Lowest Personal Loan Interest Rates Today: A Comparison Guide

Table of Contents

Understanding Personal Loan Interest Rates

Securing a personal loan with a low interest rate is crucial for managing your finances effectively. Understanding the factors that determine your interest rate is the first step to getting the best deal.

Factors Affecting Your Interest Rate

Several key factors influence the interest rate a lender offers you. Let's break them down:

-

Credit Score Impact: Your credit score is the most significant factor. A higher credit score (excellent credit, typically 750 or above) signifies lower risk to the lender, resulting in significantly lower interest rates. Conversely, a poor credit score (below 600) will lead to much higher rates or even loan rejection. Improving your credit score through responsible financial habits is crucial.

-

Debt-to-Income Ratio (DTI): Your DTI, calculated by dividing your monthly debt payments by your gross monthly income, reflects your ability to manage debt. A lower DTI indicates a greater capacity to repay the loan, leading to a potentially lower interest rate.

-

Loan Amount: Larger loan amounts often come with slightly higher interest rates due to the increased risk for the lender.

-

Loan Term: Choosing a shorter loan term means higher monthly payments but lower overall interest paid. A longer loan term results in lower monthly payments but higher total interest paid over the life of the loan. Consider your budget and financial goals when selecting a term.

-

Secured vs. Unsecured Loans: Secured loans, backed by collateral (like a car or savings account), typically offer lower interest rates than unsecured loans, which are not backed by collateral. The lender's risk is reduced with secured loans, hence the lower rates.

Types of Personal Loans and Their Rates

Different types of personal loans carry varying interest rate ranges:

-

Secured Loan Interest Rate Range: Secured loans typically have interest rates ranging from 6% to 18%, depending on your creditworthiness and the collateral offered.

-

Unsecured Loan Interest Rate Range: Unsecured loans generally have higher interest rates, ranging from 10% to 36% or even more, due to the increased risk for the lender.

-

Peer-to-Peer Lending Interest Rate: Peer-to-peer (P2P) lending platforms connect borrowers directly with individual lenders, potentially offering competitive rates but also carrying risks if not carefully chosen. Interest rates can vary widely.

How to Find the Lowest Personal Loan Interest Rates

Finding the lowest interest rate requires diligent comparison shopping and strategic negotiation.

Shop Around and Compare Offers

Don't settle for the first offer you receive. Compare offers from multiple lenders to find the most competitive rate.

-

Reputable Online Comparison Websites: Use websites like Bankrate, NerdWallet, and LendingTree to compare personal loan offers from various lenders.

-

Pre-qualification: Pre-qualifying for a loan allows you to see potential interest rates without impacting your credit score significantly.

-

Read the Fine Print: Carefully review all loan documents, including the terms and conditions, fees, and APR (Annual Percentage Rate) before signing any agreements.

Negotiate with Lenders

Once you've identified a few promising offers, don't hesitate to negotiate.

-

Leverage Your Strengths: A high credit score, a large down payment (if applicable), and a stable income are excellent negotiating points.

-

Demonstrate Financial Stability: Showcase your responsible financial management to increase your bargaining power.

-

Ask About Discounts: Inquire about any potential discounts or promotions the lender may offer.

Improve Your Credit Score

A higher credit score directly translates to lower interest rates.

-

Pay Bills On Time: Consistent on-time payments are crucial for building credit.

-

Keep Credit Utilization Low: Maintain a low credit utilization ratio (the amount of credit you use compared to your available credit).

-

Monitor Credit Reports: Regularly check your credit reports for errors and take steps to correct them promptly.

-

Consider a Secured Credit Card: If your credit is poor, a secured credit card can help you build credit history.

Avoiding Personal Loan Scams and Predatory Lending

Be aware of predatory lending practices to protect yourself.

Red Flags to Watch Out For

Beware of these warning signs:

-

Extremely High Interest Rates: Interest rates far exceeding market averages are a major red flag.

-

Hidden Fees: Be wary of lenders that are unclear about fees and charges.

-

Aggressive Sales Tactics: High-pressure sales tactics should raise concerns.

Choosing Reputable Lenders

Choose lenders with a proven track record of ethical lending practices.

-

Verify Lender Credentials: Check the lender's credentials with the Better Business Bureau (BBB) or your state's financial regulator.

-

Read Online Reviews: Thoroughly research online reviews from past borrowers to assess the lender's reputation.

-

Transparent Terms: Ensure the lender provides clear and transparent terms and conditions.

Conclusion

Securing the lowest personal loan interest rates today requires careful planning and research. By understanding the factors that influence interest rates, comparing offers from multiple lenders, and improving your creditworthiness, you can significantly reduce the overall cost of borrowing. Don't rush the process; take your time to find the best deal for your financial situation. Remember to actively compare options and negotiate to find the lowest personal loan interest rates that meet your needs. Start your search for the lowest personal loan interest rates today!

Featured Posts

-

South Koreas Next President A Guide To The Candidates And The Election

May 28, 2025

South Koreas Next President A Guide To The Candidates And The Election

May 28, 2025 -

Phillips Potential Leeds Return Examining The Transfer Talk

May 28, 2025

Phillips Potential Leeds Return Examining The Transfer Talk

May 28, 2025 -

The Phoenician Scheme Trailer Pure Wes Anderson Style

May 28, 2025

The Phoenician Scheme Trailer Pure Wes Anderson Style

May 28, 2025 -

San Diego Padres Pregame Update Lineup Changes And Injury Report

May 28, 2025

San Diego Padres Pregame Update Lineup Changes And Injury Report

May 28, 2025 -

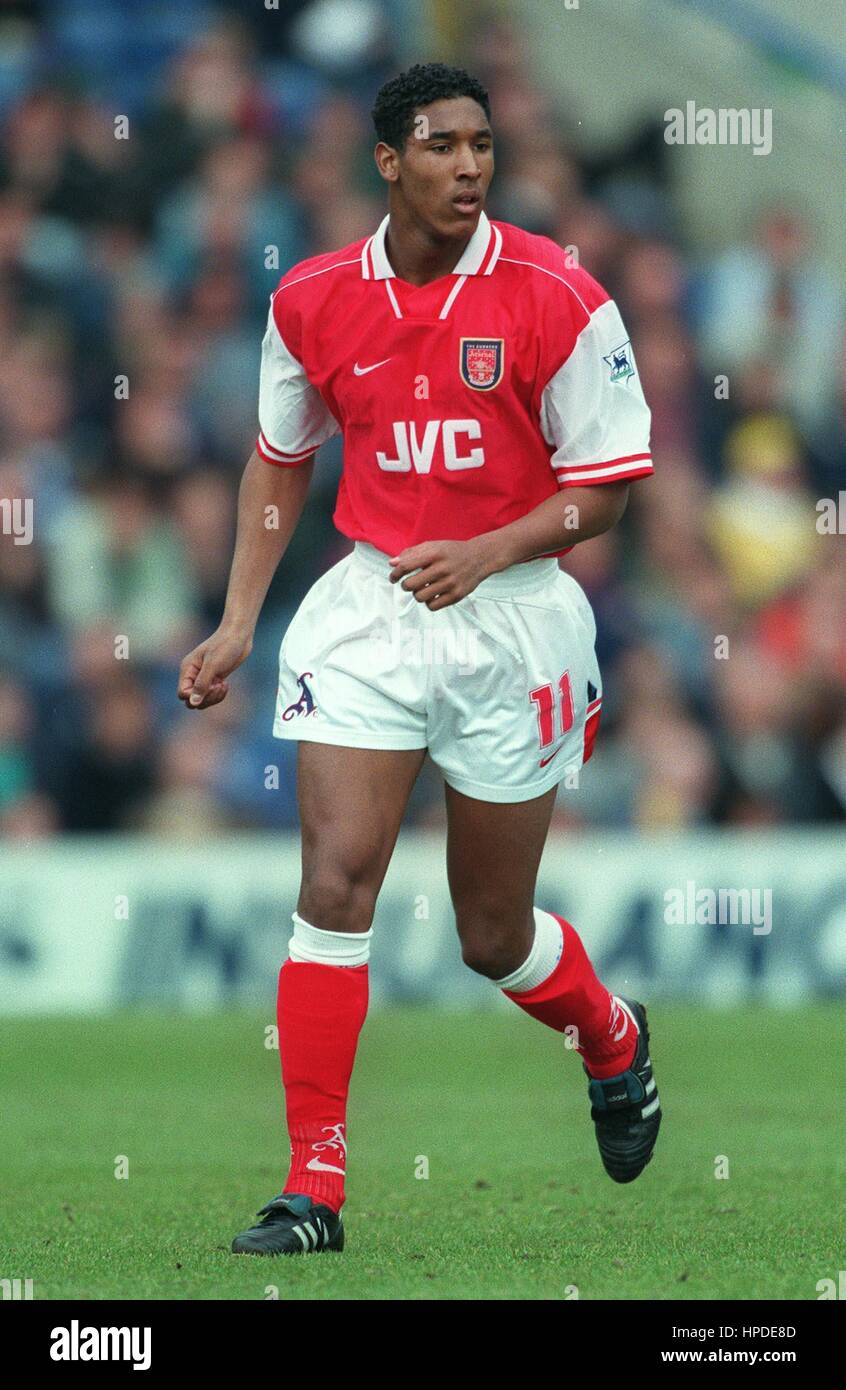

Nicolas Anelka Current News Match Results And Media Coverage

May 28, 2025

Nicolas Anelka Current News Match Results And Media Coverage

May 28, 2025