Market Brace For Volatility: Billions In Crypto Options Expire Soon

Table of Contents

Understanding Crypto Options Expiration

Crypto options, like their traditional counterparts, are contracts that give the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying cryptocurrency at a predetermined price (strike price) on or before a specific date (expiration date). Options expiration marks the day these contracts cease to exist. If the option is "in the money" (meaning it's profitable to exercise the option), the holder may exercise their right; otherwise, the contract expires worthless. This concentrated wave of potential trading activity significantly influences market dynamics.

- Call Options: Grant the buyer the right to buy the cryptocurrency at the strike price.

- Put Options: Grant the buyer the right to sell the cryptocurrency at the strike price.

- Open Interest: The total number of outstanding options contracts; high open interest before expiration suggests substantial potential market impact. Tracking open interest helps predict the magnitude of potential price movements.

- Options Contracts & Market Impact: Options contracts create both buying and selling pressure. When options expire, the holders decide whether to exercise their rights, potentially leading to large-scale buying or selling of the underlying cryptocurrency, causing significant price fluctuations.

Billions at Stake: The Scale of the Upcoming Expiry

The upcoming crypto options expiry involves billions of dollars in notional value. Major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), are heavily involved, with options contracts traded primarily on exchanges such as Deribit, Binance, and CME. This is not an insignificant event; it's a significant market-moving force.

- Specific Figures: While precise figures fluctuate until expiry, reports suggest billions of dollars’ worth of options are nearing their expiration date.

- Comparison to Previous Expirations: This expiry is comparable in scale to some of the largest options expirations seen in the crypto market's history, potentially exceeding them.

- Market Liquidity Impact: The sheer volume of options expiring simultaneously could temporarily impact market liquidity, potentially leading to wider bid-ask spreads and increased difficulty in executing trades at desired prices.

Potential Market Impacts: Volatility and Price Swings

The upcoming expiry is likely to cause increased volatility in the crypto market. The potential for sharp price increases or decreases in various cryptocurrencies is significant, depending on several factors including market sentiment and the actions of large institutional investors, often termed "whales."

- Price Swings: Expect sharp price movements, either upwards or downwards, based on whether the majority of options contracts are "in the money" and how investors react.

- Market Sentiment: Positive sentiment can amplify upward movements, while negative sentiment can exacerbate downward pressure. News, events, and general market trends play a critical role.

- Whale Activity: Large institutional investors and whales, possessing significant holdings, can significantly influence price action by either exercising their options or taking other strategic positions. Their decisions hold enormous weight.

Strategies for Navigating the Volatility

Preparing for potential market turbulence requires careful planning and a strategic approach. Effective risk management is paramount to mitigating potential losses.

- Diversification: Spread your investments across various cryptocurrencies and asset classes to reduce risk. Don't put all your eggs in one basket.

- Stop-Loss Orders: Implement stop-loss orders to automatically sell your assets if the price falls below a predetermined level, limiting potential losses.

- Options Trading Strategies: While options trading can be complex, understanding advanced strategies can offer opportunities to profit from volatility. However, only use these strategies if you have thorough knowledge of the risks involved.

- Thorough Research: Before taking any action, thoroughly research the upcoming options expiry and its potential implications for your specific portfolio.

Conclusion

The upcoming expiration of billions of dollars in crypto options presents a significant event with the potential to cause substantial volatility in the cryptocurrency market. Understanding the mechanics of options trading, the scale of this expiry, and potential market impacts is crucial for all investors. Stay informed about the upcoming crypto options expiry and its potential impact. Monitor market developments closely and employ appropriate risk management strategies to navigate the potential volatility in the crypto market. Stay tuned for further updates on the crypto options expiry and its aftermath. Learn more about managing risk during periods of high crypto options expiry to protect your investment.

Featured Posts

-

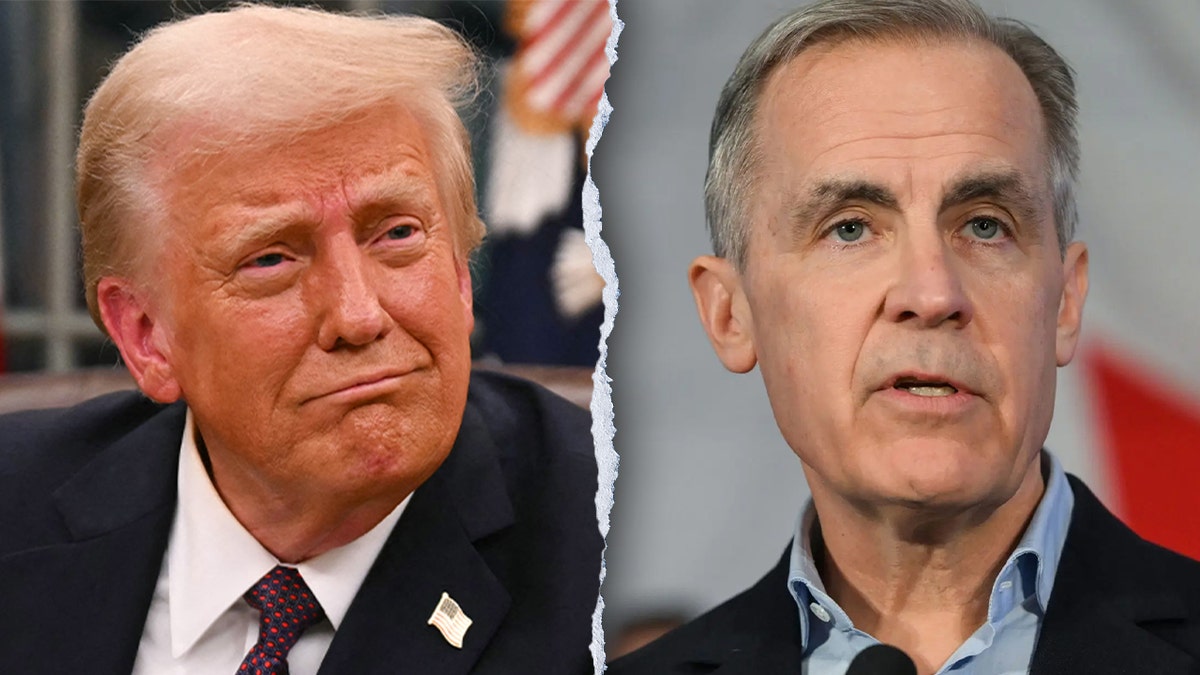

First Meeting Carney Labels Trump A Transformational President

May 08, 2025

First Meeting Carney Labels Trump A Transformational President

May 08, 2025 -

Navigating The Complexities Of The Chinese Market Case Studies Of Bmw And Porsche

May 08, 2025

Navigating The Complexities Of The Chinese Market Case Studies Of Bmw And Porsche

May 08, 2025 -

The Rookies Nathan Fillion His Memorable Wwii Performance

May 08, 2025

The Rookies Nathan Fillion His Memorable Wwii Performance

May 08, 2025 -

Psg Nin Nantes La Berabere Kalmasi Kritik Bir Sonuc Mu

May 08, 2025

Psg Nin Nantes La Berabere Kalmasi Kritik Bir Sonuc Mu

May 08, 2025 -

Will Trumps Speech Send Bitcoin To 100 000 A Price Prediction Analysis

May 08, 2025

Will Trumps Speech Send Bitcoin To 100 000 A Price Prediction Analysis

May 08, 2025