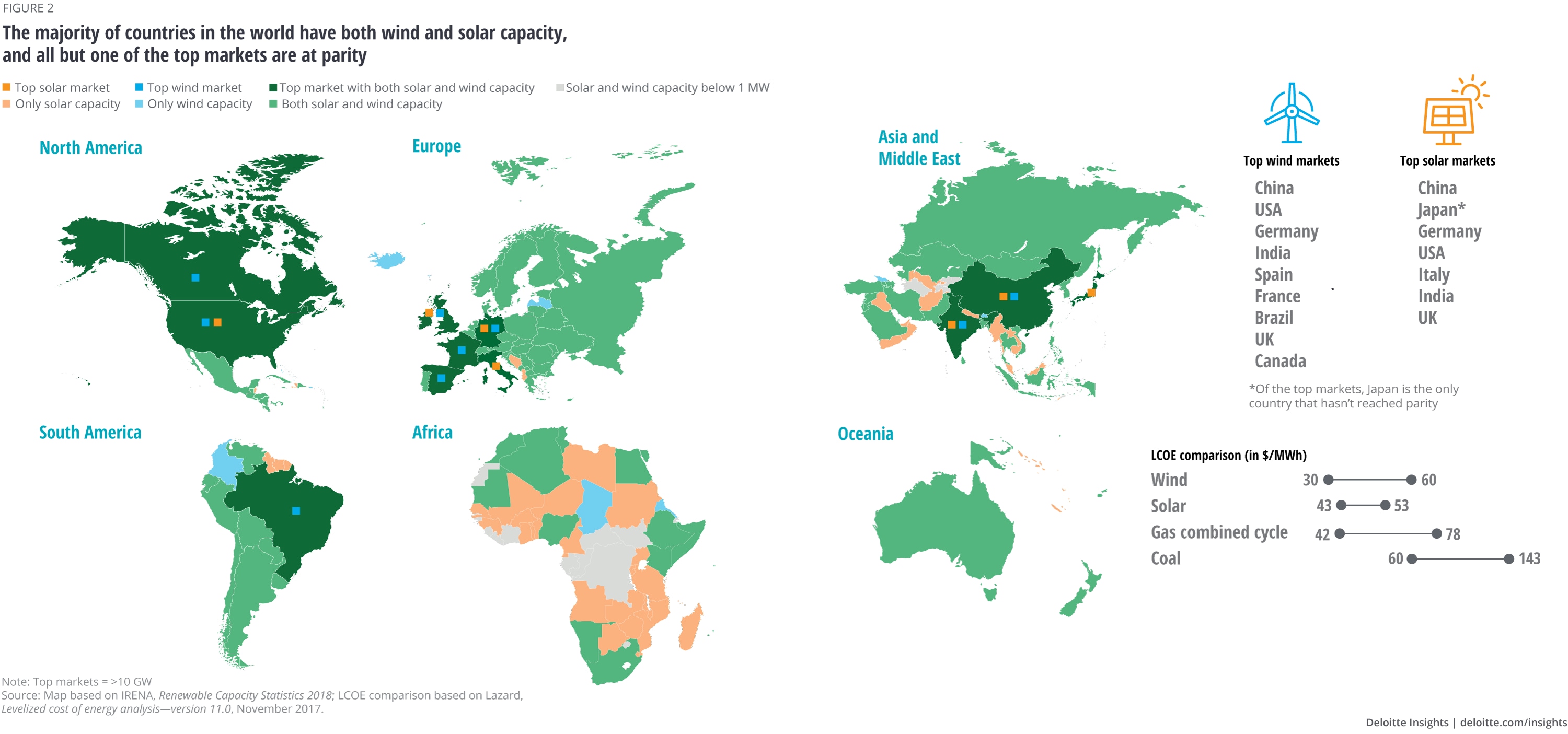

Universal Tone Tecno

Apr 28, 2025

Universal Tone Tecno

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Analyzing Espns Controversial Red Sox Outfield Projection For 2025

Apr 28, 2025

Analyzing Espns Controversial Red Sox Outfield Projection For 2025

Apr 28, 2025 -

Oppo Find X8 Ultra

Apr 28, 2025

Oppo Find X8 Ultra

Apr 28, 2025