Long-Term Investment: Berkshire Hathaway's Impact On Japanese Trading Houses

Table of Contents

Berkshire Hathaway's Investment Strategy and its Rationale

Berkshire Hathaway, under the leadership of Warren Buffett, is renowned for its unwavering dedication to long-term investment. This philosophy, prioritizing value investing and holding assets for extended periods, contrasts sharply with short-term market speculation. Buffett's emphasis on identifying fundamentally sound companies with strong management teams aligns remarkably well with the often-overlooked stability and resilience found within Japanese corporate culture, a culture known for its long-term vision and emphasis on building sustainable businesses.

Berkshire Hathaway's decision to invest in these Japanese trading houses was driven by several key factors:

- Stable, long-term growth potential: These trading houses possess a history of consistent profitability and steady growth, offering a reliable foundation for long-term investment returns.

- Undervalued assets relative to the global market: Berkshire Hathaway likely saw an opportunity to acquire significant stakes in companies whose intrinsic value was not fully reflected in their market capitalization.

- Diversification of Berkshire Hathaway's portfolio: The investment represents a strategic move to diversify its holdings beyond its traditional focus, mitigating risk and accessing a new market with unique growth opportunities.

- Access to a unique and robust business model: Japanese sogo shosha (general trading companies) have a long-established and complex global network, offering unique access to various markets and commodities, a key component of their enduring success.

The Targeted Japanese Trading Houses: An Overview

Berkshire Hathaway's investments targeted five major Japanese trading houses: Mitsubishi Corporation, Mitsui & Co., Itochu Corporation, Sumitomo Corporation, and Marubeni Corporation. These companies operate on a global scale, engaging in a diverse range of businesses including energy, metals, machinery, and chemicals. Their business models are characterized by their extensive global networks, strong relationships with governments and corporations worldwide, and their ability to manage complex international transactions. Their historical performance demonstrates significant financial stability and resilience, even amidst global economic downturns. These companies represent a unique blend of long-term stability and significant global reach.

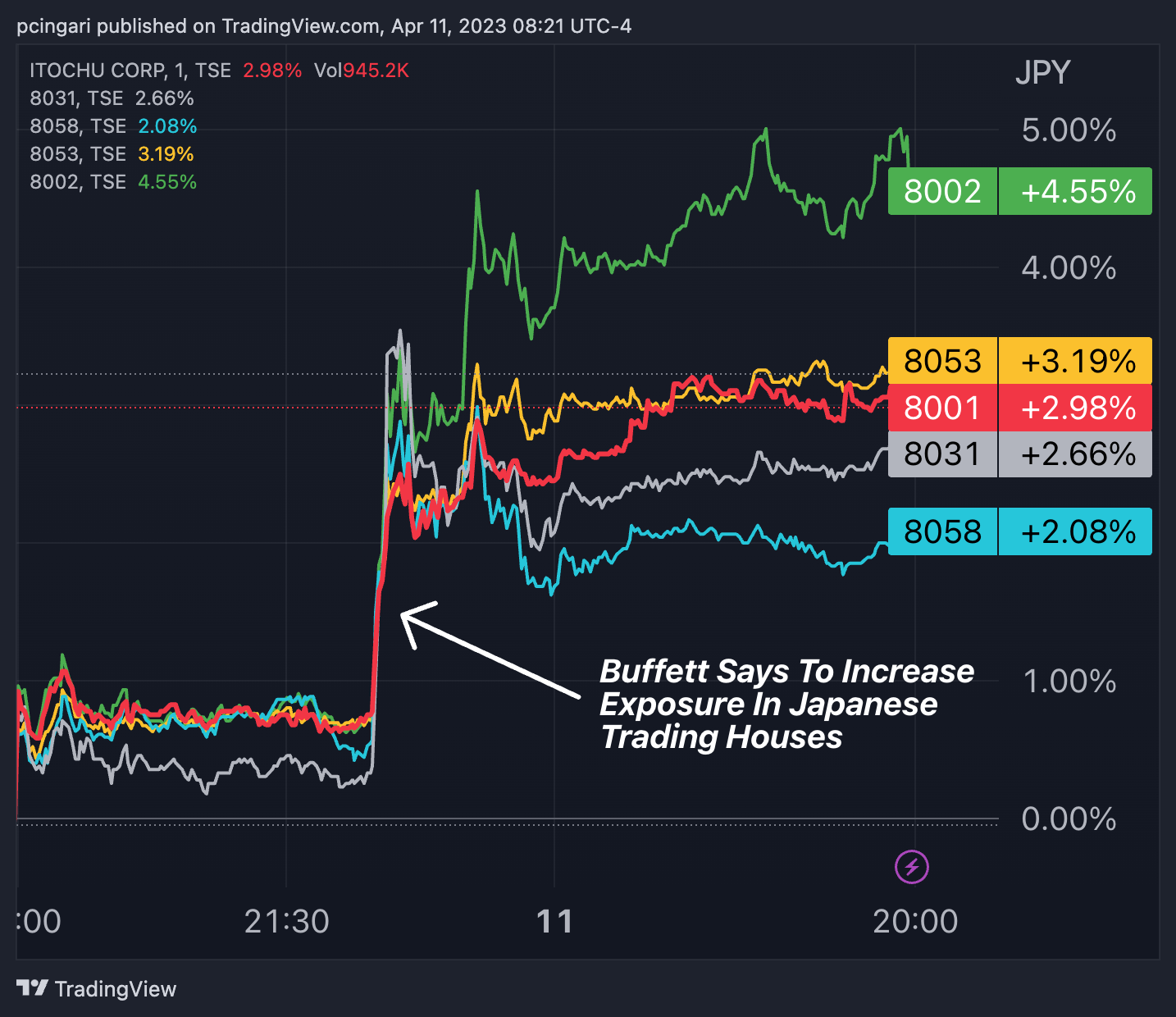

Impact on Share Prices and Market Sentiment

The announcement of Berkshire Hathaway's investment immediately sent shockwaves through the market, resulting in a noticeable surge in the share prices of the targeted Japanese trading houses. Investor confidence received a significant boost, reflecting a positive market sentiment towards these traditionally conservative companies. This influx of confidence signaled a renewed interest in the potential of Japanese equities and suggests the possibility of further price appreciation in the long term, driven both by the intrinsic value of these companies and the perceived endorsement from a globally respected investor like Berkshire Hathaway.

Potential Long-Term Implications for the Japanese Economy

Berkshire Hathaway's investment holds significant potential for long-term implications for the Japanese economy. It could stimulate increased foreign investment in Japan, attracting further capital and boosting overall market capitalization. The collaboration and knowledge sharing between Berkshire Hathaway and the trading houses could lead to innovation, efficiency improvements, and potentially new business opportunities. This infusion of global expertise could also contribute to a wider modernization of Japanese business practices and strengthen Japan's position in the global trade landscape.

Risks and Challenges Associated with the Investment

While the long-term outlook appears positive, certain risks and challenges are associated with Berkshire Hathaway's investment. Geopolitical events, global economic fluctuations, and unforeseen regulatory changes could all impact the investment's performance. Changes within the Japanese market itself, such as shifts in government policy or unexpected economic downturns, could also present challenges. Careful monitoring of these factors is crucial for managing risk and ensuring the long-term success of the investment.

Conclusion: Long-Term Investment and the Future of Berkshire Hathaway's Japanese Holdings

Berkshire Hathaway's substantial investment in Japanese trading houses exemplifies the power of a well-researched long-term investment strategy. The immediate positive impact on share prices and market sentiment highlights the confidence this move instilled in investors. While risks exist, the potential for long-term growth and mutual benefit remains substantial. Understanding Berkshire Hathaway's approach to long-term investment can offer valuable insights for your own investment strategy, particularly considering the potential within the Japanese trading houses. Further research into Berkshire Hathaway's investment philosophy and the intricacies of the Japanese market can offer valuable perspectives for navigating the complexities of global finance. Learn more about long-term investment strategies and the Japanese market by exploring [link to relevant resource 1] and [link to relevant resource 2].

Featured Posts

-

The Long Walk Trailer Mark Hamills Departure From Luke Skywalker

May 08, 2025

The Long Walk Trailer Mark Hamills Departure From Luke Skywalker

May 08, 2025 -

Xrp Price Prediction Is A Parabolic Move Imminent Ripple Vs Remittix Analyzing The Market

May 08, 2025

Xrp Price Prediction Is A Parabolic Move Imminent Ripple Vs Remittix Analyzing The Market

May 08, 2025 -

Anchor Brewing Company Shuttering Impact On The Craft Beer Industry

May 08, 2025

Anchor Brewing Company Shuttering Impact On The Craft Beer Industry

May 08, 2025 -

Brezilya Bitcoin Oedemelerini Kabul Ediyor Isverenler Ve Calisanlar Icin Rehber

May 08, 2025

Brezilya Bitcoin Oedemelerini Kabul Ediyor Isverenler Ve Calisanlar Icin Rehber

May 08, 2025 -

Colin Cowherd Takes Aim At Jayson Tatum Post Celtics Game 1

May 08, 2025

Colin Cowherd Takes Aim At Jayson Tatum Post Celtics Game 1

May 08, 2025